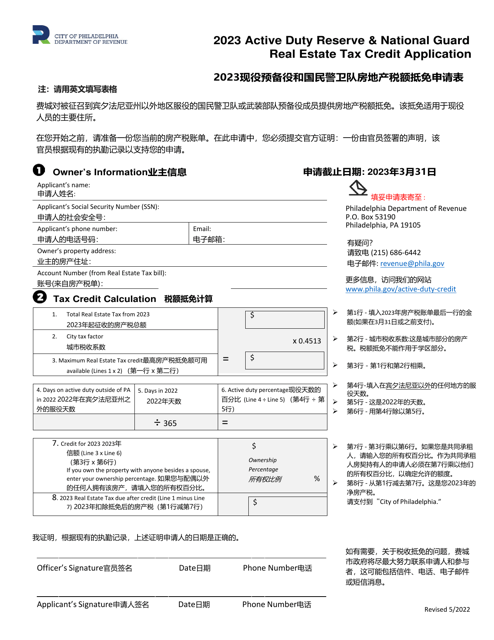

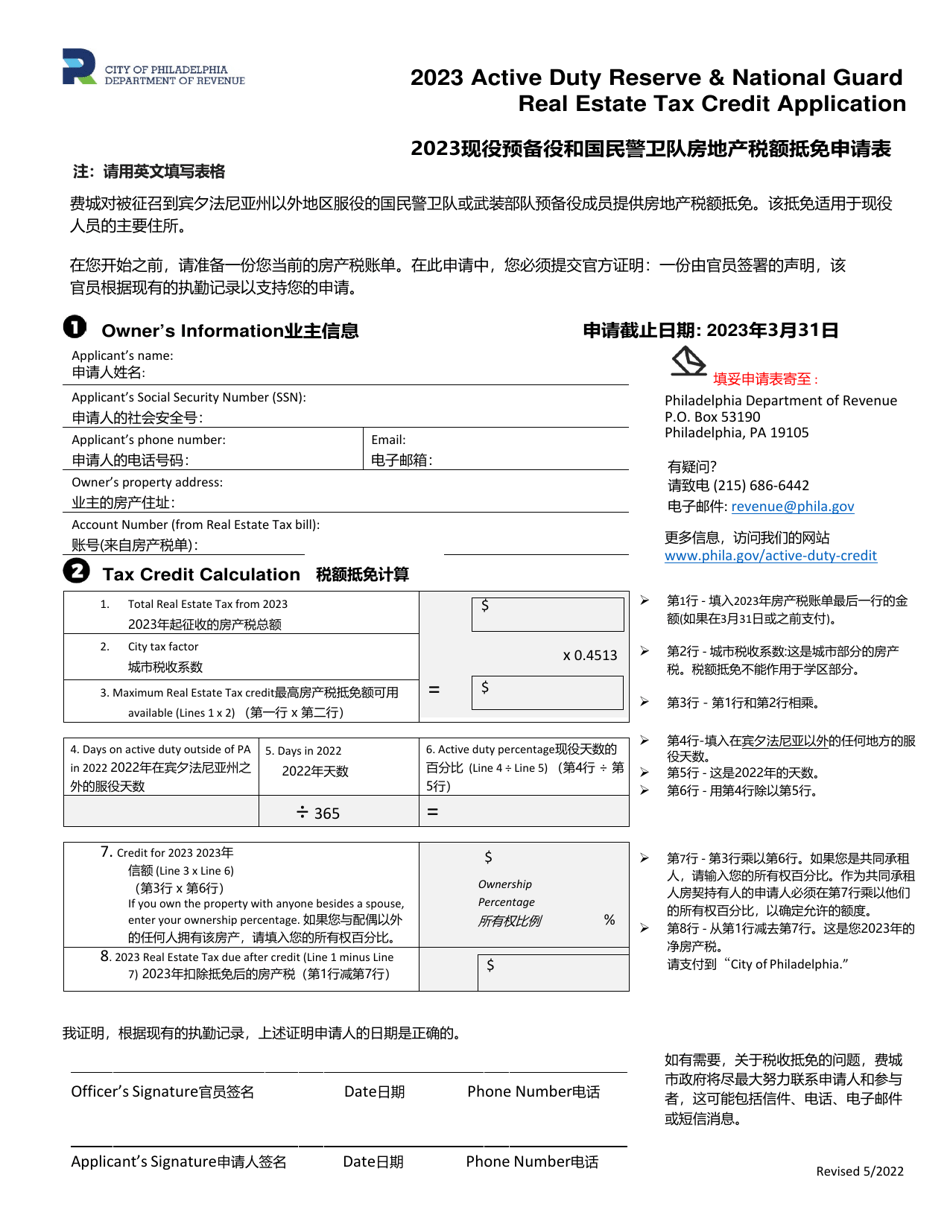

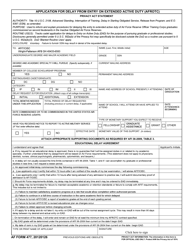

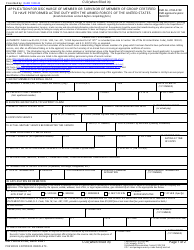

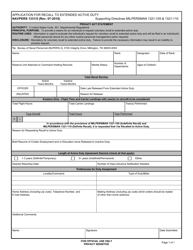

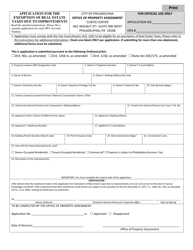

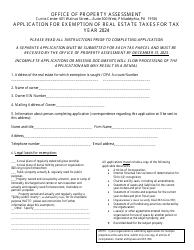

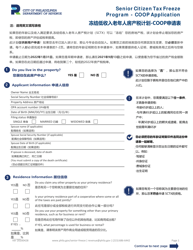

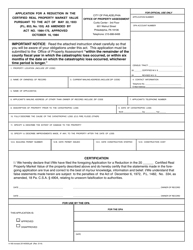

Active Duty Reserve & National Guard Real Estate Tax Credit Application - City of Philadelphia, Pennsylvania (English / Chinese)

Active Duty Reserve & Tax Credit Application is a legal document that was released by the Department of Revenue - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia.

FAQ

Q: What is the Active Duty Reserve & National Guard Real Estate Tax Credit Application?

A: It is an application for a tax credit available to active duty/reserve/national guard members in Philadelphia, PA.

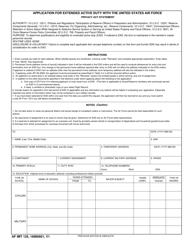

Q: What is the purpose of the tax credit?

A: The tax credit is available to offset real estate tax liability for eligible service members.

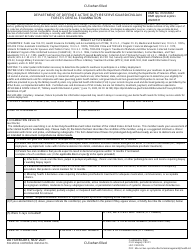

Q: Who is eligible for the tax credit?

A: Active duty military, reserve military, and National Guard members who own a primary residence in Philadelphia, PA.

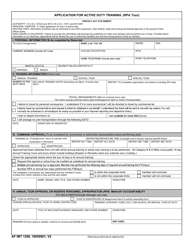

Q: Can I apply for the tax credit if I don't live in Philadelphia?

A: No, the tax credit is only available to those who own a primary residence in Philadelphia.

Q: How can I apply for the tax credit?

A: You can apply by completing the application form and submitting it to the City of Philadelphia's Revenue Department.

Q: Is there a deadline to apply for the tax credit?

A: Yes, the application must be submitted by March 31st of each year.

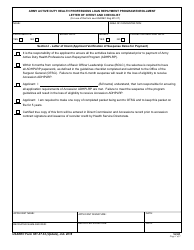

Q: What documents do I need to submit with the application?

A: You will need to submit a copy of your military orders and proof of ownership of the property.

Q: How much is the tax credit?

A: The tax credit is equal to 100% of the real estate taxes due on the eligible property.

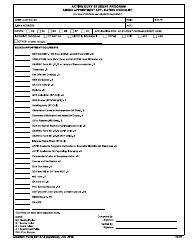

Q: Is the tax credit renewable every year?

A: Yes, you must reapply for the tax credit each year.

Q: Can I transfer the tax credit to another property?

A: No, the tax credit is specific to the eligible property owned by the service member.

Form Details:

- Released on May 1, 2022;

- The latest edition currently provided by the Department of Revenue - City of Philadelphia, Pennsylvania;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Department of Revenue - City of Philadelphia, Pennsylvania.