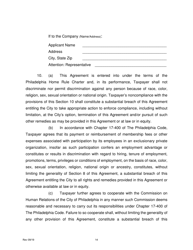

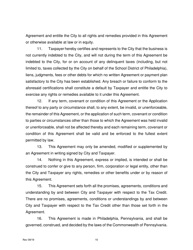

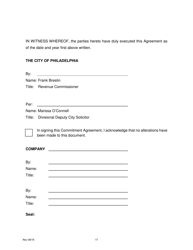

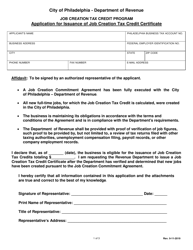

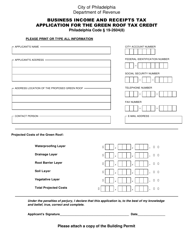

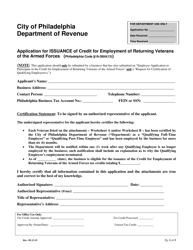

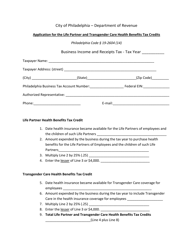

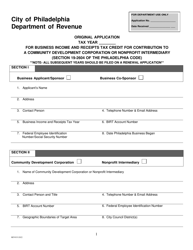

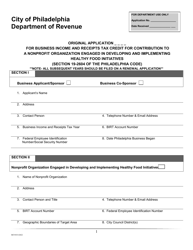

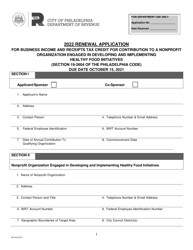

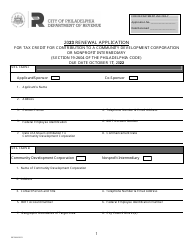

Job Creation Tax Credit Application - City of Philadelphia, Pennsylvania

Job Creation Tax Credit Application is a legal document that was released by the Department of Revenue - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia.

FAQ

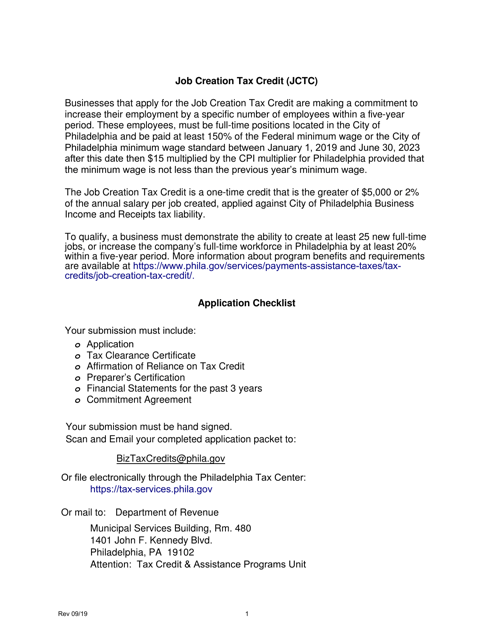

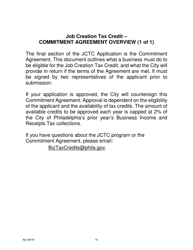

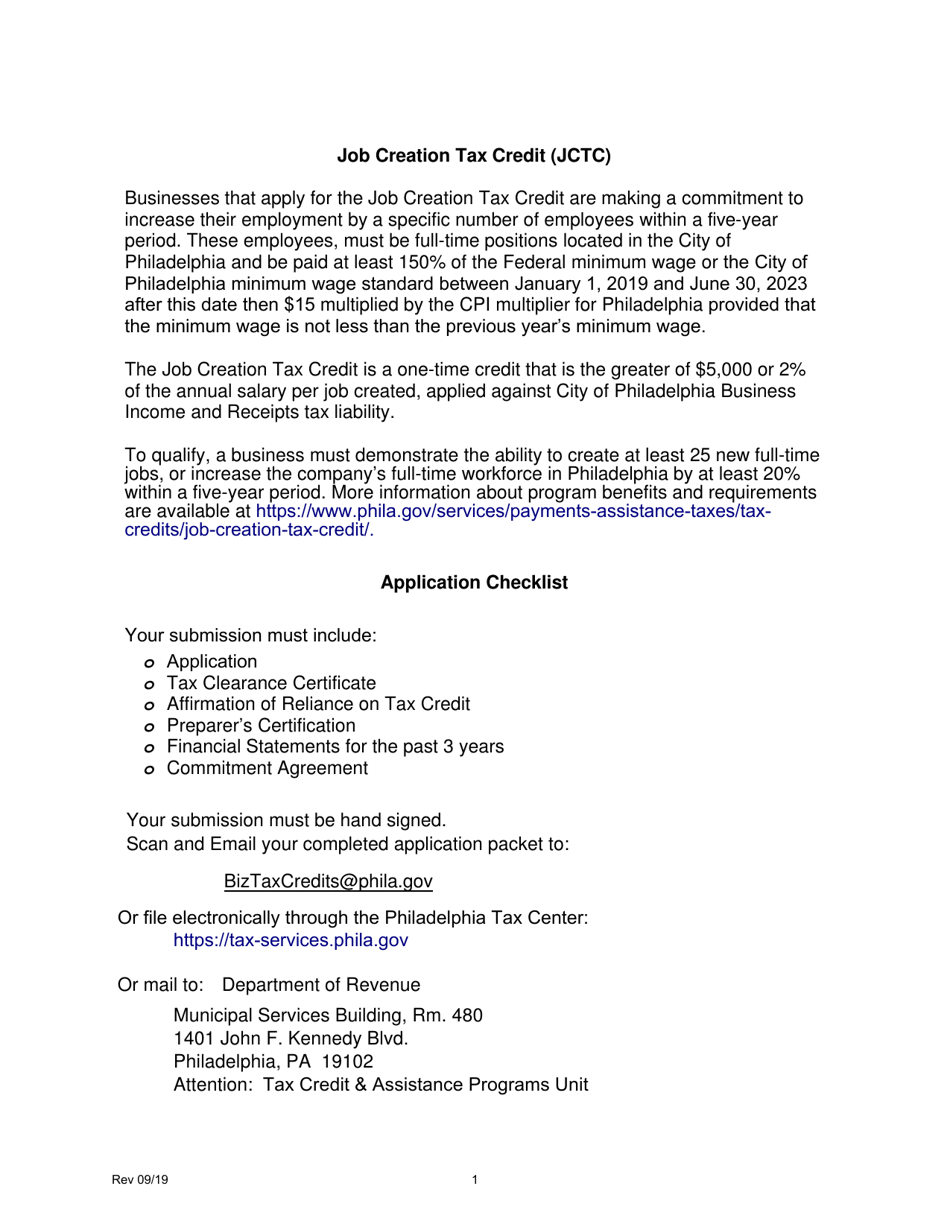

Q: What is the Job Creation Tax Credit?

A: The Job Creation Tax Credit is a tax incentive program offered by the City of Philadelphia, Pennsylvania.

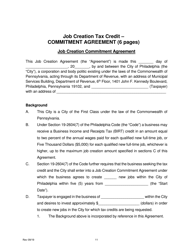

Q: Who is eligible to apply for the Job Creation Tax Credit?

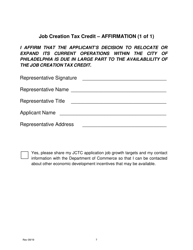

A: Eligible businesses that are creating new jobs in Philadelphia may apply for the Job Creation Tax Credit.

Q: How can I apply for the Job Creation Tax Credit?

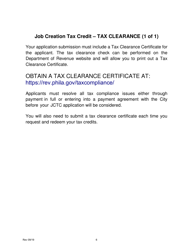

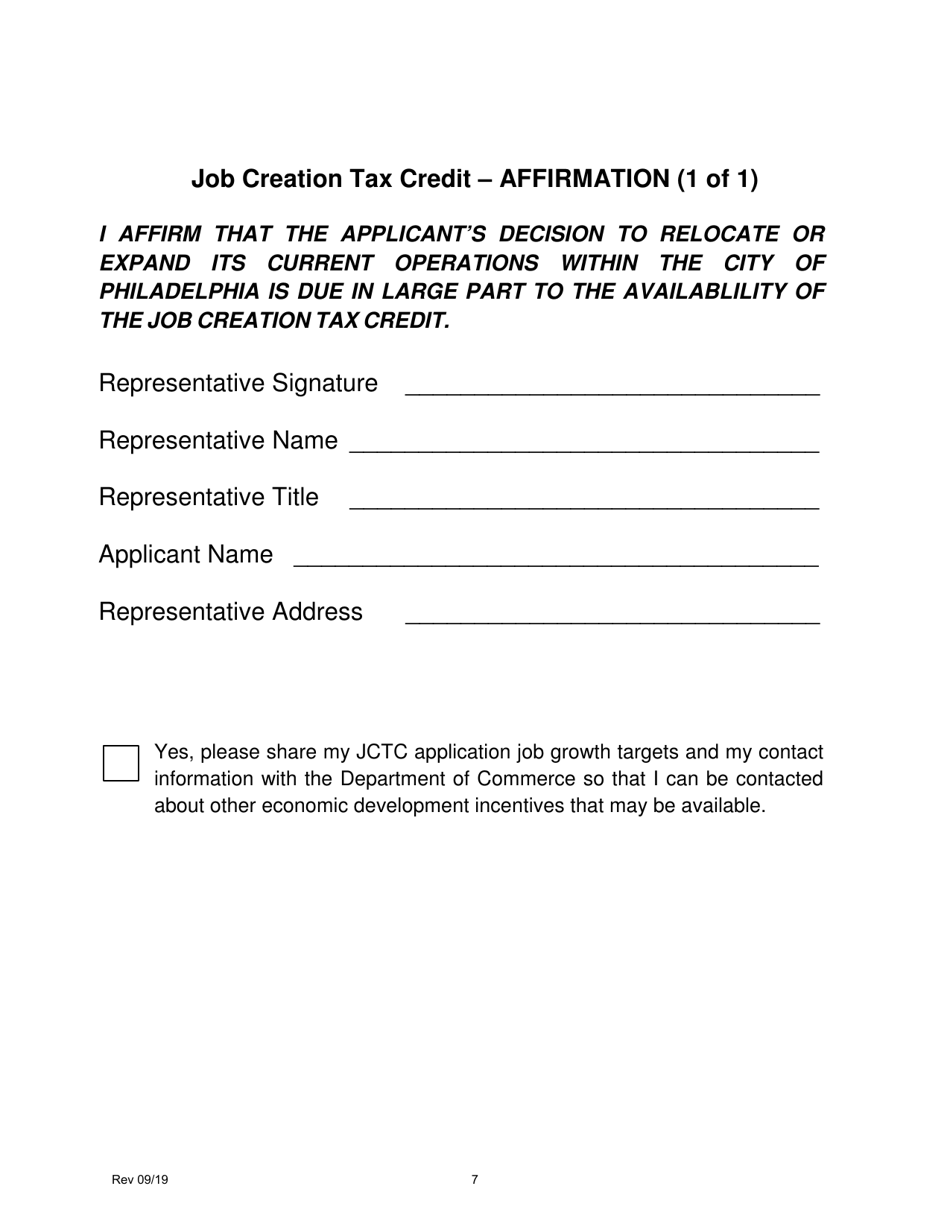

A: You can apply for the Job Creation Tax Credit by submitting an application to the City of Philadelphia, Pennsylvania.

Q: What is the purpose of the Job Creation Tax Credit?

A: The purpose of the Job Creation Tax Credit is to encourage businesses to create new jobs in Philadelphia and stimulate economic growth.

Q: What are the benefits of the Job Creation Tax Credit?

A: The Job Creation Tax Credit provides tax incentives to eligible businesses, which can help reduce their tax liability and potentially save money.

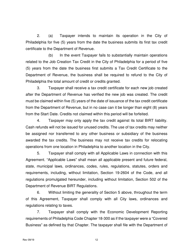

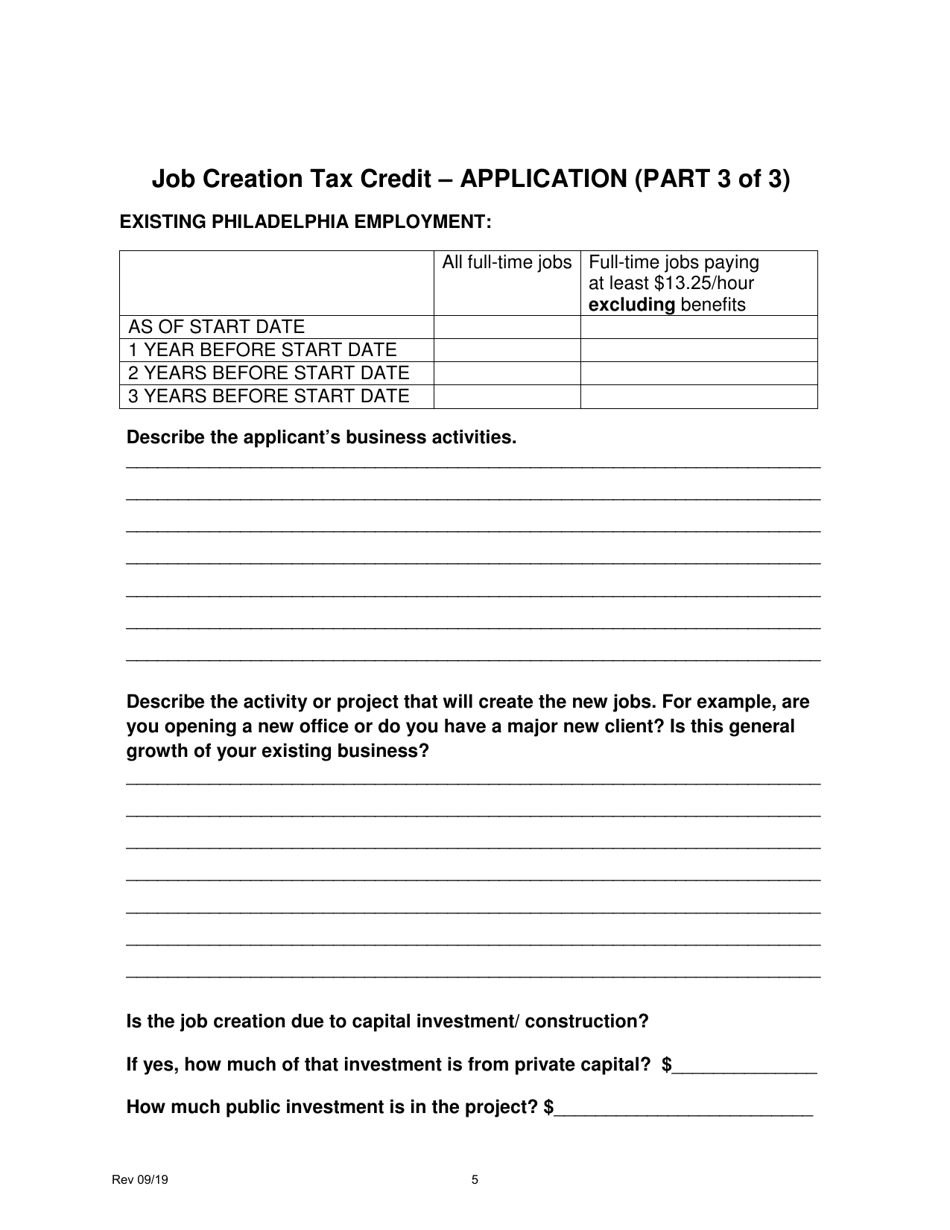

Q: Are there any specific requirements for the Job Creation Tax Credit?

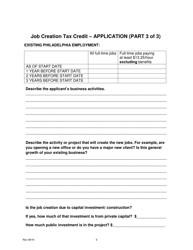

A: Yes, eligible businesses must meet certain criteria, such as creating a minimum number of full-time jobs and paying competitive wages.

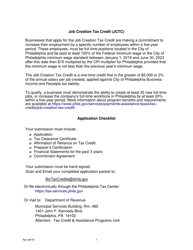

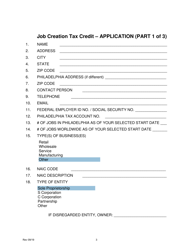

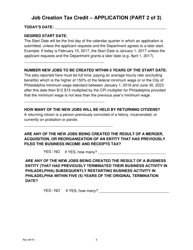

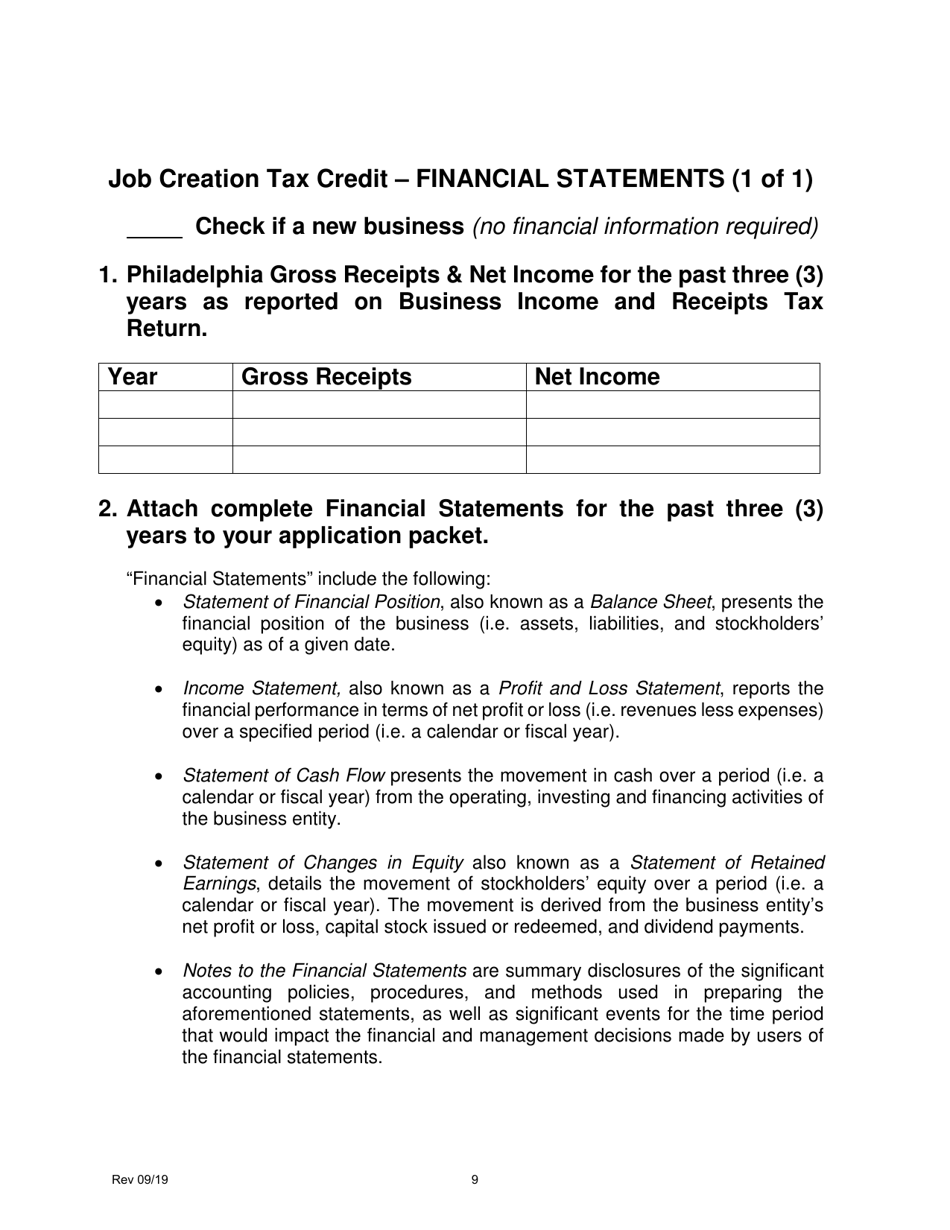

Q: What is the application process for the Job Creation Tax Credit?

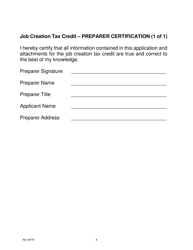

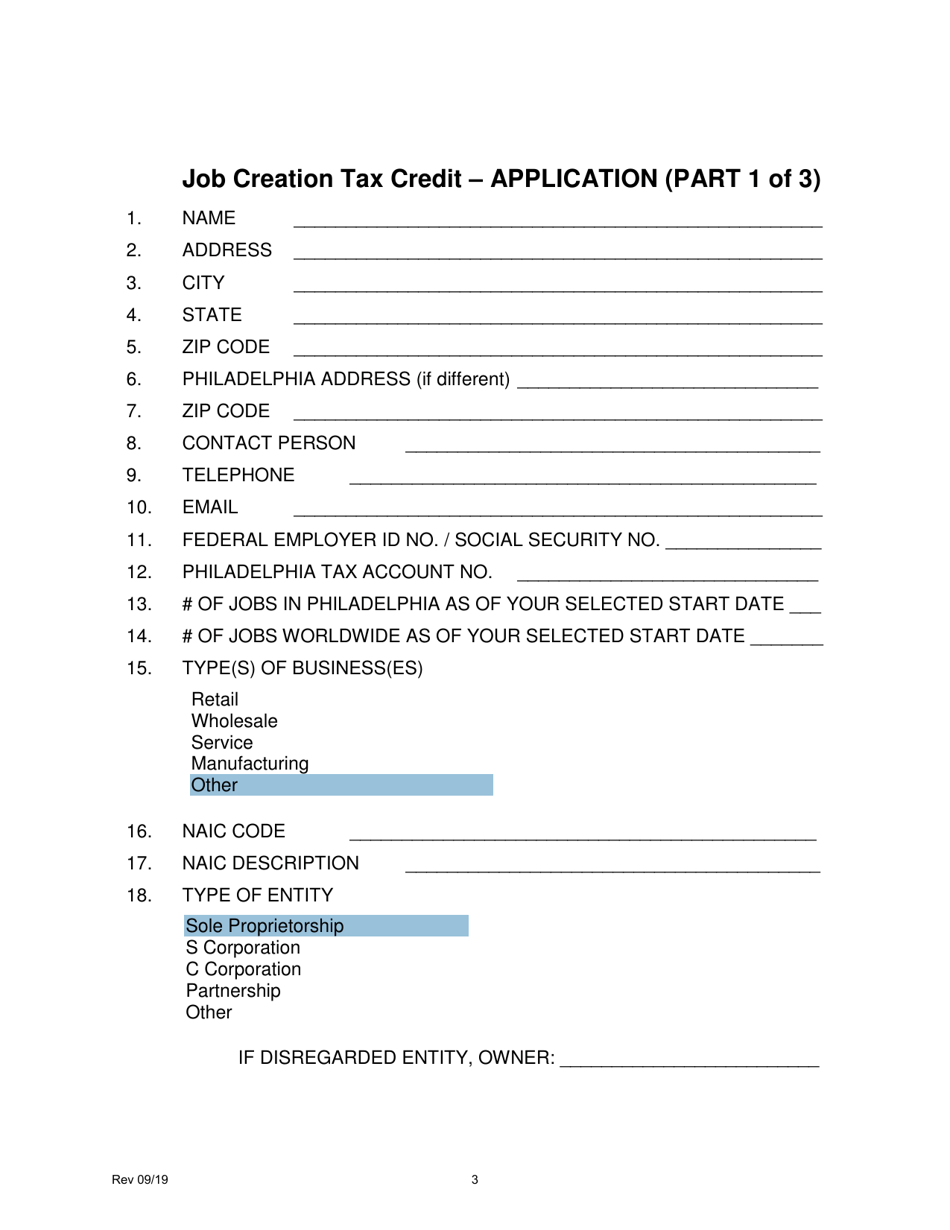

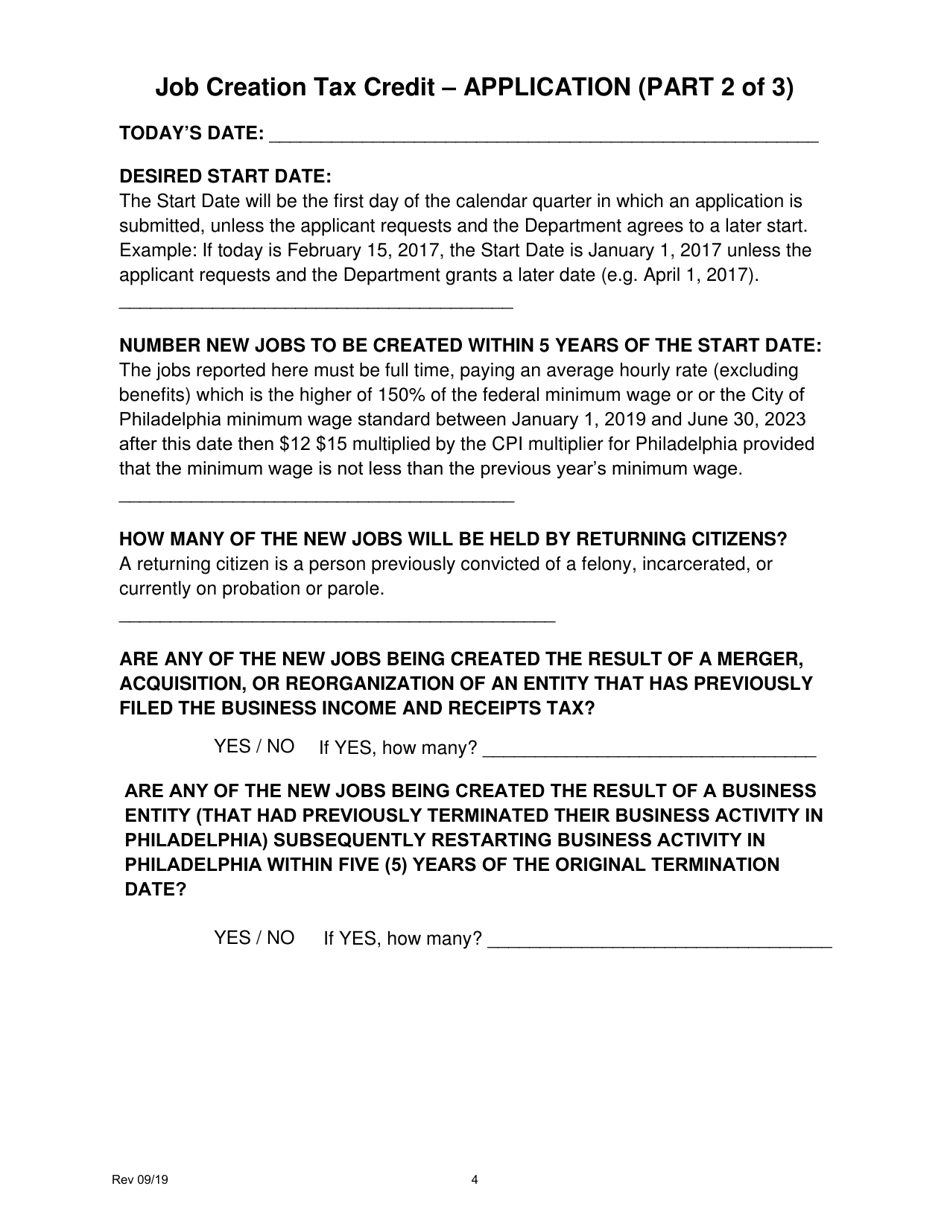

A: The application process for the Job Creation Tax Credit involves submitting an application, providing supporting documents, and potentially going through a review and approval process.

Q: Are there any deadlines for applying for the Job Creation Tax Credit?

A: Yes, businesses must submit their application for the Job Creation Tax Credit by a specific deadline, which is typically indicated in the application instructions or guidelines.

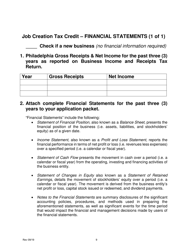

Form Details:

- Released on September 1, 2019;

- The latest edition currently provided by the Department of Revenue - City of Philadelphia, Pennsylvania;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Department of Revenue - City of Philadelphia, Pennsylvania.