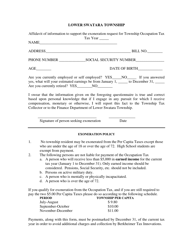

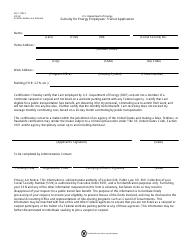

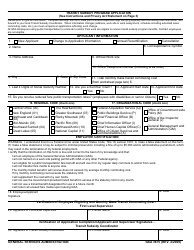

Affidavit in Support of Application for Homestead Exemption - City of Philadelphia, Pennsylvania

Affidavit in Support of Application for Homestead Exemption is a legal document that was released by the Department of Revenue - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia.

FAQ

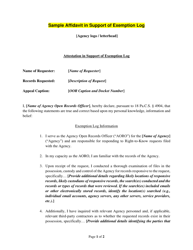

Q: What is an Affidavit in Support of Application for Homestead Exemption?

A: An Affidavit in Support of Application for Homestead Exemption is a legal document used to apply for a property tax exemption in the City of Philadelphia, Pennsylvania.

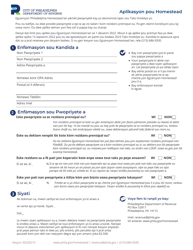

Q: What is a Homestead Exemption?

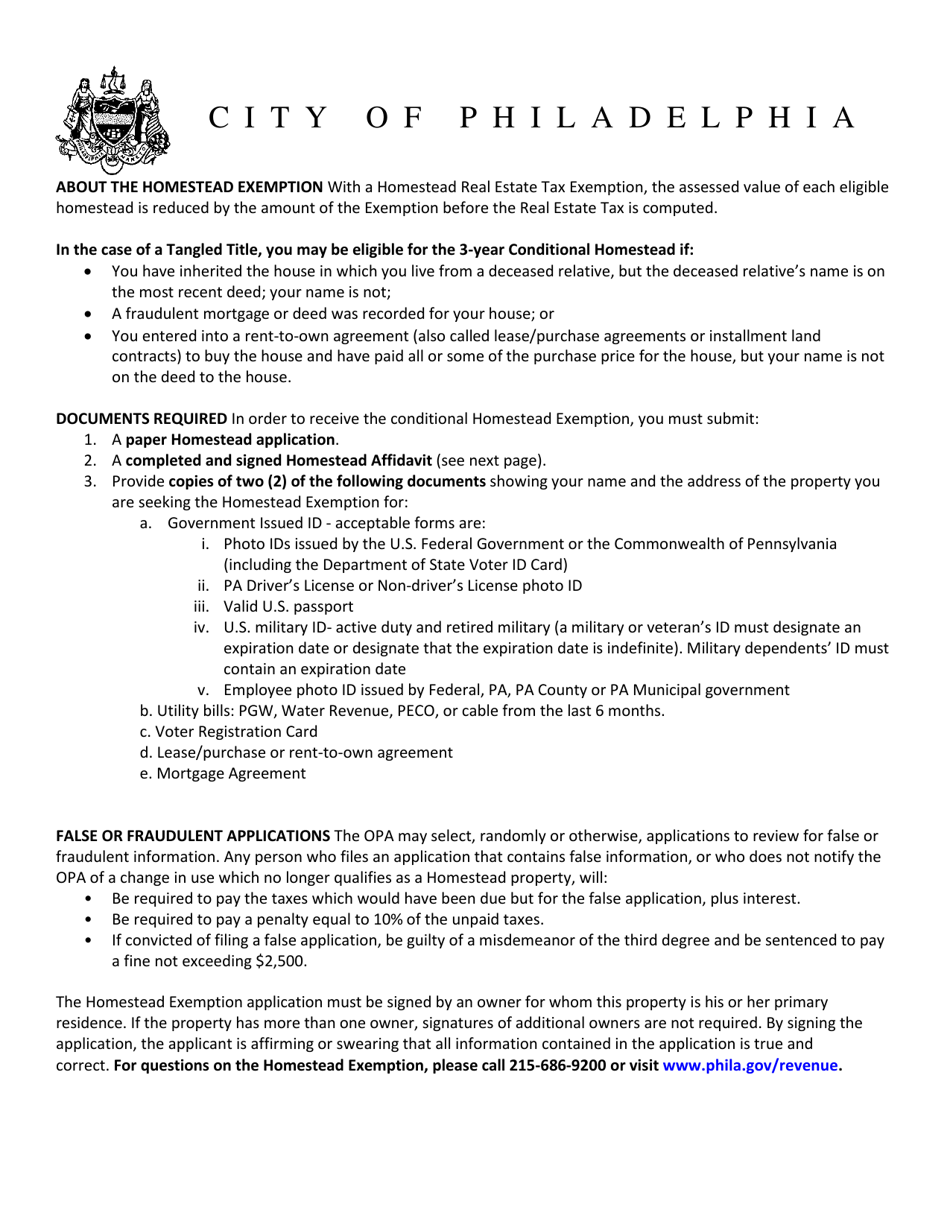

A: A Homestead Exemption is a property tax reduction provided to homeowners who use their property as their primary residence.

Q: Who is eligible for a Homestead Exemption in the City of Philadelphia?

A: To be eligible for a Homestead Exemption in the City of Philadelphia, you must own and occupy the property as your primary residence.

Q: How do I apply for a Homestead Exemption in the City of Philadelphia?

A: To apply for a Homestead Exemption in the City of Philadelphia, you need to complete an Affidavit in Support of Application for Homestead Exemption and submit it to the proper authorities.

Q: What supporting documents are required for the application?

A: The application may require supporting documents such as proof of ownership, proof of residency, and any other documents specified by the City of Philadelphia.

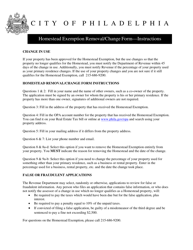

Q: When is the deadline to apply for a Homestead Exemption?

A: The deadline to apply for a Homestead Exemption in the City of Philadelphia is typically March 1st of the tax year.

Q: What are the benefits of a Homestead Exemption?

A: A Homestead Exemption can lower your property tax bill by reducing the taxable value of your property.

Q: Can I apply for a Homestead Exemption if I rent out a portion of my property?

A: No, the property must be your primary residence, and renting out a portion of it may disqualify you from the Homestead Exemption.

Q: What happens if my application for a Homestead Exemption is approved?

A: If your application is approved, you will receive a reduction in your property taxes for the eligible tax year.

Q: What should I do if my application for a Homestead Exemption is denied?

A: If your application is denied, you may have the option to appeal the decision or reapply for the exemption in the following tax year.

Q: Are there any income limitations for the Homestead Exemption in the City of Philadelphia?

A: No, there are no income limitations for the Homestead Exemption in the City of Philadelphia.

Form Details:

- The latest edition currently provided by the Department of Revenue - City of Philadelphia, Pennsylvania;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Department of Revenue - City of Philadelphia, Pennsylvania.