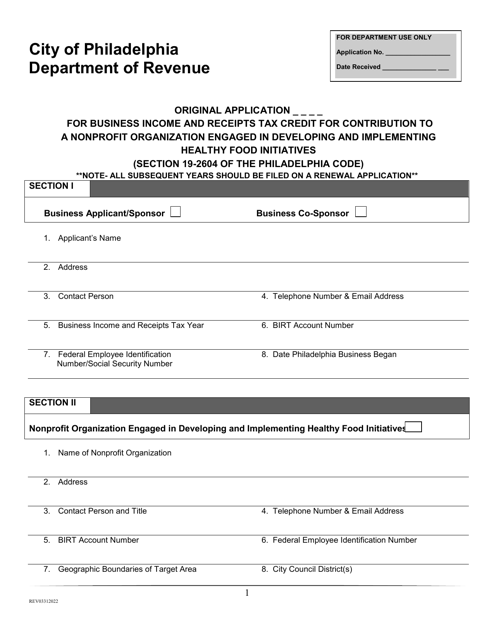

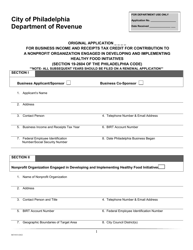

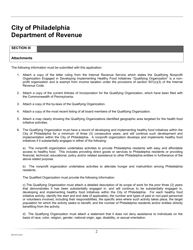

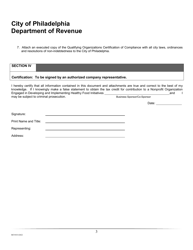

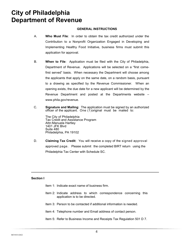

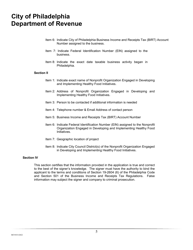

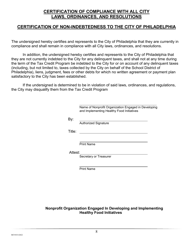

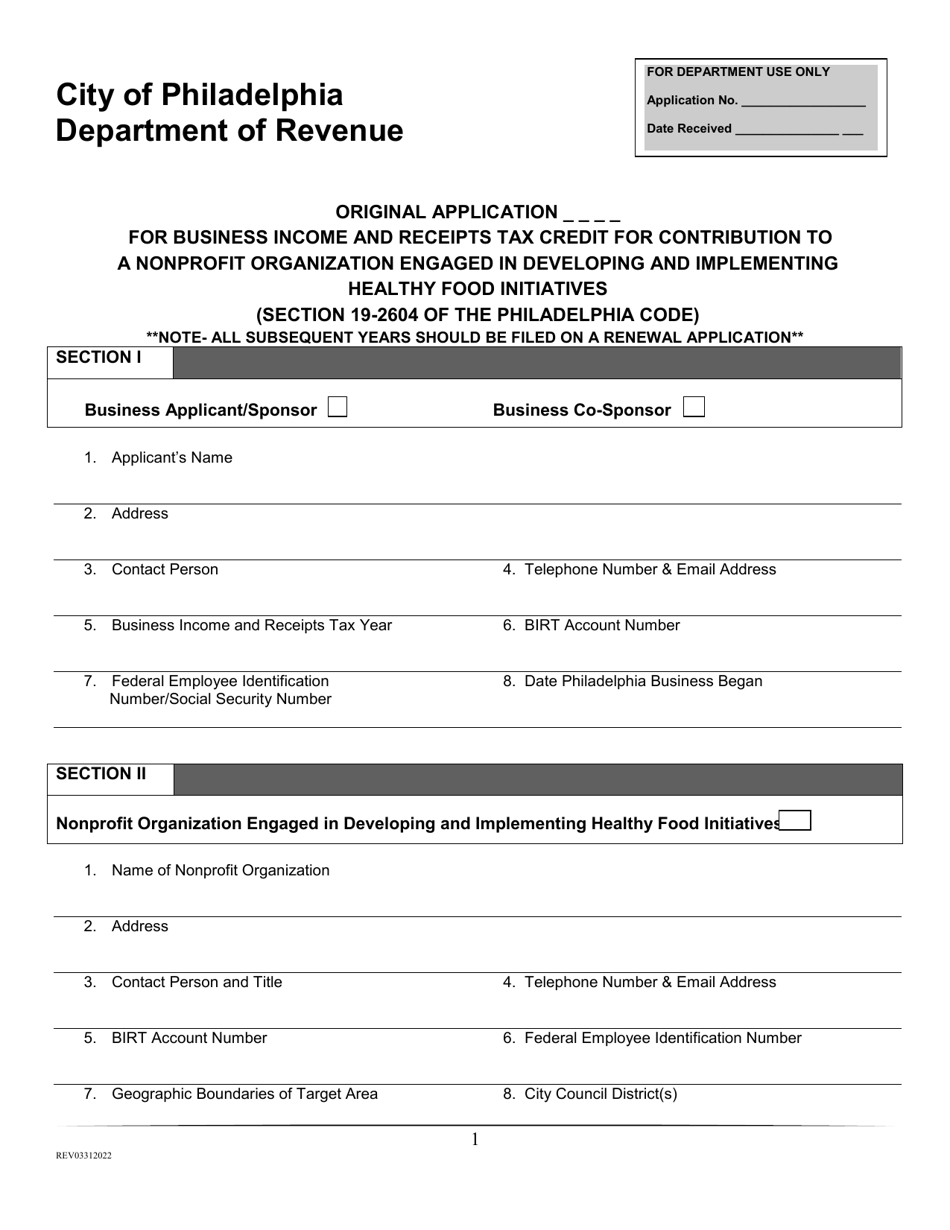

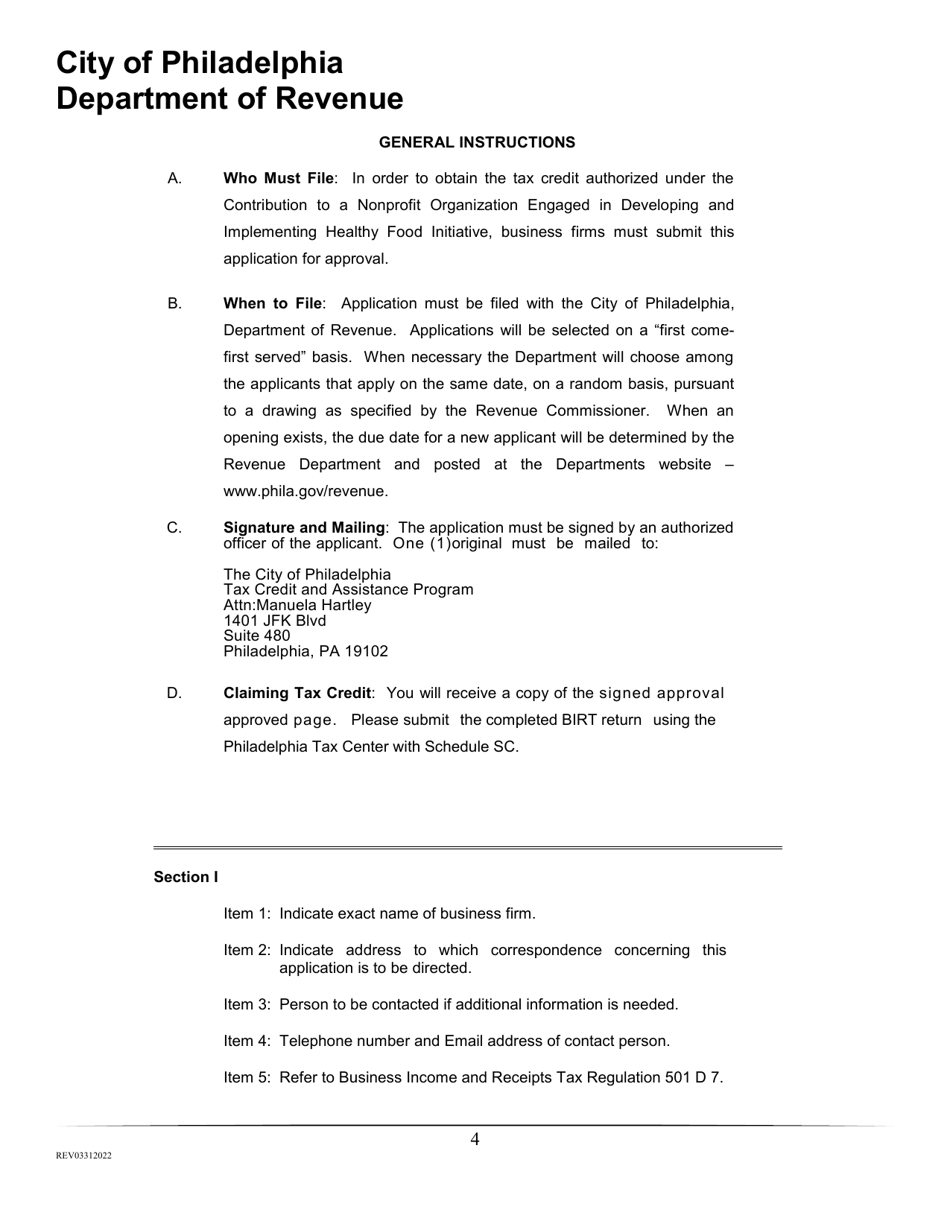

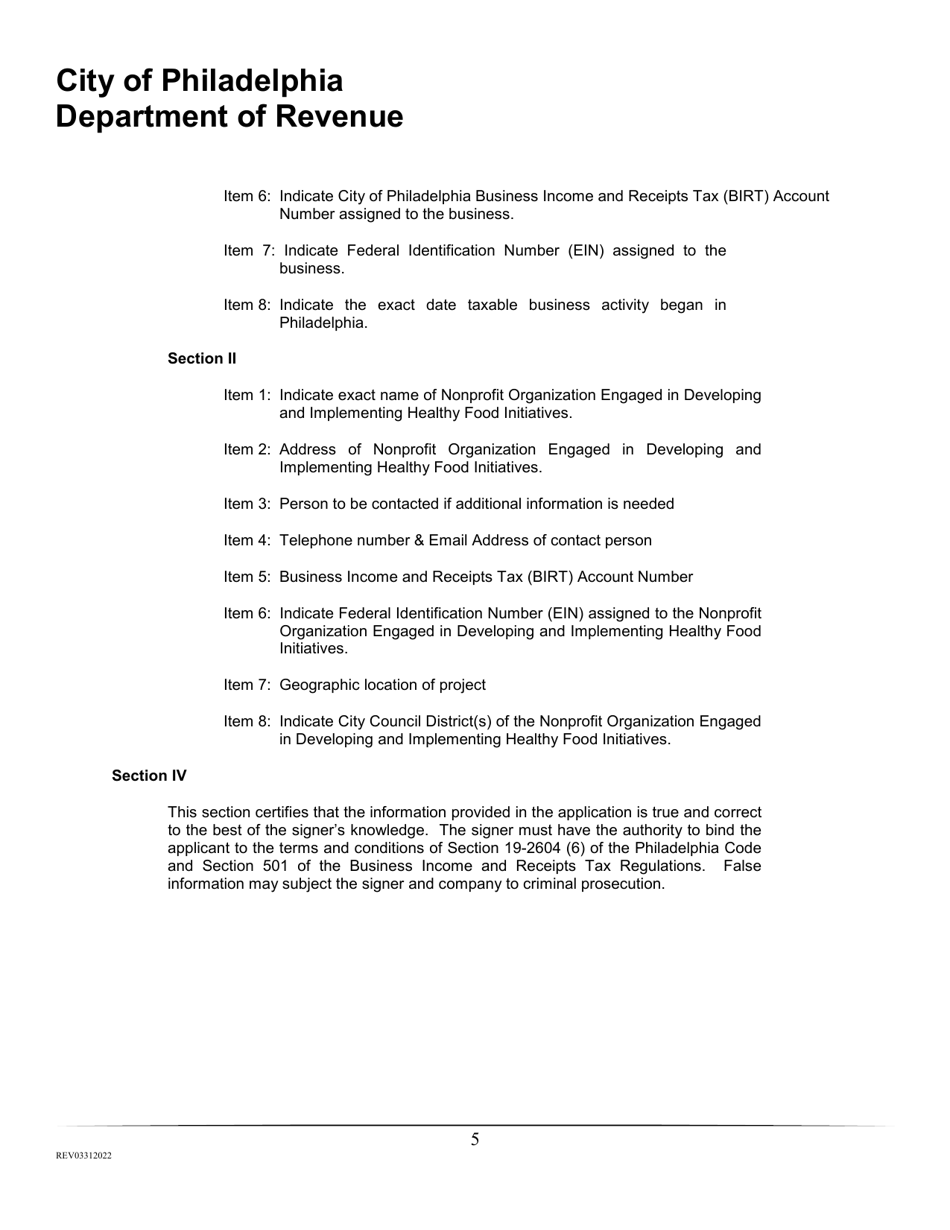

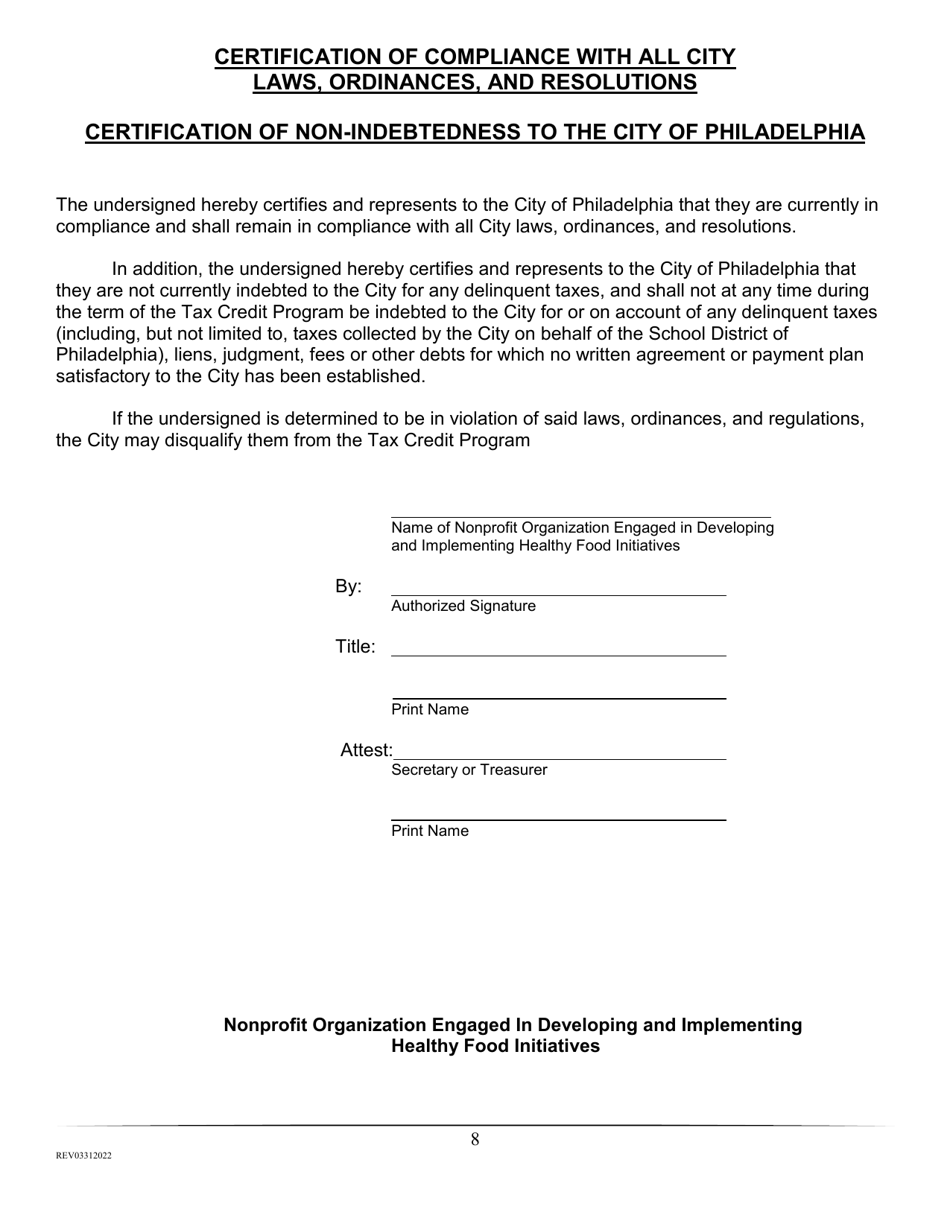

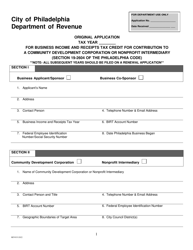

Original Application for Business Income and Receipts Tax Credit for Contribution to a Nonprofit Organization Engaged in Developing and Implementing Healthy Food Initiatives - City of Philadelphia, Pennsylvania

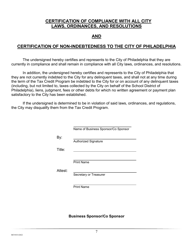

Original Application for Business Income and Receipts Tax Credit for Contribution to a Nonprofit Organization Engaged in Developing and Implementing Healthy Food Initiatives is a legal document that was released by the Department of Revenue - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia.

FAQ

Q: What is the application for?

A: The application is for a Business Income and Receipts Tax Credit for Contribution to a Nonprofit Organization engaged in developing and implementing healthy food initiatives in Philadelphia, Pennsylvania.

Q: Who can apply for the tax credit?

A: Businesses in Philadelphia, Pennsylvania.

Q: What is the purpose of the tax credit?

A: To incentivize businesses to contribute to nonprofit organizations working on healthy food initiatives.

Q: What are healthy food initiatives?

A: Initiatives that focus on developing and implementing programs related to healthy eating and food access.

Q: What is the City of Philadelphia's role in this program?

A: The City of Philadelphia offers the tax credit to encourage businesses to support healthy food initiatives.

Q: How can businesses apply for the tax credit?

A: By filling out the application form for the Business Income and Receipts Tax Credit.

Q: Is this tax credit available for individuals?

A: No, this tax credit is specifically for businesses.

Q: Are there any eligibility criteria for businesses to apply?

A: Yes, businesses must be located in Philadelphia, Pennsylvania.

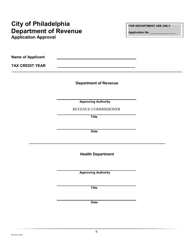

Q: Is the tax credit guaranteed upon application?

A: The tax credit is subject to approval and compliance with the program requirements.

Q: What is the benefit of receiving the tax credit?

A: Businesses can reduce their Business Income and Receipts Tax liability by the amount of the credit received.

Form Details:

- Released on March 31, 2022;

- The latest edition currently provided by the Department of Revenue - City of Philadelphia, Pennsylvania;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Department of Revenue - City of Philadelphia, Pennsylvania.