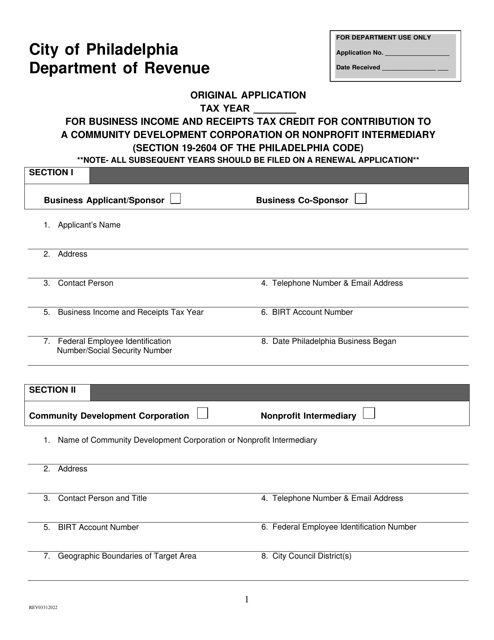

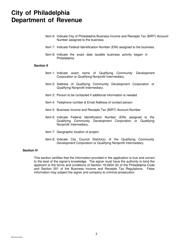

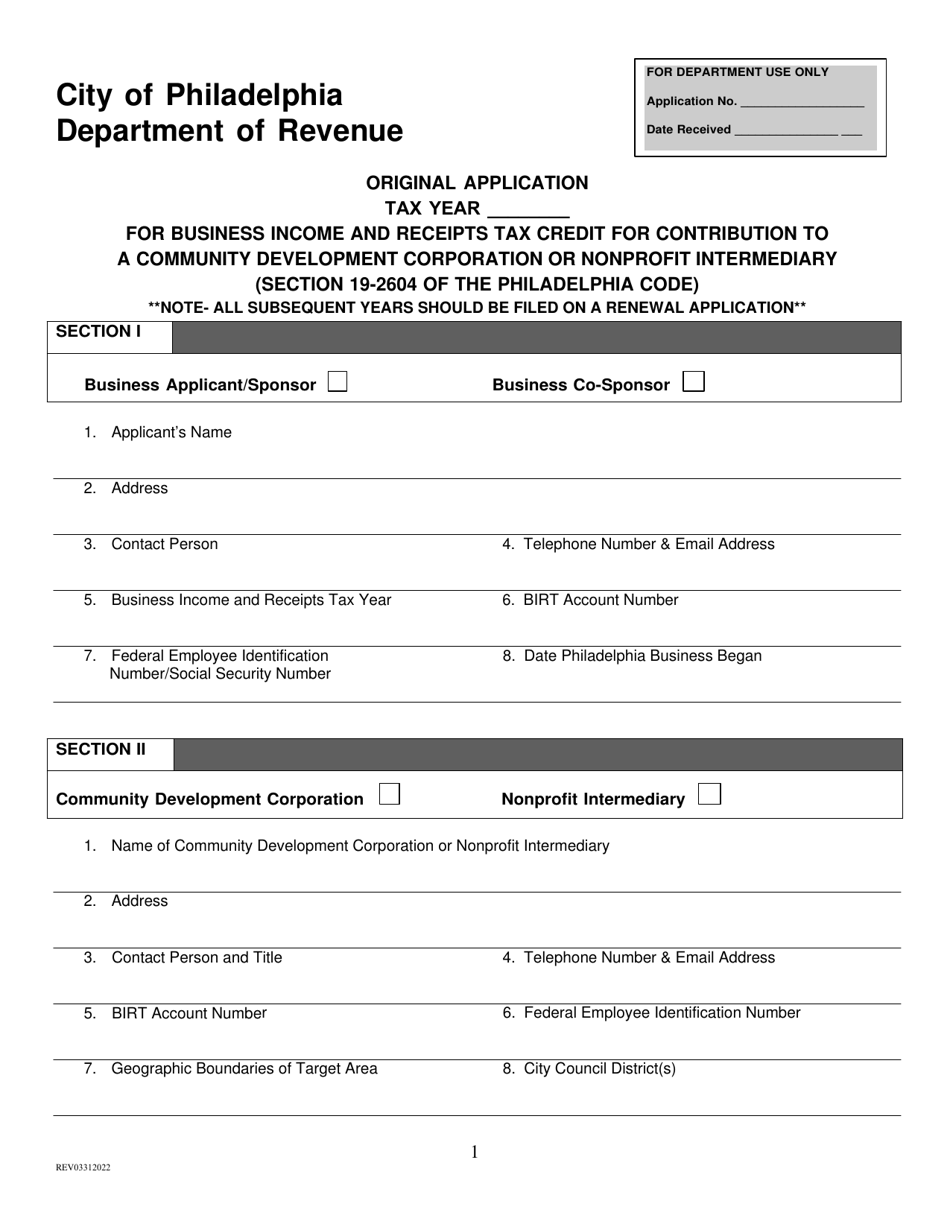

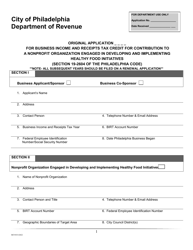

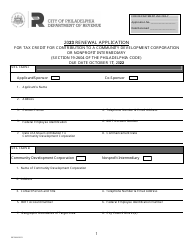

Original Application for Business Income and Receipts Tax Credit for Contribution to a Community Development Corporation or Nonprofit Intermediary - City of Philadelphia, Pennsylvania

Original Application for Business Income and Receipts Tax Credit for Contribution to a Community Development Corporation or Nonprofit Intermediary is a legal document that was released by the Department of Revenue - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia.

FAQ

Q: What is the purpose of the Business Income and Receipts Tax Credit?

A: The purpose of the Business Income and Receipts Tax Credit is to provide an incentive for businesses to contribute to community development corporations or nonprofit intermediaries in Philadelphia, Pennsylvania.

Q: Who is eligible to apply for this tax credit?

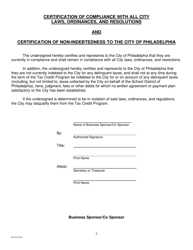

A: Any business that is subject to the Business Income and Receipts Tax in Philadelphia, Pennsylvania and has made a contribution to a community development corporation or nonprofit intermediary can apply for this tax credit.

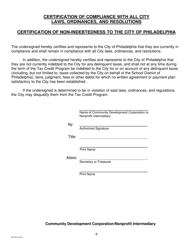

Q: What is a community development corporation?

A: A community development corporation is a nonprofit organization that focuses on improving and revitalizing a specific neighborhood or community.

Q: What is a nonprofit intermediary?

A: A nonprofit intermediary is an organization that acts as a bridge between funders and community development corporations, providing financial or technical assistance.

Q: How much is the tax credit and how is it calculated?

A: The tax credit is equal to 90% of the amount contributed to a community development corporation or nonprofit intermediary, up to a maximum of $750,000 per year.

Q: What are the steps to apply for the tax credit?

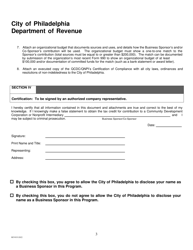

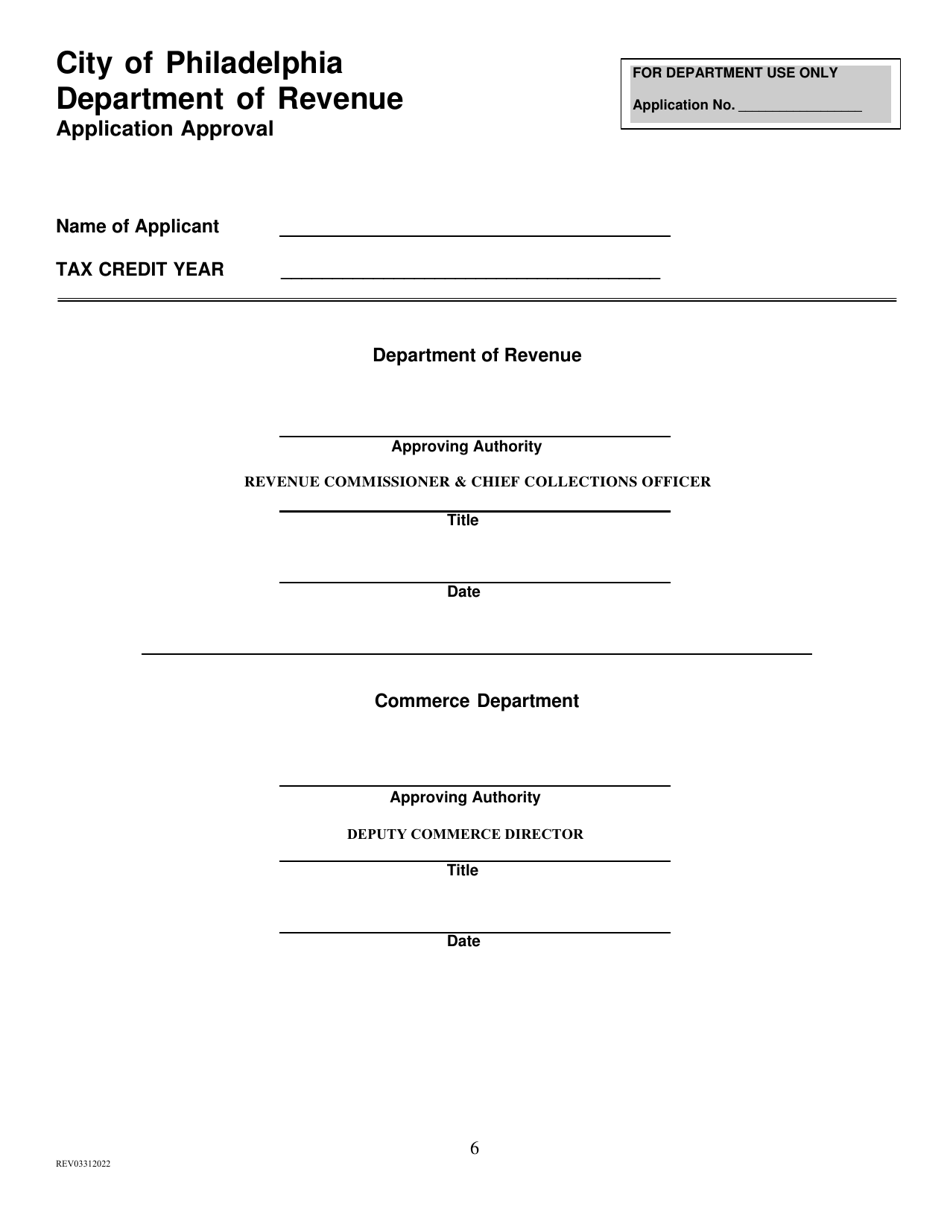

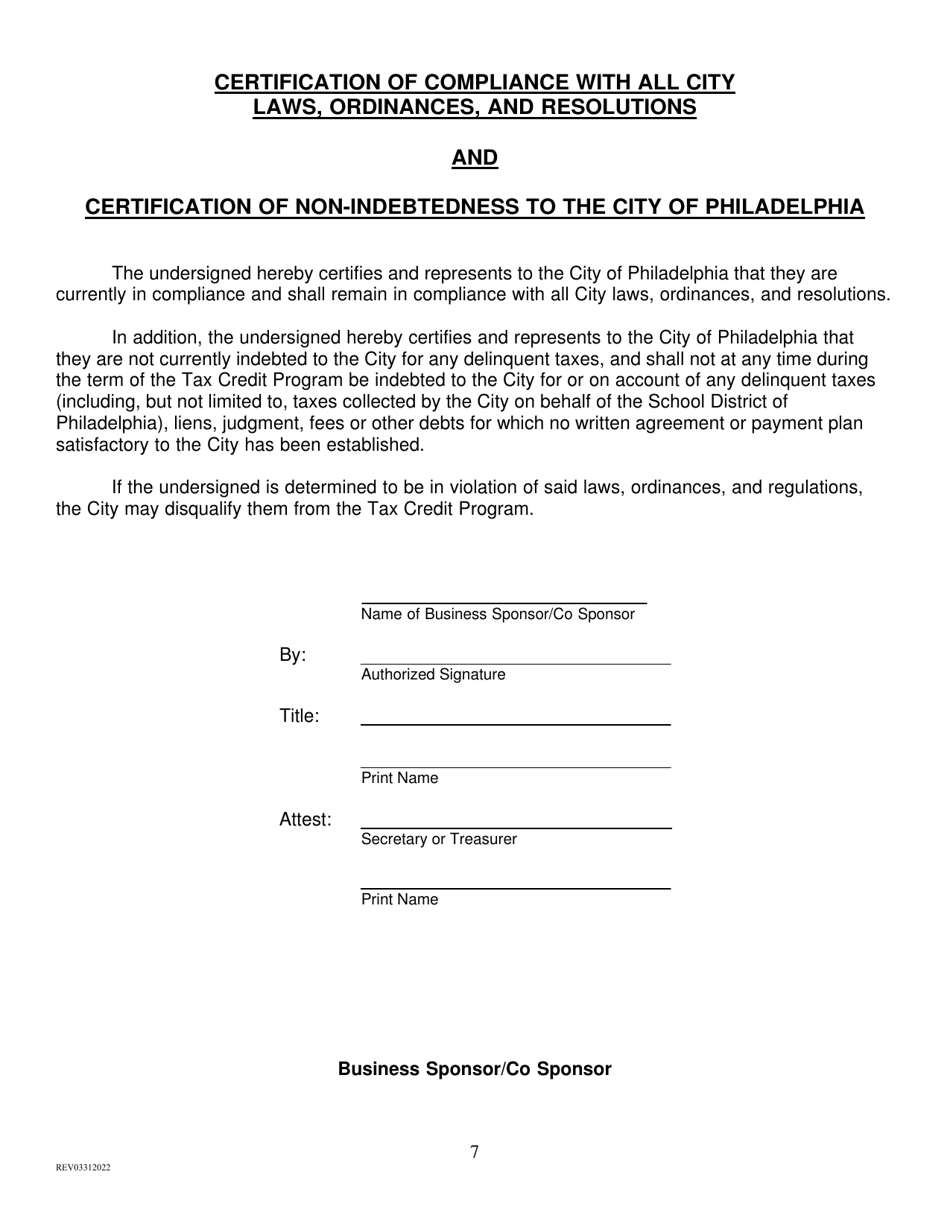

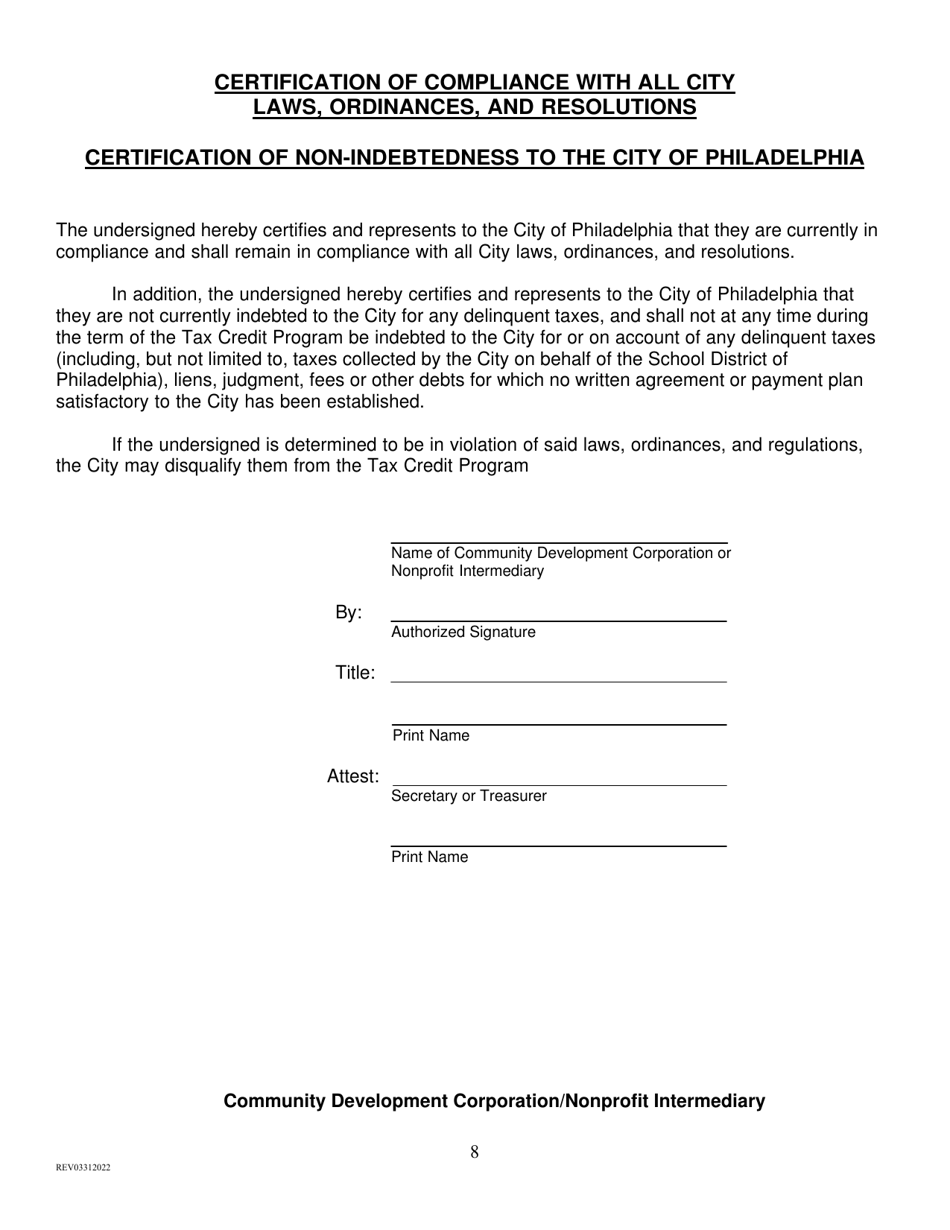

A: To apply for the tax credit, businesses must complete the Original Application for Business Income and Receipts Tax Credit for Contribution to a Community Development Corporation or Nonprofit Intermediary form and submit it to the City of Philadelphia's Department of Revenue.

Q: Is there a deadline for applying for the tax credit?

A: Yes, the deadline to apply for the tax credit is usually March 15th of the year following the tax year for which the credit is being claimed.

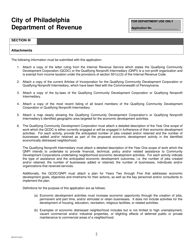

Q: Are there any additional requirements or documentation needed to apply for the tax credit?

A: Yes, businesses must provide proof of the contribution made to a community development corporation or nonprofit intermediary, such as a copy of the cancelled check or receipt.

Form Details:

- Released on March 31, 2022;

- The latest edition currently provided by the Department of Revenue - City of Philadelphia, Pennsylvania;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Department of Revenue - City of Philadelphia, Pennsylvania.