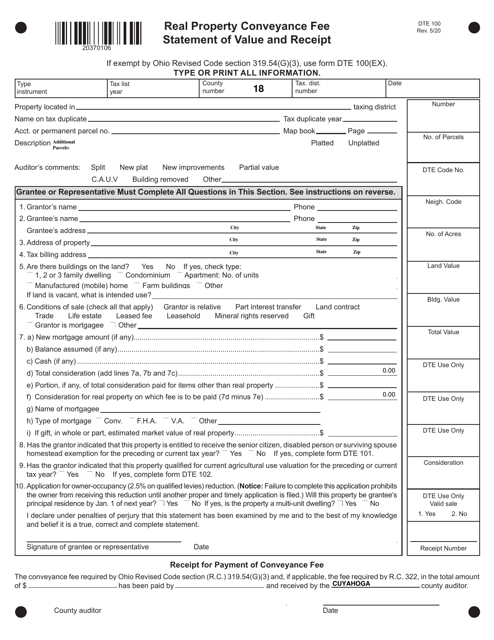

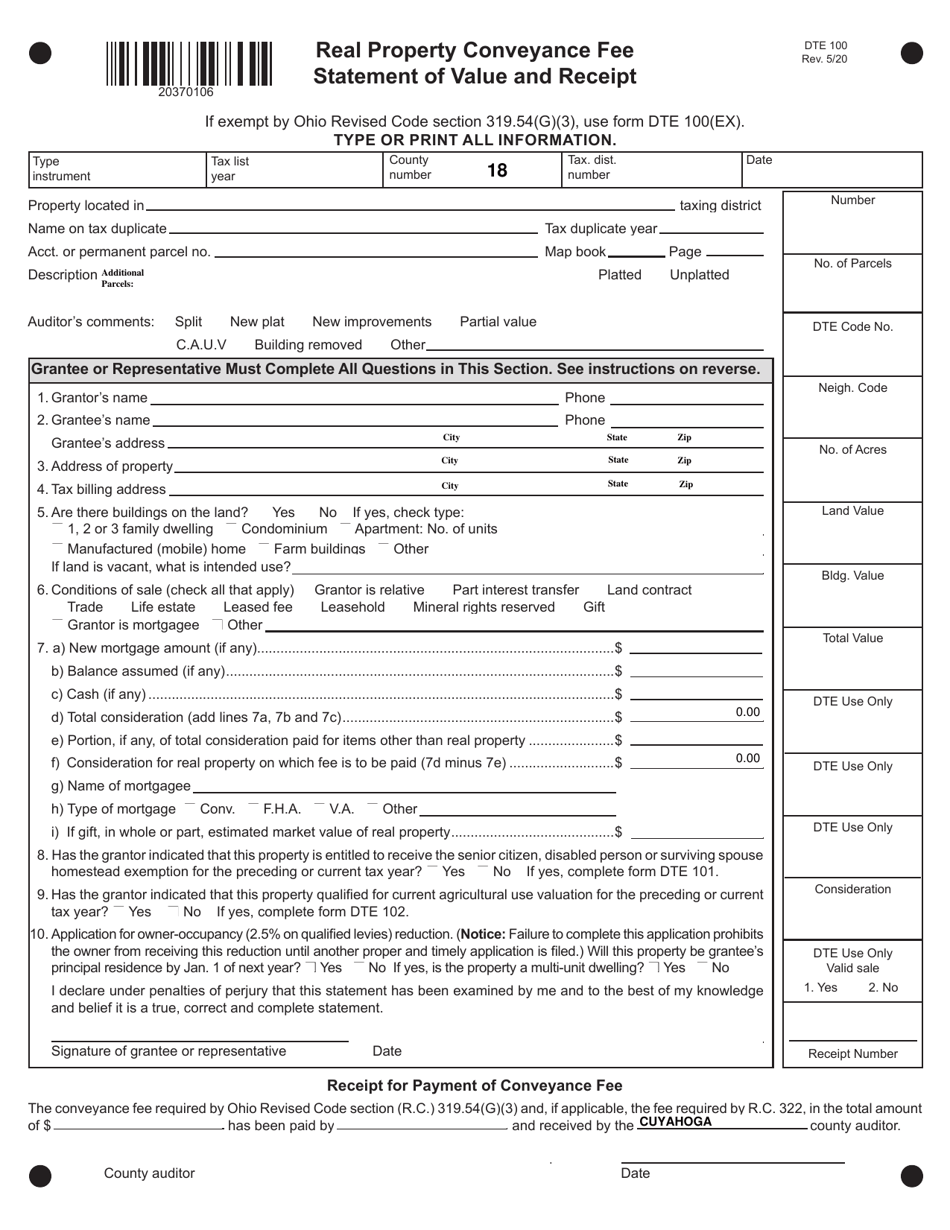

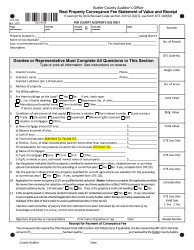

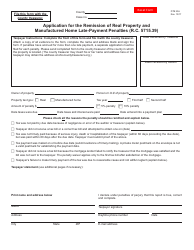

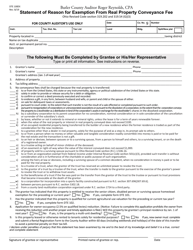

Form DTE100 Real Property Conveyance Fee Statement of Value and Receipt - Cuyahoga County, Ohio

What Is Form DTE100?

This is a legal form that was released by the Fiscal Office - Cuyahoga County, Ohio - a government authority operating within Ohio. The form may be used strictly within Cuyahoga County. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTE100?

A: Form DTE100 is the Real PropertyConveyance Fee Statement of Value and Receipt in Cuyahoga County, Ohio.

Q: What is the purpose of Form DTE100?

A: The purpose of Form DTE100 is to report the value of real property being transferred and to pay the conveyance fee.

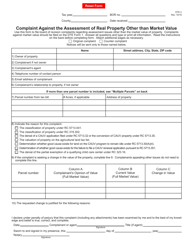

Q: Who needs to complete Form DTE100?

A: The person or entity transferring the real property is responsible for completing Form DTE100.

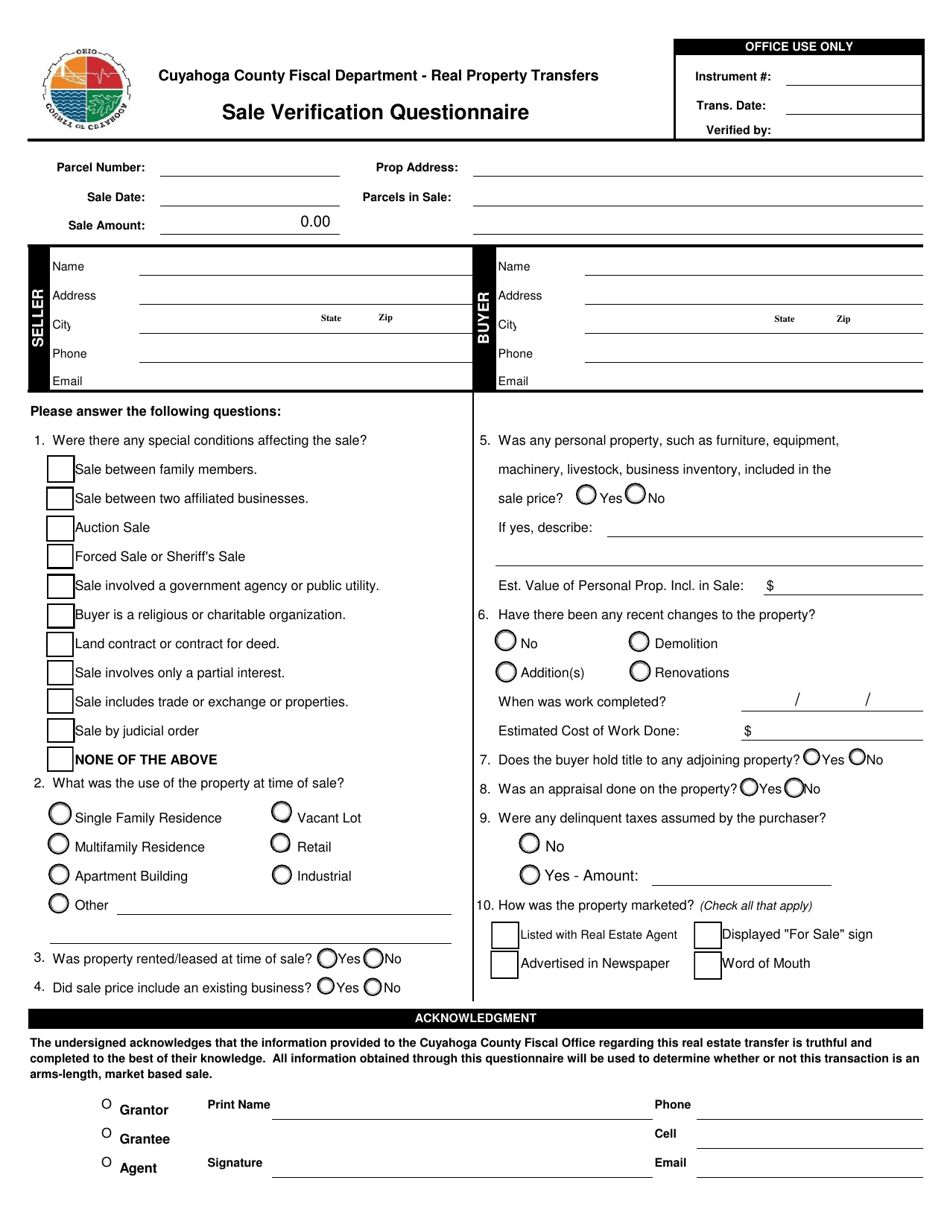

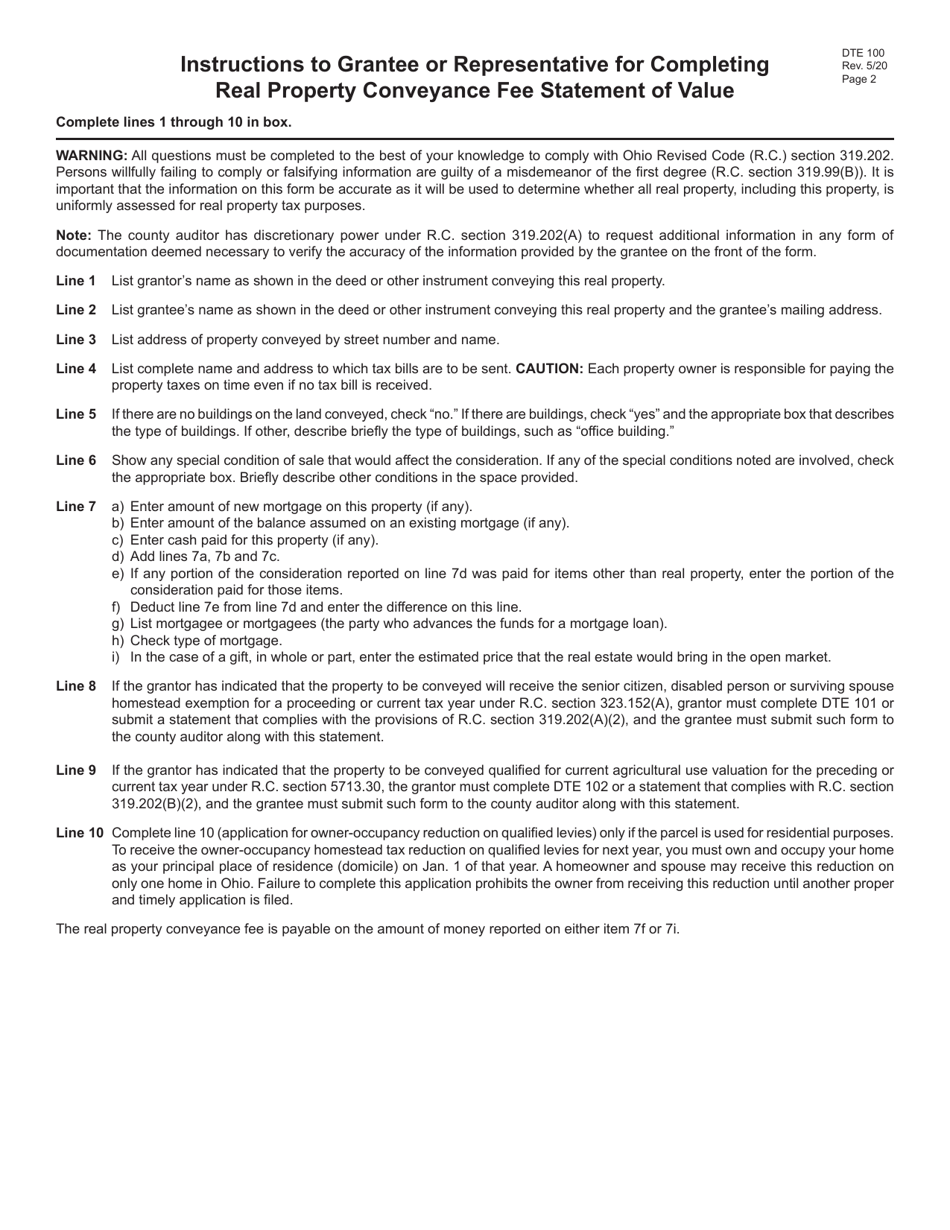

Q: What information is required on Form DTE100?

A: Form DTE100 requires information such as the names of the buyer and seller, property details, and the value of the property.

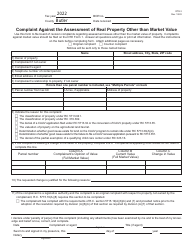

Q: What is the conveyance fee?

A: The conveyance fee is a tax that is paid when real property is transferred from one party to another.

Q: How much is the conveyance fee in Cuyahoga County, Ohio?

A: The conveyance fee in Cuyahoga County, Ohio is $4 per $1,000 of the property value.

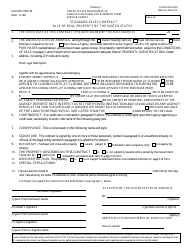

Q: When is Form DTE100 due?

A: Form DTE100 is due within 30 days of the transfer of the real property.

Q: Who should I contact for more information about Form DTE100?

A: You can contact the Cuyahoga County Fiscal Office for more information about Form DTE100.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the Fiscal Office - Cuyahoga County, Ohio;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE100 by clicking the link below or browse more documents and templates provided by the Fiscal Office - Cuyahoga County, Ohio.