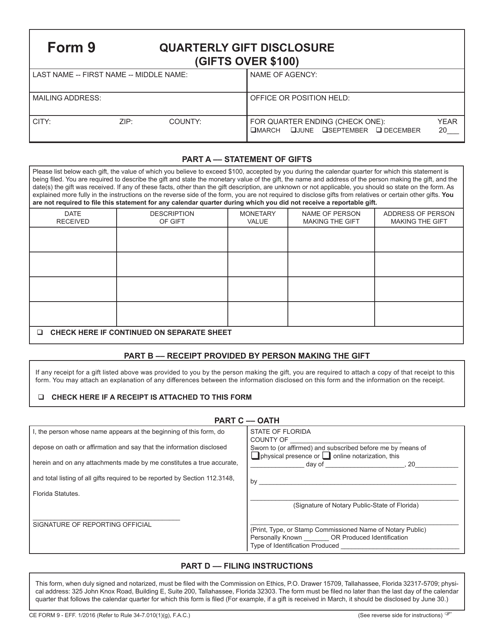

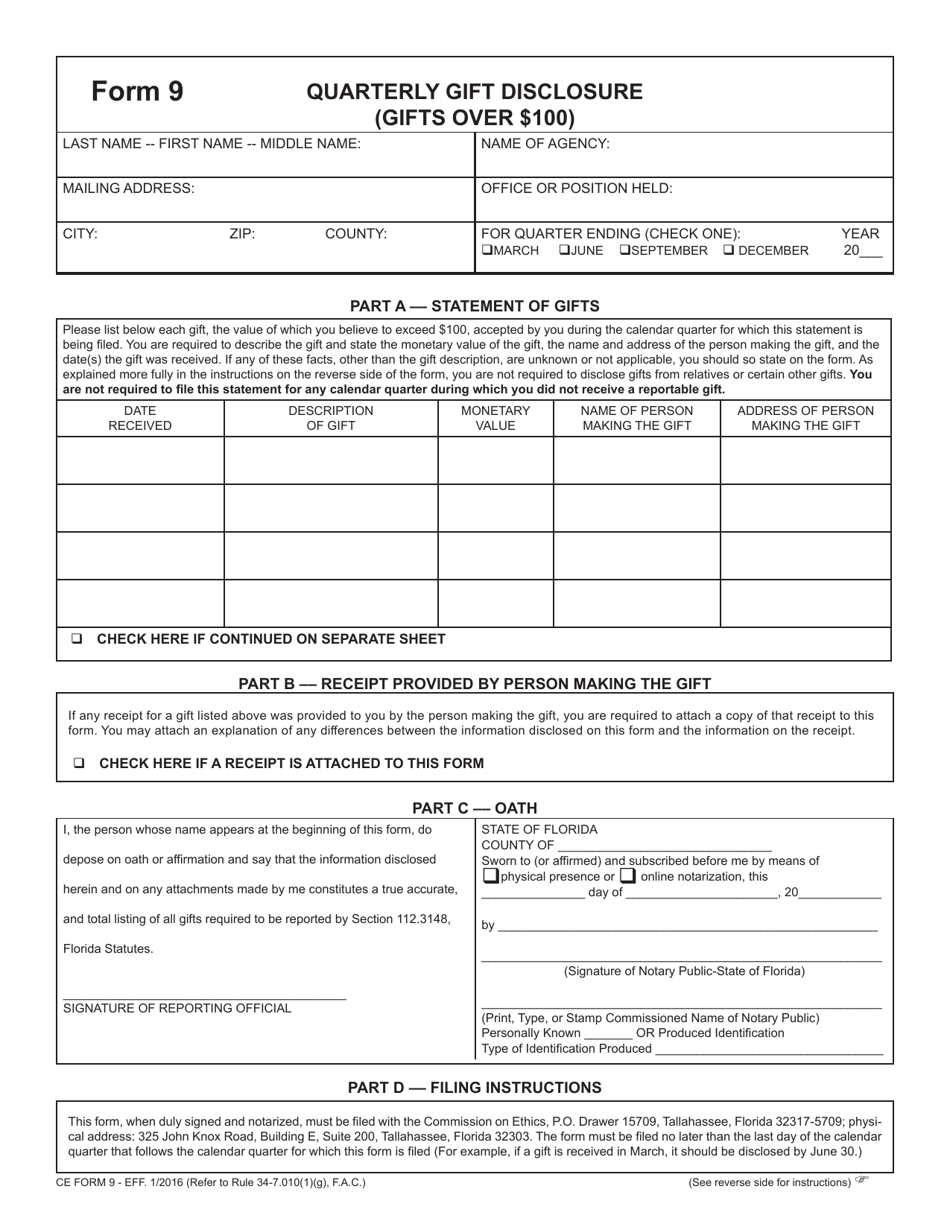

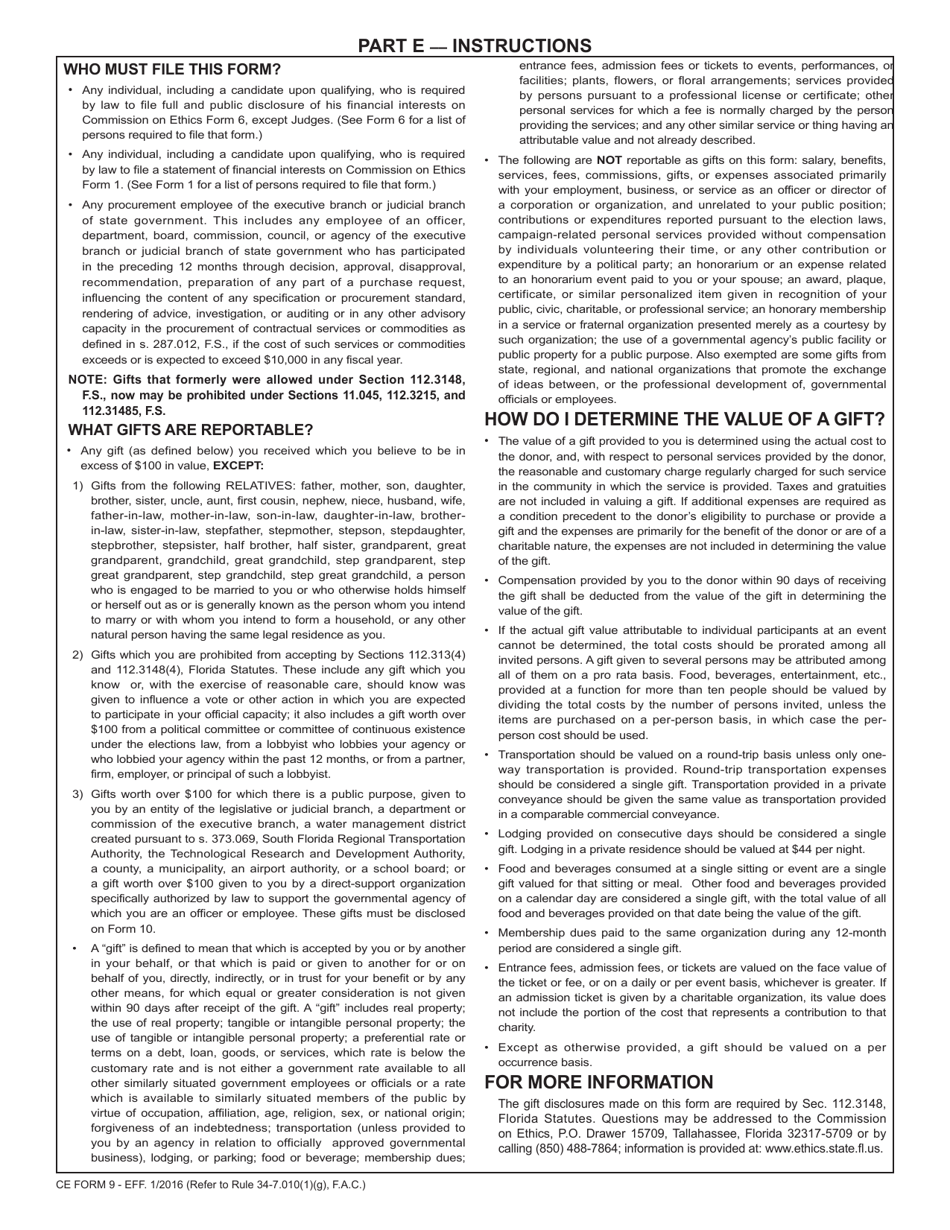

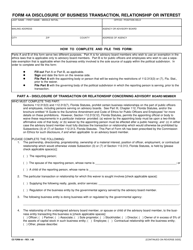

CE Form 9 Quarterly Gift Disclosure (Gifts Over $100) - Florida

What Is CE Form 9?

This is a legal form that was released by the Florida Commission on Ethics - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a CE Form 9 Quarterly Gift Disclosure?

A: CE Form 9 is a form used to disclose gifts over $100 for quarterly reporting.

Q: Who is required to file a CE Form 9?

A: The form must be filed by individuals who receive gifts over $100 in the state of Florida.

Q: What is the purpose of filing a CE Form 9?

A: The purpose of filing the form is to report any gifts over $100 received by individuals.

Q: Do gifts under $100 need to be reported?

A: No, only gifts over $100 need to be reported using the CE Form 9.

Q: When should the CE Form 9 be filed?

A: The form should be filed quarterly, with the deadlines falling on January 15, April 15, July 15, and October 15 of each year.

Q: What happens if I fail to file a CE Form 9?

A: Failure to file the form in a timely manner may result in penalties or legal consequences.

Q: Are there any exceptions to filing the CE Form 9?

A: Exceptions may apply to certain types of gifts, such as those received from family members or personal friends.

Q: What information is required on the CE Form 9?

A: The form requires information about the donor, the value of the gift, the date received, and any other relevant details.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Florida Commission on Ethics;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of CE Form 9 by clicking the link below or browse more documents and templates provided by the Florida Commission on Ethics.