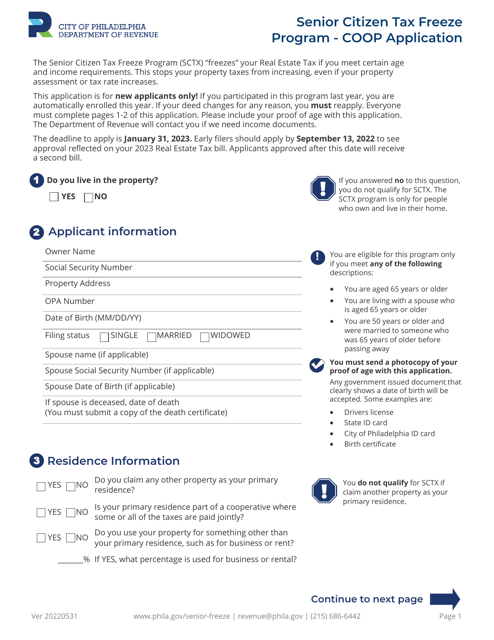

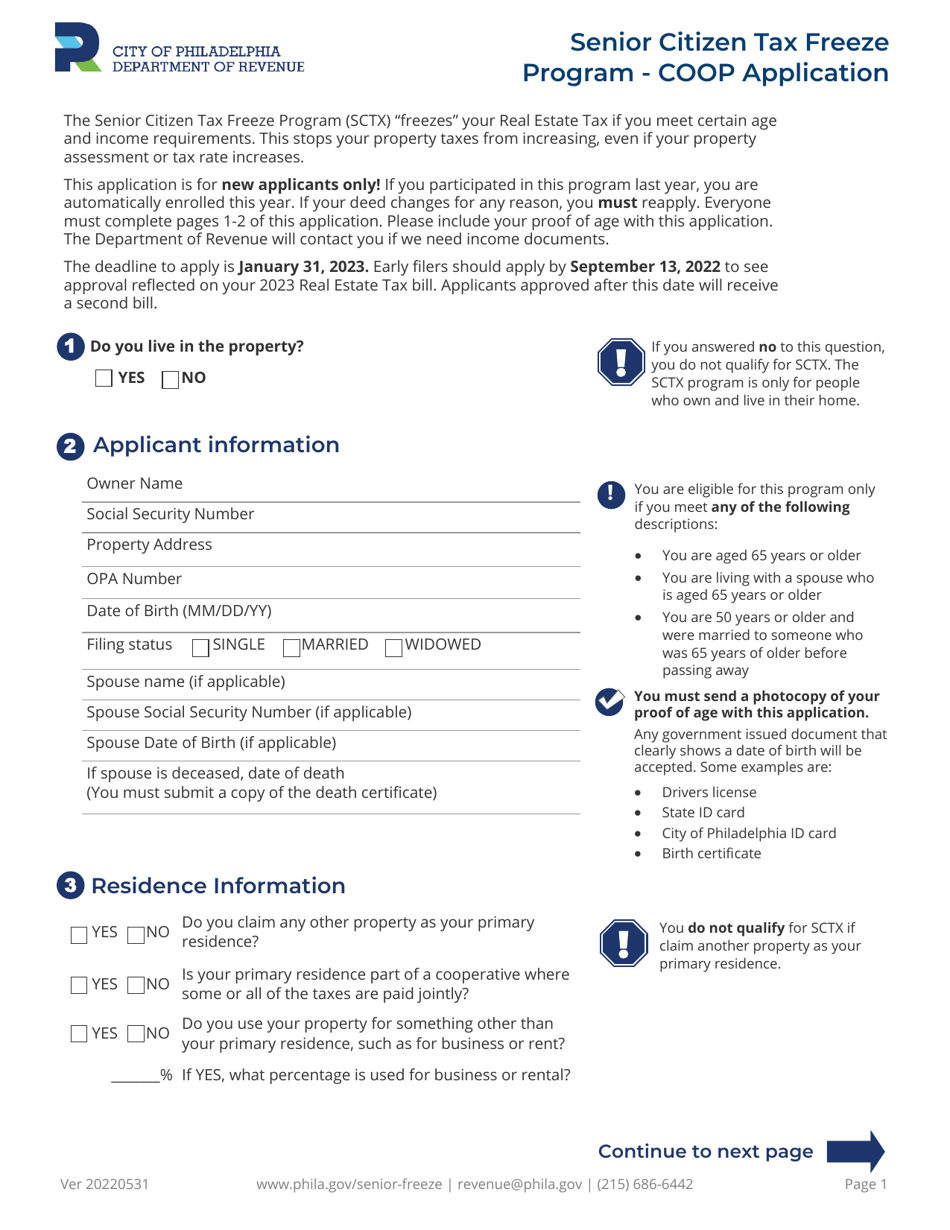

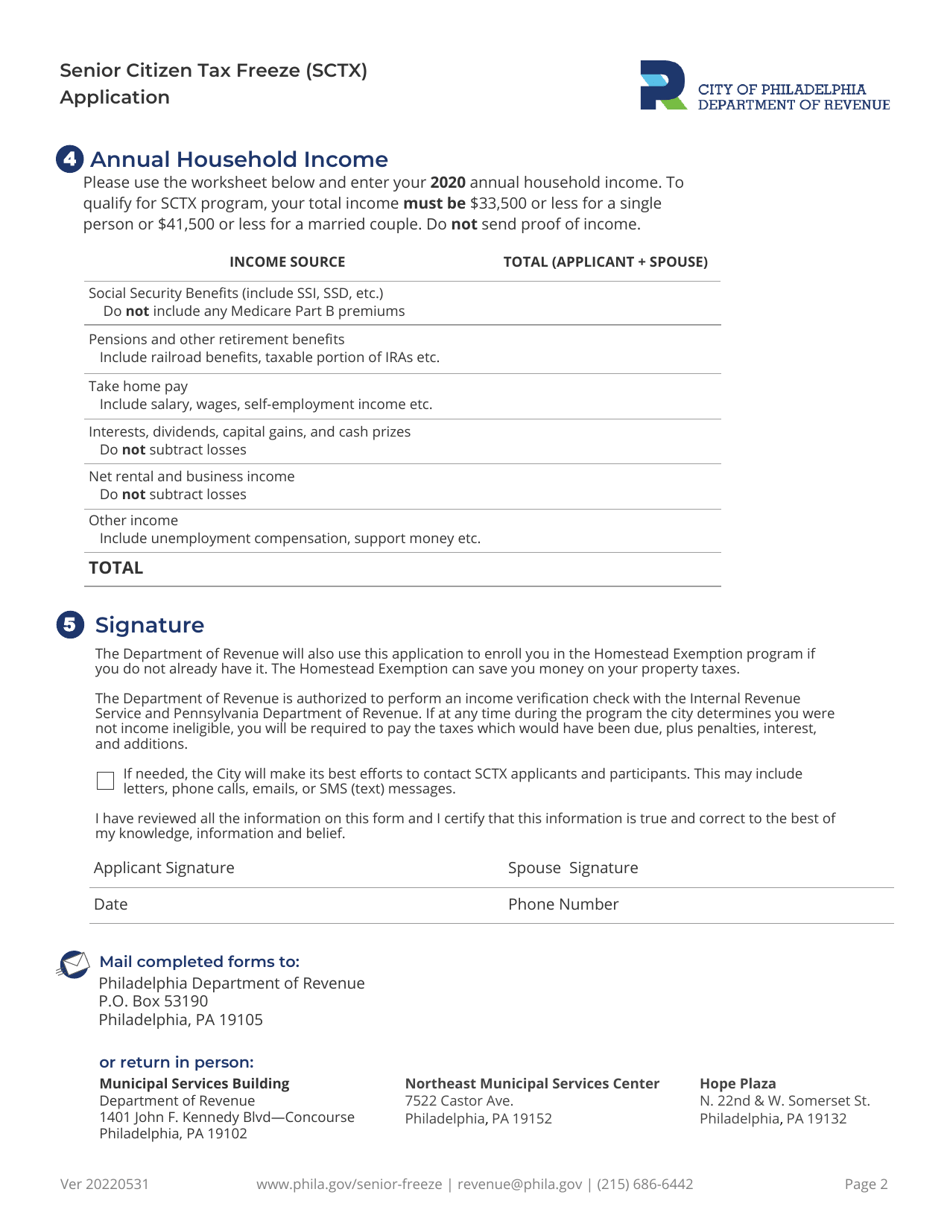

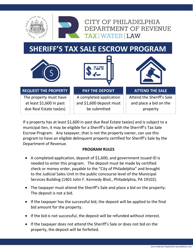

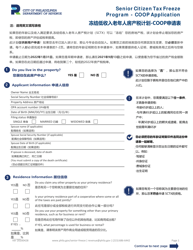

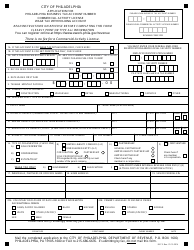

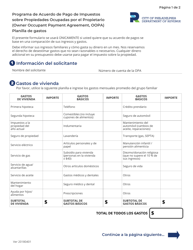

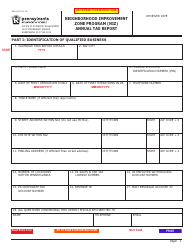

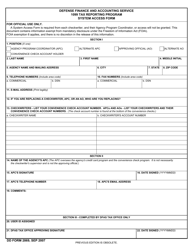

Coop Application Form - Senior Citizen Tax Freeze Program - City of Philadelphia, Pennsylvania

Coop Application Form - Senior Citizen Tax Freeze Program is a legal document that was released by the Department of Revenue - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia.

FAQ

Q: What is the Coop Application Form?

A: The Coop Application Form is a form used for applying to the Senior Citizen Tax Freeze Program in the City of Philadelphia, Pennsylvania.

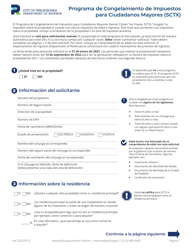

Q: What is the Senior Citizen Tax Freeze Program?

A: The Senior Citizen Tax Freeze Program is a program in the City of Philadelphia, Pennsylvania that freezes property taxes for eligible senior citizens.

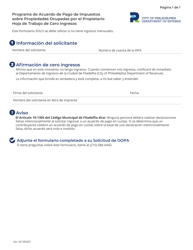

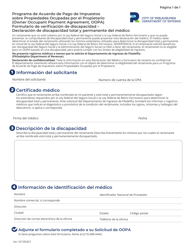

Q: Who is eligible for the Senior Citizen Tax Freeze Program?

A: Senior citizens who meet certain income and residency requirements are eligible for the Senior Citizen Tax Freeze Program.

Q: Is the Senior Citizen Tax Freeze Program only available in Philadelphia?

A: Yes, the Senior Citizen Tax Freeze Program is specific to the City of Philadelphia, Pennsylvania.

Q: Does the Senior Citizen Tax Freeze Program cover all property taxes?

A: The Senior Citizen Tax Freeze Program freezes property taxes at a certain base year amount. It does not cover any increases due to additional improvements or reassessments of the property.

Q: Can I apply for the Senior Citizen Tax Freeze Program if I am not a senior citizen?

A: No, the Senior Citizen Tax Freeze Program is specifically for senior citizens.

Q: What are the benefits of the Senior Citizen Tax Freeze Program?

A: The Senior Citizen Tax Freeze Program helps eligible senior citizens by freezing their property taxes and providing financial stability.

Q: How long does the Coop Application Form process take?

A: The processing time for the Coop Application Form may vary. It is best to contact the relevant department for an estimate.

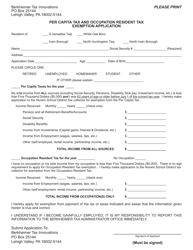

Form Details:

- Released on May 31, 2022;

- The latest edition currently provided by the Department of Revenue - City of Philadelphia, Pennsylvania;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Department of Revenue - City of Philadelphia, Pennsylvania.