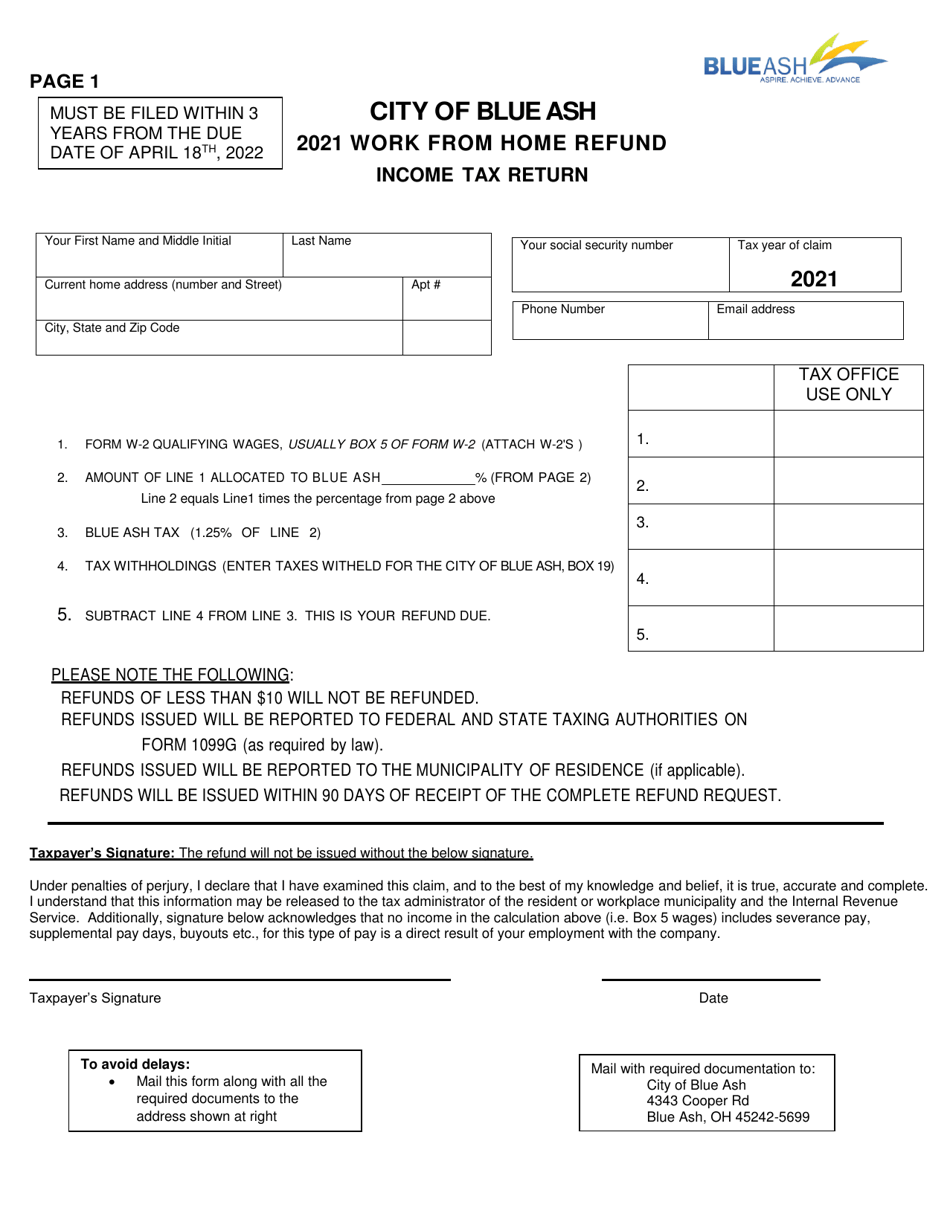

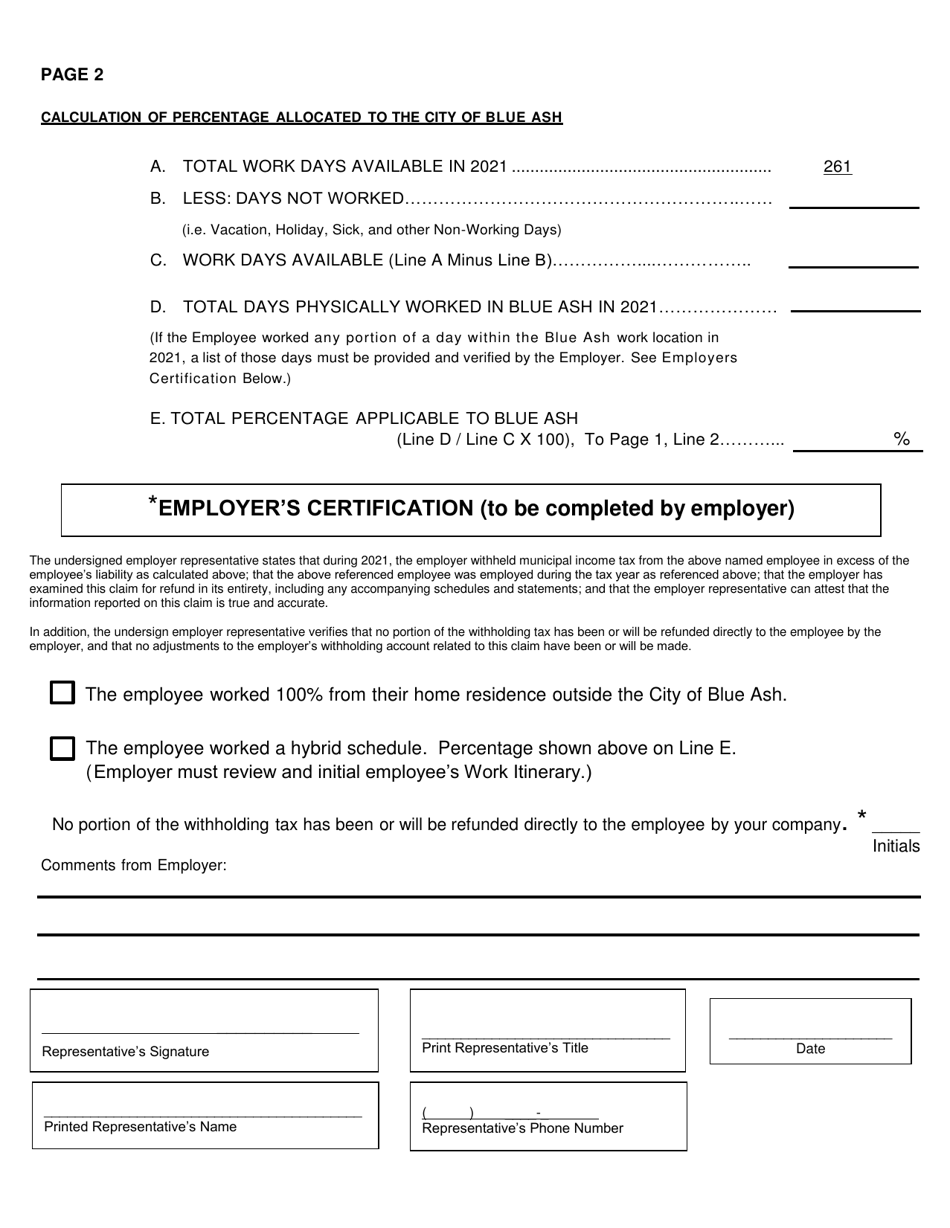

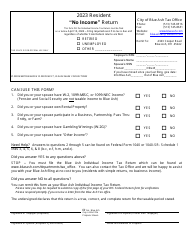

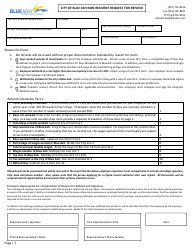

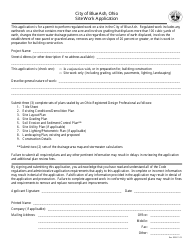

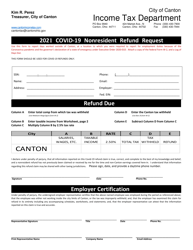

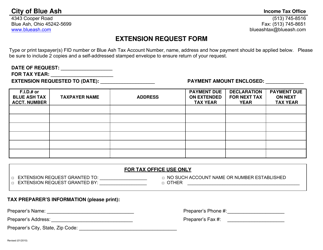

Non-resident Work From Home Refund Request - City of Blue Ash, Ohio

Non-resident Work From Home Refund Request is a legal document that was released by the Tax Office - City of Blue Ash, Ohio - a government authority operating within Ohio. The form may be used strictly within City of Blue Ash.

FAQ

Q: Who is eligible to request a non-resident work from home refund in Blue Ash, Ohio?

A: Non-residents who worked from home during the COVID-19 pandemic and paid municipal income tax to the City of Blue Ash.

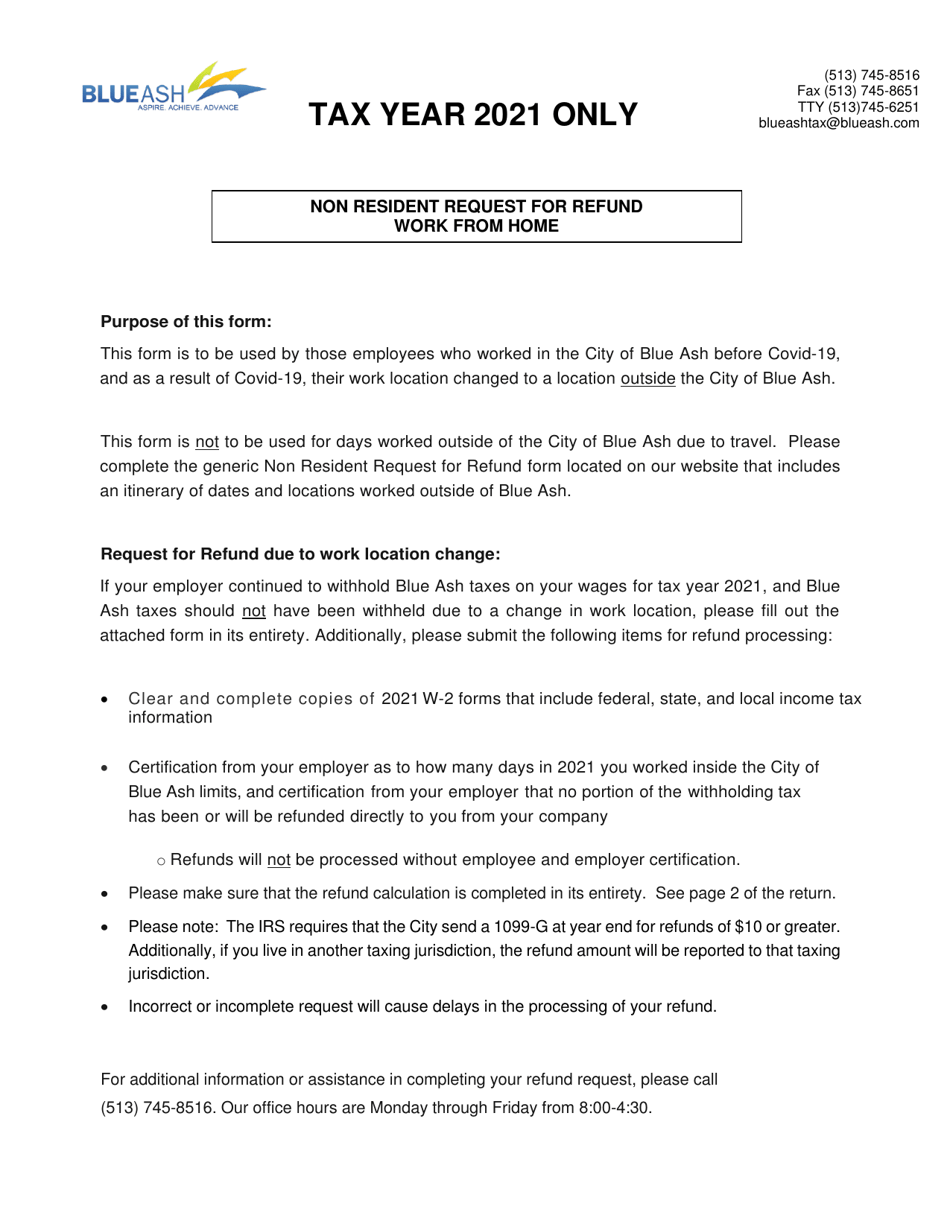

Q: What is the purpose of the non-resident work from home refund?

A: The purpose of the refund is to provide relief to non-residents who paid municipal income tax to the City of Blue Ash while working from home.

Q: How can I request a non-resident work from home refund?

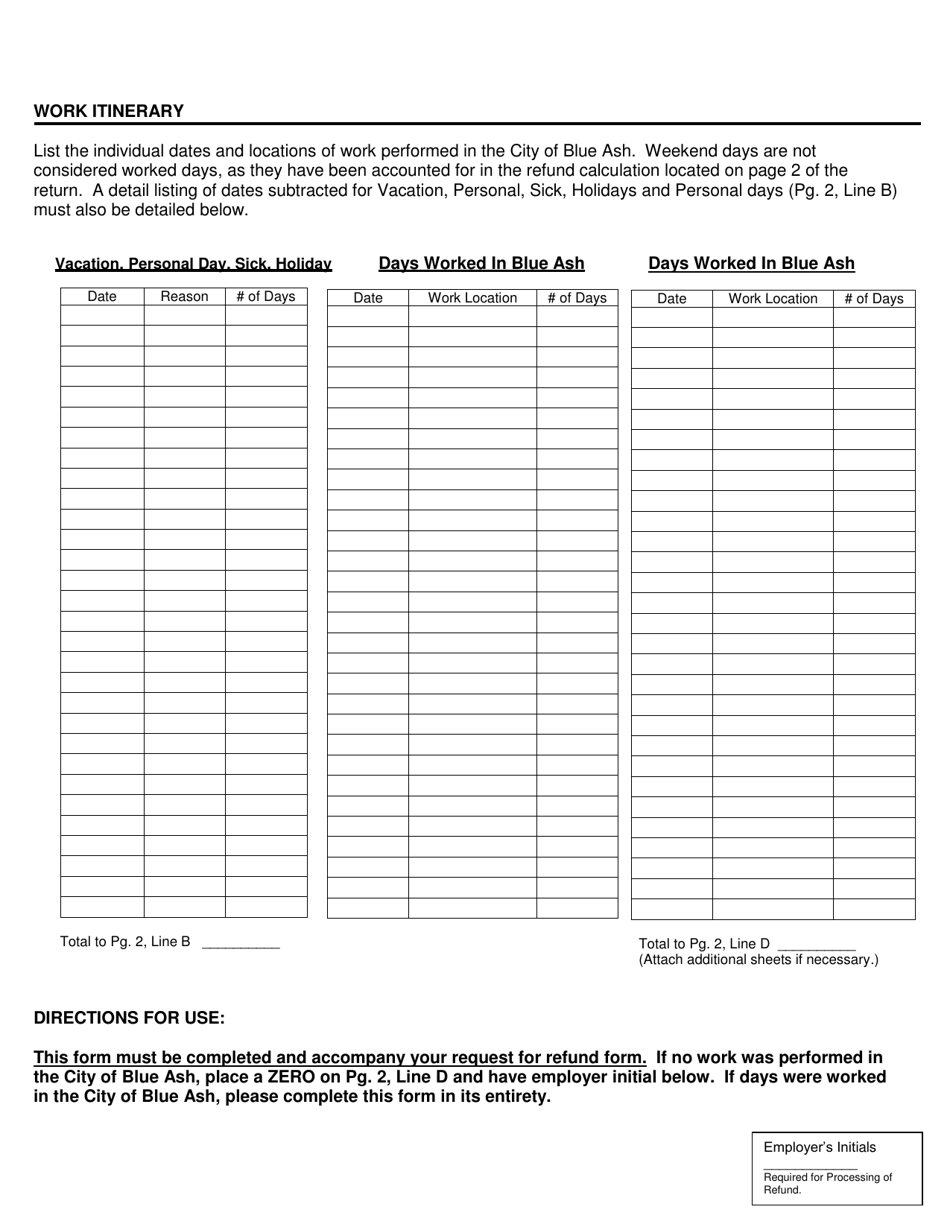

A: You can request a refund by submitting a completed refund request form along with the required documentation to the City of Blue Ash.

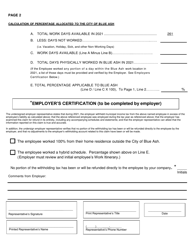

Q: What documentation is required to request a non-resident work from home refund?

A: You will need to provide proof of residency, proof of employment, and proof of taxes paid to the City of Blue Ash during the work from home period.

Q: Is there a deadline to request a non-resident work from home refund?

A: Yes, the deadline to submit a refund request is December 31, 2021.

Q: How much is the non-resident work from home refund in Blue Ash, Ohio?

A: The refund amount will vary based on the individual's tax liability and the number of days worked from home.

Q: When will I receive my non-resident work from home refund?

A: Refund processing can take up to 6-8 weeks from the date the request is received.

Q: Are non-residents who work from home in Blue Ash eligible for any other tax benefits?

A: Non-residents may also qualify for a credit against their Blue Ash municipal income tax liability for taxes paid to another municipality.

Form Details:

- The latest edition currently provided by the Tax Office - City of Blue Ash, Ohio;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Tax Office - City of Blue Ash, Ohio.