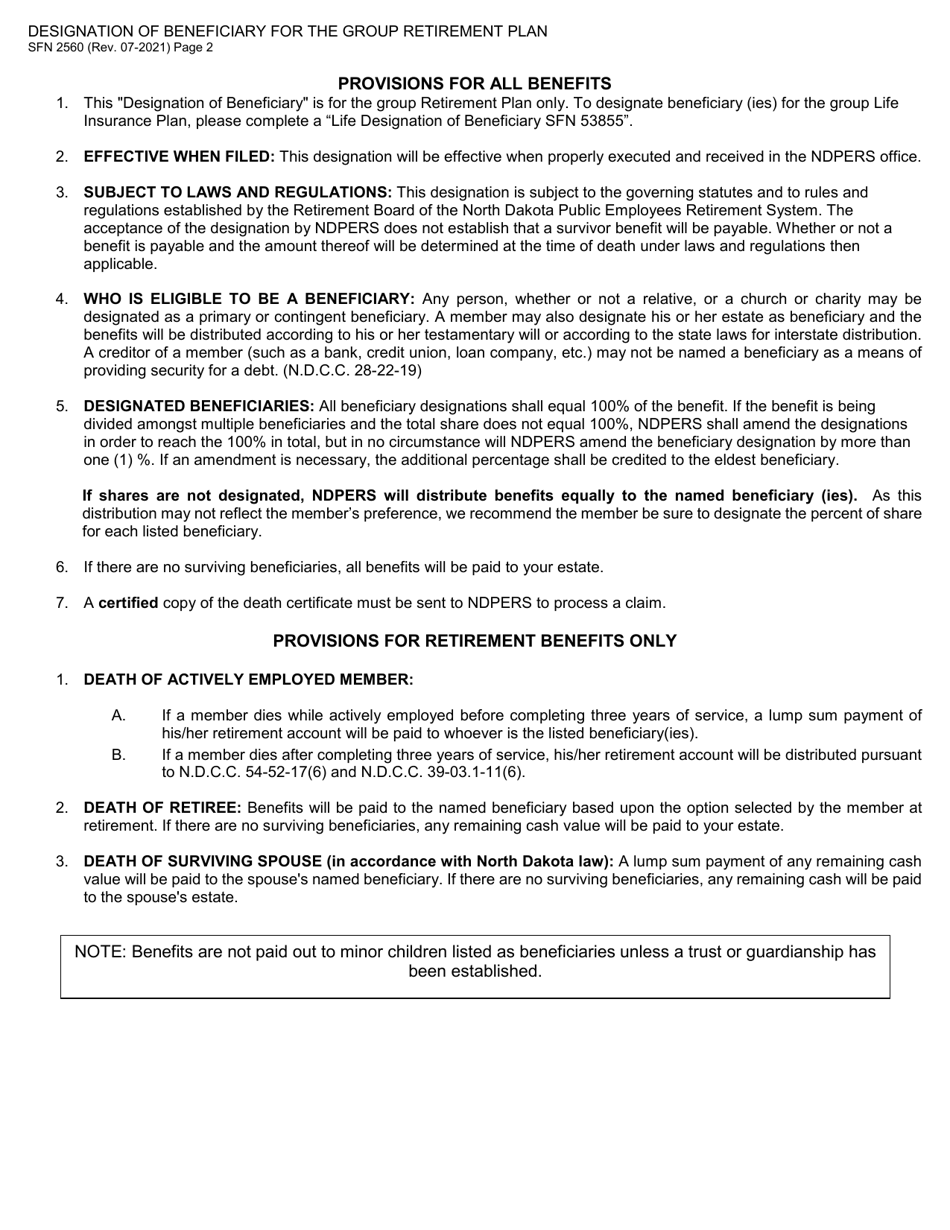

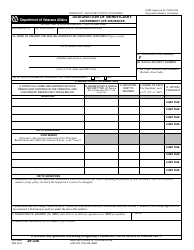

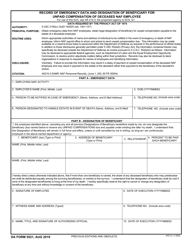

Form SFN2560 Designation of Beneficiary for the Group Retirement Plan - North Dakota

What Is Form SFN2560?

This is a legal form that was released by the North Dakota Public Employees Retirement System - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

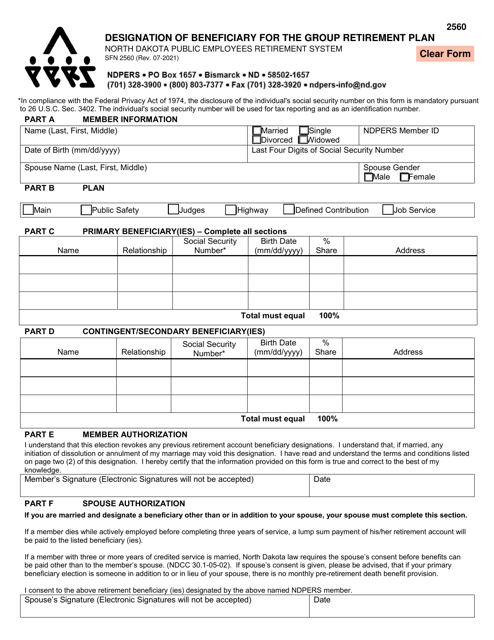

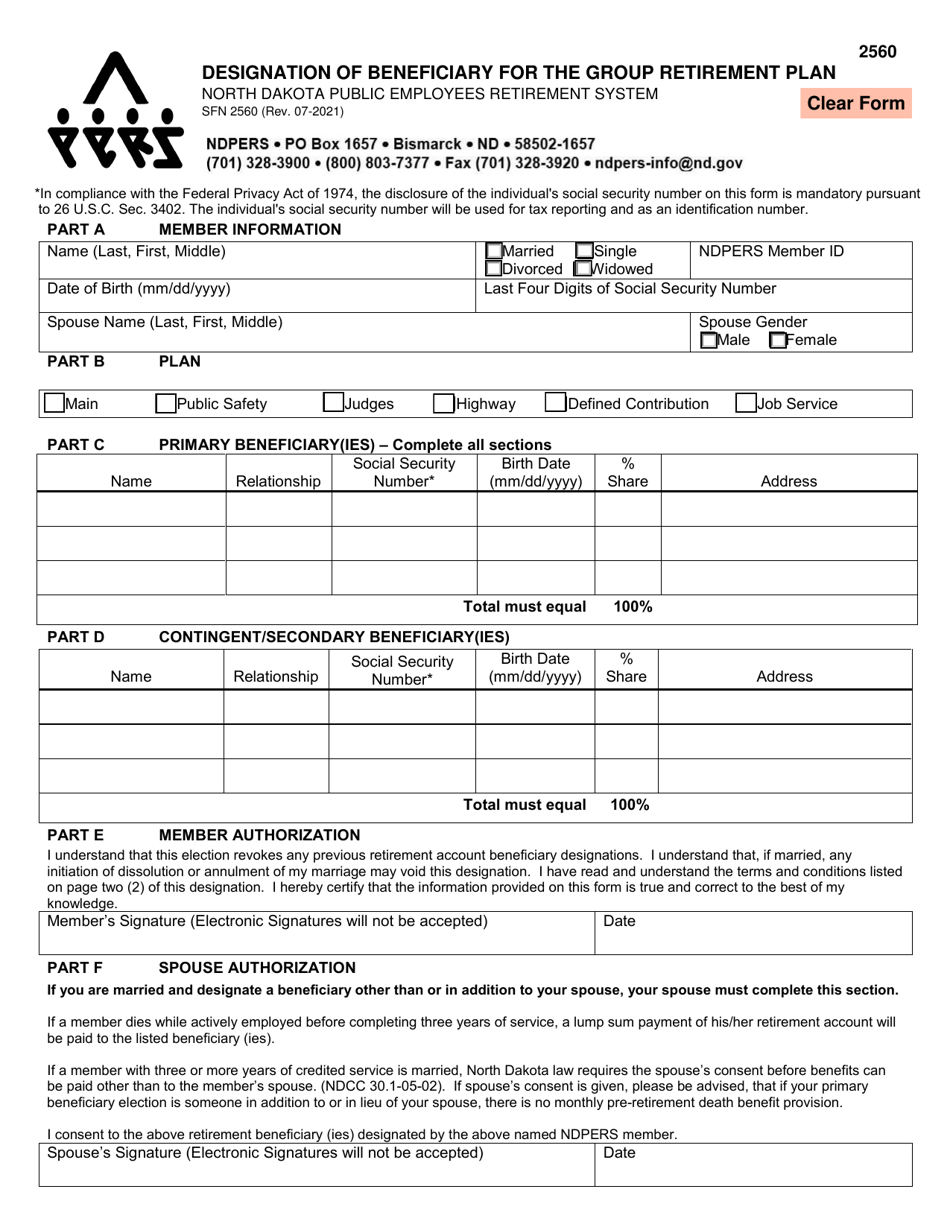

Q: What is Form SFN2560?

A: Form SFN2560 is the Designation of Beneficiary for the Group Retirement Plan in North Dakota.

Q: What is the purpose of Form SFN2560?

A: The purpose of Form SFN2560 is to designate a beneficiary for the Group Retirement Plan in North Dakota.

Q: What is the Group Retirement Plan in North Dakota?

A: The Group Retirement Plan in North Dakota is a retirement savings plan for employees.

Q: Why do I need to designate a beneficiary for the Group Retirement Plan?

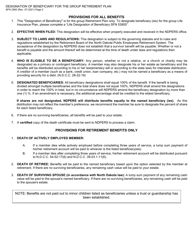

A: Designating a beneficiary ensures that your retirement savings are distributed according to your wishes in the event of your death.

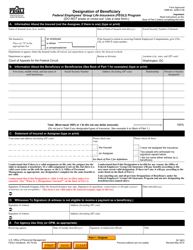

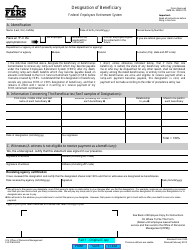

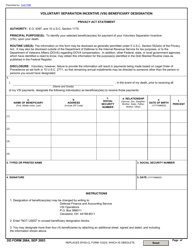

Q: How do I fill out Form SFN2560?

A: You need to provide your personal information, such as your name and address, and then specify the beneficiary's information, including their name and relationship to you.

Q: When should I submit Form SFN2560?

A: It is recommended to submit Form SFN2560 as soon as possible after enrolling in the Group Retirement Plan.

Q: Can I change my designated beneficiary?

A: Yes, you can change your designated beneficiary at any time by submitting a new Form SFN2560.

Q: Do I need to submit a new Form SFN2560 if my beneficiary information changes?

A: Yes, you should submit a new Form SFN2560 if there are any changes to your designated beneficiary.

Q: What happens if I don't submit Form SFN2560?

A: If you don't submit Form SFN2560, your retirement savings may be distributed according to default rules determined by the Group Retirement Plan.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the North Dakota Public Employees Retirement System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN2560 by clicking the link below or browse more documents and templates provided by the North Dakota Public Employees Retirement System.