This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

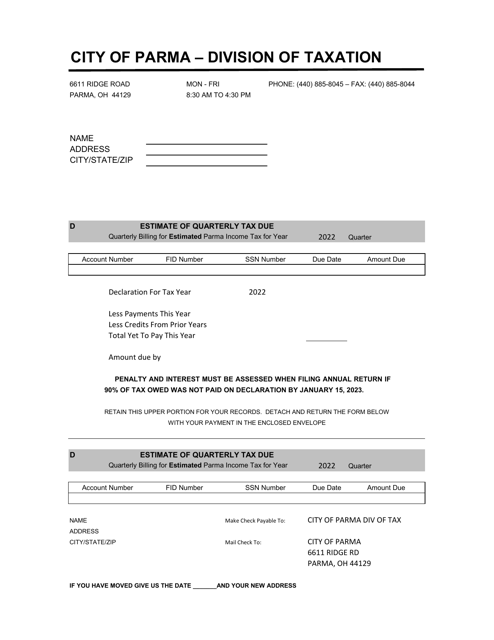

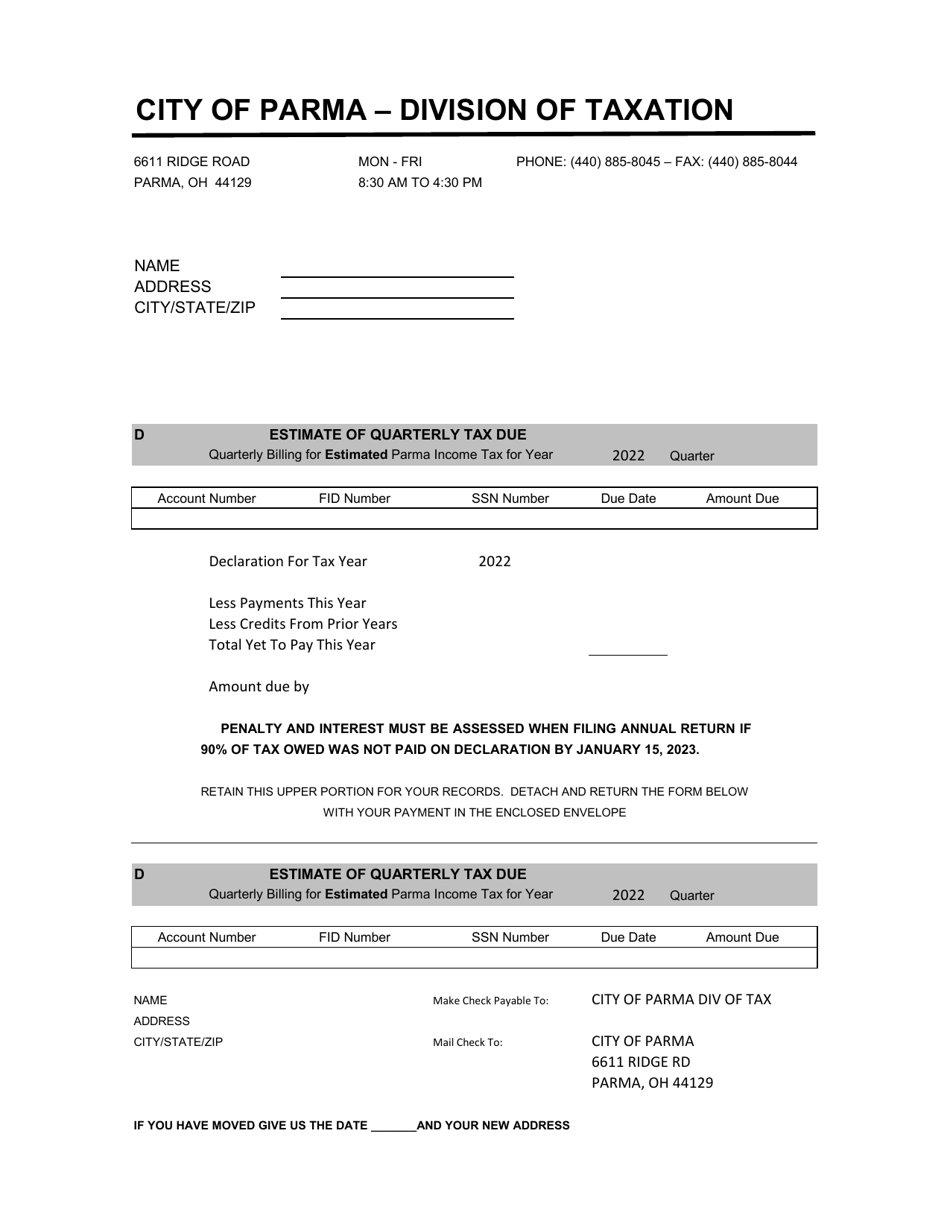

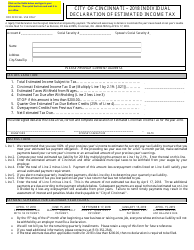

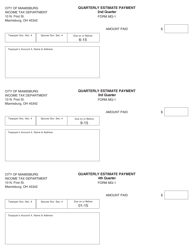

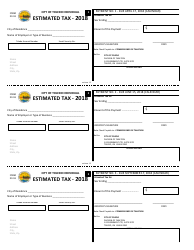

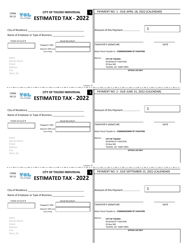

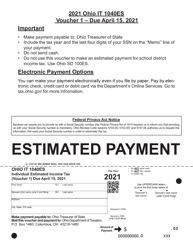

Individual Estimate of Quarterly Tax Due - City of Parma, Ohio

Individual Estimate of Quarterly Tax Due is a legal document that was released by the Division of Taxation - City of Parma, Ohio - a government authority operating within Ohio. The form may be used strictly within City of Parma.

FAQ

Q: How can I estimate my quarterly tax due in the City of Parma, Ohio?

A: To estimate your quarterly tax due in the City of Parma, Ohio, you can use the tax rate provided by the city and multiply it by your estimated taxable income for the quarter.

Q: What income is subject to quarterly tax in the City of Parma, Ohio?

A: In the City of Parma, Ohio, quarterly tax is levied on different types of income, including wages, salaries, commissions, and self-employment income.

Q: How can I determine my taxable income for the quarter?

A: To determine your taxable income for the quarter in the City of Parma, Ohio, you should calculate your earnings from wages, salaries, commissions, and self-employment income, and subtract any allowable deductions.

Q: What happens if I fail to pay my quarterly taxes in the City of Parma, Ohio?

A: If you fail to pay your quarterly taxes in the City of Parma, Ohio, you may be subject to penalties and interest. It is important to fulfill your tax obligations in a timely manner to avoid any potential consequences.

Form Details:

- The latest edition currently provided by the Division of Taxation - City of Parma, Ohio;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Division of Taxation - City of Parma, Ohio.