This version of the form is not currently in use and is provided for reference only. Download this version of

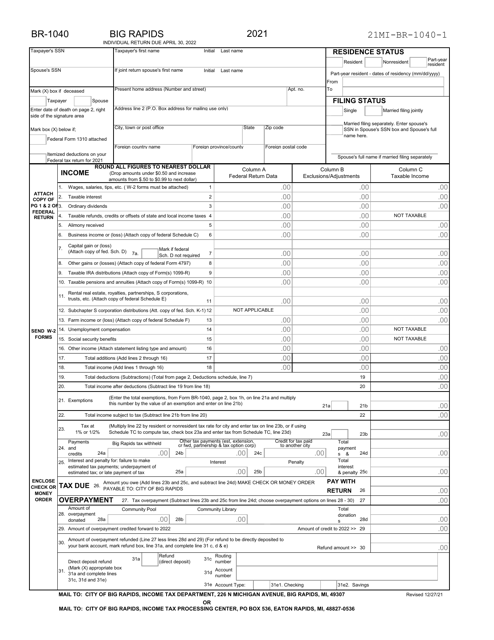

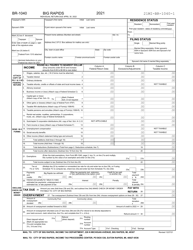

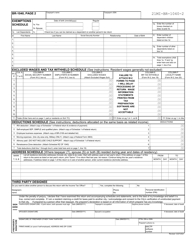

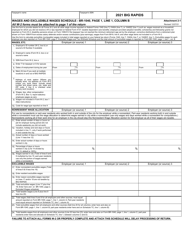

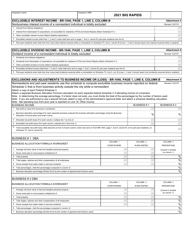

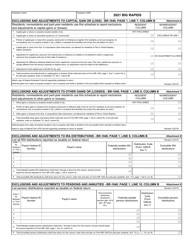

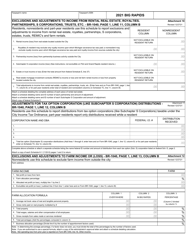

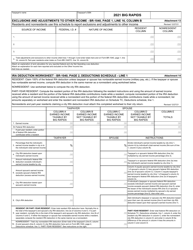

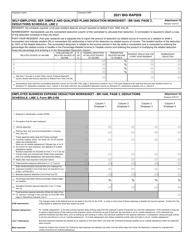

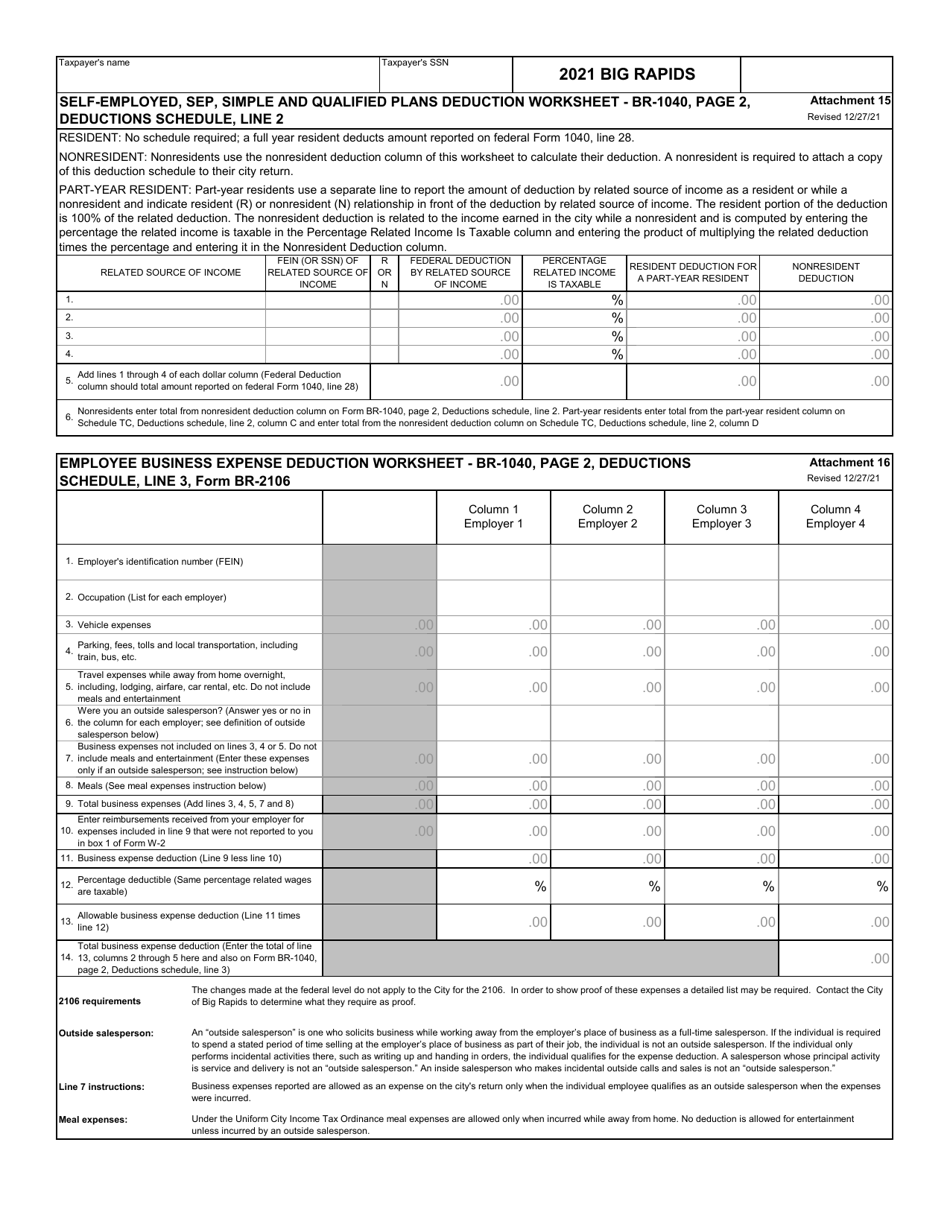

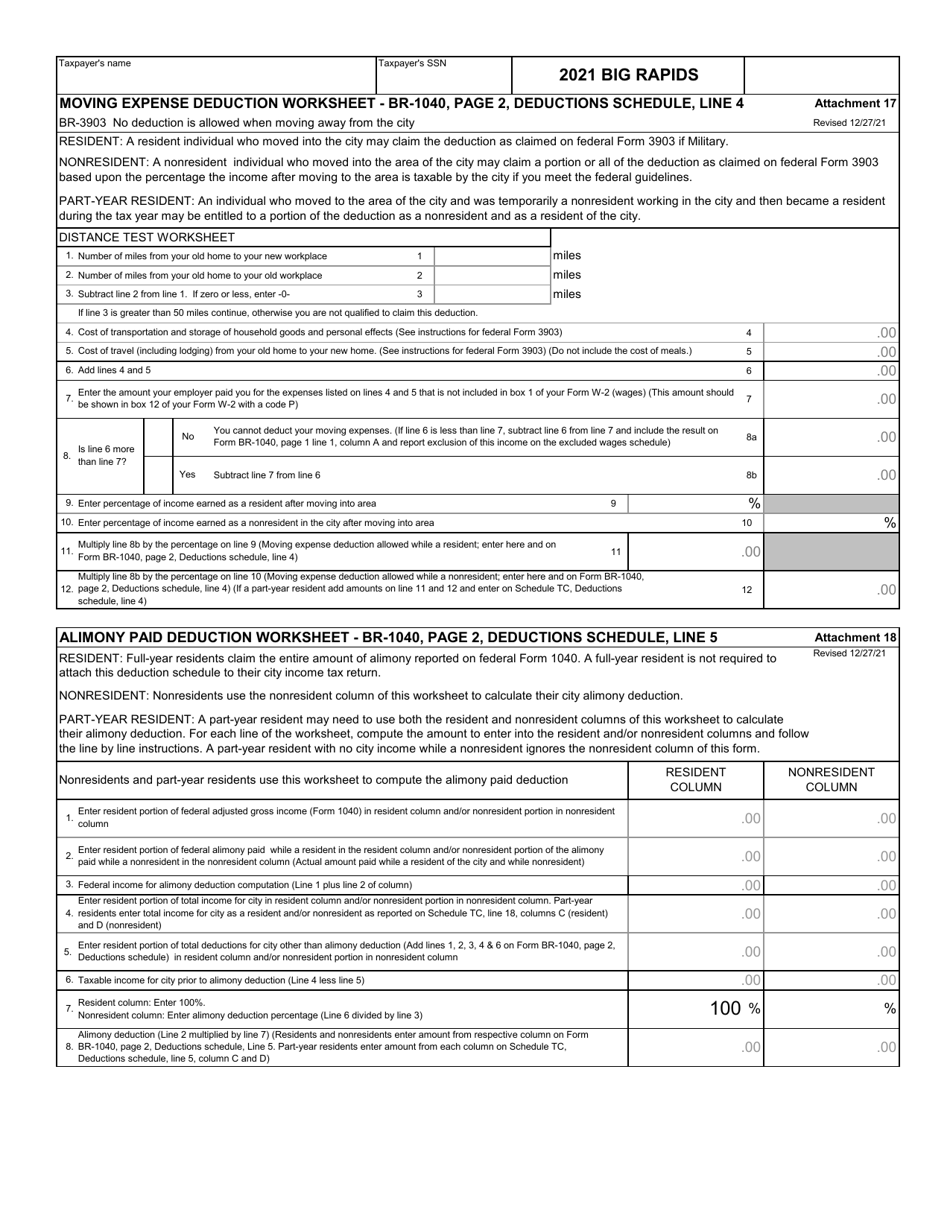

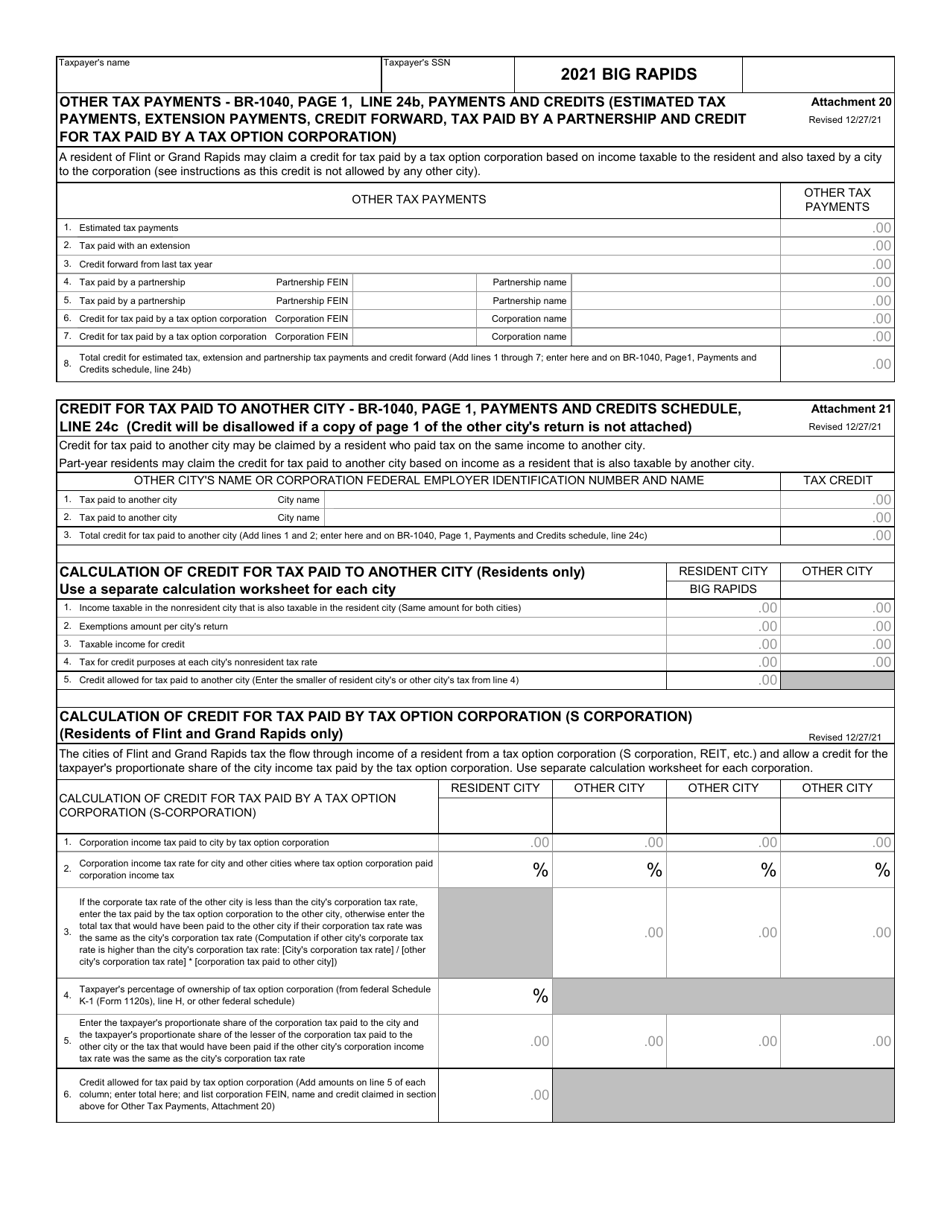

Form BR-1040

for the current year.

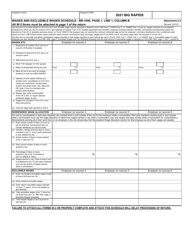

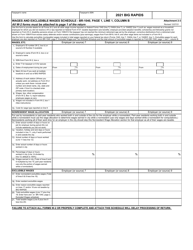

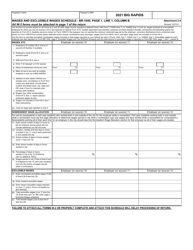

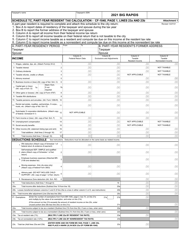

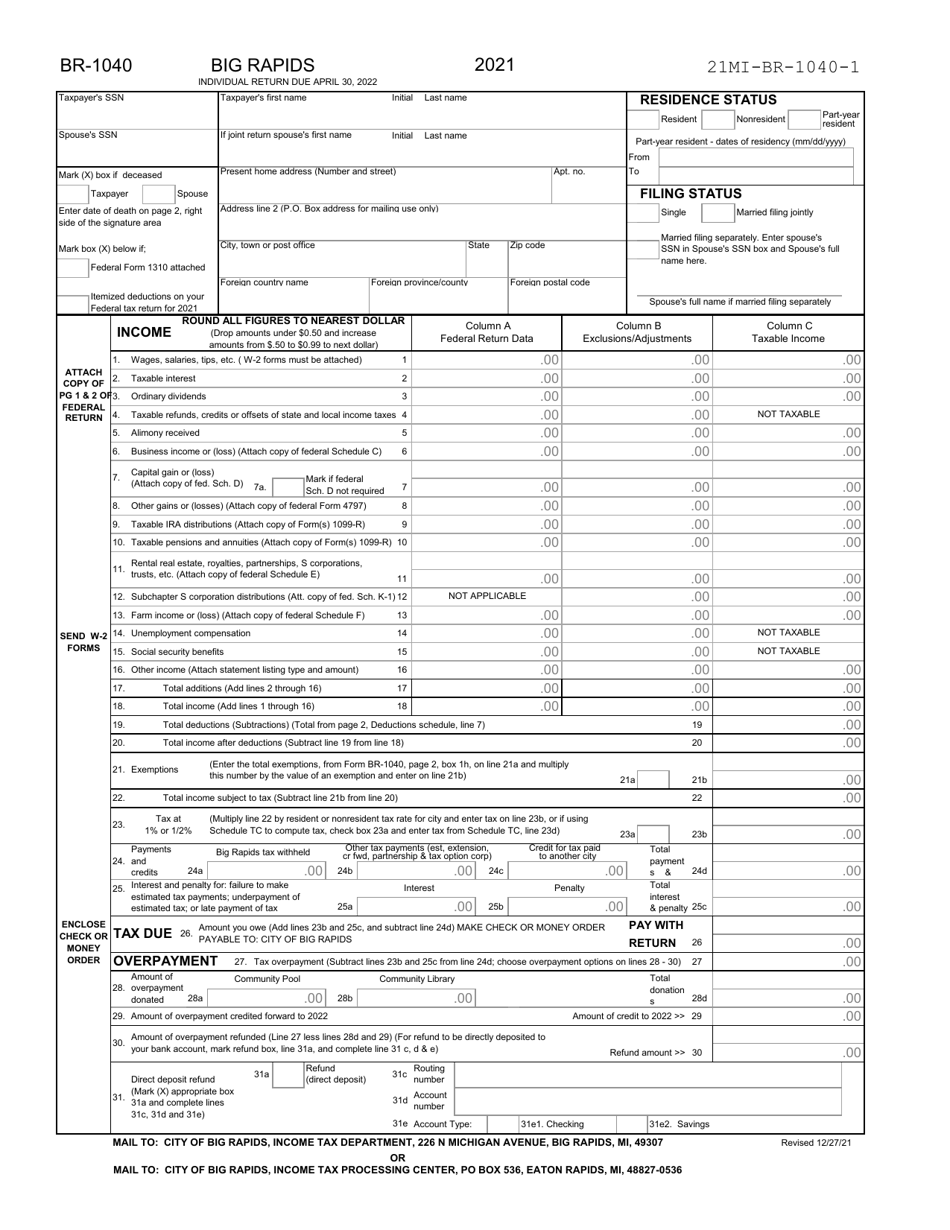

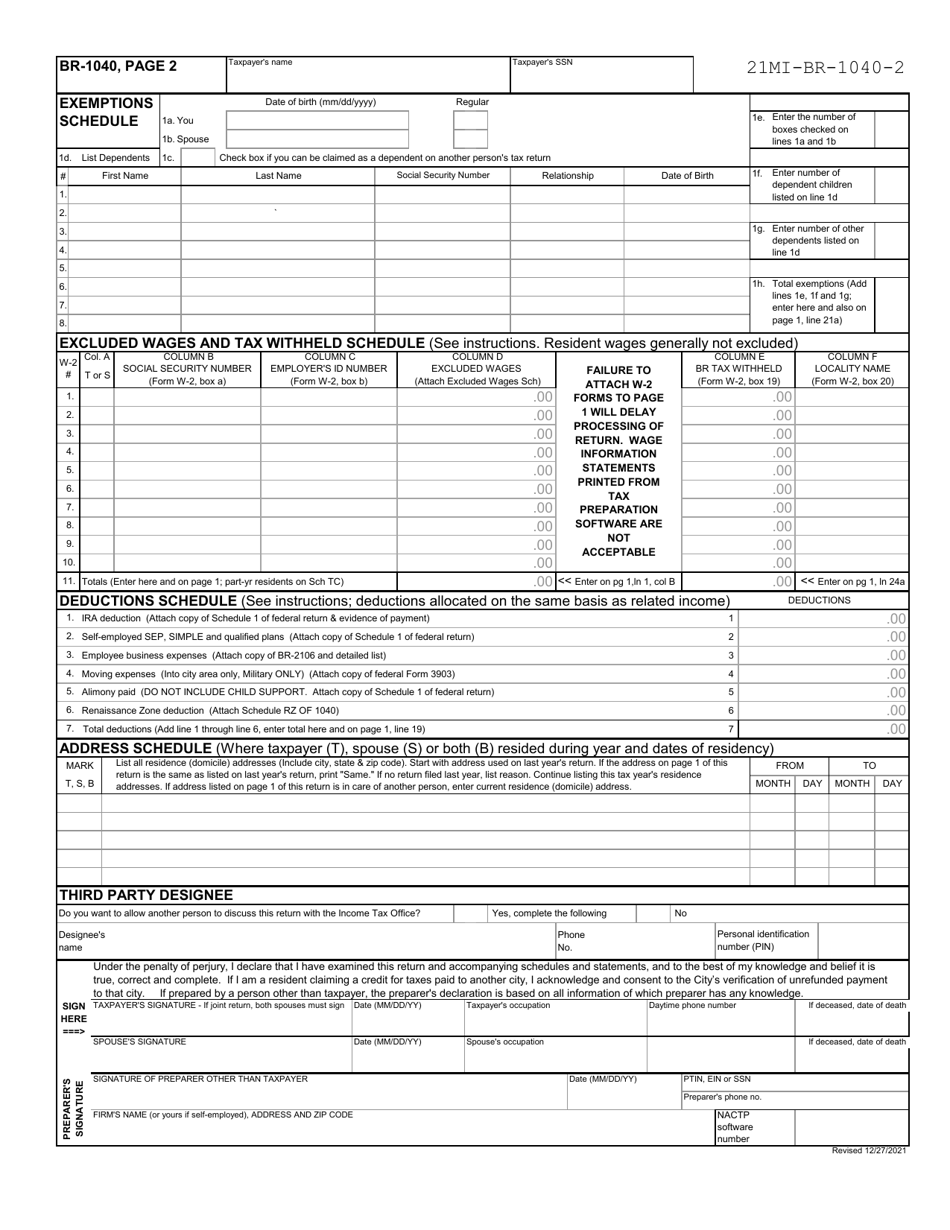

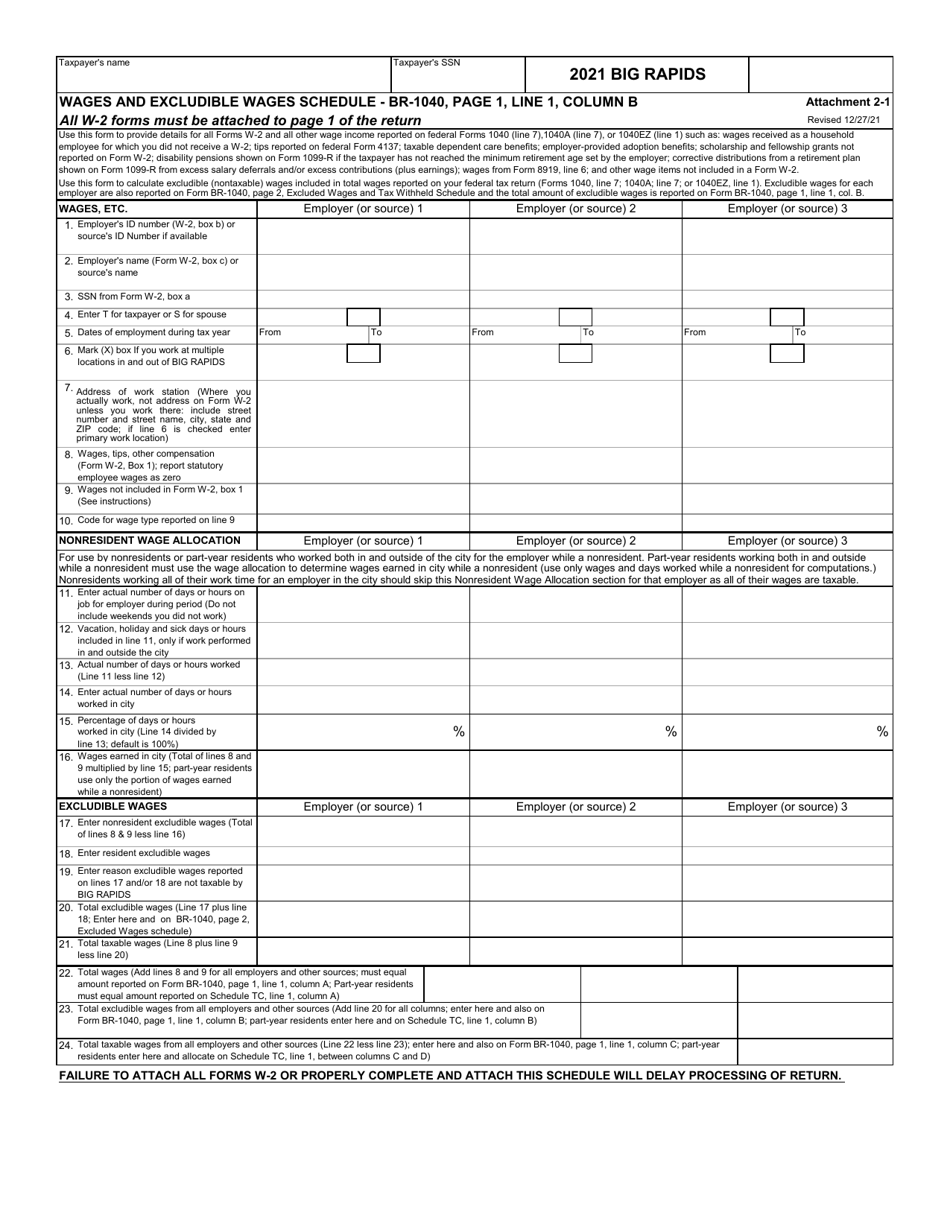

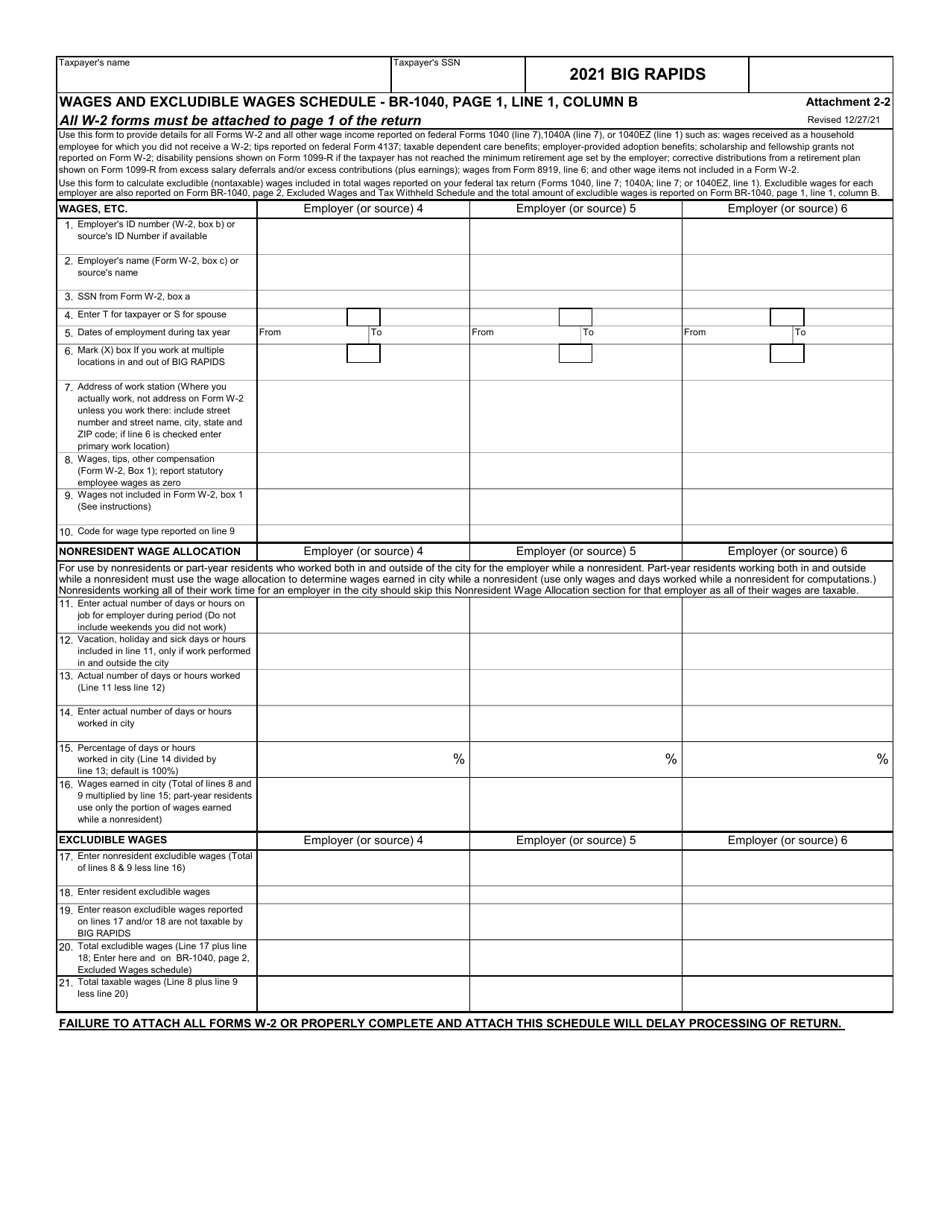

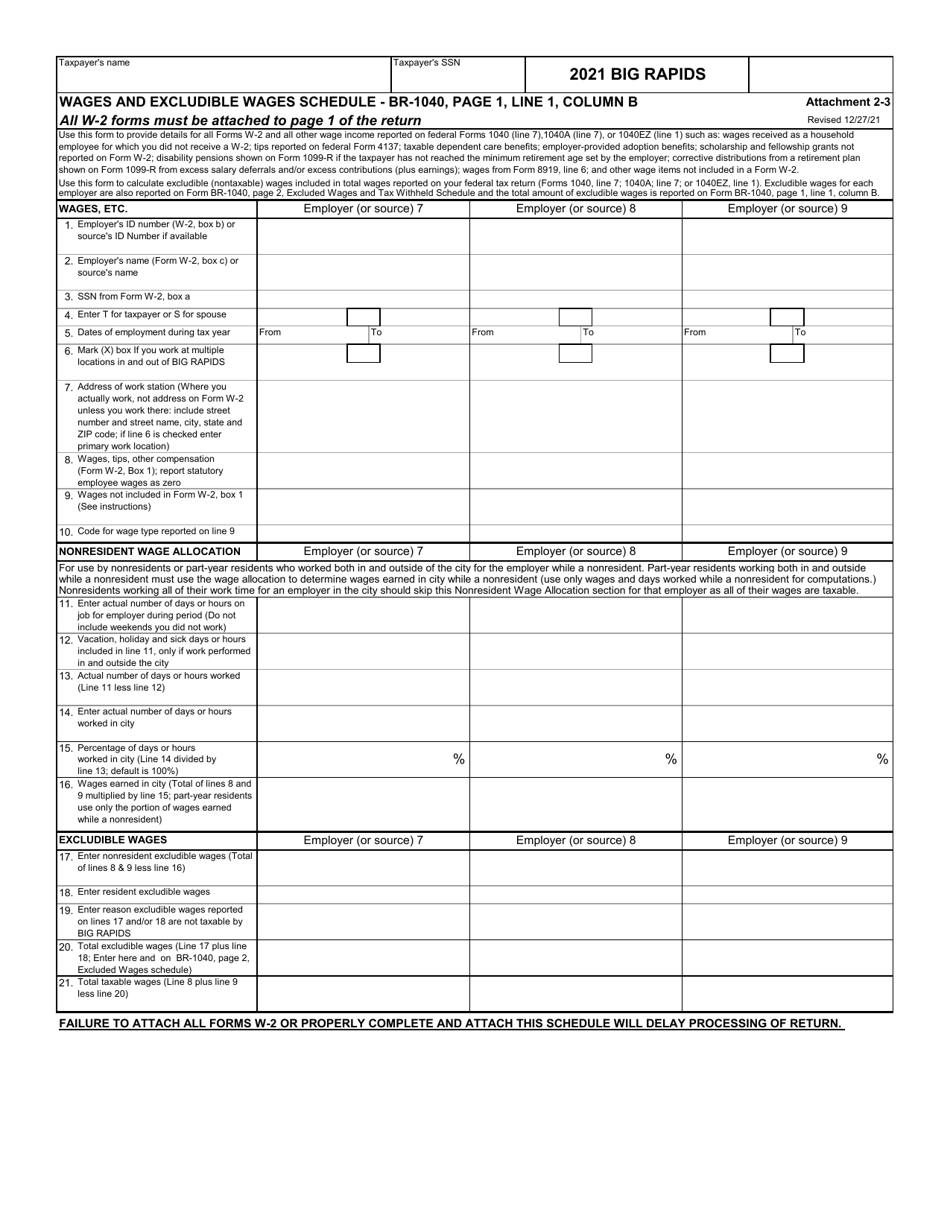

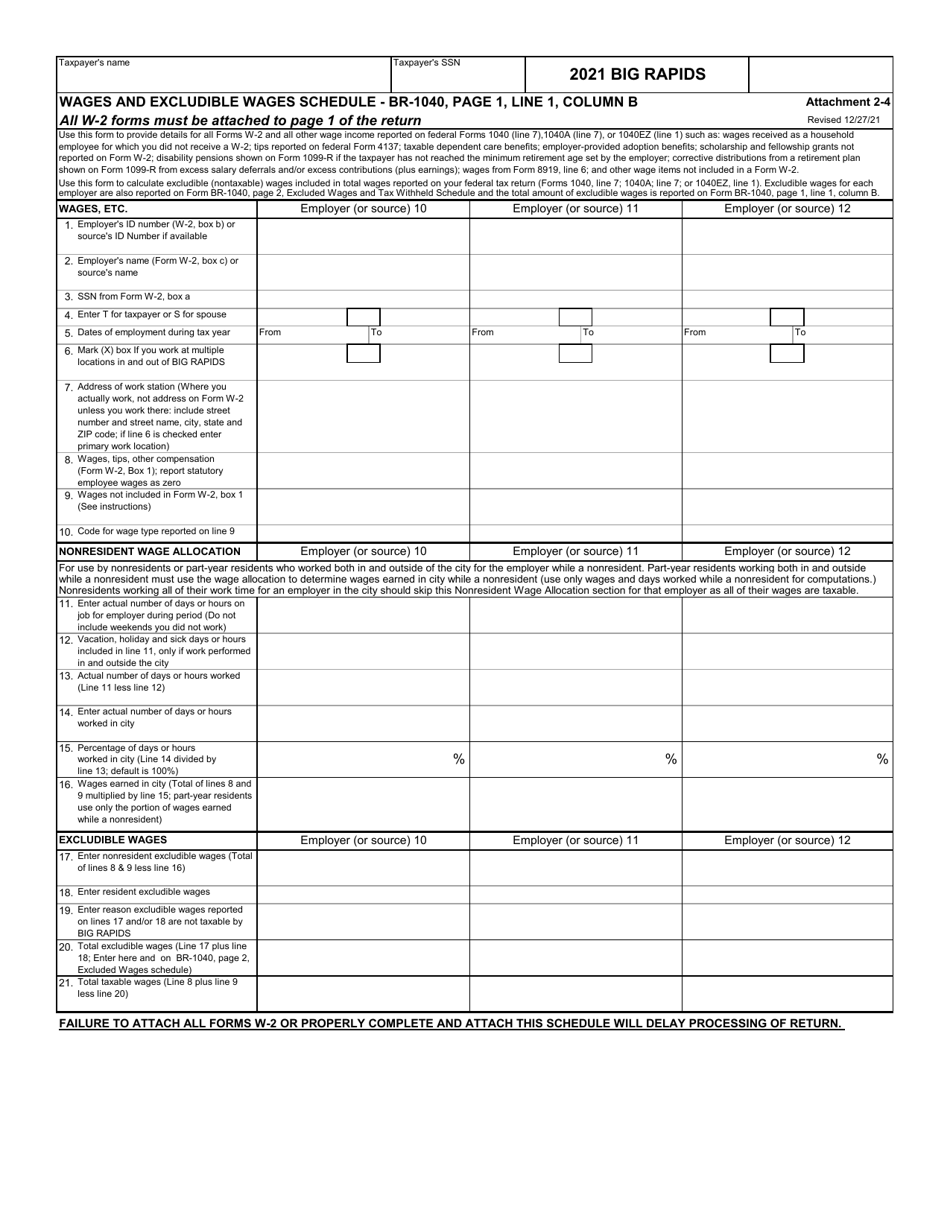

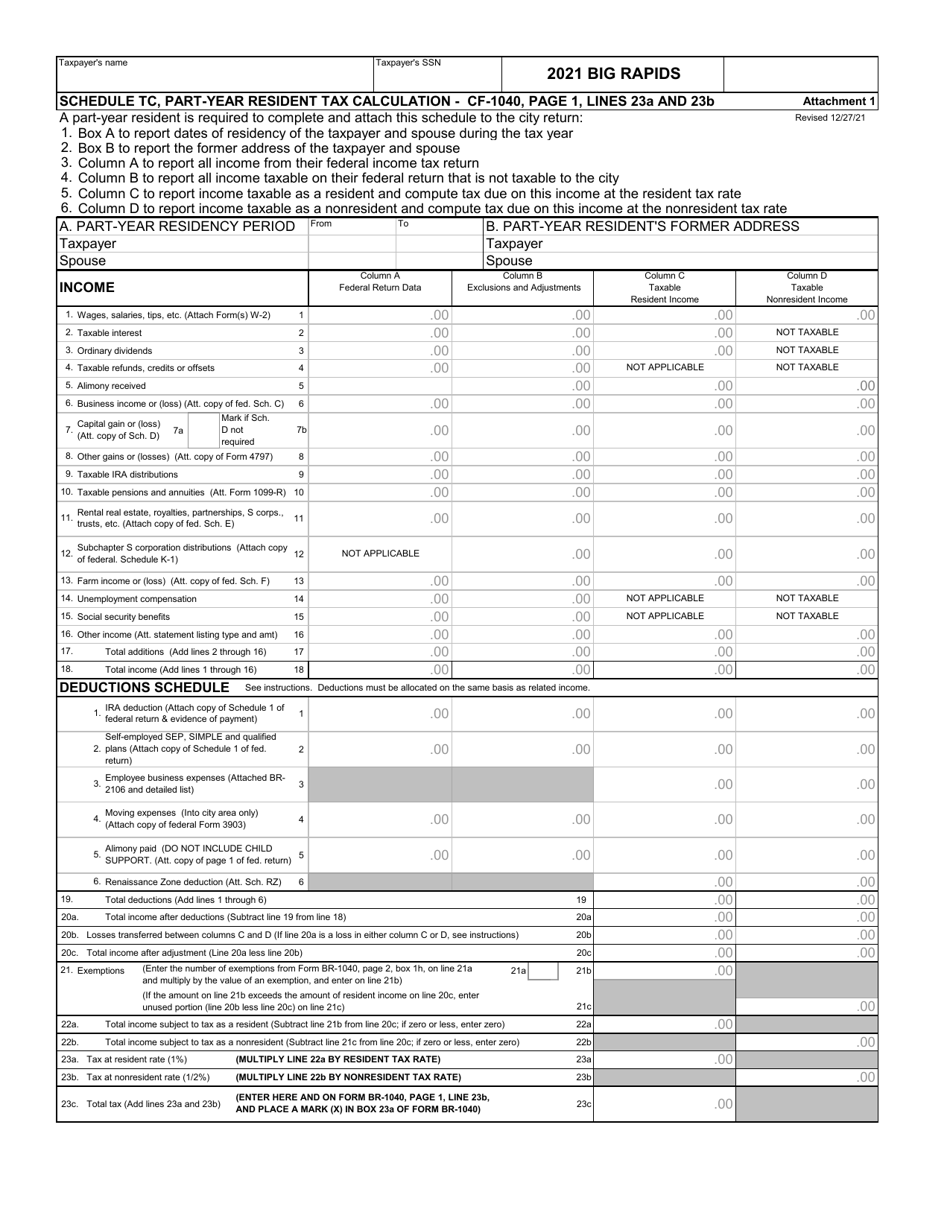

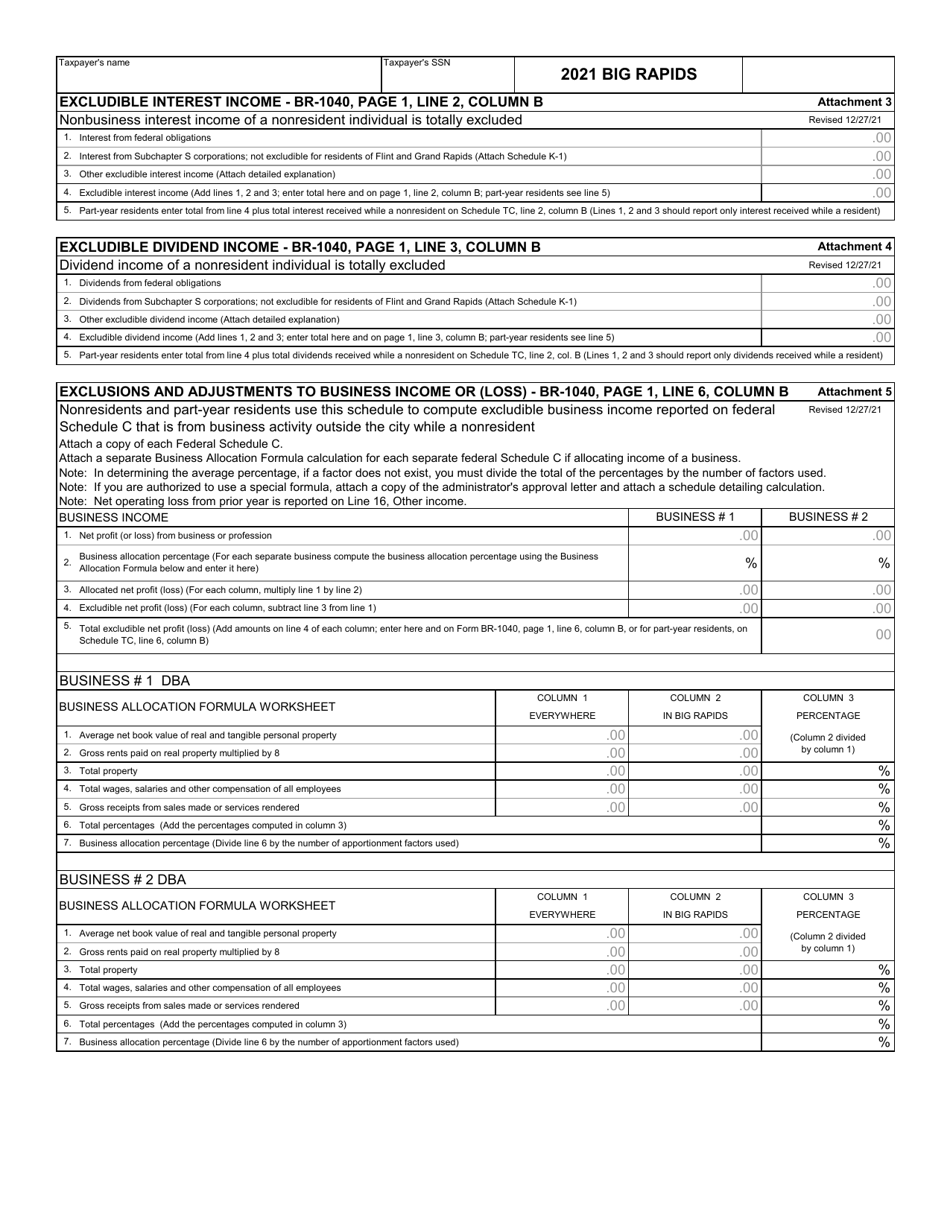

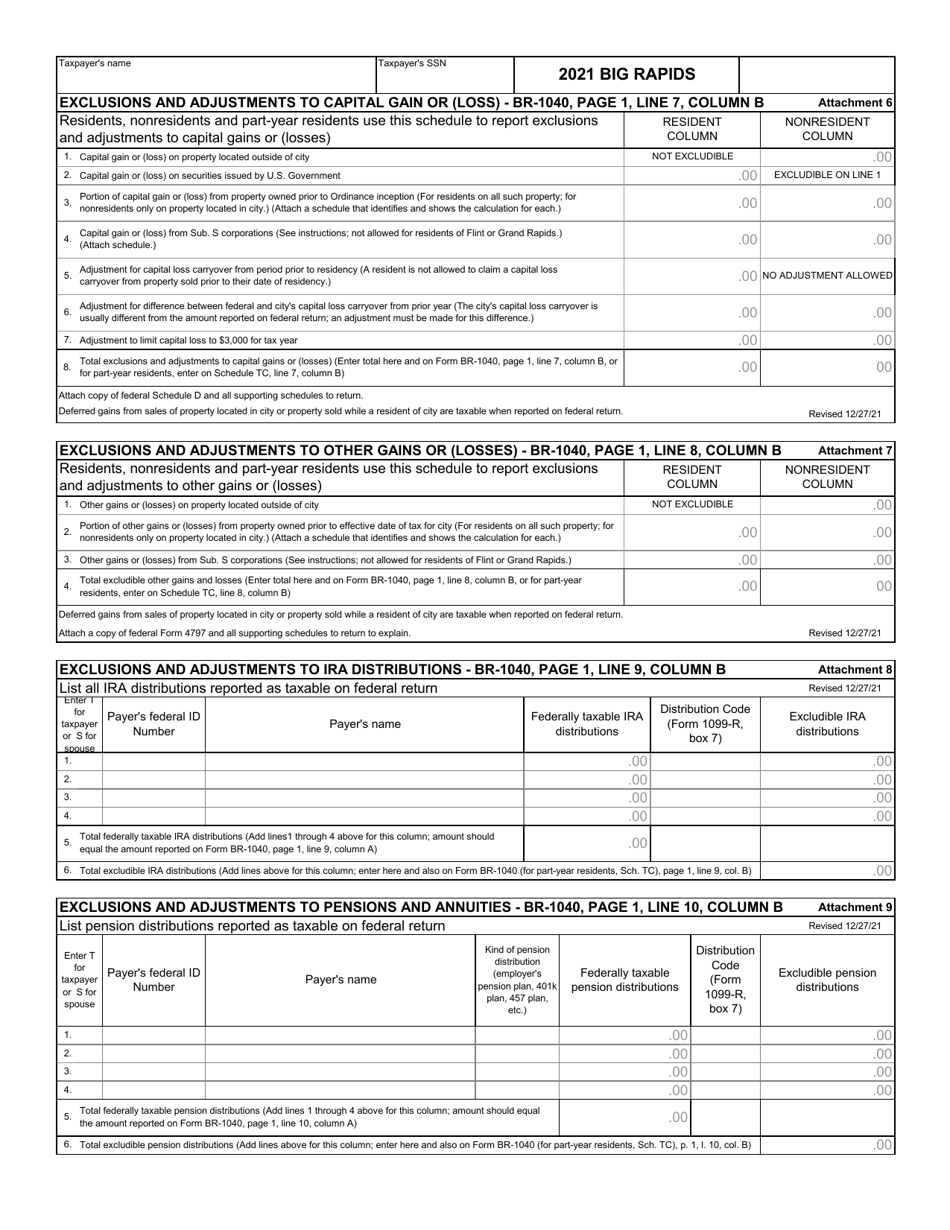

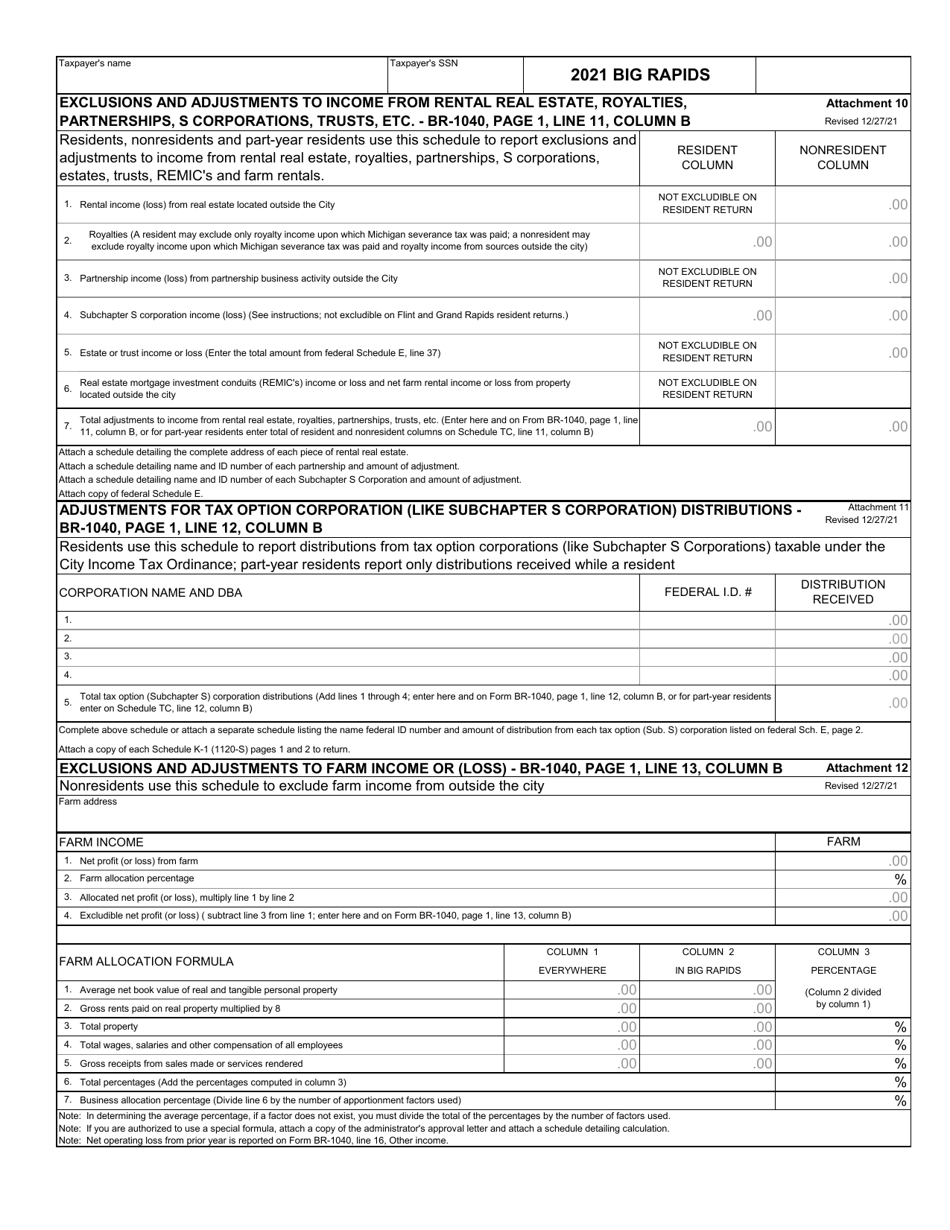

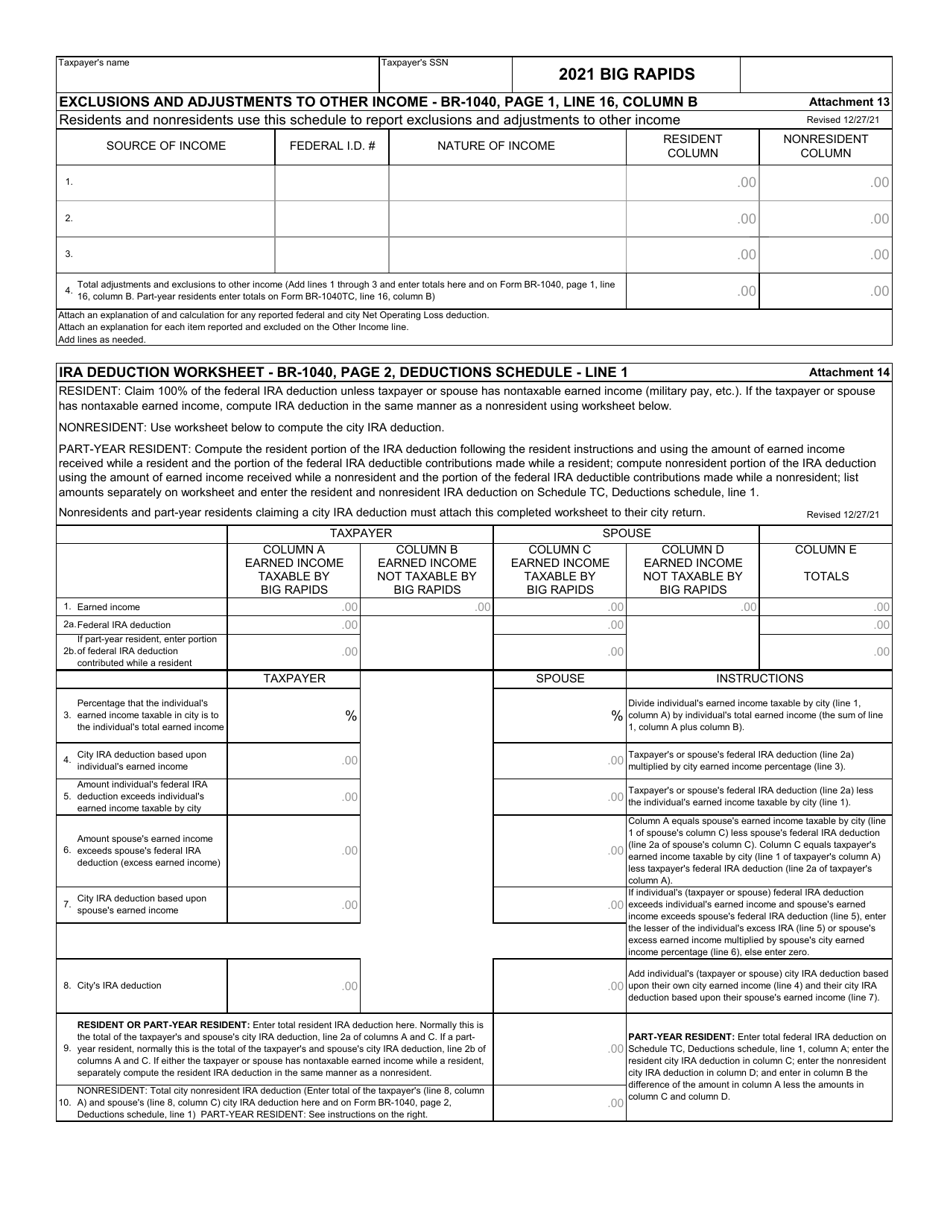

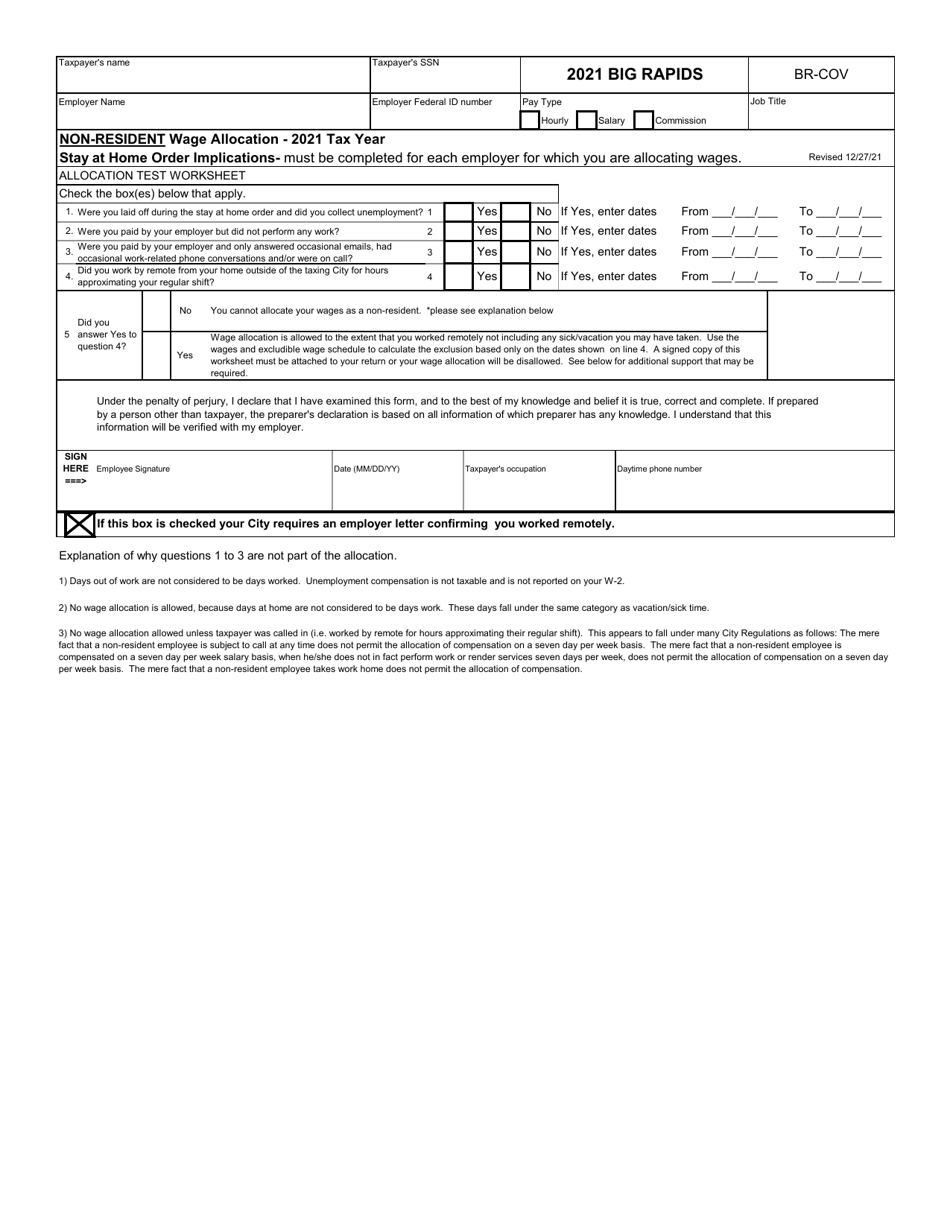

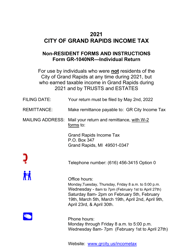

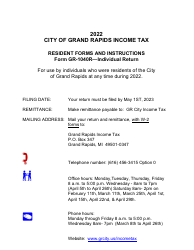

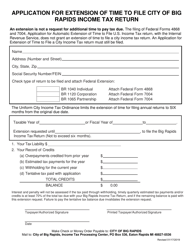

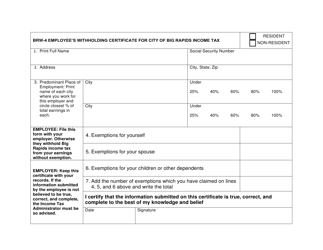

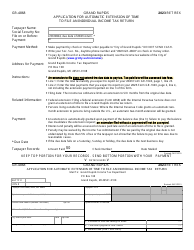

Form BR-1040 Individual Income Tax Return - City of Big Rapids, Michigan

What Is Form BR-1040?

This is a legal form that was released by the Income Tax Department - City of Big Rapids, Michigan - a government authority operating within Michigan. The form may be used strictly within City of Big Rapids. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form BR-1040?

A: Form BR-1040 is the Individual Income Tax Return for residents of Big Rapids, Michigan.

Q: Who should use Form BR-1040?

A: Residents of Big Rapids, Michigan should use Form BR-1040 to file their individual income tax returns.

Q: What is the purpose of Form BR-1040?

A: The purpose of Form BR-1040 is to report and calculate the individual income tax liability for residents of Big Rapids, Michigan.

Q: Is Form BR-1040 specific to the City of Big Rapids, Michigan?

A: Yes, Form BR-1040 is specific to residents of Big Rapids, Michigan and cannot be used by residents of other cities or states.

Q: When is the deadline to file Form BR-1040?

A: The deadline to file Form BR-1040 is typically April 15th, unless it falls on a weekend or holiday, in which case the deadline is extended to the next business day.

Q: What should I include when filing Form BR-1040?

A: When filing Form BR-1040, you should include all necessary documentation such as W-2 forms, 1099 forms, and any other income statements or deductions applicable to your situation.

Q: What happens if I don't file Form BR-1040?

A: If you are a resident of Big Rapids, Michigan and are required to file a tax return but fail to do so, you may be subject to penalties and interest on any unpaid tax liability.

Form Details:

- Released on December 27, 2021;

- The latest edition provided by the Income Tax Department - City of Big Rapids, Michigan;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BR-1040 by clicking the link below or browse more documents and templates provided by the Income Tax Department - City of Big Rapids, Michigan.