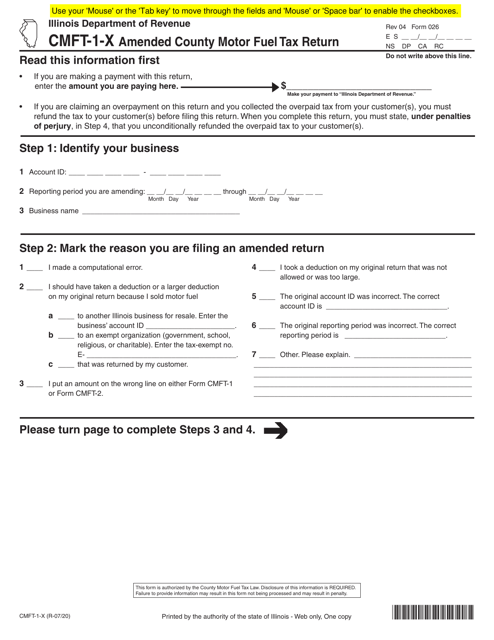

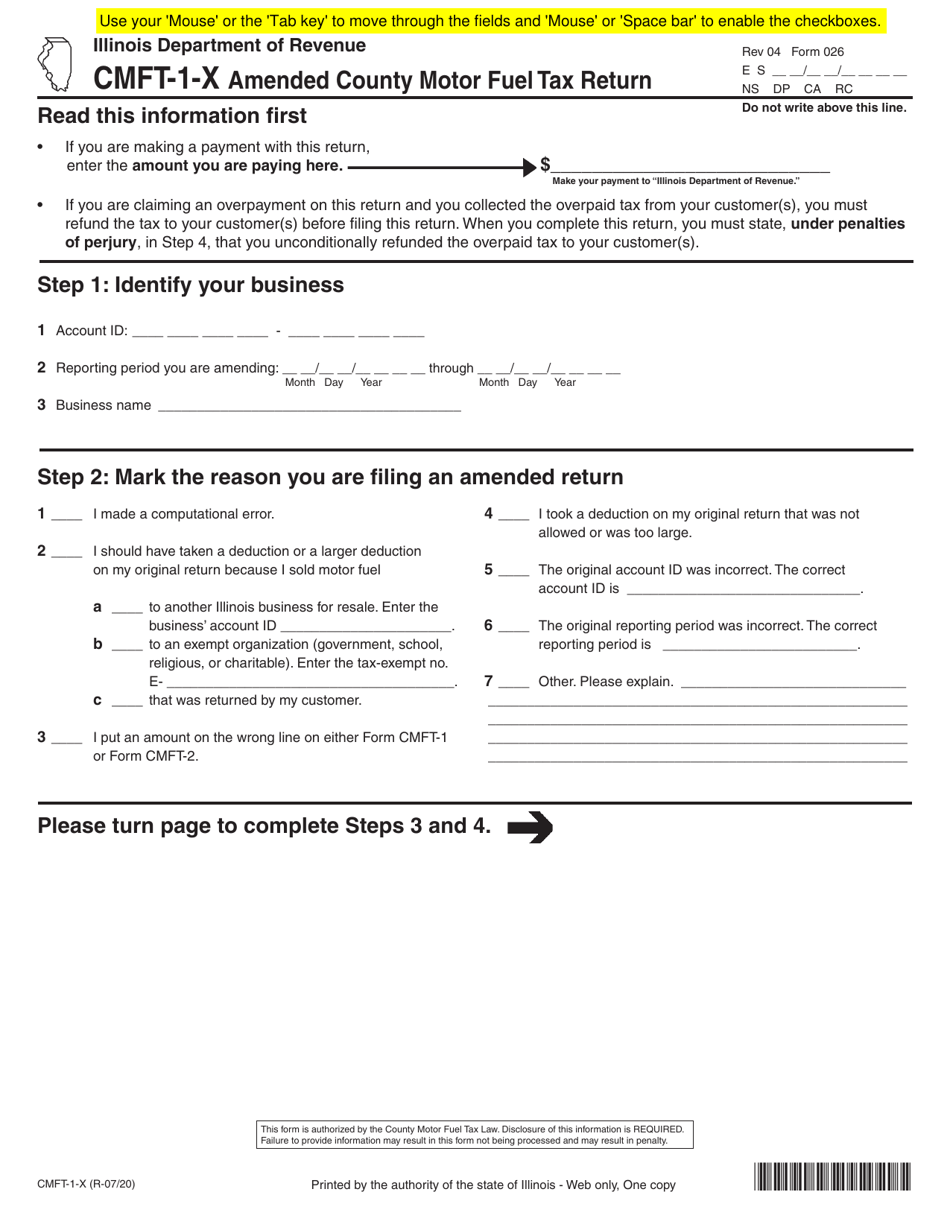

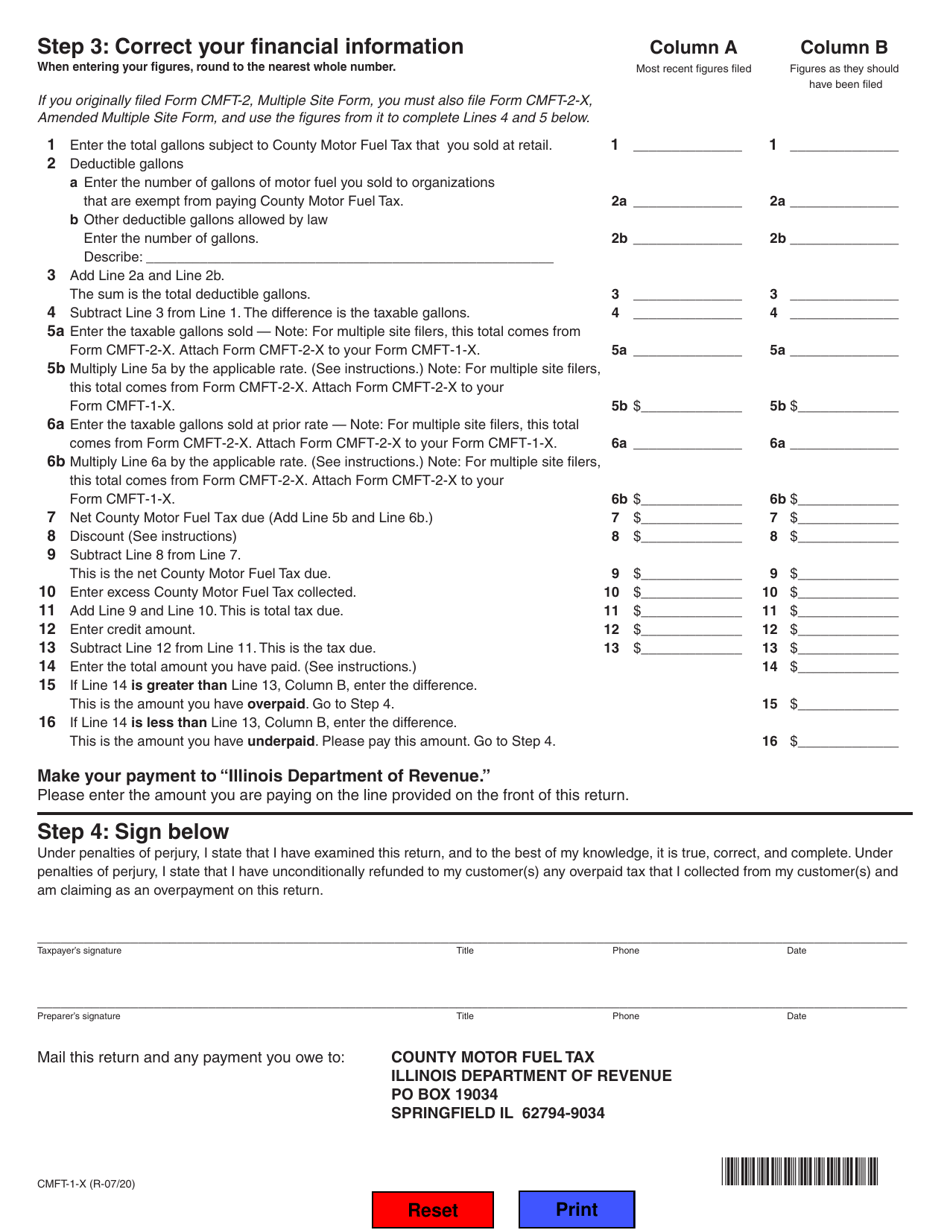

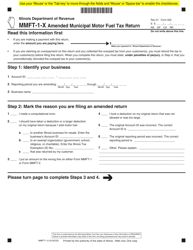

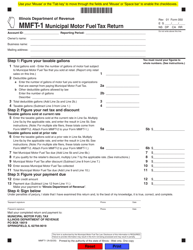

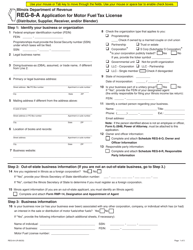

Form CMFT-1-X (026) Amended County Motor Fuel Tax Return - Illinois

What Is Form CMFT-1-X (026)?

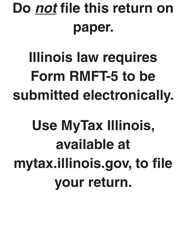

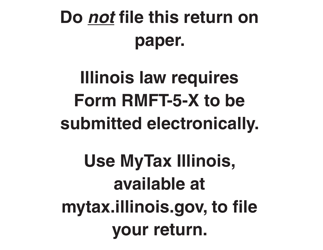

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is form CMFT-1-X (026)?

A: Form CMFT-1-X (026) is the Amended County Motor Fuel Tax Return for the state of Illinois.

Q: Who needs to file form CMFT-1-X (026)?

A: This form needs to be filed by individuals or businesses located in Illinois that are liable for county motor fuel tax and need to make amendments to their original return.

Q: What is the purpose of form CMFT-1-X (026)?

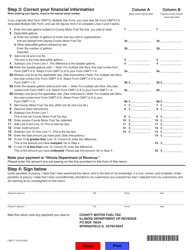

A: The purpose of this form is to report any changes or corrections to a previously filed County Motor Fuel Tax Return.

Q: When is form CMFT-1-X (026) due?

A: The due date for filing form CMFT-1-X (026) varies and is determined by the Illinois Department of Revenue. It is important to check with the department for the specific deadline.

Q: Are there any penalties for not filing form CMFT-1-X (026) or filing it late?

A: Yes, there may be penalties for failing to file form CMFT-1-X (026) or filing it late. Penalties vary depending on the circumstances, so it's best to consult the Illinois Department of Revenue for more information.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CMFT-1-X (026) by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.