This version of the form is not currently in use and is provided for reference only. Download this version of

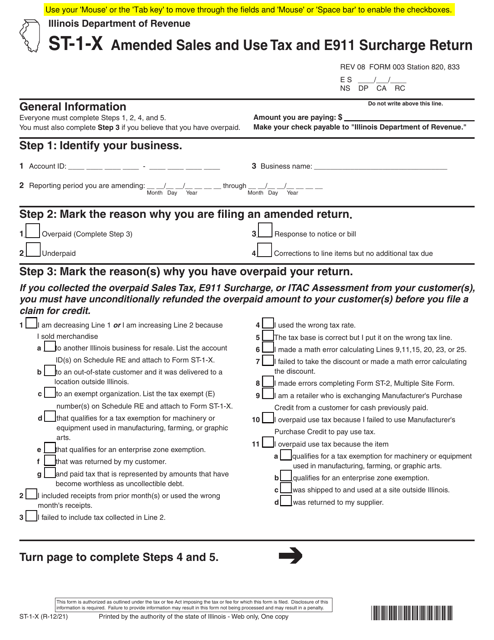

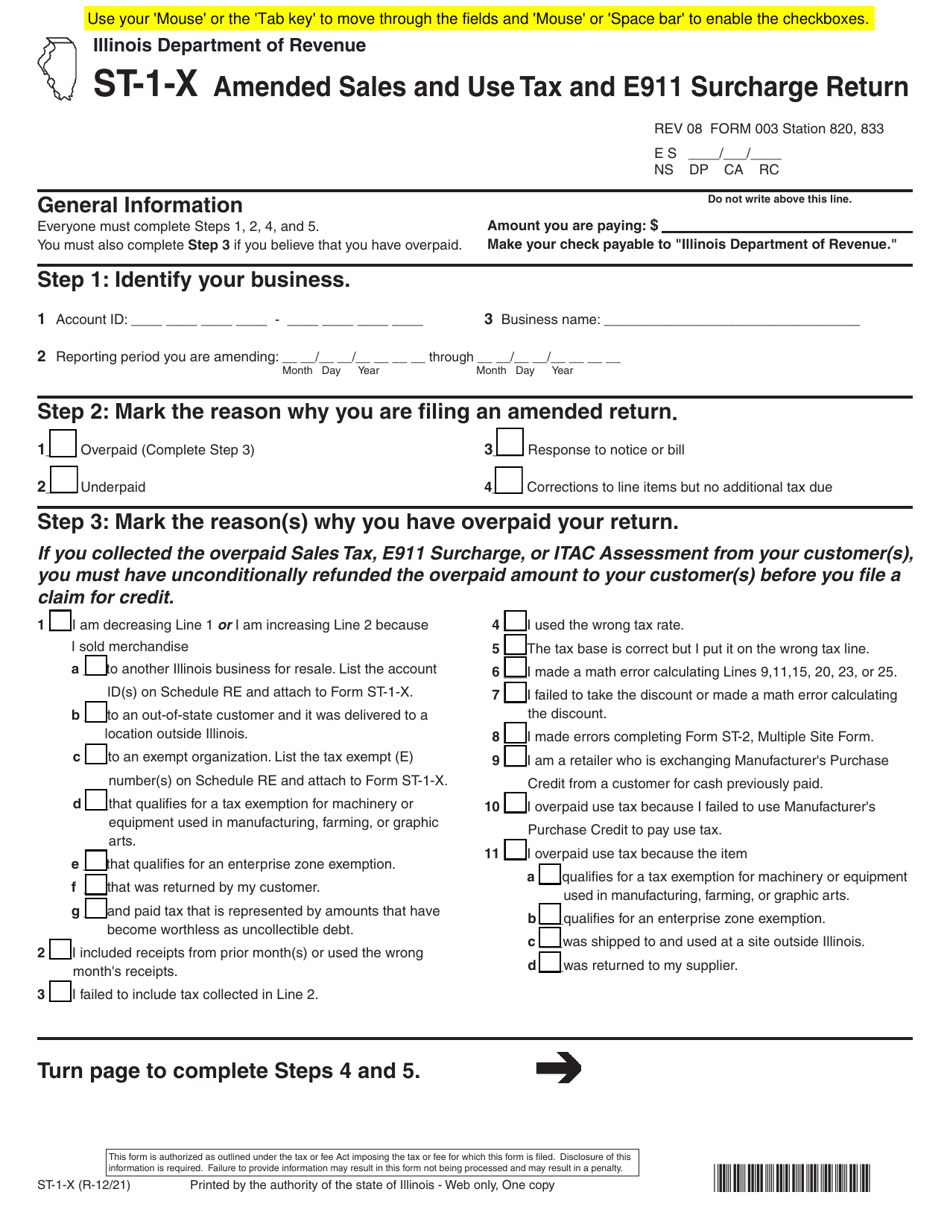

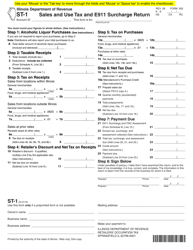

Form ST-1-X

for the current year.

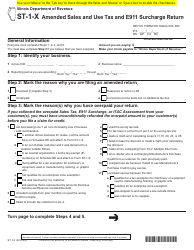

Form ST-1-X Amended Sales and Use Tax and E911 Surcharge Return - Illinois

What Is Form ST-1-X?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

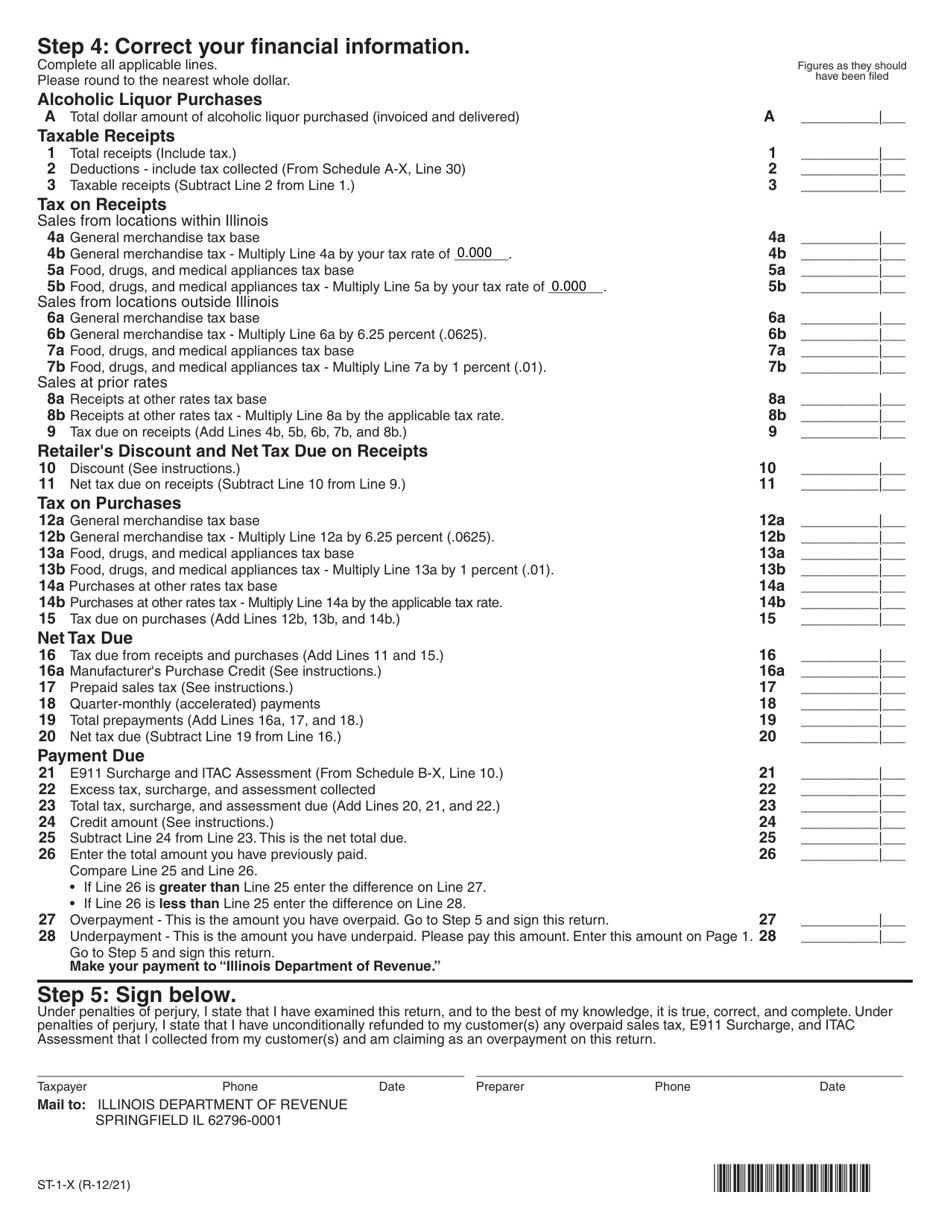

Q: What is Form ST-1-X?

A: Form ST-1-X is the Amended Sales and Use Tax and E911 Surcharge Return for the state of Illinois.

Q: What is the purpose of Form ST-1-X?

A: The purpose of Form ST-1-X is to correct any errors or make changes to a previously filed Form ST-1 for sales and use tax and E911 surcharge.

Q: Who needs to file Form ST-1-X?

A: Anyone who needs to amend their previously filed Form ST-1 for sales and use tax and E911 surcharge in Illinois needs to file Form ST-1-X.

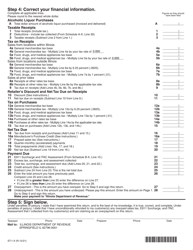

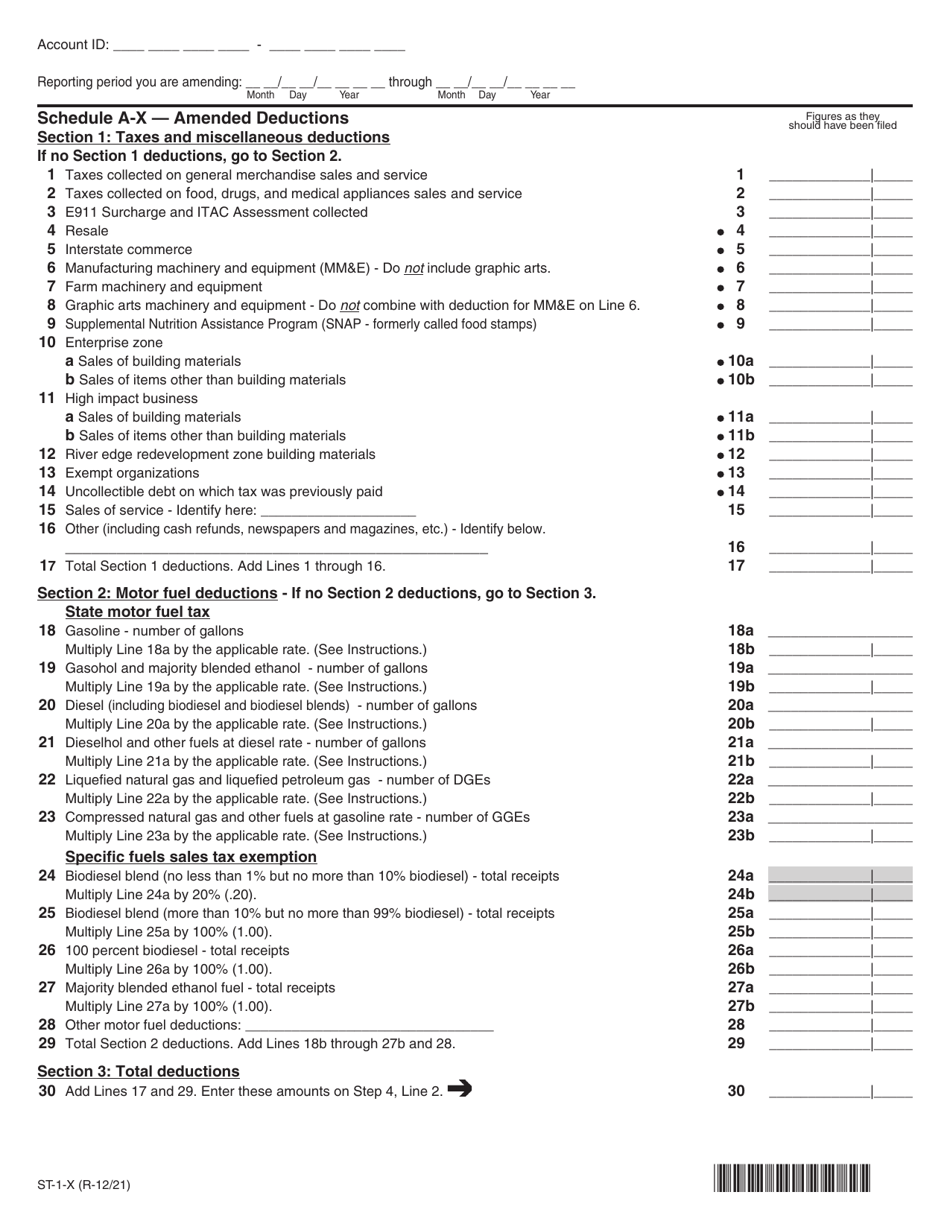

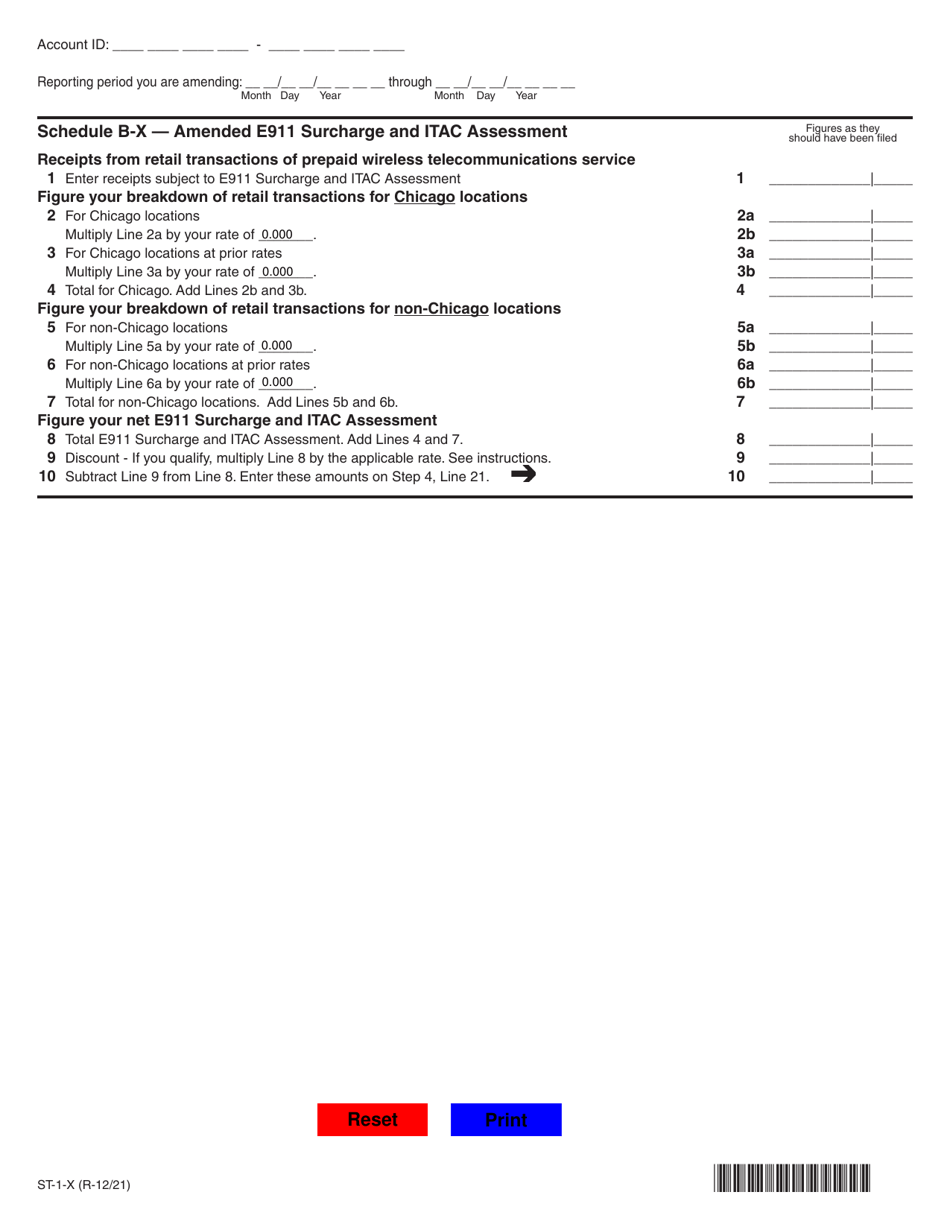

Q: What information is required on Form ST-1-X?

A: Form ST-1-X requires information such as the original reporting period, the corrected reporting period, the changes being made, and the reason for the amendment.

Q: When is Form ST-1-X due?

A: Form ST-1-X is due on the same due date as the original Form ST-1, which is the 20th day of the month following the reporting period.

Q: Are there any penalties for filing Form ST-1-X late?

A: Yes, there may be penalties for filing Form ST-1-X late, so it is important to submit the amended return by the due date.

Q: Is there a fee for filing Form ST-1-X?

A: No, there is no fee for filing Form ST-1-X.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-1-X by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.