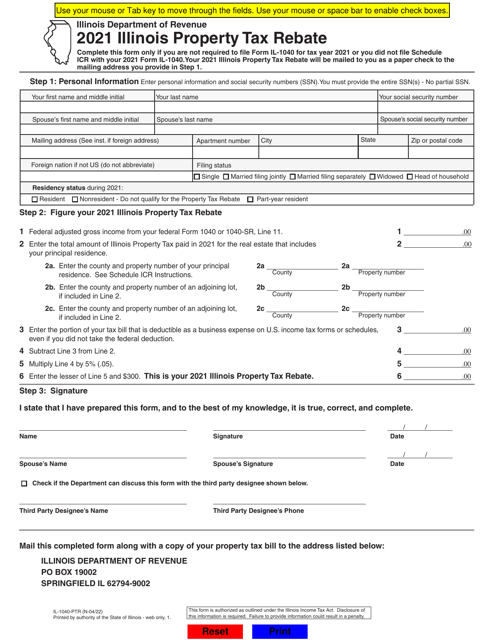

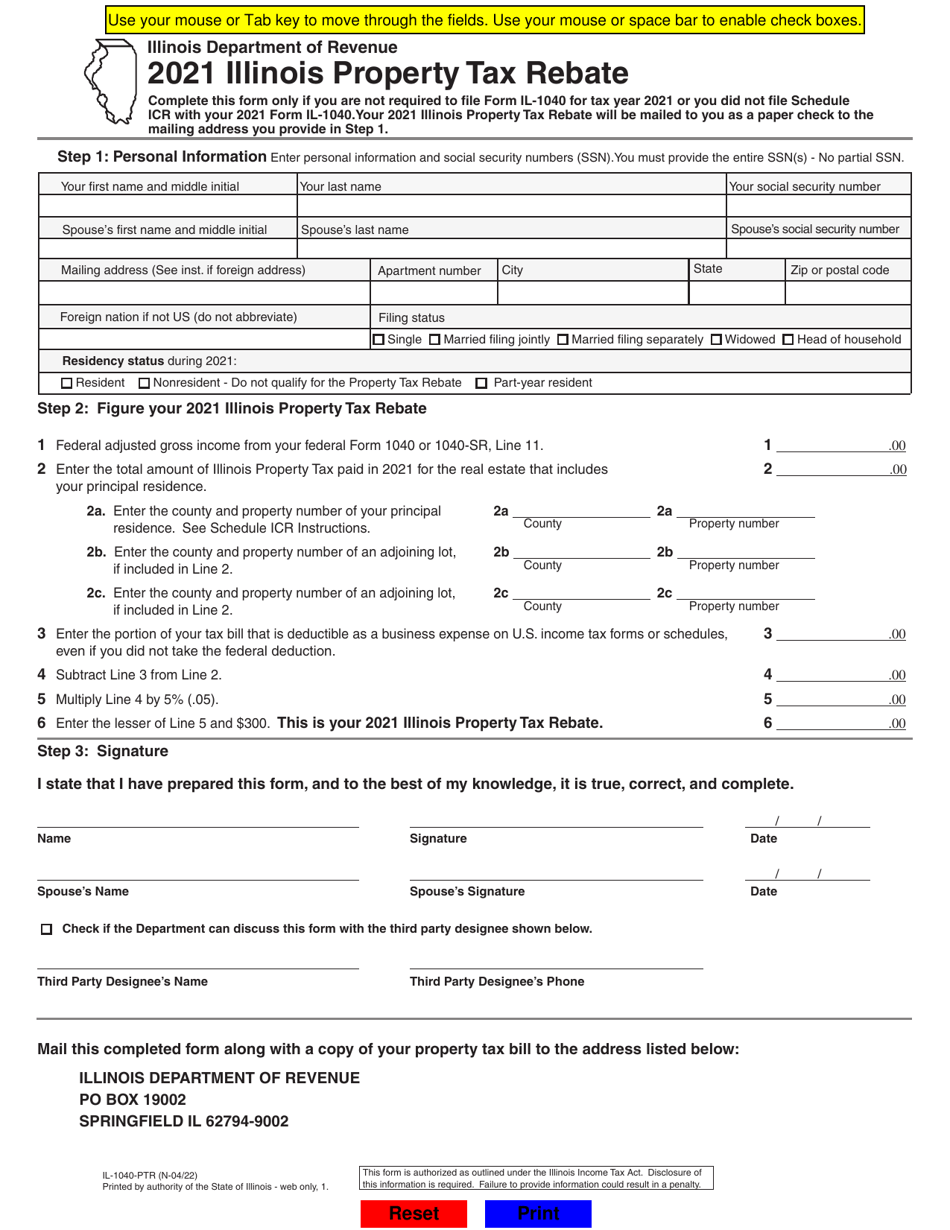

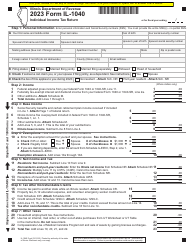

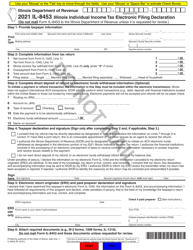

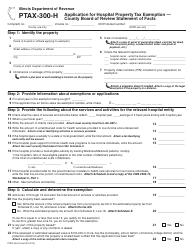

Form IL-1040-PTR Illinois Property Tax Rebate - Illinois

What Is Form IL-1040-PTR?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the Form IL-1040-PTR?

A: The Form IL-1040-PTR is a form used in Illinois to claim a property tax rebate.

Q: Who is eligible to claim the property tax rebate?

A: Eligibility for the property tax rebate varies based on income and other factors. You can check the instructions on the Form IL-1040-PTR for specific eligibility requirements.

Q: What information do I need to complete the Form IL-1040-PTR?

A: You will need information on your property taxes paid, income, and other personal details to complete the Form IL-1040-PTR. Check the form's instructions for specific requirements.

Form Details:

- Released on April 1, 2022;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-1040-PTR by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.