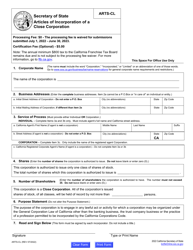

This version of the form is not currently in use and is provided for reference only. Download this version of

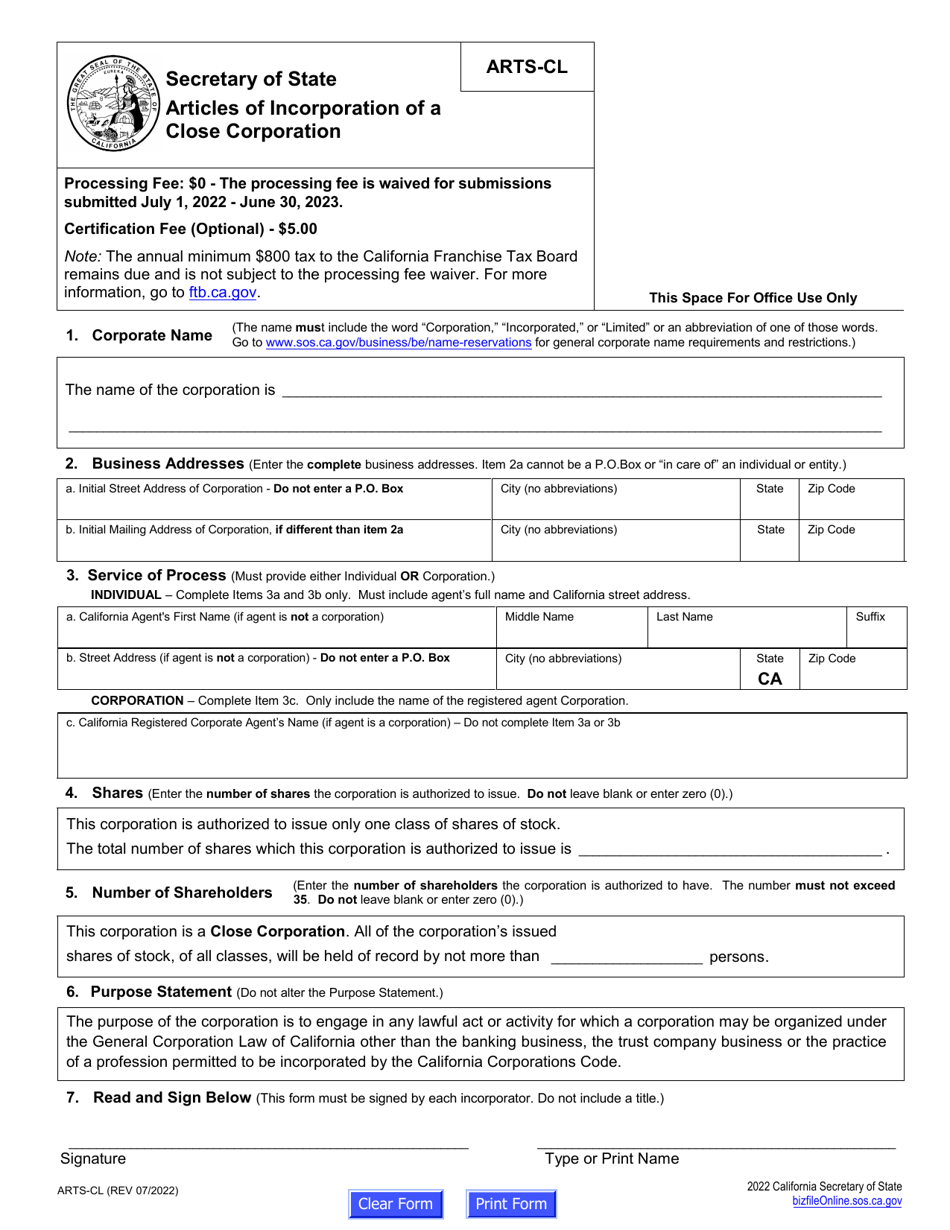

Form ARTS-CL

for the current year.

Form ARTS-CL Articles of Incorporation of a Close Corporation - California

What Is Form ARTS-CL?

This is a legal form that was released by the California Secretary of State - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ARTS-CL?

A: Form ARTS-CL is the Articles of Incorporation for a Close Corporation in California.

Q: What is a Close Corporation?

A: A Close Corporation is a type of corporation that is owned and operated by a small number of shareholders.

Q: How do I complete Form ARTS-CL?

A: You need to provide basic information about the corporation, such as its name, address, purpose, and the names of the initial shareholders.

Q: Do I have to file Form ARTS-CL?

A: Yes, if you want to form a Close Corporation in California, you must file Form ARTS-CL with the California Secretary of State.

Q: What are the requirements to form a Close Corporation in California?

A: To form a Close Corporation in California, you must have at least one shareholder, directors are not required, and the corporation's articles of incorporation must include the specified provisions for a Close Corporation.

Q: Can a Close Corporation have more than one class of stock?

A: No, a Close Corporation is limited to one class of stock.

Q: What is the main advantage of a Close Corporation?

A: The main advantage of a Close Corporation is that it provides a more flexible and informal structure compared to a regular corporation.

Q: Can a Close Corporation convert to a regular corporation?

A: Yes, a Close Corporation can convert to a regular corporation by filing a Certificate of Conversion with the California Secretary of State.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the California Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

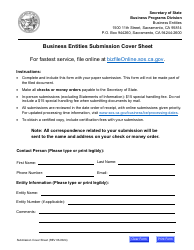

Download a fillable version of Form ARTS-CL by clicking the link below or browse more documents and templates provided by the California Secretary of State.