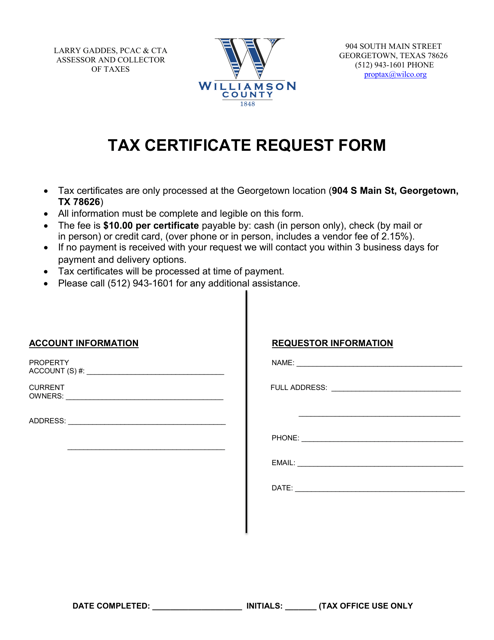

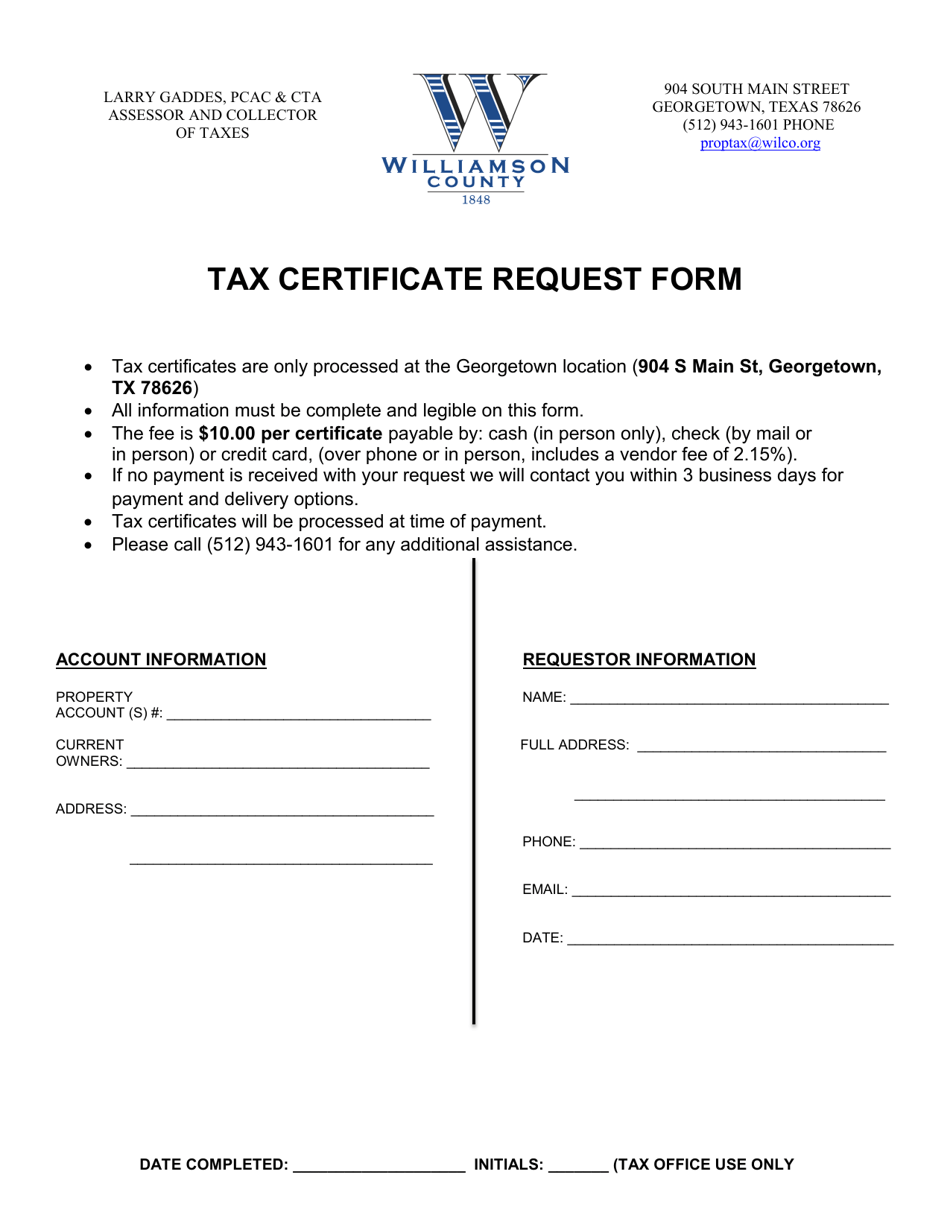

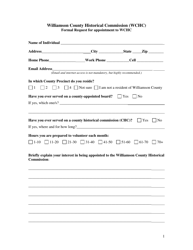

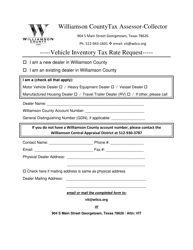

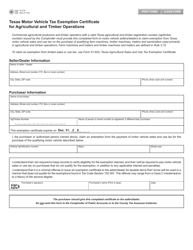

Tax Certificate Request Form - Williamson County, Texas

Tax Certificate Request Form is a legal document that was released by the Tax Assessor/Collector's Office - Williamson County, Texas - a government authority operating within Texas. The form may be used strictly within Williamson County.

FAQ

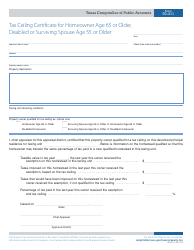

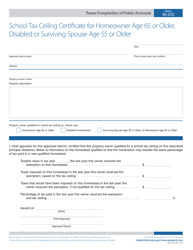

Q: What is a tax certificate?

A: A tax certificate is an official document provided by the government that verifies a person's tax information.

Q: Why would I need a tax certificate?

A: You may need a tax certificate for various purposes, such as applying for a loan, proving your tax compliance, or providing proof of residency.

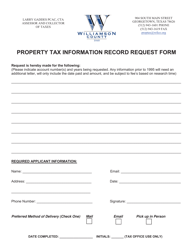

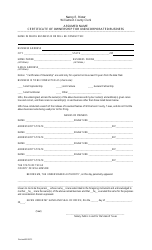

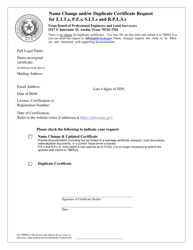

Q: What information do I need to provide on the Tax Certificate Request Form?

A: You will need to provide your name, property address, account number, and any additional information requested on the form.

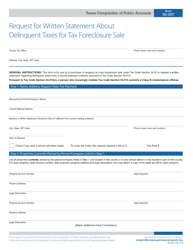

Q: How long does it take to receive a tax certificate?

A: The processing time for a tax certificate request can vary. It is advisable to contact the county's office for an estimated timeframe.

Q: Can someone else request a tax certificate on my behalf?

A: Yes, someone else can request a tax certificate on your behalf, but they may need to provide a written authorization or power of attorney.

Q: What documents can I use a tax certificate for?

A: A tax certificate can be used for various purposes, such as applying for a loan, proving your tax compliance, or providing proof of residency.

Form Details:

- The latest edition currently provided by the Tax Assessor/Collector's Office - Williamson County, Texas;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Tax Assessor/Collector's Office - Williamson County, Texas.