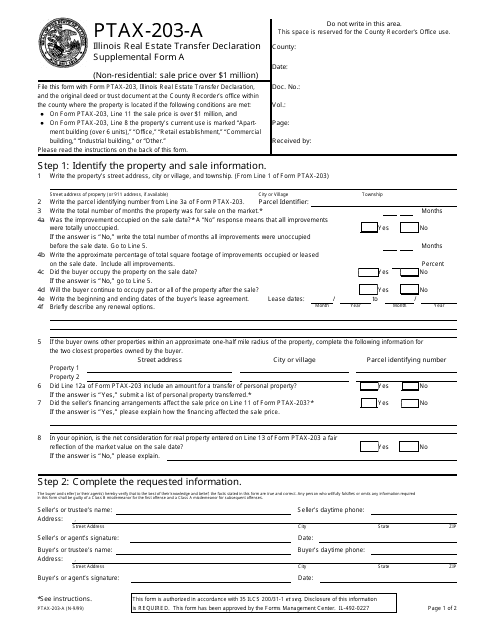

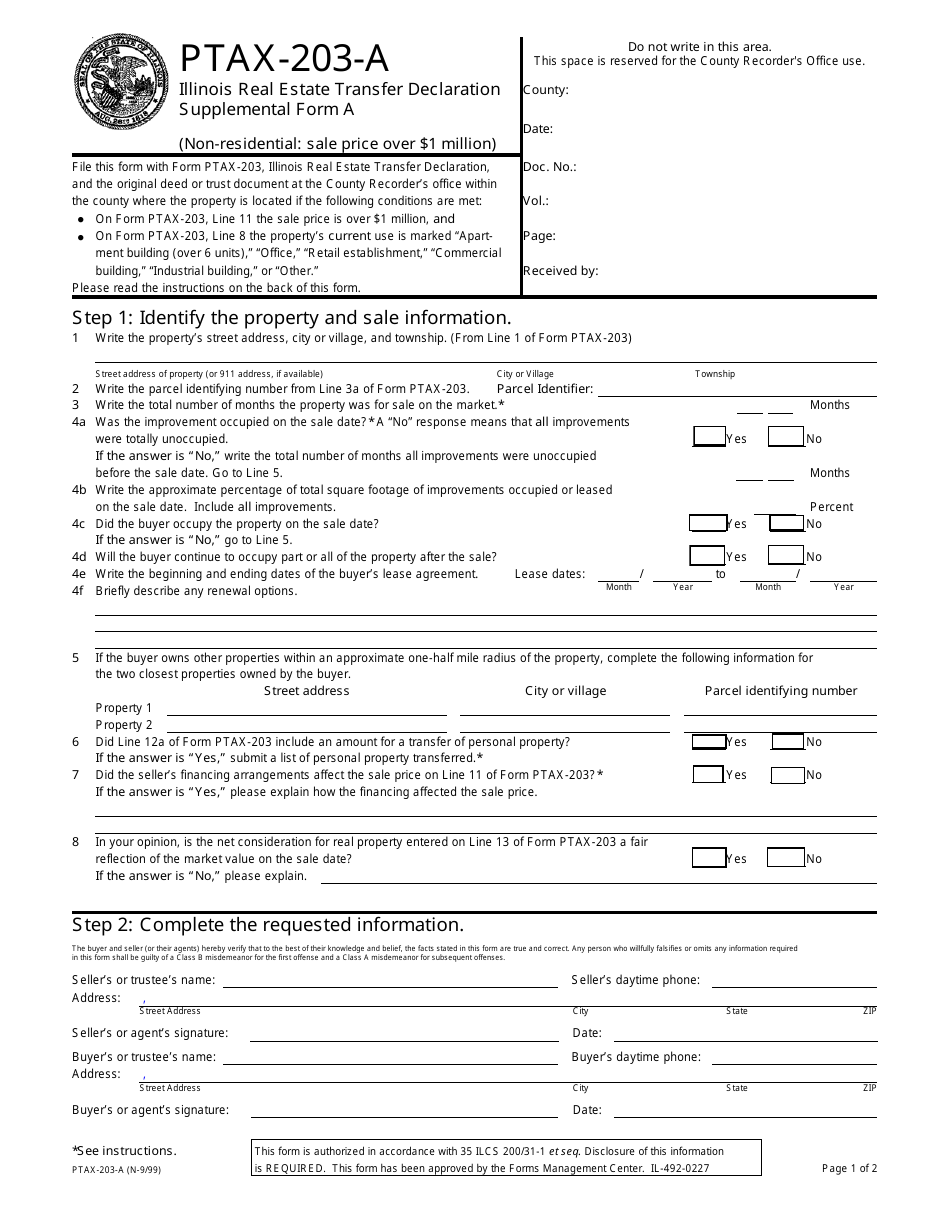

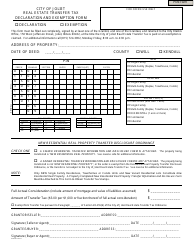

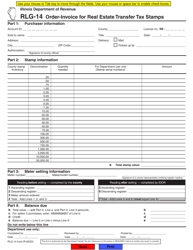

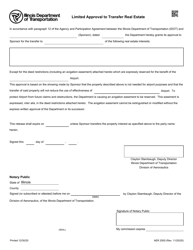

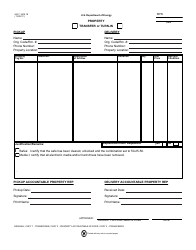

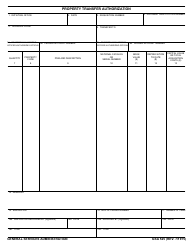

Form PTAX-203-A Real Estate Transfer Declaration - Supplemental Form a - Illinois

What Is Form PTAX-203-A?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PTAX-203-A?

A: Form PTAX-203-A is a supplemental form for the Real Estate Transfer Declaration in Illinois.

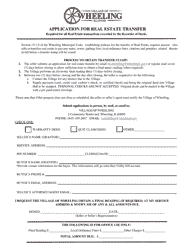

Q: What is the purpose of Form PTAX-203-A?

A: The purpose of Form PTAX-203-A is to provide additional information for the Real Estate Transfer Declaration.

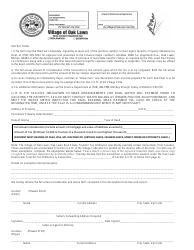

Q: Who needs to fill out Form PTAX-203-A?

A: Anyone who is required to file a Real Estate Transfer Declaration in Illinois may need to fill out Form PTAX-203-A if they have additional information to provide.

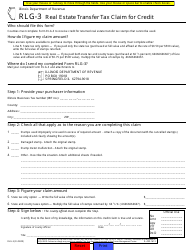

Q: Are there any fees associated with filing Form PTAX-203-A?

A: No, there are no fees associated with filing Form PTAX-203-A.

Q: When is the deadline for filing Form PTAX-203-A?

A: The deadline for filing Form PTAX-203-A is the same as the deadline for the Real Estate Transfer Declaration, which is typically within 30 days of the transfer of the property.

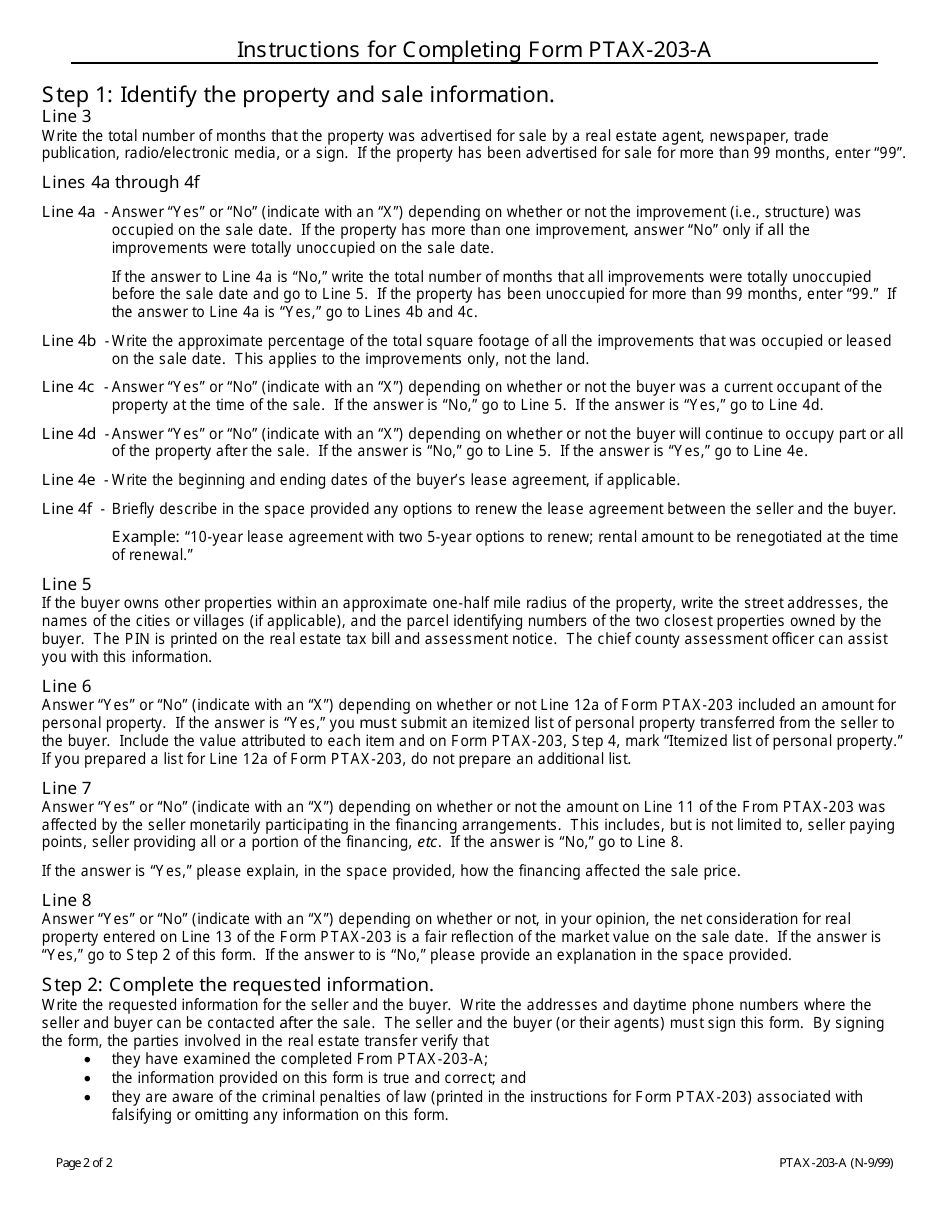

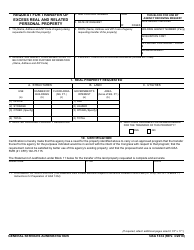

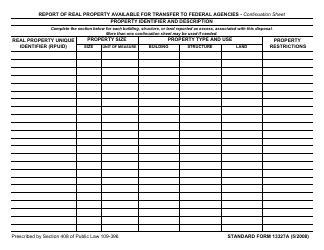

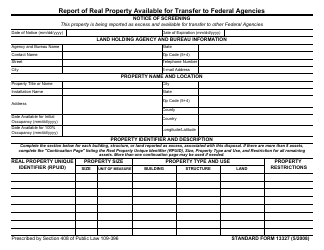

Q: What information is required on Form PTAX-203-A?

A: Form PTAX-203-A requires information such as property address, legal description, buyer and seller information, and any exemptions or special circumstances that apply.

Q: Can I submit Form PTAX-203-A electronically?

A: It depends on the county. Some counties in Illinois allow for electronic submission of Form PTAX-203-A, while others may require a printed copy to be submitted by mail.

Q: What happens after I submit Form PTAX-203-A?

A: After submitting Form PTAX-203-A, it will be reviewed by the county assessor's office and processed accordingly. You will receive notification if any further action is required.

Q: Can I amend Form PTAX-203-A after it has been submitted?

A: If you need to make changes or corrections to Form PTAX-203-A after it has been submitted, you should contact the county assessor's office for guidance.

Form Details:

- Released on September 1, 1999;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PTAX-203-A by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.