This version of the form is not currently in use and is provided for reference only. Download this version of

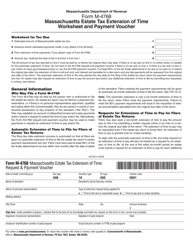

Form M-4868

for the current year.

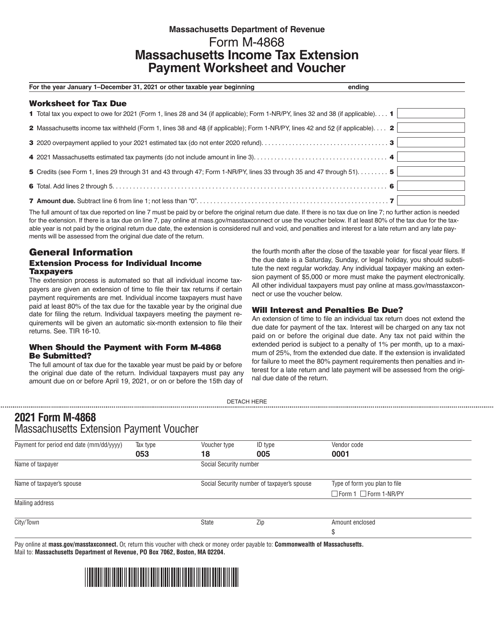

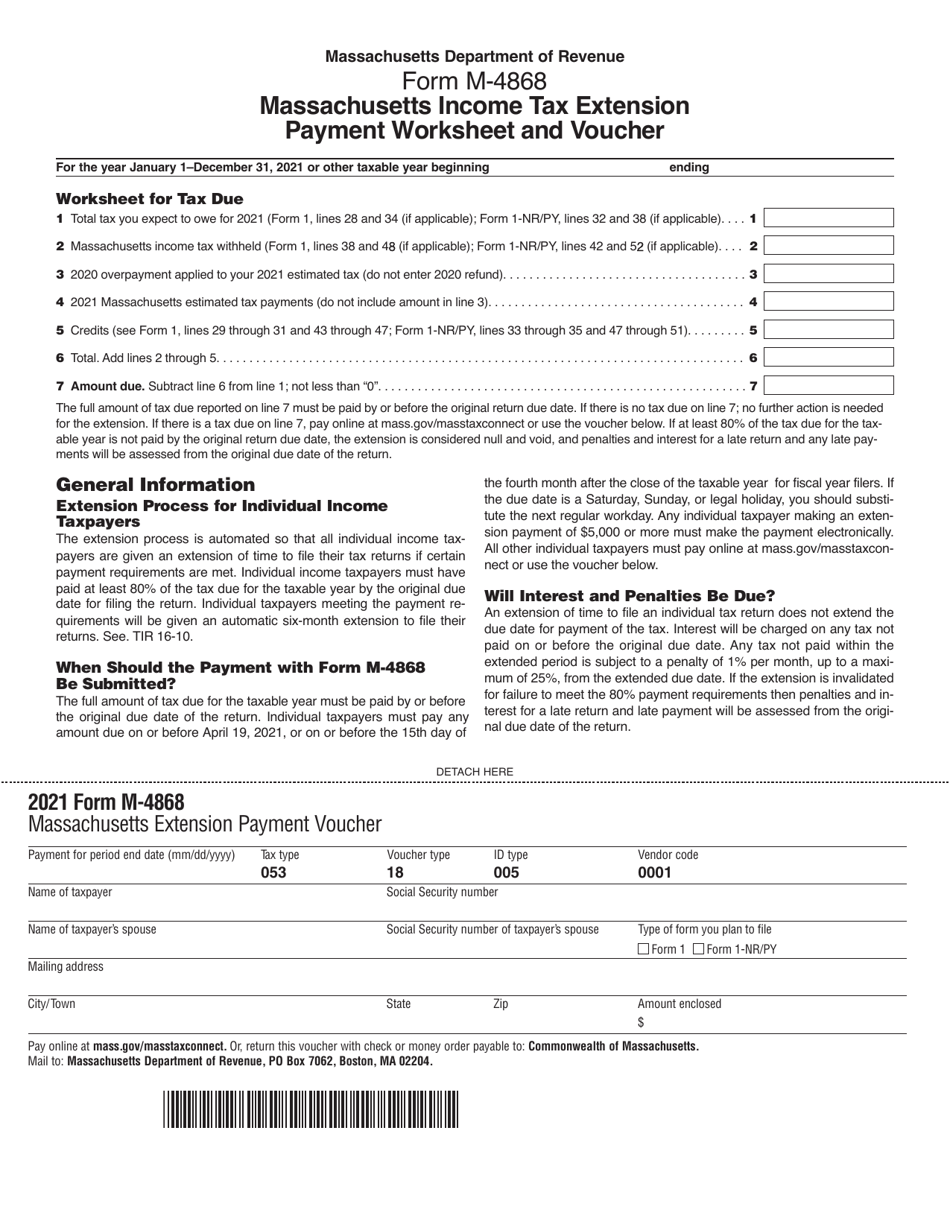

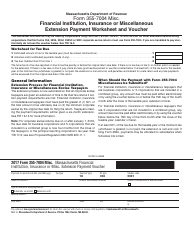

Form M-4868 Massachusetts Income Tax Extension Payment Worksheet and Voucher - Massachusetts

What Is Form M-4868?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M-4868?

A: Form M-4868 is the Massachusetts Income Tax Extension Payment Worksheet and Voucher.

Q: What is the purpose of Form M-4868?

A: The purpose of Form M-4868 is to request an extension of time to file your Massachusetts income tax return and to make any necessary payment.

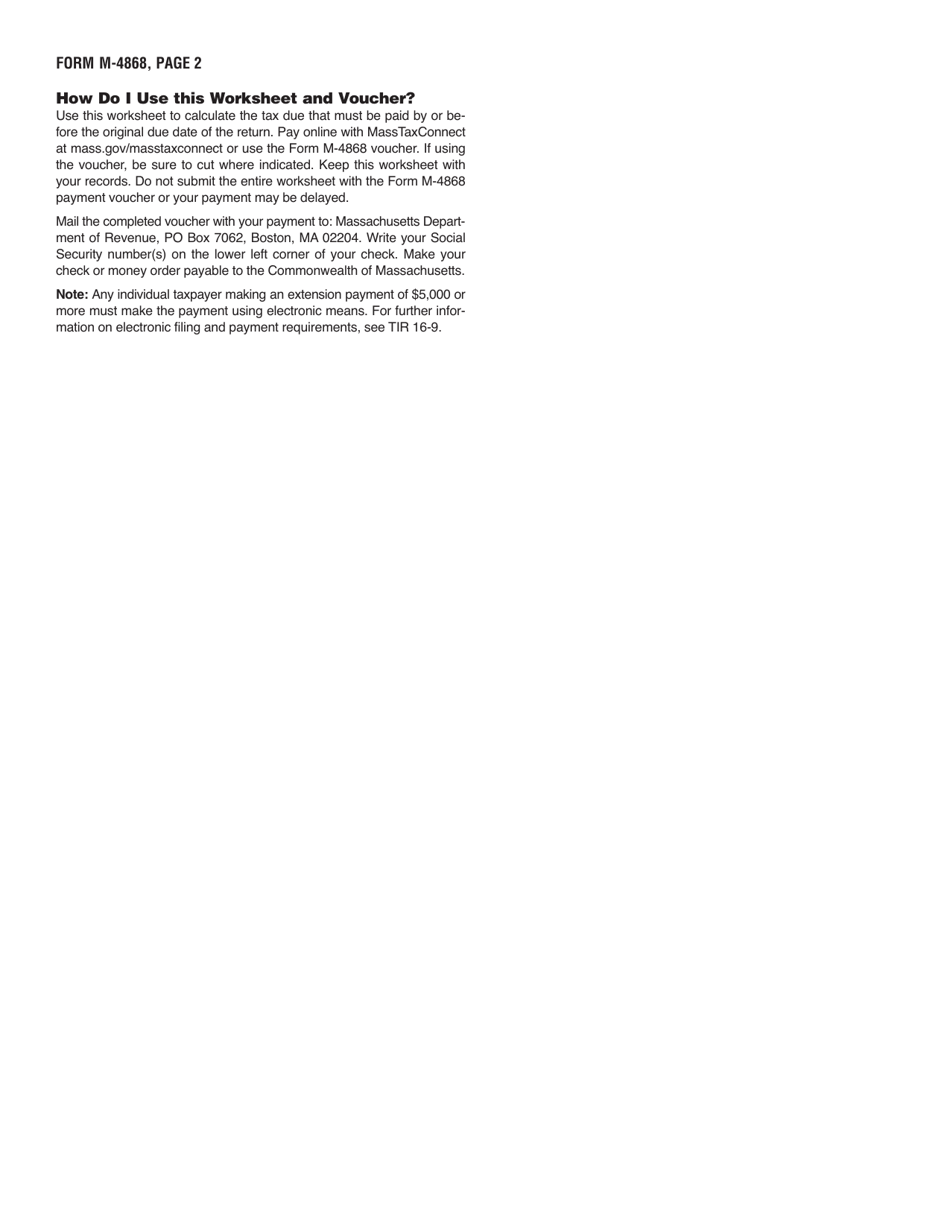

Q: How do I use Form M-4868?

A: You should use Form M-4868 to estimate your tax liability and make a payment if you are requesting an extension.

Q: Can I file an extension without making a payment?

A: No, if you owe taxes, you must make an estimated payment with your extension request.

Q: When is the deadline for filing Form M-4868?

A: The deadline for filing Form M-4868 is typically April 15th, the same as the deadline for submitting your Massachusetts income tax return.

Q: What happens if I don't file Form M-4868?

A: If you don't file Form M-4868 and fail to pay your taxes by the deadline, you may be subject to penalties and interest charges.

Q: Can I e-file Form M-4868?

A: Yes, you can e-file Form M-4868 using approved tax software or through a tax professional.

Q: What should I do after filing Form M-4868?

A: After filing Form M-4868, you should promptly file your Massachusetts income tax return and pay any remaining taxes owed.

Q: Can I request an extension for my federal tax return using Form M-4868?

A: No, Form M-4868 is specific to Massachusetts income taxes. To request an extension for your federal tax return, you need to use IRS Form 4868.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form M-4868 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.