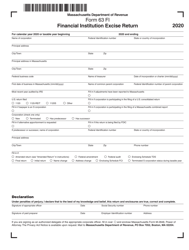

Form 63 FI-ES Financial Institution Corporation Estimated Excise Worksheet - Massachusetts

What Is Form 63 FI-ES?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 63 FI-ES?

A: Form 63 FI-ES is the Financial Institution Corporation Estimated Excise Worksheet.

Q: What is the purpose of Form 63 FI-ES?

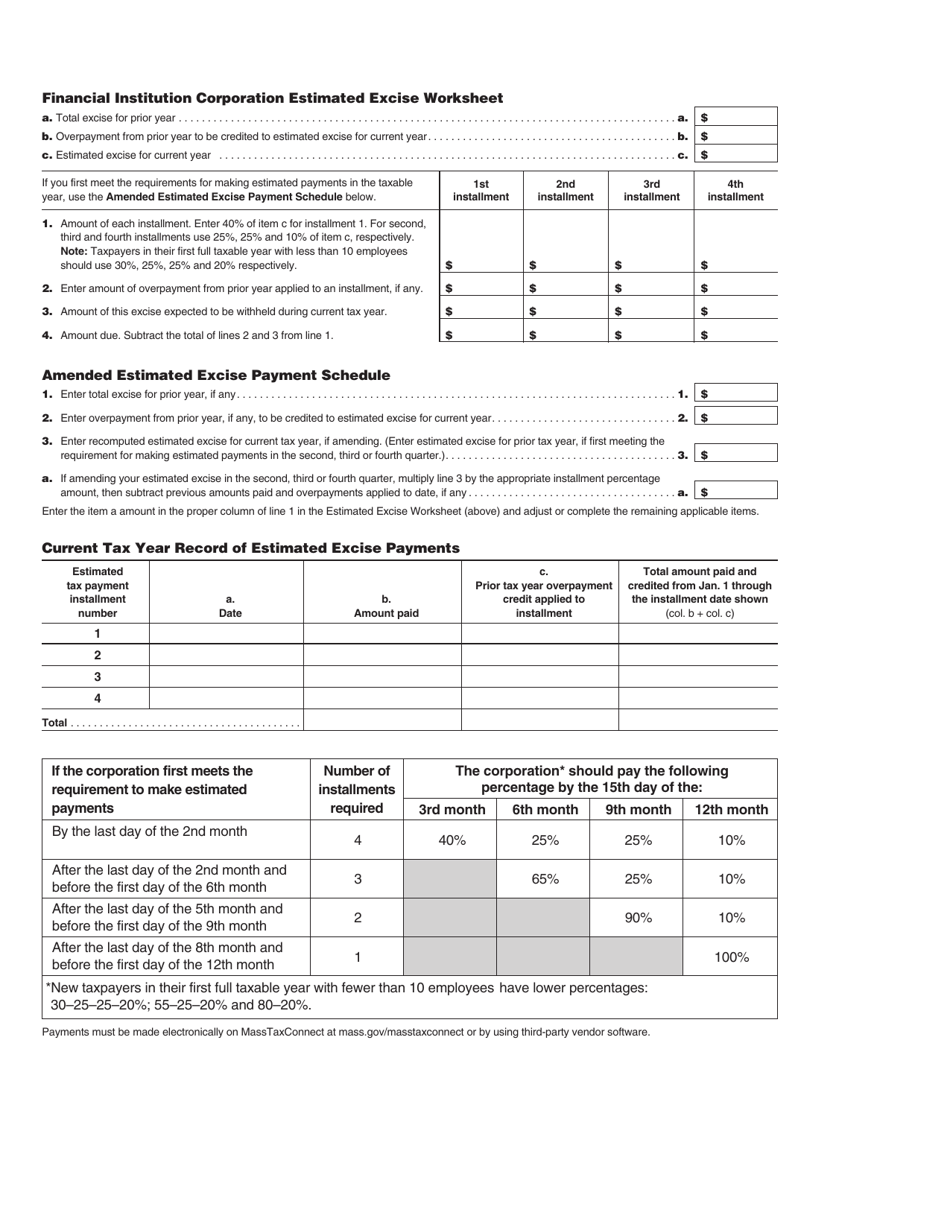

A: The purpose of Form 63 FI-ES is to calculate the estimated excise tax liability for financial institutions in Massachusetts.

Q: Who needs to file Form 63 FI-ES?

A: Financial institutions in Massachusetts that are subject to excise tax need to file Form 63 FI-ES.

Q: What information is required to complete Form 63 FI-ES?

A: To complete Form 63 FI-ES, you will need information about the financial institution's income, deductions, and tax credits.

Q: When is the due date for filing Form 63 FI-ES?

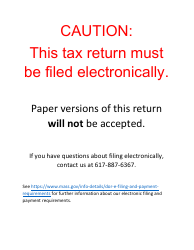

A: The due date for filing Form 63 FI-ES is determined by the Massachusetts Department of Revenue and may vary each year.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 63 FI-ES by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.