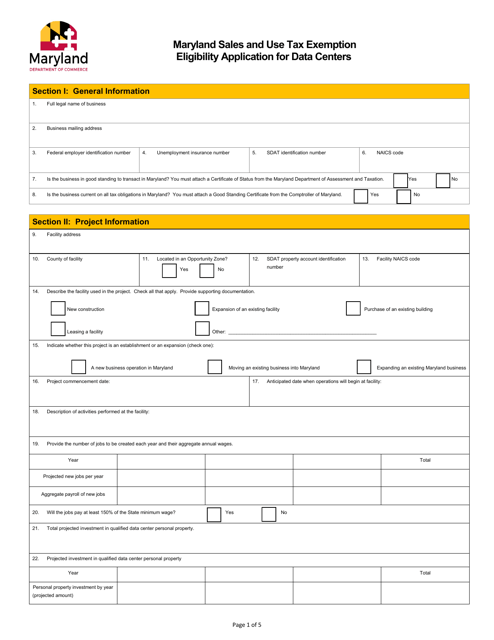

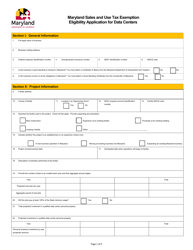

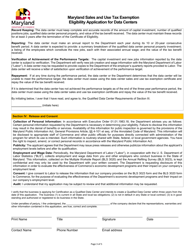

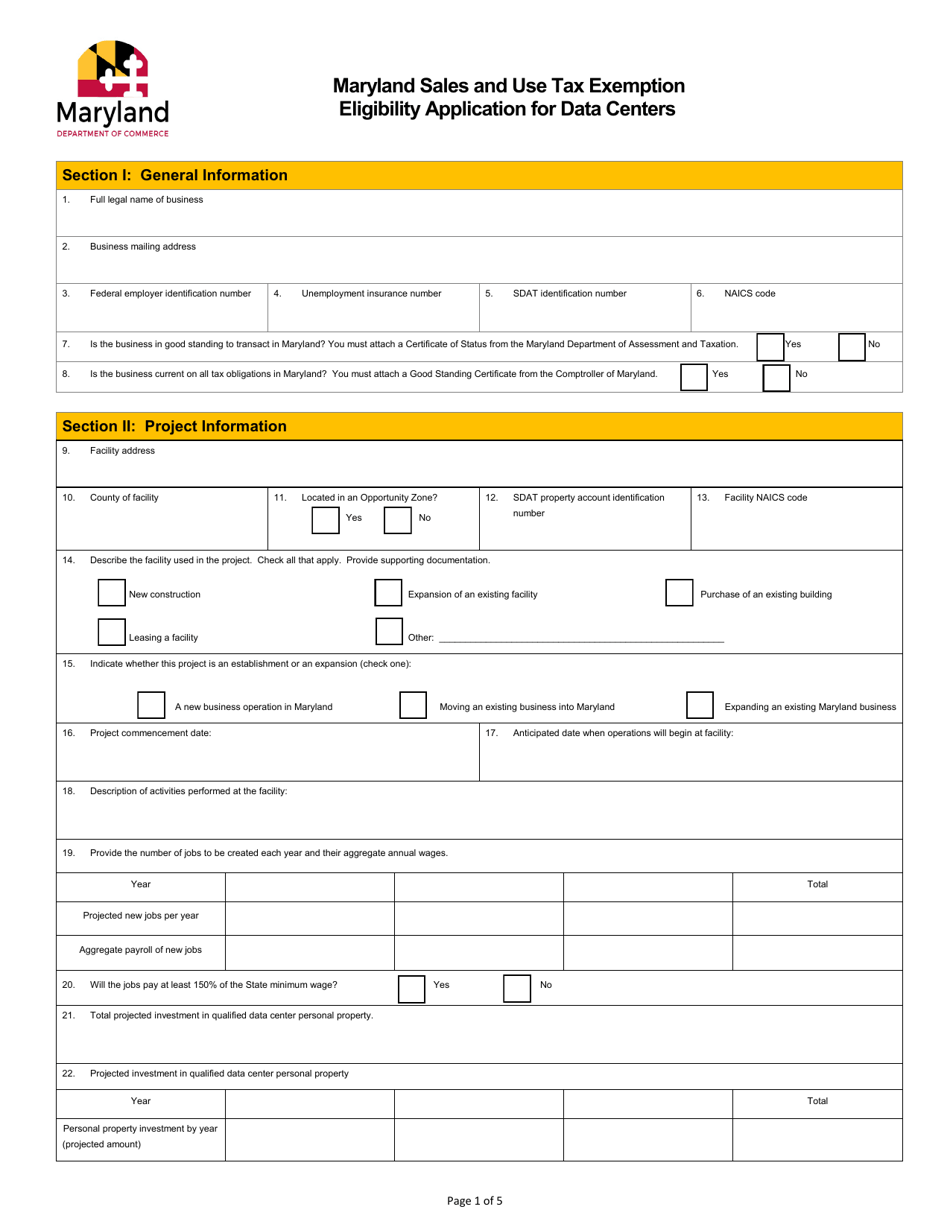

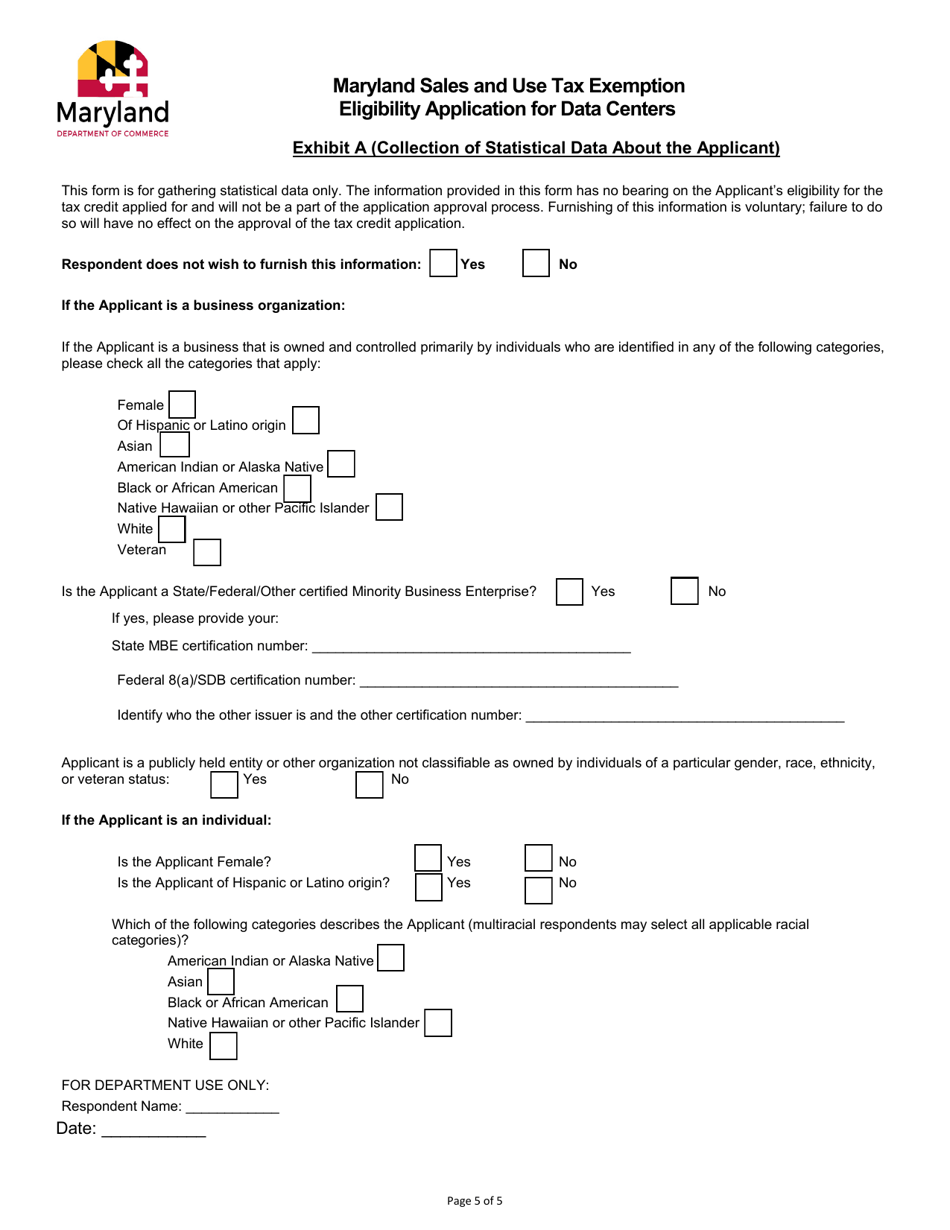

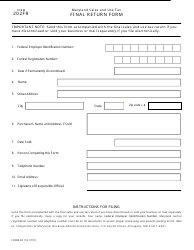

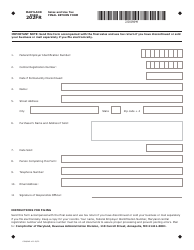

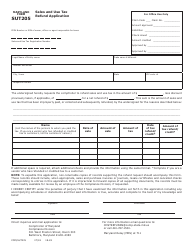

Maryland Sales and Use Tax Exemption Eligibility Application for Data Centers - Maryland

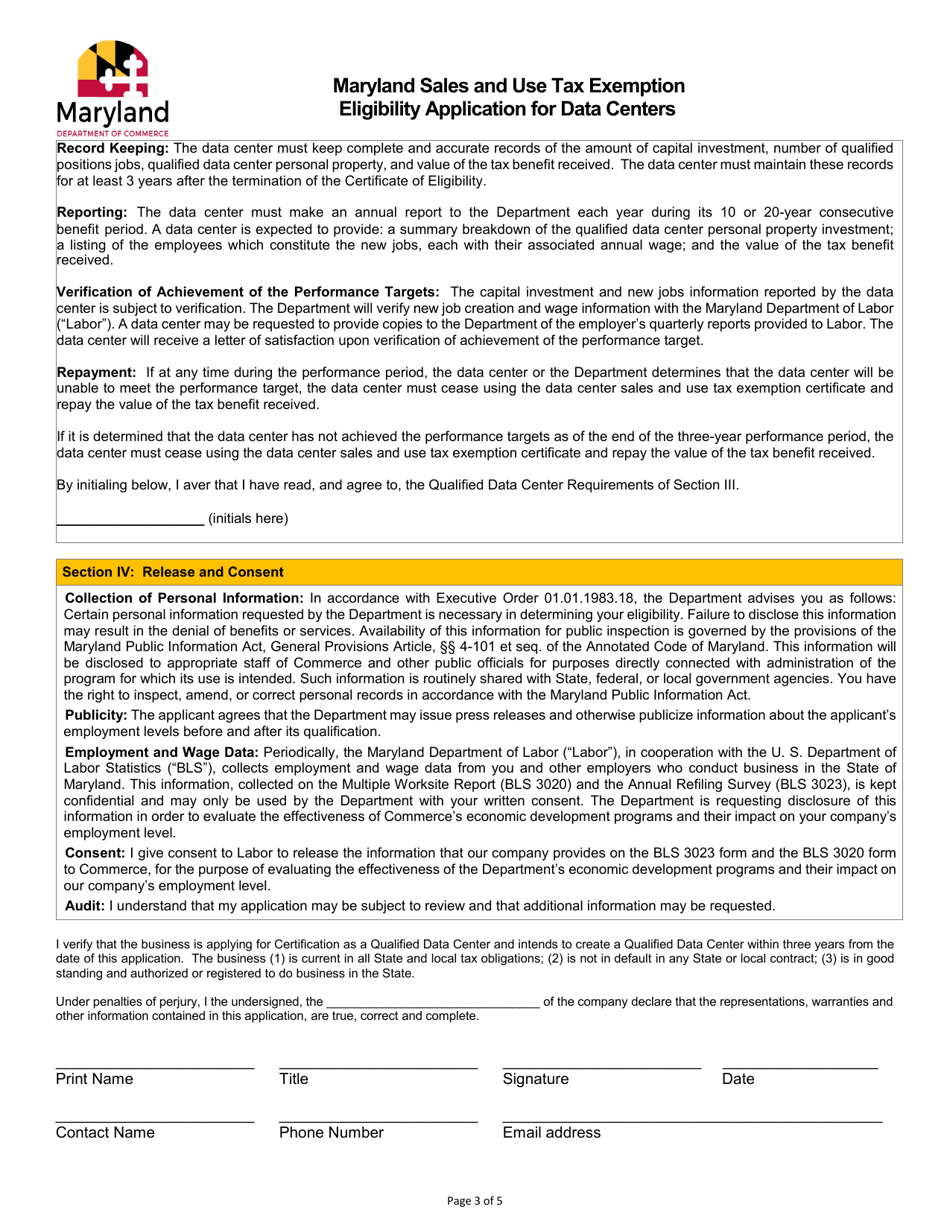

Maryland Sales and Use Tax Exemption Eligibility Application for Data Centers is a legal document that was released by the Maryland Department of Commerce - a government authority operating within Maryland.

FAQ

Q: What is the Maryland Sales and Use Tax Exemption Eligibility Application for Data Centers?

A: It is an application for data centers to apply for sales and use tax exemption in Maryland.

Q: Who can apply for the Maryland Sales and Use Tax Exemption?

A: Data centers can apply for the exemption.

Q: What is the purpose of the exemption?

A: The purpose is to attract data center investment and encourage economic growth in Maryland.

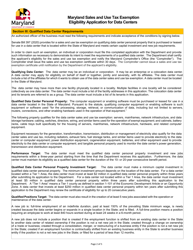

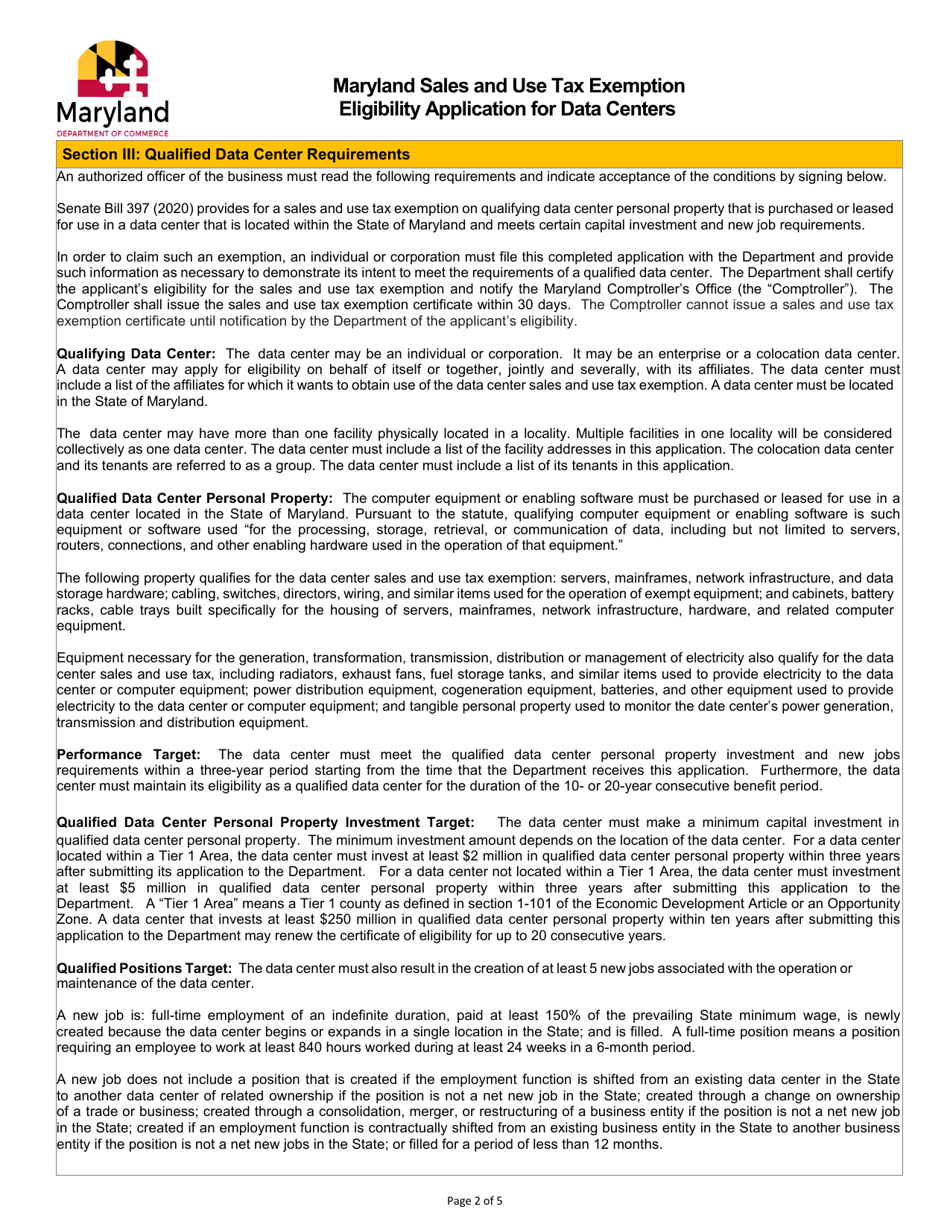

Q: What are the eligibility requirements for the exemption?

A: Data centers must meet certain investment and job creation thresholds to be eligible.

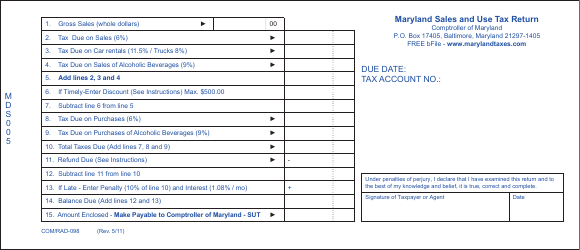

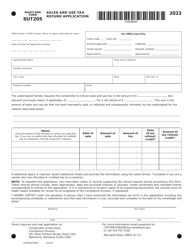

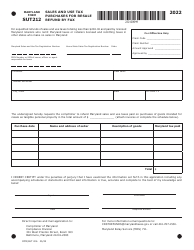

Q: What types of taxes are exempted?

A: Sales and use taxes on qualifying purchases and leases of data center equipment and infrastructure.

Q: How long does the exemption last?

A: The exemption can be granted for up to 20 years.

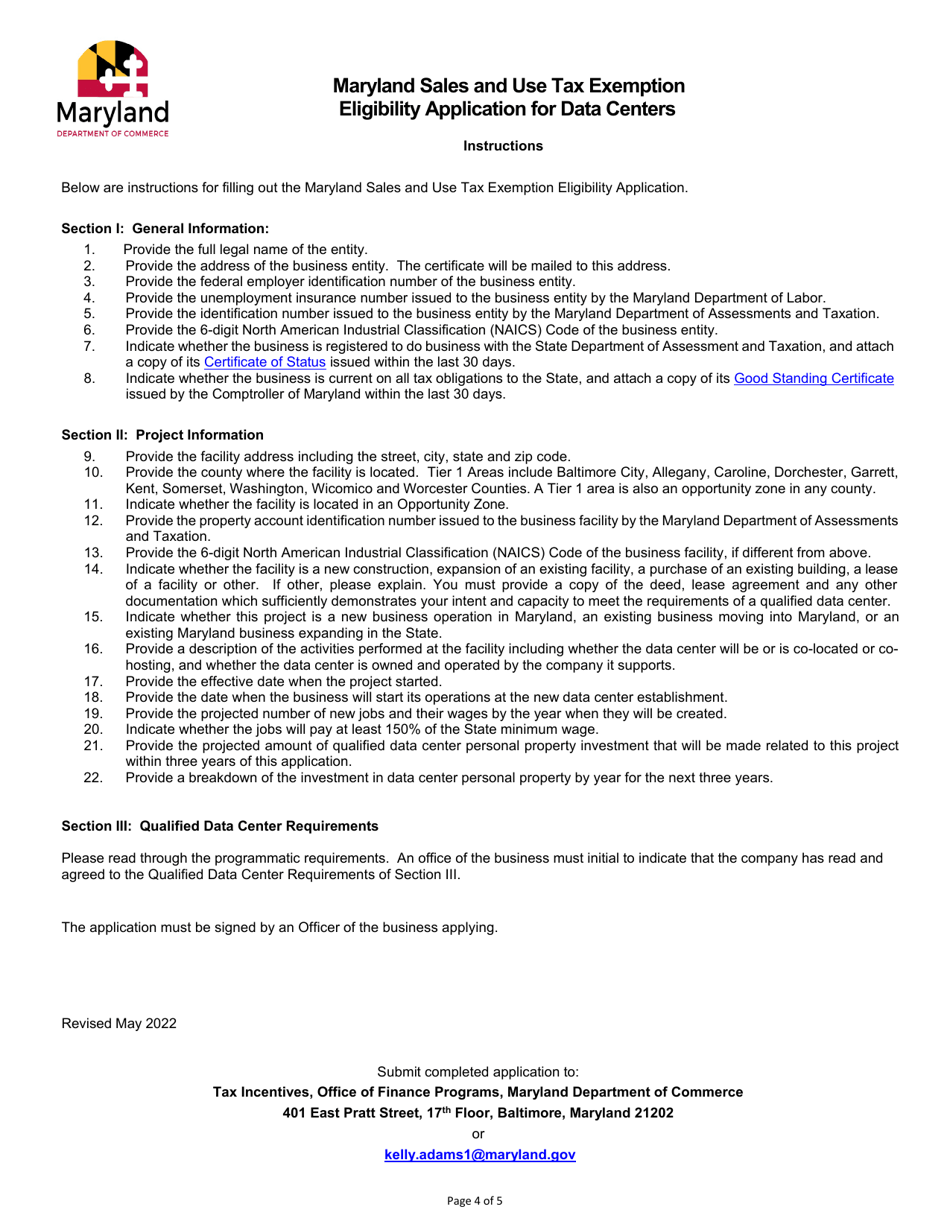

Form Details:

- Released on May 1, 2022;

- The latest edition currently provided by the Maryland Department of Commerce;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Department of Commerce.