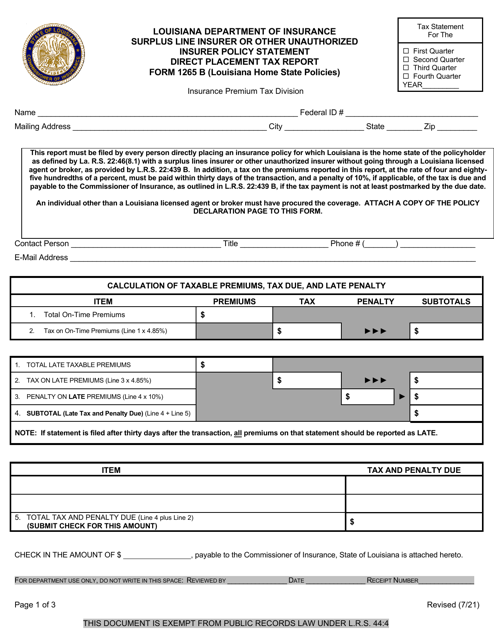

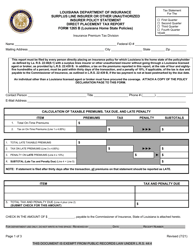

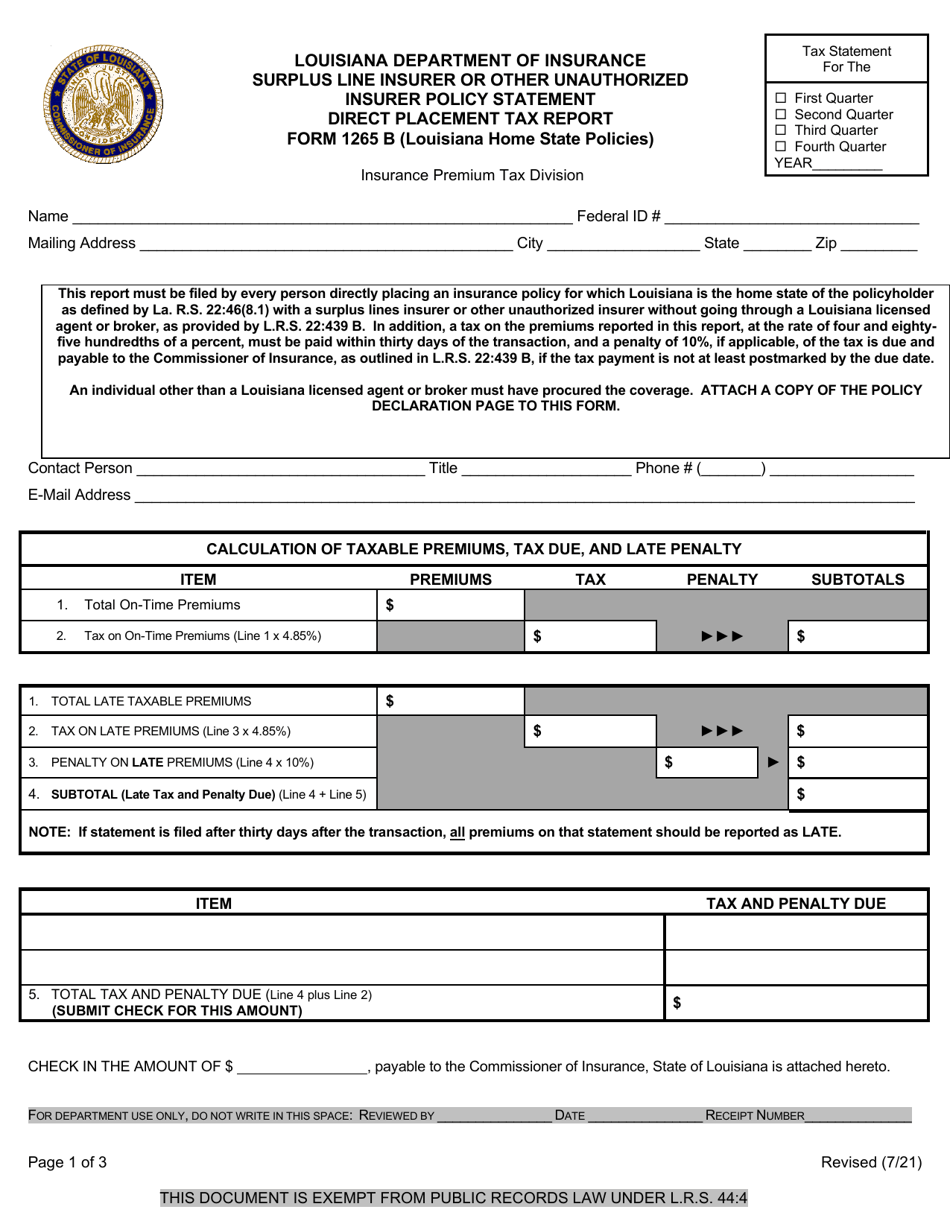

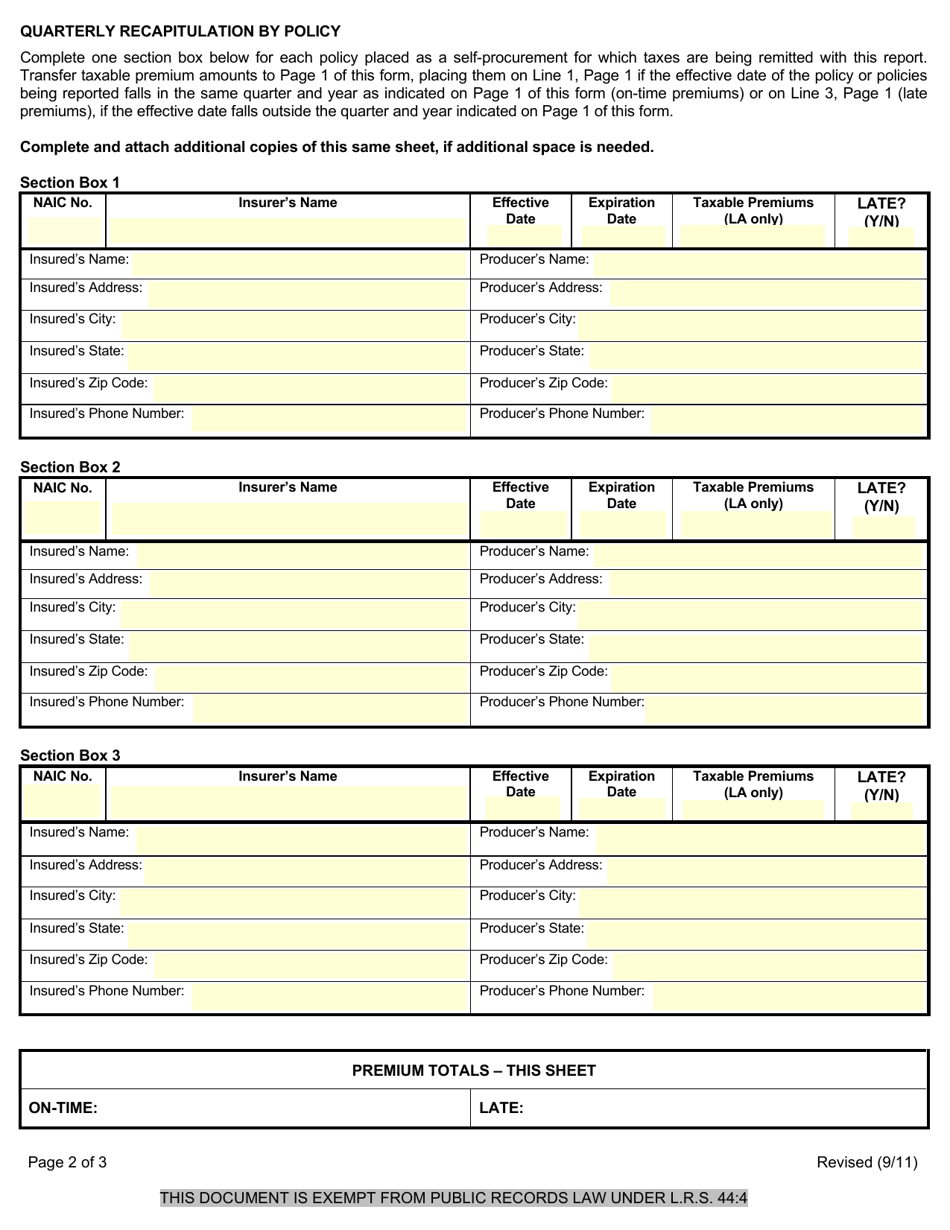

Form 1265B Surplus Line Insurer or Other Unauthorized Insurer Policy Statement Direct Placement Tax Report - Louisiana

What Is Form 1265B?

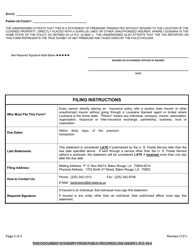

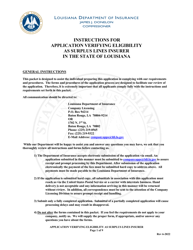

This is a legal form that was released by the Louisiana Department of Insurance - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1265B?

A: Form 1265B is a policy statement and tax report for direct placement of insurance with surplus line insurer or other unauthorized insurer in Louisiana.

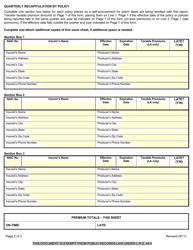

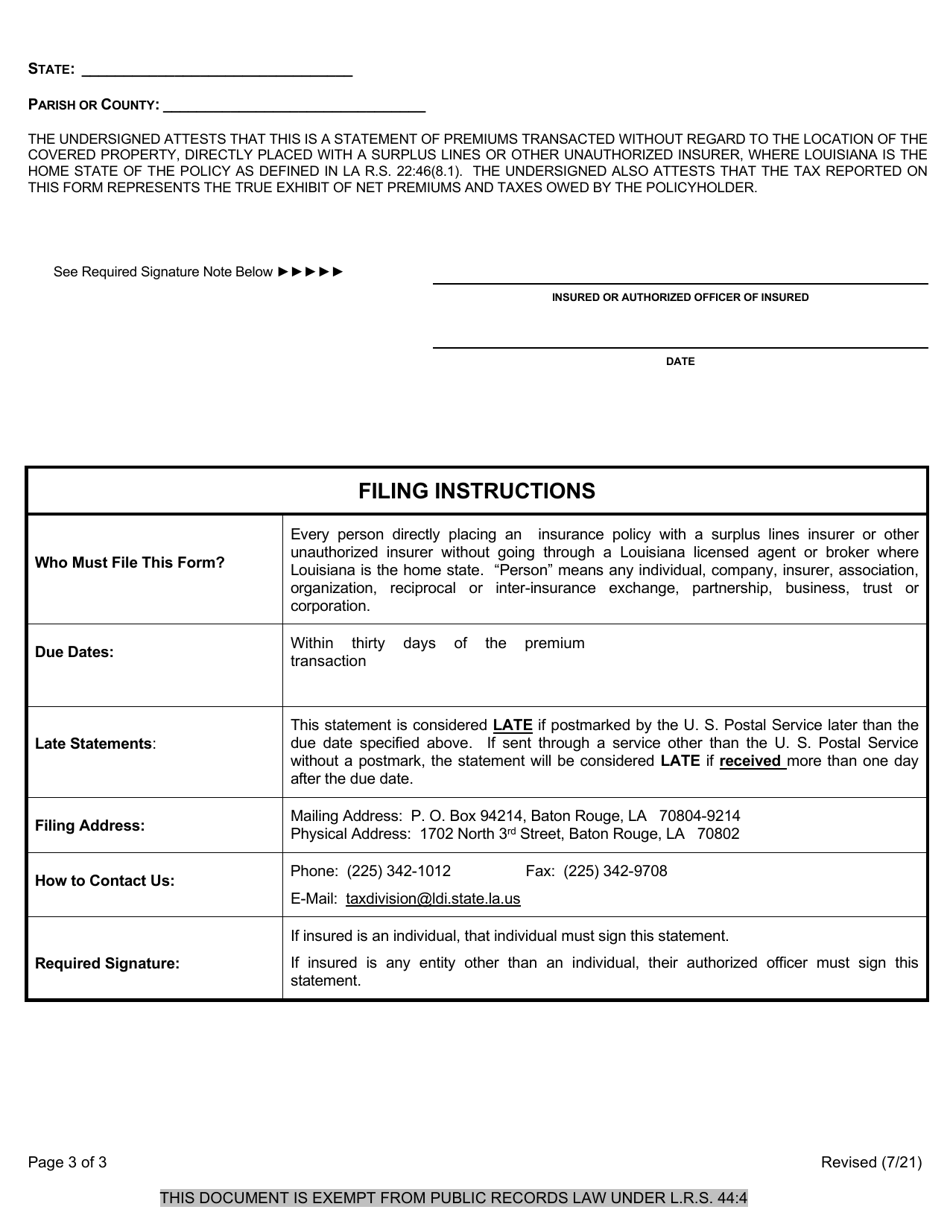

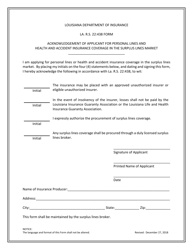

Q: Who needs to file Form 1265B?

A: Insurance brokers and agents who place insurance with surplus line insurers or other unauthorized insurers in Louisiana.

Q: What is the purpose of Form 1265B?

A: The purpose of Form 1265B is to report and remit the premium tax due on direct placements of insurance with surplus line insurers or other unauthorized insurers in Louisiana.

Q: When is Form 1265B due?

A: Form 1265B is due on or before the 20th day of the month following the end of the calendar quarter in which the direct placement occurred.

Q: Is there a penalty for late filing?

A: Yes, there is a penalty for late filing of Form 1265B. The penalty is 5% of the tax due for each month or fraction of a month that the report is late, up to a maximum of 25%.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Louisiana Department of Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1265B by clicking the link below or browse more documents and templates provided by the Louisiana Department of Insurance.