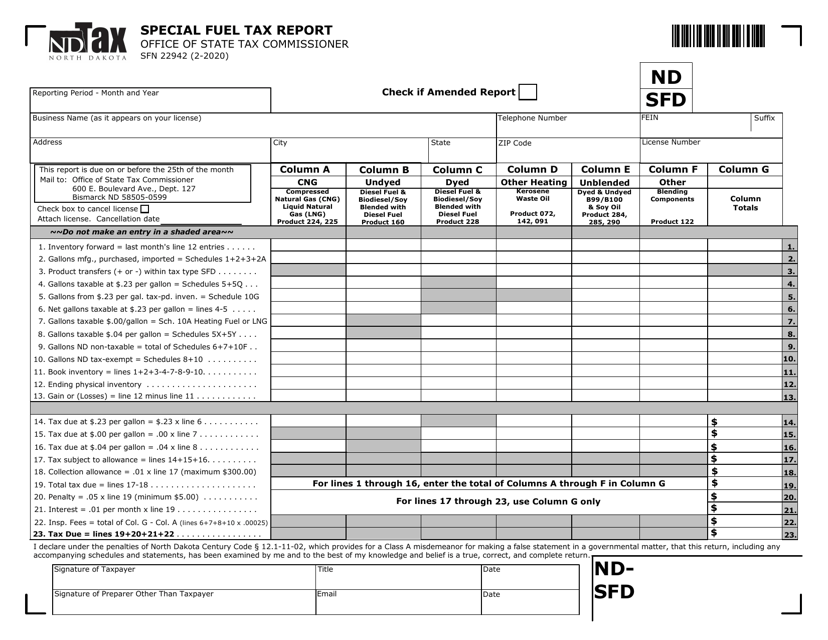

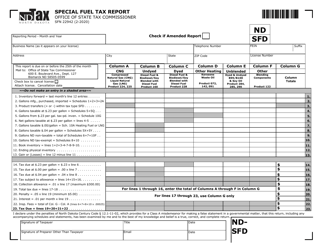

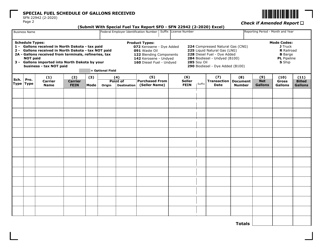

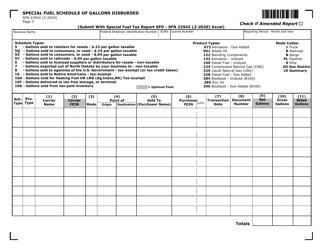

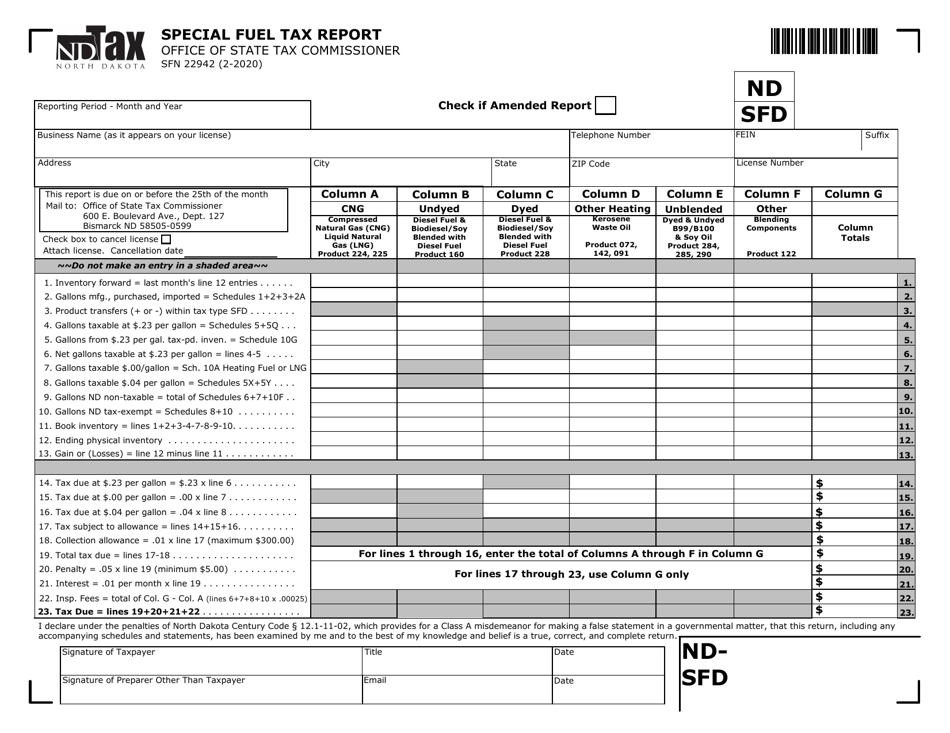

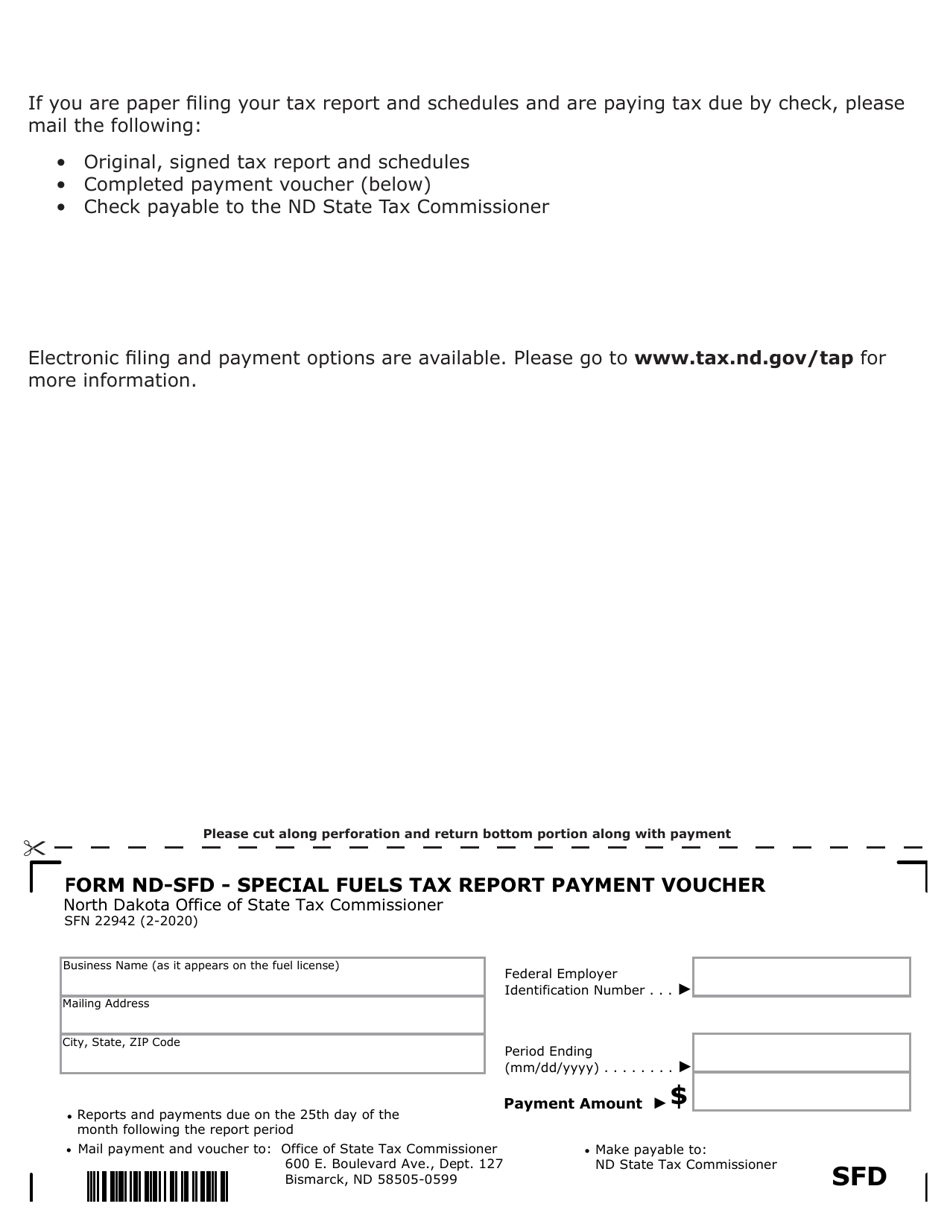

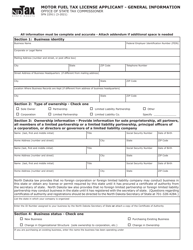

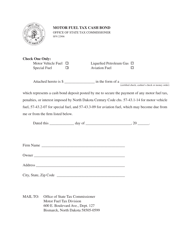

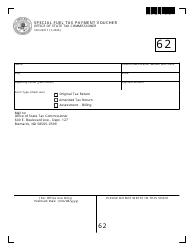

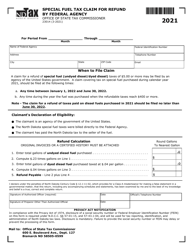

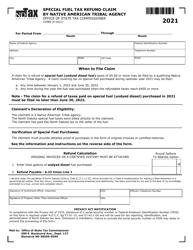

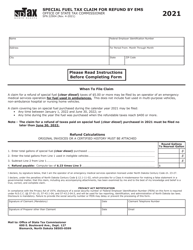

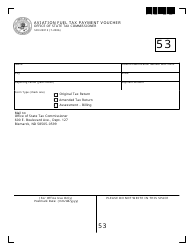

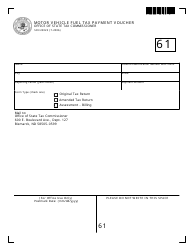

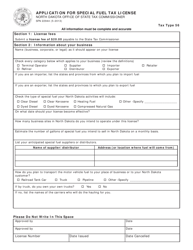

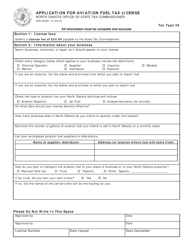

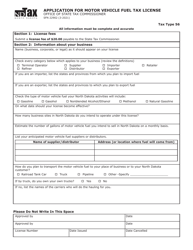

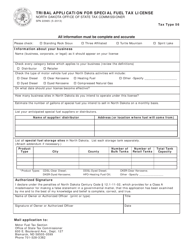

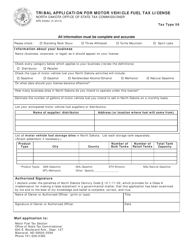

Form ND-SFD (SFN22942) Special Fuel Tax Report - North Dakota

What Is Form ND-SFD (SFN22942)?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ND-SFD?

A: Form ND-SFD is the Special Fuel Tax Report for North Dakota.

Q: Who needs to file Form ND-SFD?

A: Any person or business engaged in the sale, distribution, or consumption of special fuel in North Dakota needs to file Form ND-SFD.

Q: What is special fuel?

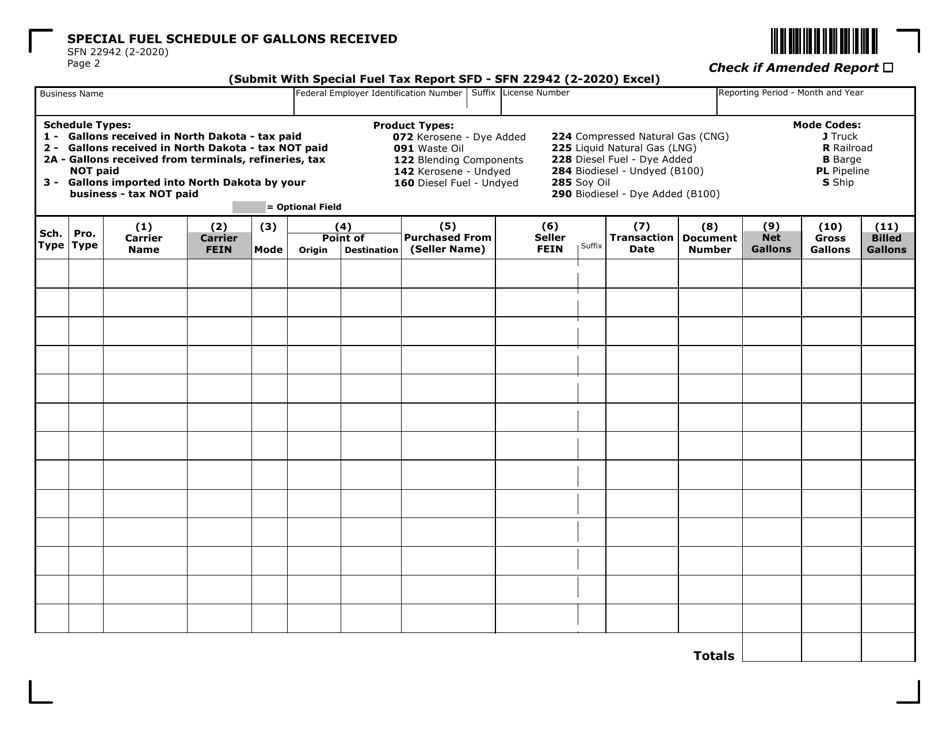

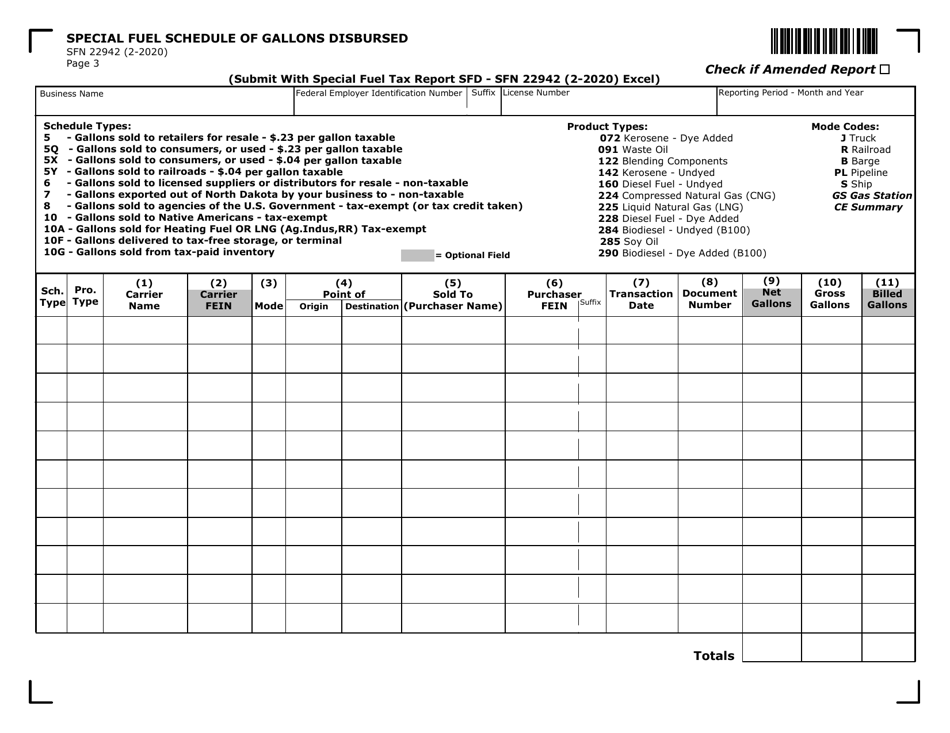

A: Special fuel refers to diesel fuel, biodiesel fuel, kerosene, heating oil, or other combustible liquids used for propulsion or heating purposes.

Q: When is Form ND-SFD due?

A: Form ND-SFD is due on a monthly basis, and the due date is on or before the 23rd day of the following month.

Q: What information is required on Form ND-SFD?

A: Form ND-SFD requires information such as fuel sales, gallons sold, tax rates, and total tax due.

Q: Is there a penalty for late filing of Form ND-SFD?

A: Yes, there is a penalty for late filing of Form ND-SFD. The penalty amount varies depending on the number of days the report is late.

Q: Are there any exemptions or deductions available for Form ND-SFD?

A: Yes, there are certain exemptions and deductions available for Form ND-SFD. These include exemptions for certain non-highway fuels and deductions for exported or delivered fuels.

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ND-SFD (SFN22942) by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.