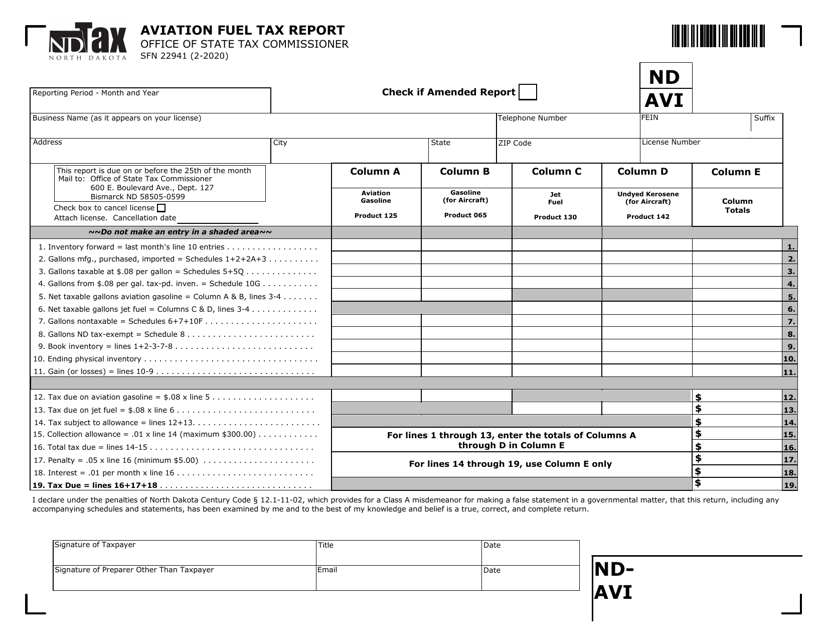

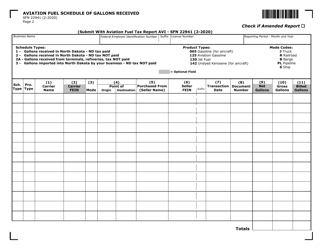

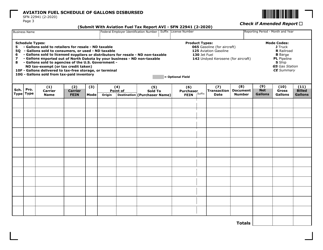

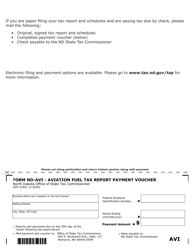

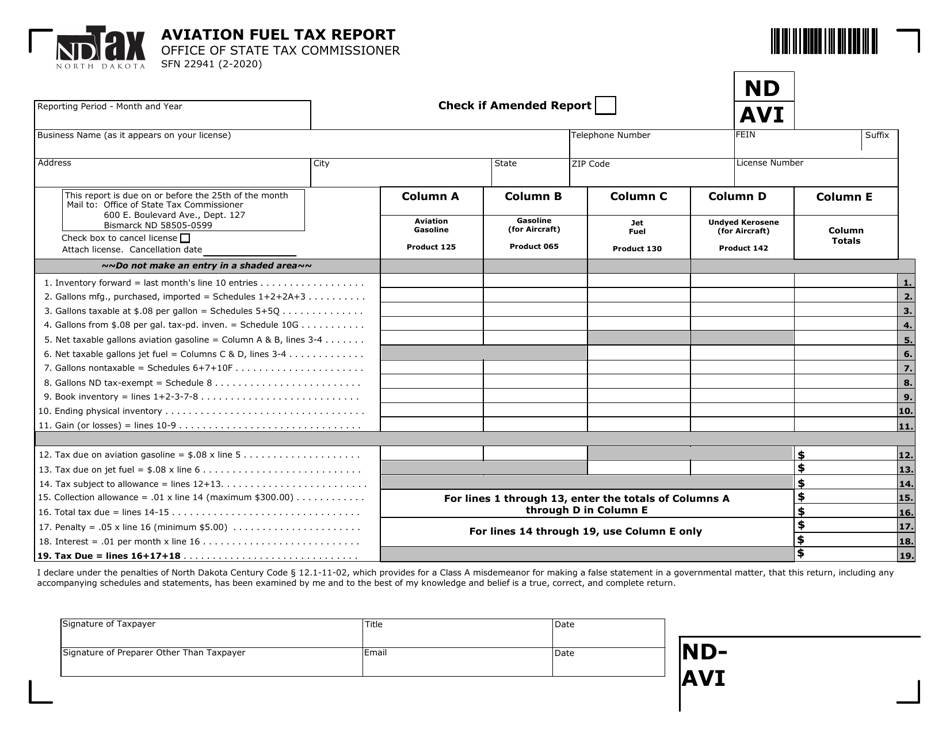

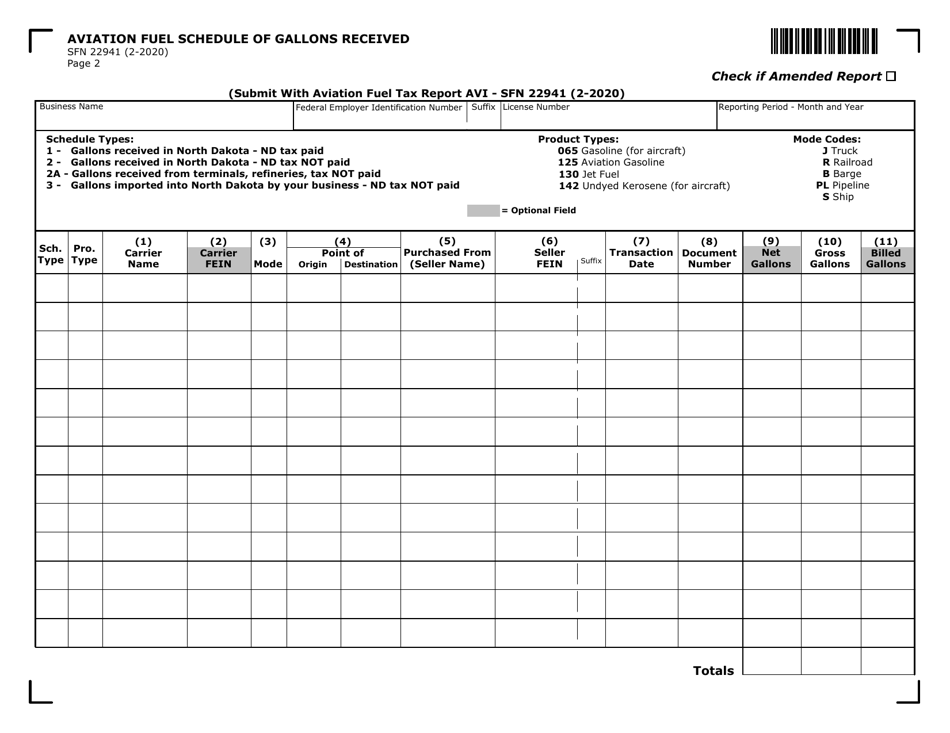

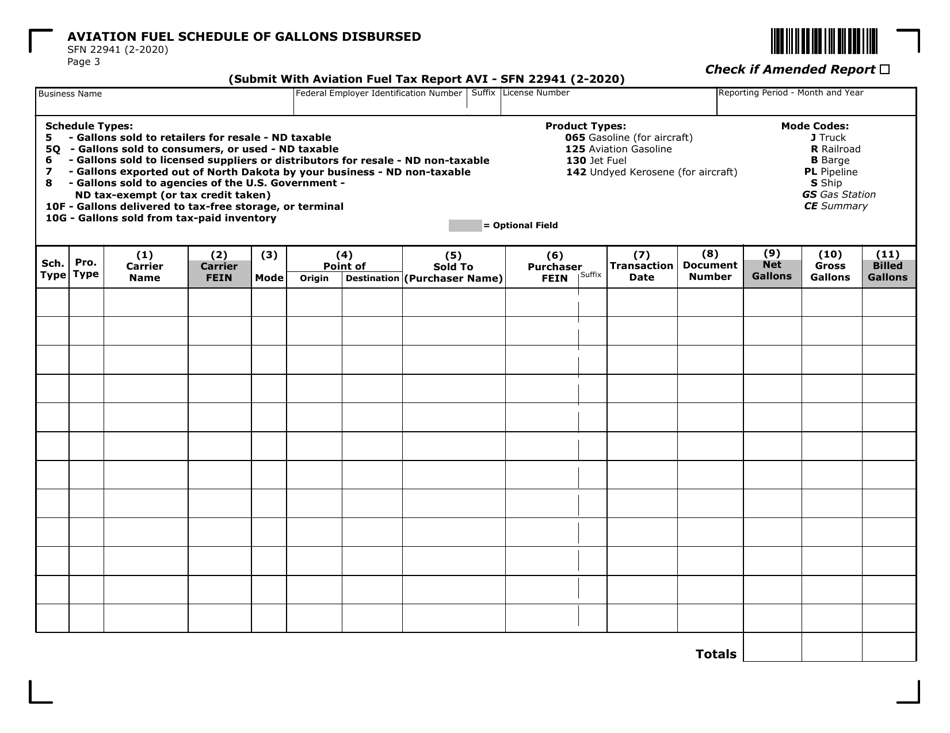

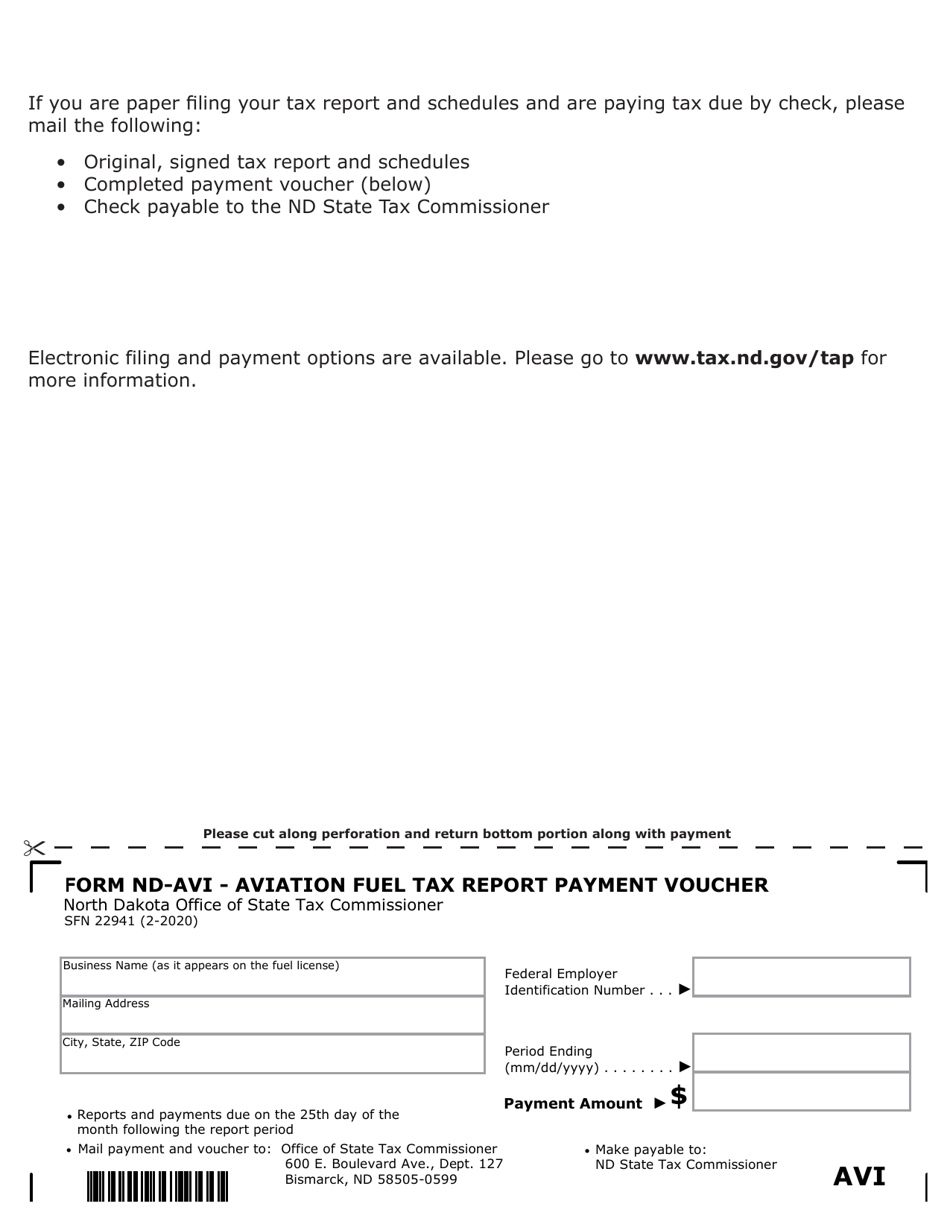

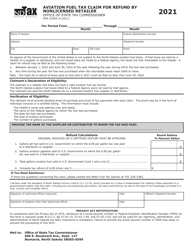

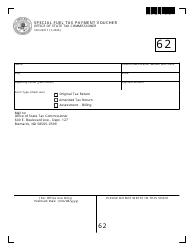

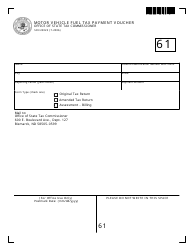

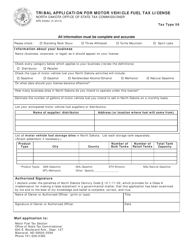

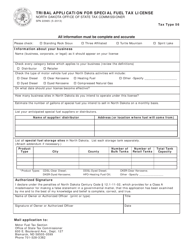

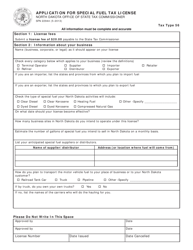

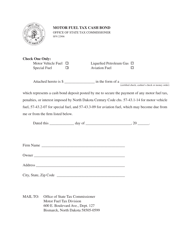

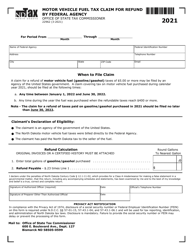

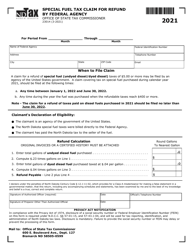

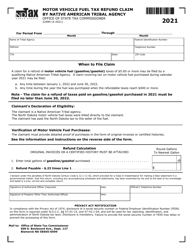

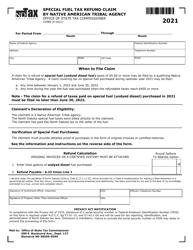

Form ND-AVI (SFN22941) Aviation Fuel Tax Report - North Dakota

What Is Form ND-AVI (SFN22941)?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ND-AVI?

A: Form ND-AVI is the Aviation FuelTax Report used in North Dakota.

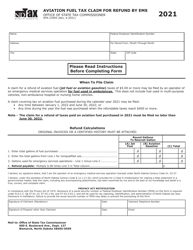

Q: Who is required to file Form ND-AVI?

A: Anyone who sells or uses aviation fuel in North Dakota is required to file Form ND-AVI.

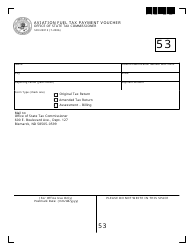

Q: What is the purpose of Form ND-AVI?

A: The purpose of Form ND-AVI is to report and pay the aviation fuel tax in North Dakota.

Q: How often is Form ND-AVI filed?

A: Form ND-AVI is filed on a monthly basis.

Q: Is there a deadline for filing Form ND-AVI?

A: Yes, Form ND-AVI must be filed and the payment must be made by the 20th day of the month following the reporting period.

Q: What happens if I don't file Form ND-AVI or pay the aviation fuel tax?

A: Failure to file Form ND-AVI or pay the aviation fuel tax can result in penalties and interest.

Q: Are there any exemptions to the aviation fuel tax in North Dakota?

A: Yes, certain exempt entities and uses may be eligible for exemption from the aviation fuel tax. Please refer to the instructions of Form ND-AVI for more information.

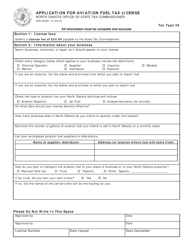

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ND-AVI (SFN22941) by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.