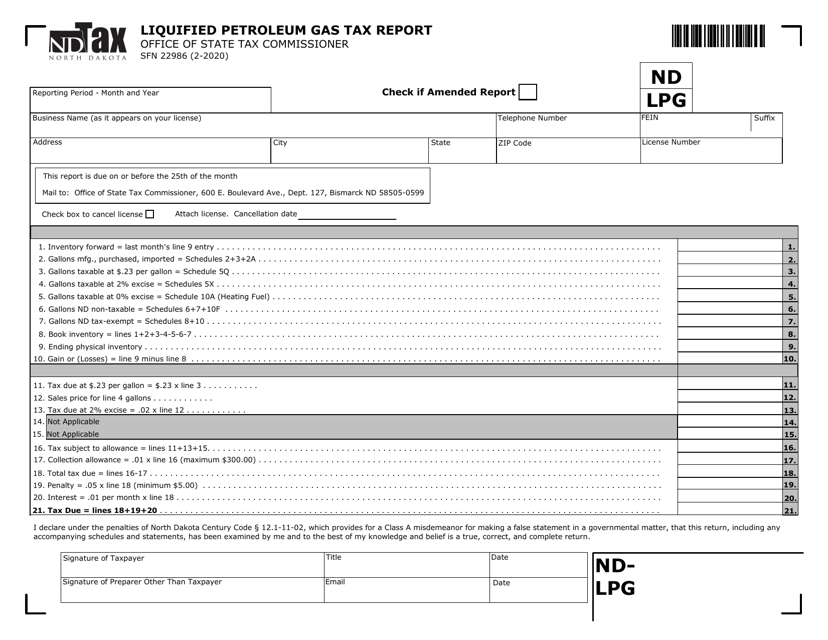

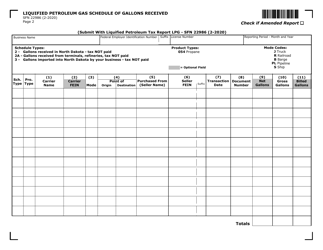

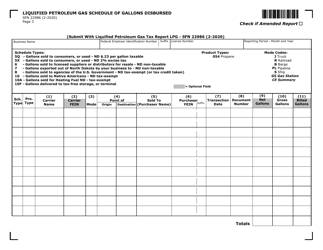

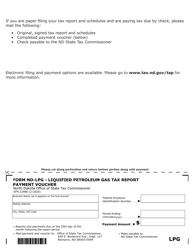

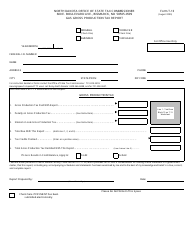

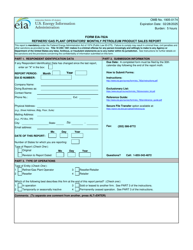

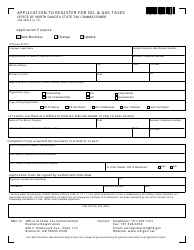

Form ND-LPG (SFN22986) Liquified Petroleum Gas Tax Report - North Dakota

What Is Form ND-LPG (SFN22986)?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form ND-LPG (SFN22986)?

A: Form ND-LPG (SFN22986) is the Liquified Petroleum Gas Tax Report for the state of North Dakota.

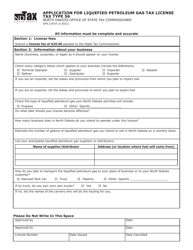

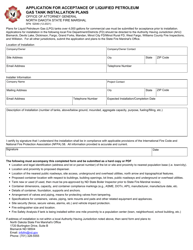

Q: Who needs to file form ND-LPG (SFN22986)?

A: Anyone engaged in the sale or use of liquified petroleum gas in North Dakota needs to file form ND-LPG (SFN22986).

Q: What information is required on form ND-LPG (SFN22986)?

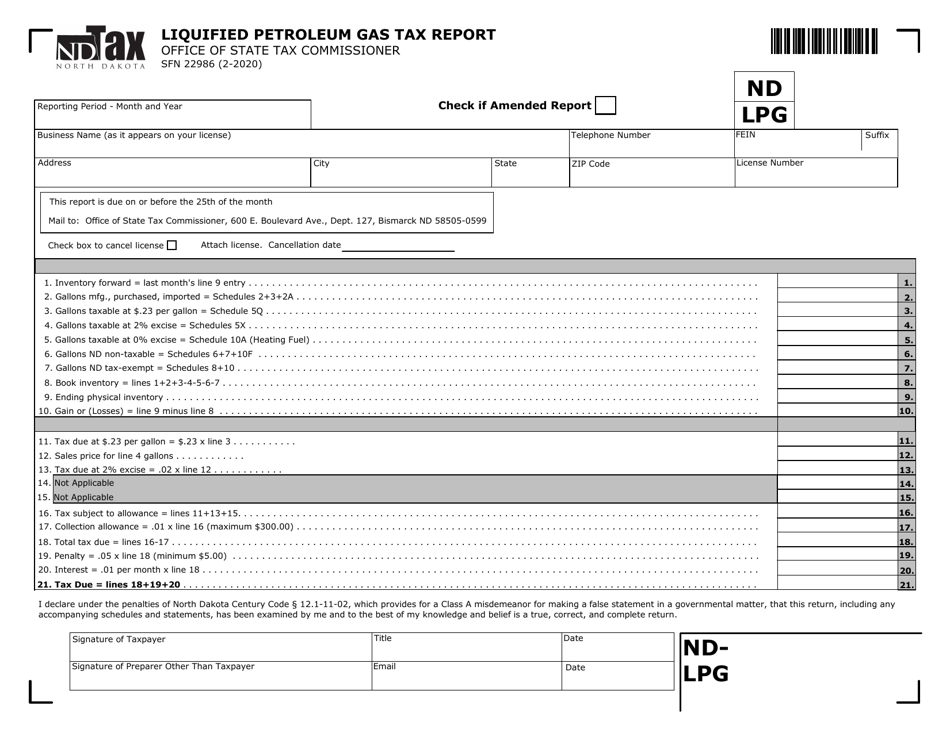

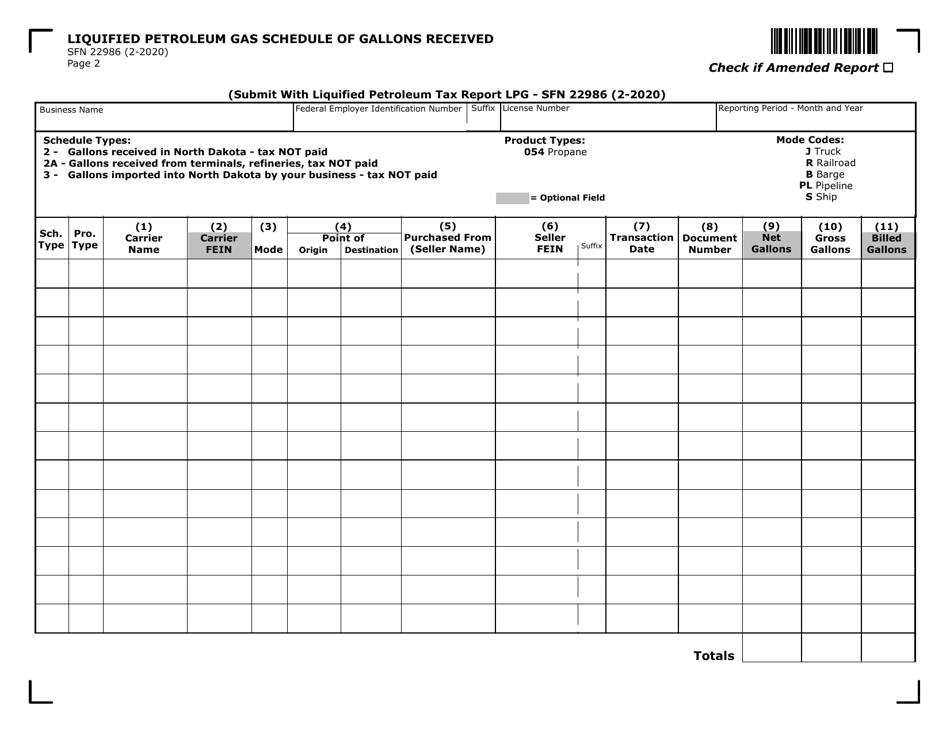

A: Form ND-LPG (SFN22986) requires information such as the amount of liquified petroleum gas sold or used, the tax rate, and the total tax due.

Q: When is the due date for filing form ND-LPG (SFN22986)?

A: Form ND-LPG (SFN22986) is due on the 20th day of the month following the end of the reporting period.

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ND-LPG (SFN22986) by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.