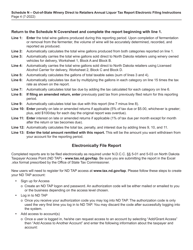

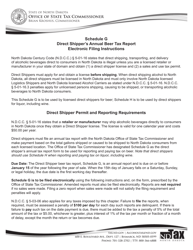

Instructions for Schedule N Out-of-State Winery Direct to Retailers Annual Liquor Tax Report - North Dakota

This document contains official instructions for Schedule N , Out-of-State Winery Direct to Retailers Annual Liquor Tax Report - a form released and collected by the North Dakota Office of State Tax Commissioner.

FAQ

Q: What is Schedule N?

A: Schedule N is the Out-of-State Winery Direct to Retailers Annual Liquor Tax Report in North Dakota.

Q: Who needs to file Schedule N?

A: Out-of-state wineries that sell liquor directly to retailers in North Dakota need to file Schedule N.

Q: How often do I need to file Schedule N?

A: Schedule N needs to be filed annually.

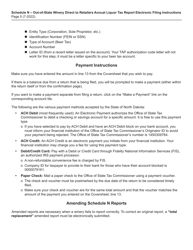

Q: What information is required in Schedule N?

A: Schedule N requires you to provide information about your out-of-state winery, the retailers you sold liquor to, and the total amount of liquor sold.

Q: Are there any deadlines for filing Schedule N?

A: Yes, Schedule N must be filed and paid by January 31st of the following year.

Q: Are there any penalties for late or incorrect filing of Schedule N?

A: Yes, there are penalties for late or incorrect filing of Schedule N. It is important to ensure accurate and timely filing to avoid penalties.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the North Dakota Office of State Tax Commissioner.