This version of the form is not currently in use and is provided for reference only. Download this version of

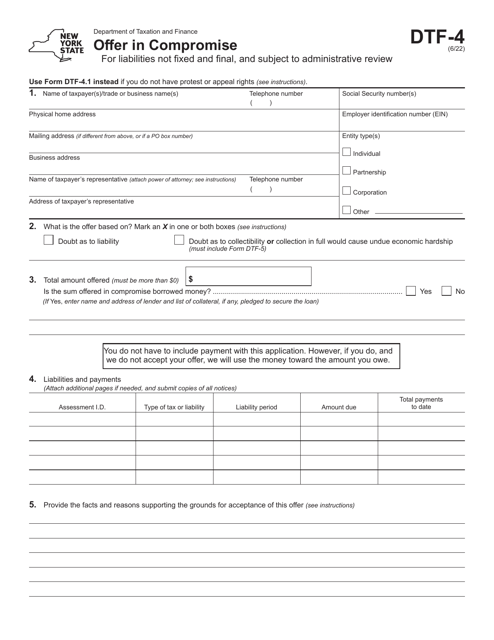

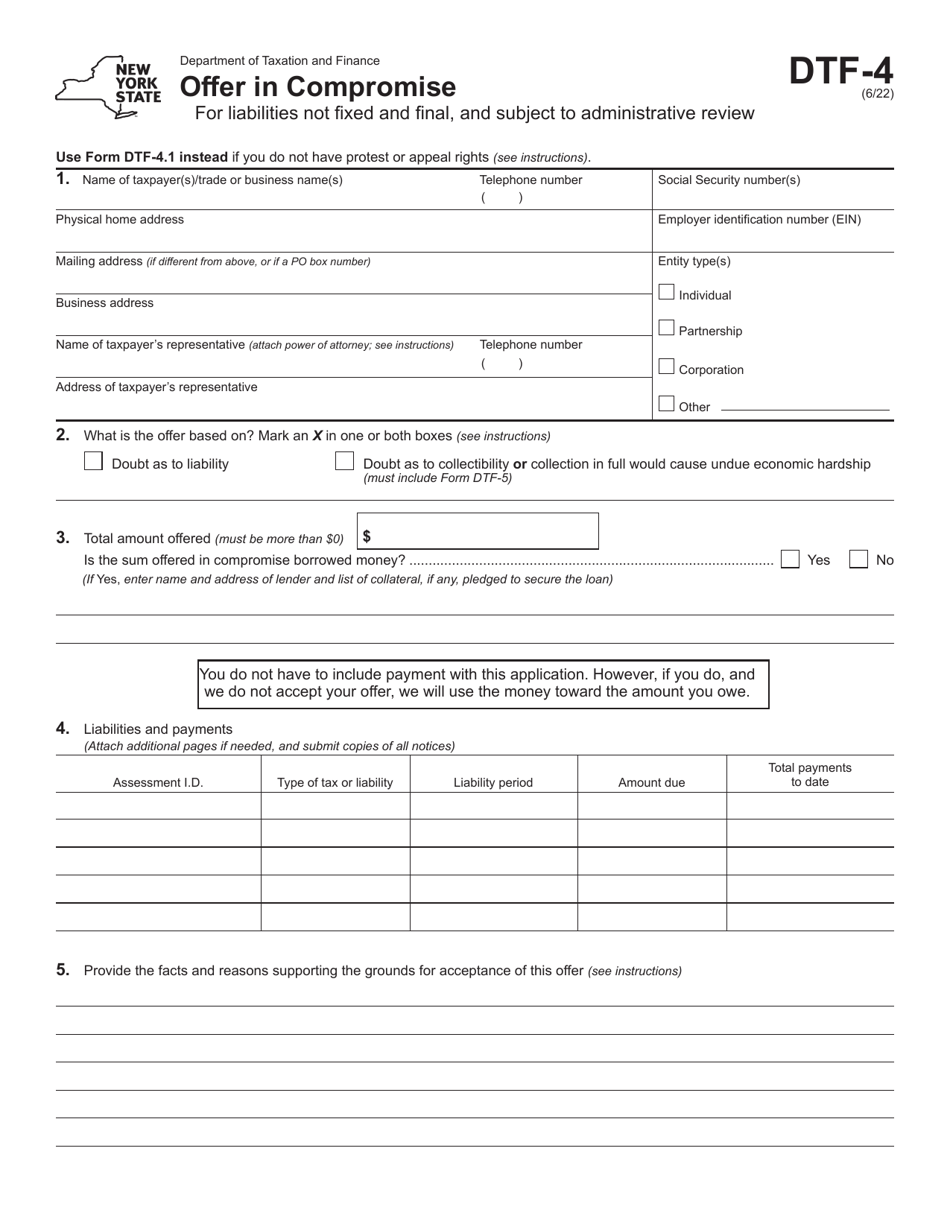

Form DTF-4

for the current year.

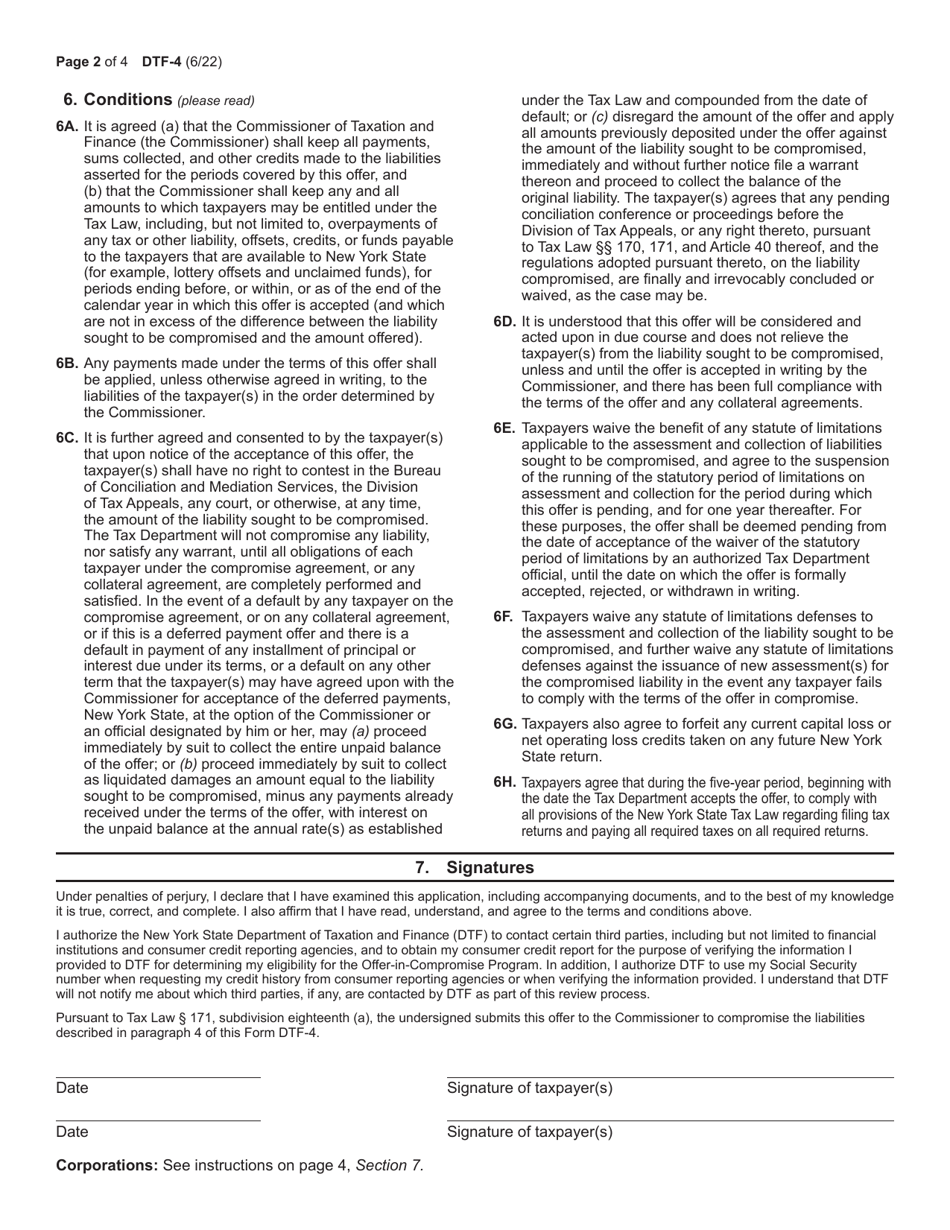

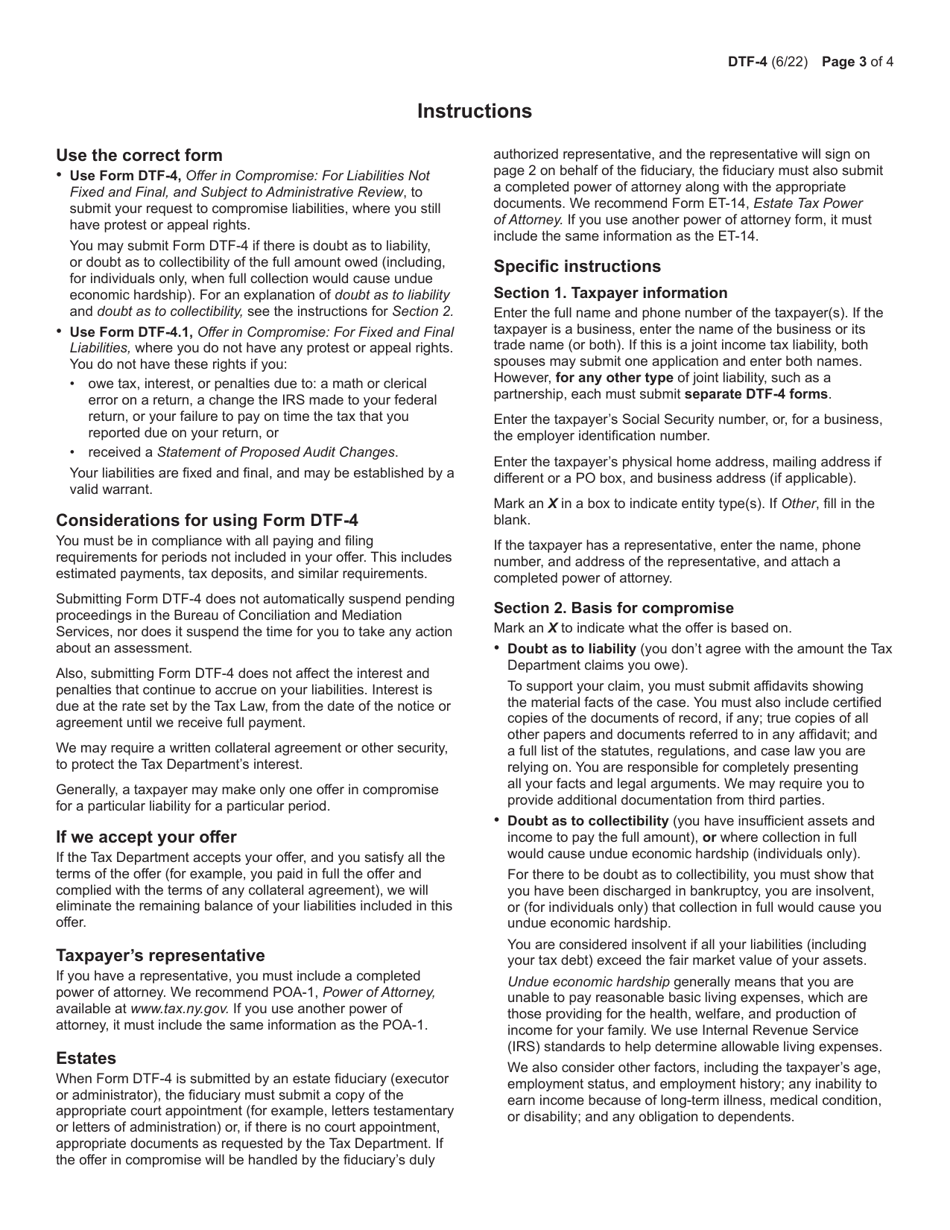

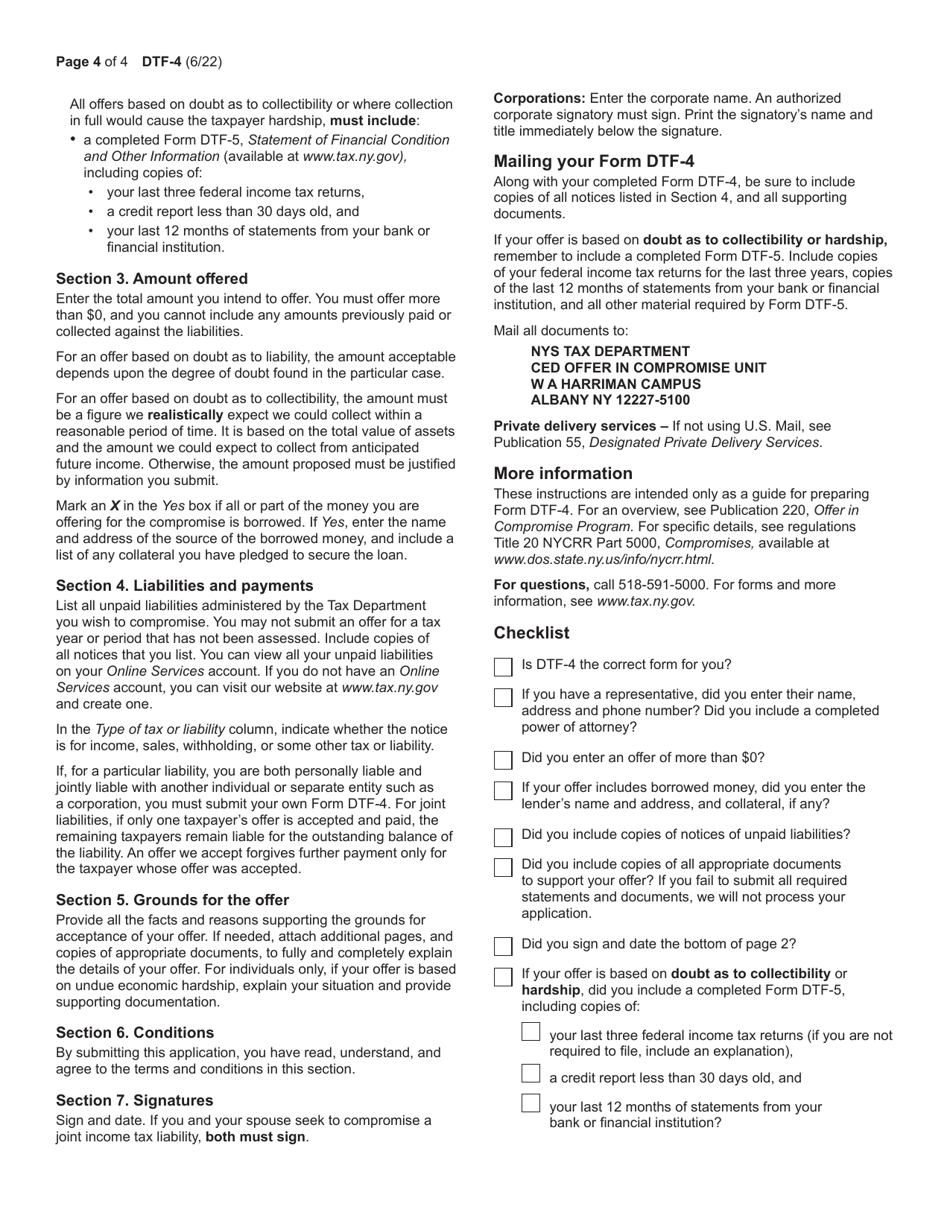

Form DTF-4 Offer in Compromise for Liabilities Not Fixed and Final, and Subject to Administrative Review - New York

What Is Form DTF-4?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTF-4?

A: Form DTF-4 is the Offer in Compromise for Liabilities Not Fixed and Final, and Subject to Administrative Review in New York.

Q: What is an Offer in Compromise?

A: An Offer in Compromise is a program that allows taxpayers to settle their tax liabilities for less than the full amount owed.

Q: Who can file Form DTF-4?

A: Taxpayers in New York who have tax liabilities that are not fixed and final and are subject to administrative review can file Form DTF-4.

Q: What does it mean for a liability to be not fixed and final?

A: A liability is considered not fixed and final if it is still subject to review or appeal.

Q: How does Form DTF-4 help with tax liabilities?

A: Form DTF-4 allows taxpayers to propose an offer to the New York Department of Taxation and Finance to settle their tax liabilities.

Q: What is the purpose of administrative review?

A: Administrative review allows taxpayers to formally dispute a tax liability before it becomes fixed and final.

Q: Is there a fee for filing Form DTF-4?

A: Yes, there is a non-refundable $50 fee for filing Form DTF-4.

Q: Can an Offer in Compromise be accepted or rejected?

A: Yes, the New York Department of Taxation and Finance has the discretion to accept or reject an Offer in Compromise.

Q: Is there a deadline for submitting Form DTF-4?

A: No, there is no specific deadline for submitting Form DTF-4. However, it is recommended to file as soon as possible to avoid accruing additional interest and penalties.

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTF-4 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.