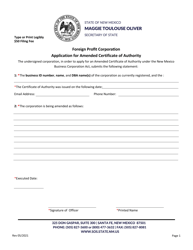

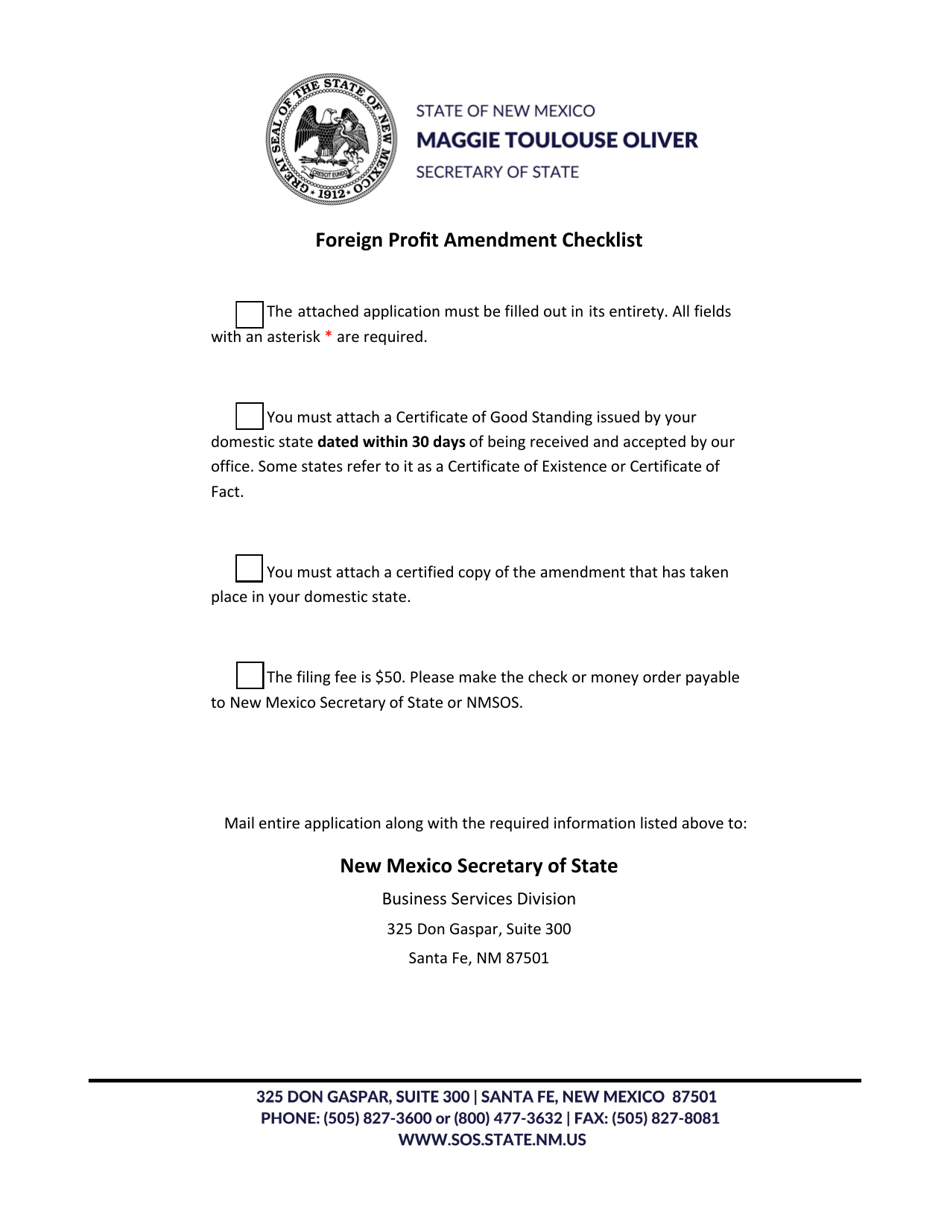

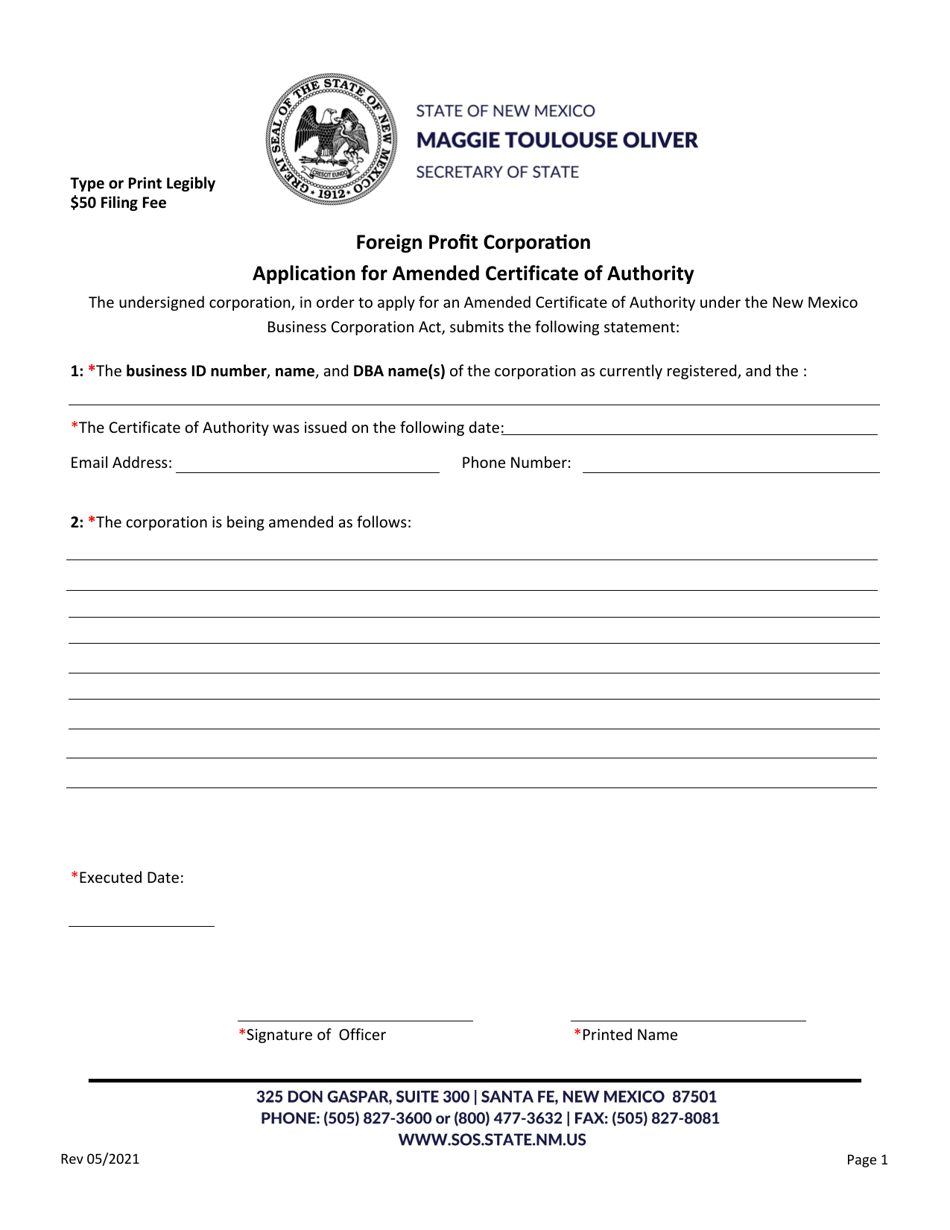

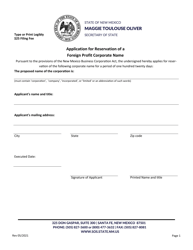

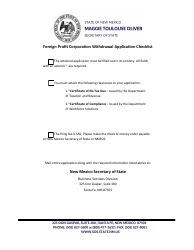

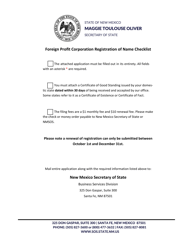

Foreign Profit Corporation Application for Amended Certificate of Authority - New Mexico

Foreign Profit Corporation Application for Amended Certificate of Authority is a legal document that was released by the New Mexico Secretary of State - a government authority operating within New Mexico.

FAQ

Q: What is a Foreign Profit Corporation?

A: A Foreign Profit Corporation is a corporation that was originally formed in a state other than New Mexico.

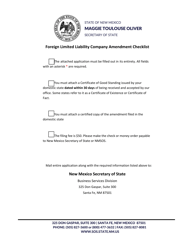

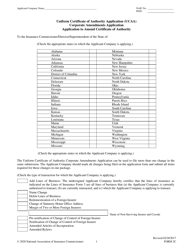

Q: What is an Amended Certificate of Authority?

A: An Amended Certificate of Authority is a document that a foreign profit corporation files to make changes to their existing certificate of authority, such as updating their registered agent or changing their business address.

Q: Why would a Foreign Profit Corporation need to file an Amended Certificate of Authority?

A: A Foreign Profit Corporation would need to file an Amended Certificate of Authority if they need to make changes to their existing certificate, such as updating their registered agent or changing their business address.

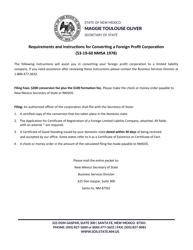

Q: How can a Foreign Profit Corporation file an Amended Certificate of Authority in New Mexico?

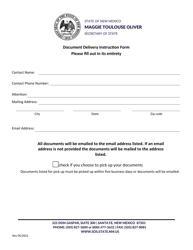

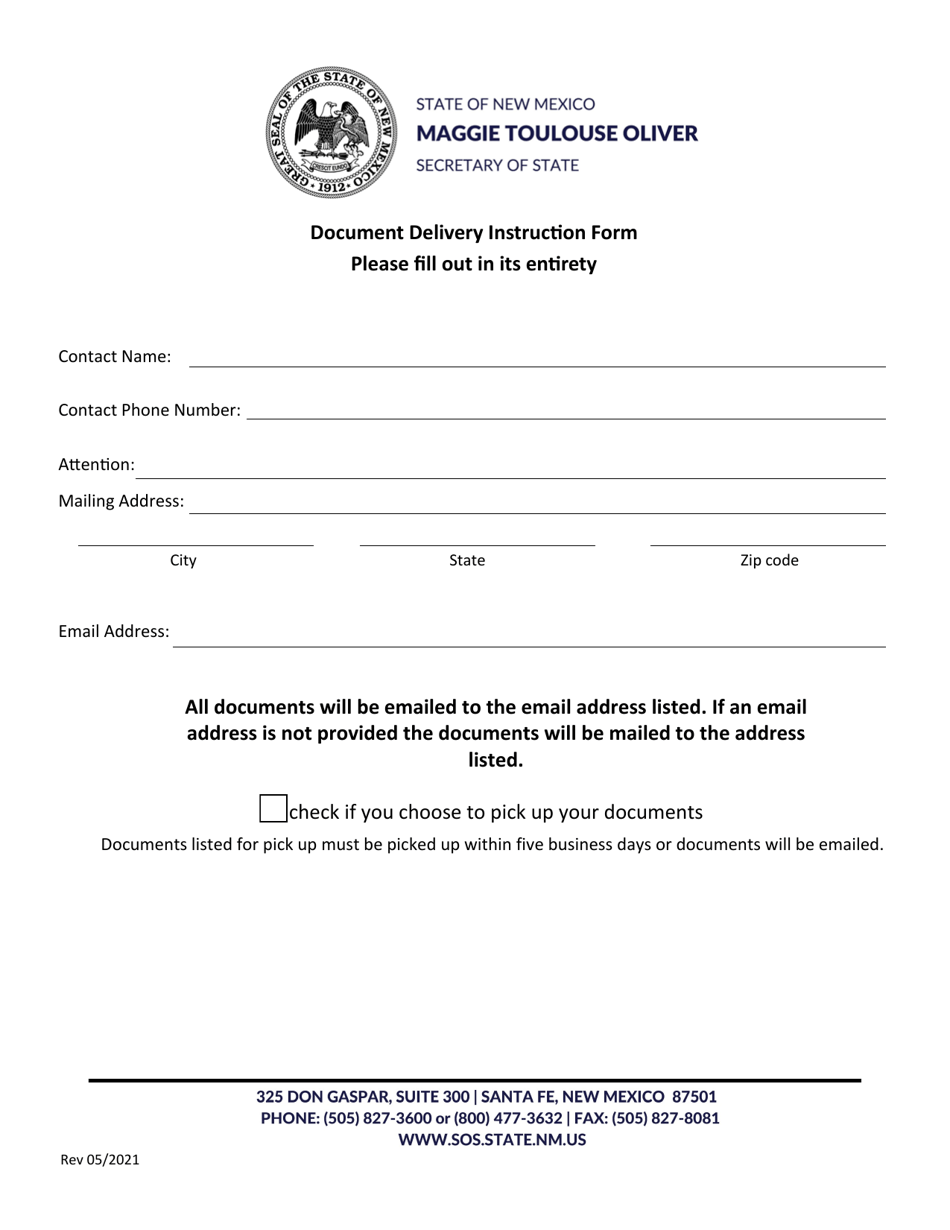

A: A Foreign Profit Corporation can file an Amended Certificate of Authority in New Mexico by completing the required form and submitting it to the New Mexico Secretary of State.

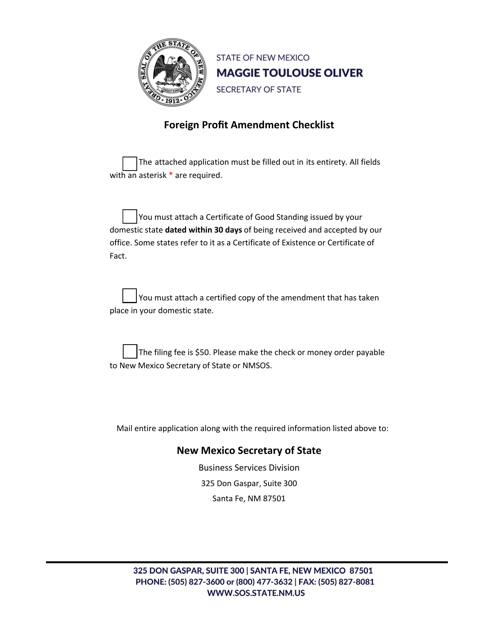

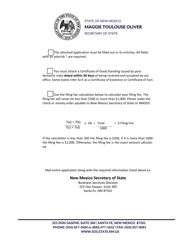

Q: What is the process for filing an Amended Certificate of Authority?

A: The process for filing an Amended Certificate of Authority involves completing the required form, providing any necessary documentation, and submitting the form and fee to the New Mexico Secretary of State.

Q: Is there a deadline for filing an Amended Certificate of Authority?

A: There is no specific deadline for filing an Amended Certificate of Authority, but it is recommended to file the amendment as soon as possible after the changes are made.

Q: What happens after a Foreign Profit Corporation files an Amended Certificate of Authority?

A: After a Foreign Profit Corporation files an Amended Certificate of Authority, the New Mexico Secretary of State will review the filing and, if approved, issue the amended certificate.

Q: Can a Foreign Profit Corporation continue doing business in New Mexico without filing an Amended Certificate of Authority?

A: No, a Foreign Profit Corporation cannot continue doing business in New Mexico without filing an Amended Certificate of Authority if there are changes to their existing certificate that need to be updated.

Q: Can a Foreign Profit Corporation withdraw their Amended Certificate of Authority?

A: Yes, a Foreign Profit Corporation can withdraw their Amended Certificate of Authority by filing a Withdrawal of Amended Certificate of Authority form with the New Mexico Secretary of State.

Form Details:

- Released on May 1, 2021;

- The latest edition currently provided by the New Mexico Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New Mexico Secretary of State.