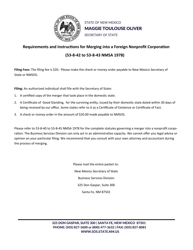

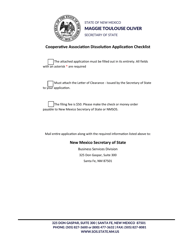

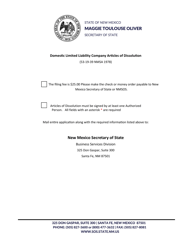

Nonprofit Corporation Articles of Dissolution - New Mexico

Nonprofit Corporation Articles of Dissolution is a legal document that was released by the New Mexico Secretary of State - a government authority operating within New Mexico.

FAQ

Q: What is a nonprofit corporation?

A: A nonprofit corporation is an organization formed for purposes other than generating profit. Its activities are intended to benefit the public or a specific group of people.

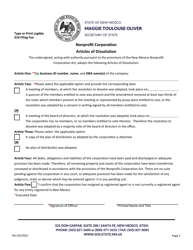

Q: What are Articles of Dissolution?

A: Articles of Dissolution are legal documents that officially terminate the existence of a nonprofit corporation.

Q: Why would a nonprofit corporation file Articles of Dissolution?

A: A nonprofit corporation may file Articles of Dissolution if they no longer wish to operate or if they have completed their mission.

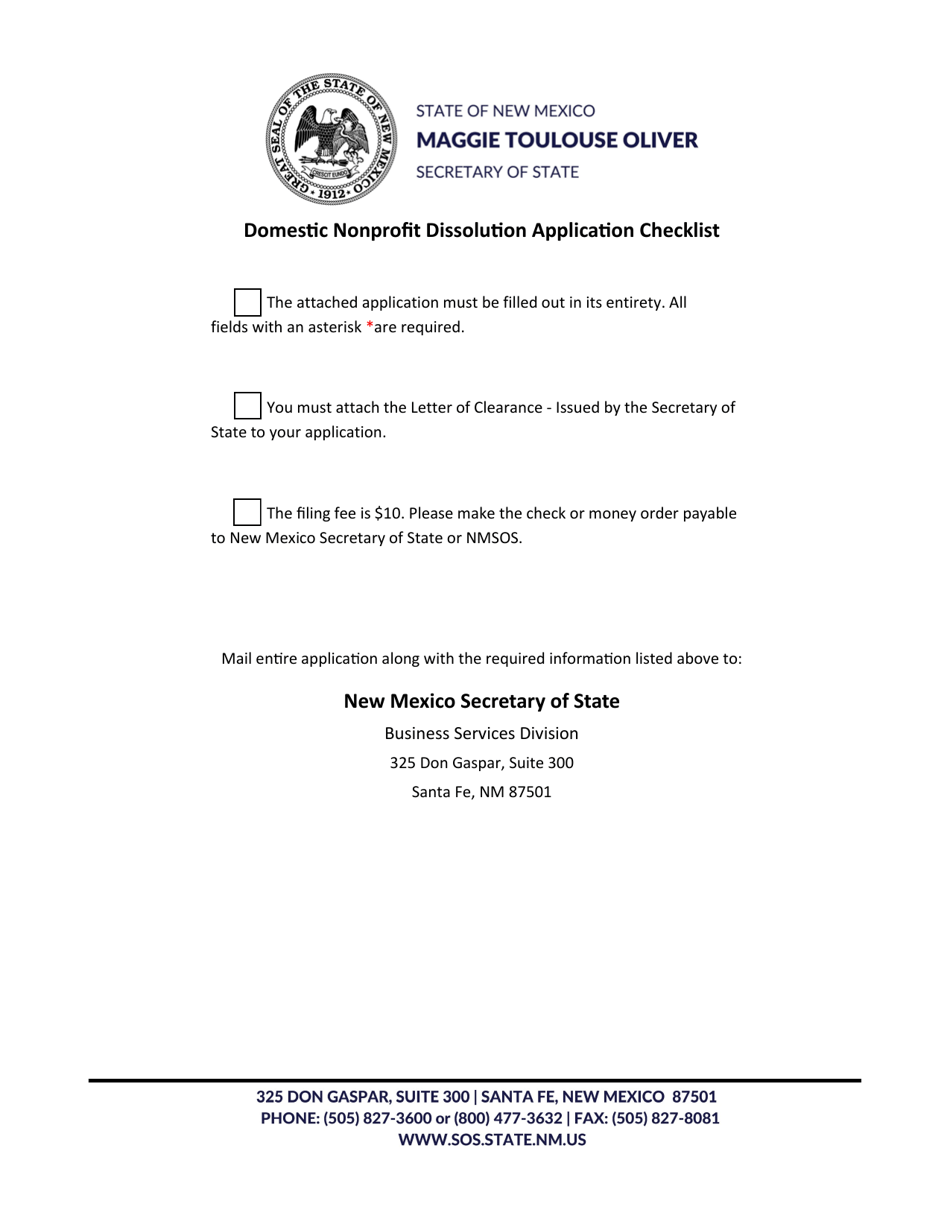

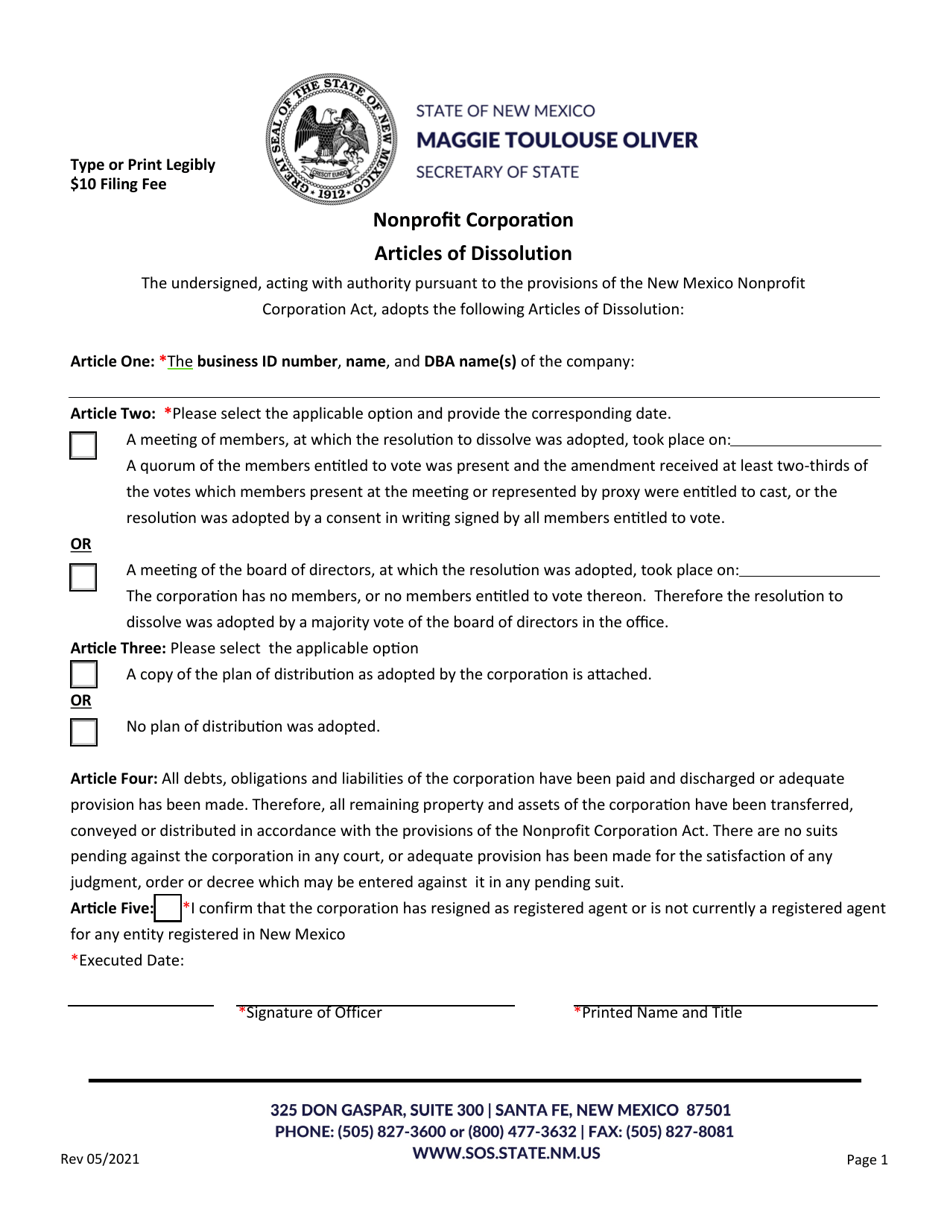

Q: What information is required in Articles of Dissolution?

A: Articles of Dissolution typically include the name of the nonprofit corporation, the reason for dissolution, and the date of dissolution.

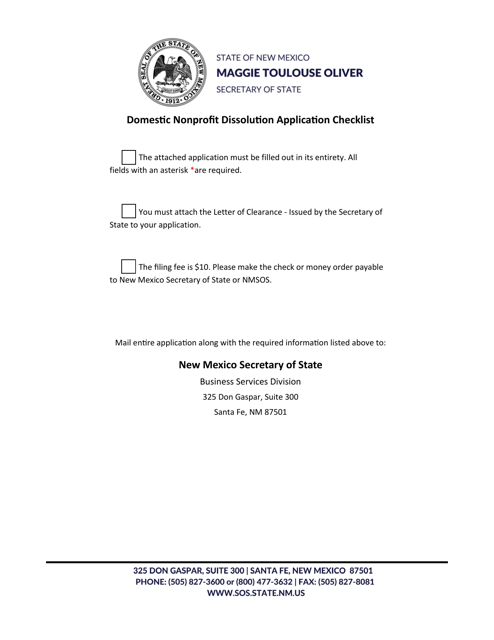

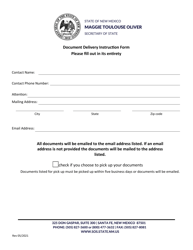

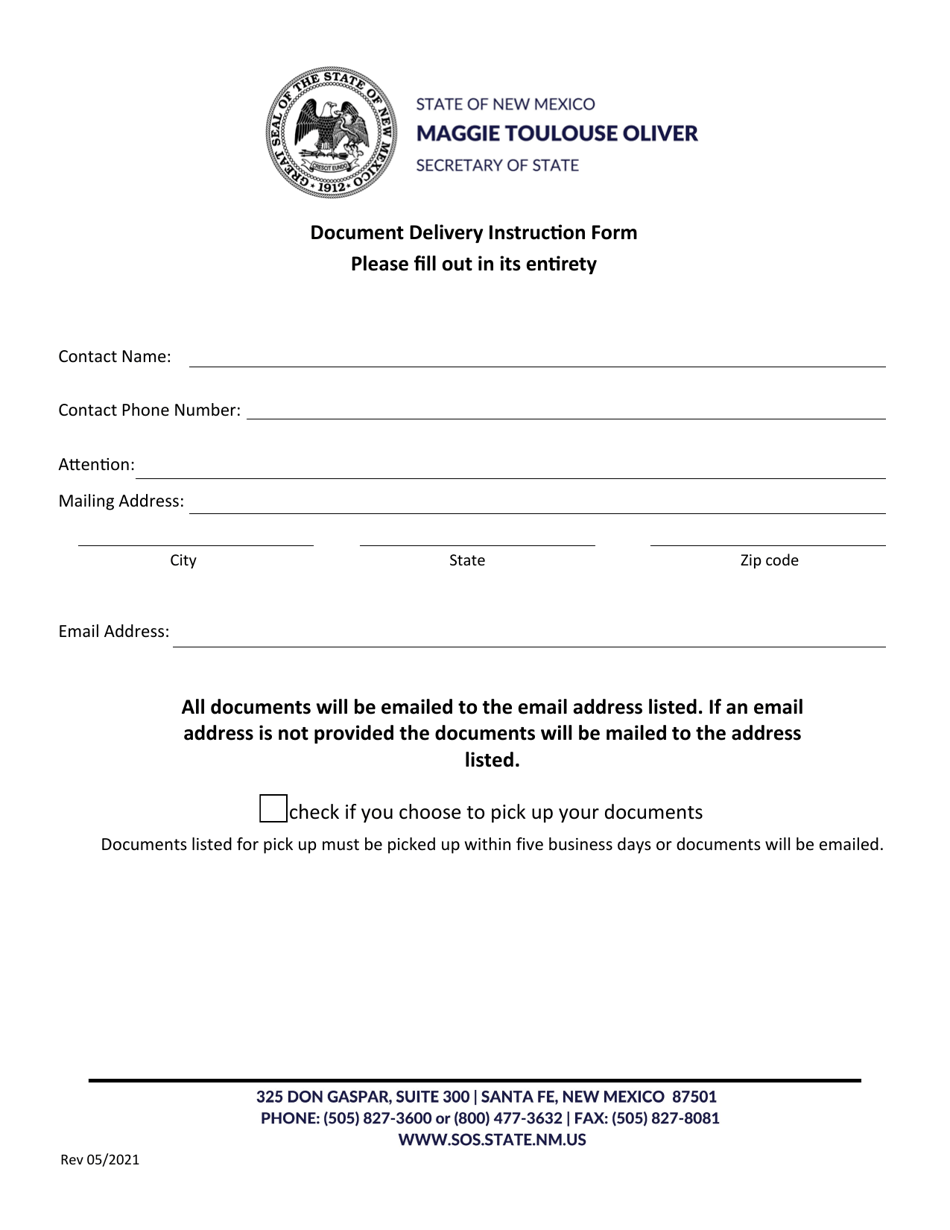

Q: How can a nonprofit corporation file Articles of Dissolution?

A: Articles of Dissolution can be filed with the appropriate state agency, usually the Secretary of State's office, in the state where the nonprofit corporation is incorporated.

Q: Are there any fees associated with filing Articles of Dissolution?

A: Yes, there are typically filing fees associated with filing Articles of Dissolution. The amount of the fees may vary depending on the state.

Q: What happens after Articles of Dissolution are filed?

A: After Articles of Dissolution are filed, the nonprofit corporation's legal existence is terminated, and they are no longer able to conduct business or incur new debts or obligations.

Q: Is it possible for a nonprofit corporation to revive after filing Articles of Dissolution?

A: In some cases, a nonprofit corporation may be able to revive their existence after filing Articles of Dissolution. This usually involves filing additional paperwork and paying any required fees.

Q: Can a nonprofit corporation distribute its remaining assets after filing Articles of Dissolution?

A: Yes, a nonprofit corporation can distribute its remaining assets after filing Articles of Dissolution, but these distributions must be made in accordance with state law and the organization's bylaws.

Q: What should a nonprofit corporation do to ensure a proper dissolution?

A: To ensure a proper dissolution, a nonprofit corporation should notify all stakeholders, settle any outstanding liabilities, and properly distribute its remaining assets in accordance with state laws and their own bylaws.

Form Details:

- Released on May 1, 2021;

- The latest edition currently provided by the New Mexico Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New Mexico Secretary of State.