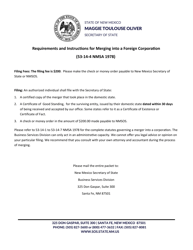

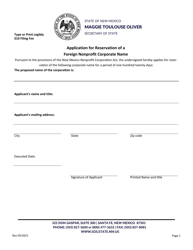

Merger Into a Foreign Nonprofit Corporation - New Mexico

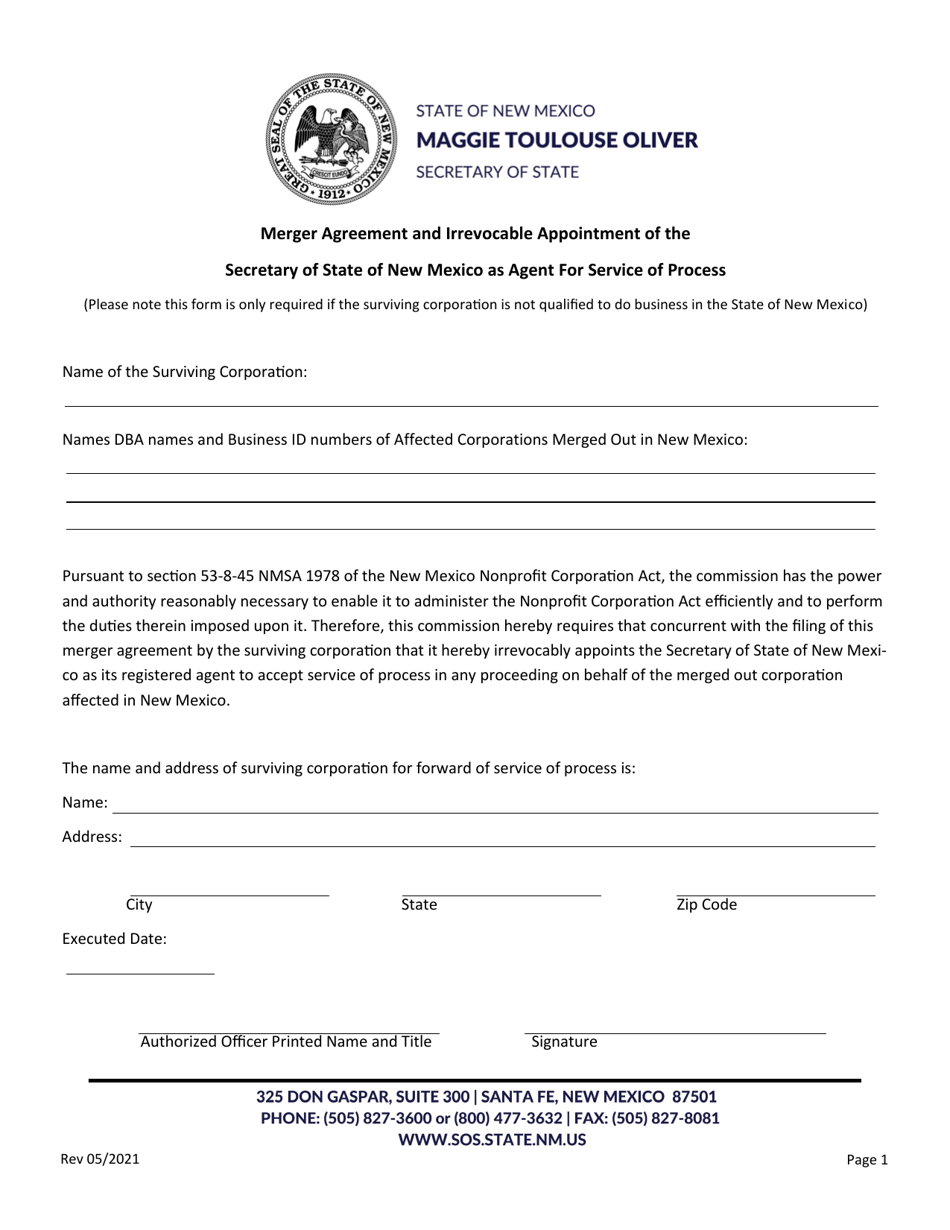

Merger Into a Foreign Nonprofit Corporation is a legal document that was released by the New Mexico Secretary of State - a government authority operating within New Mexico.

FAQ

Q: What is a merger into a foreign nonprofit corporation?

A: A merger into a foreign nonprofit corporation is a process where a nonprofit corporation in one state becomes part of a nonprofit corporation in another state.

Q: Why would a nonprofit corporation consider a merger with a foreign nonprofit corporation?

A: A nonprofit corporation might consider a merger with a foreign nonprofit corporation to expand its reach, increase its resources, or gain access to new opportunities.

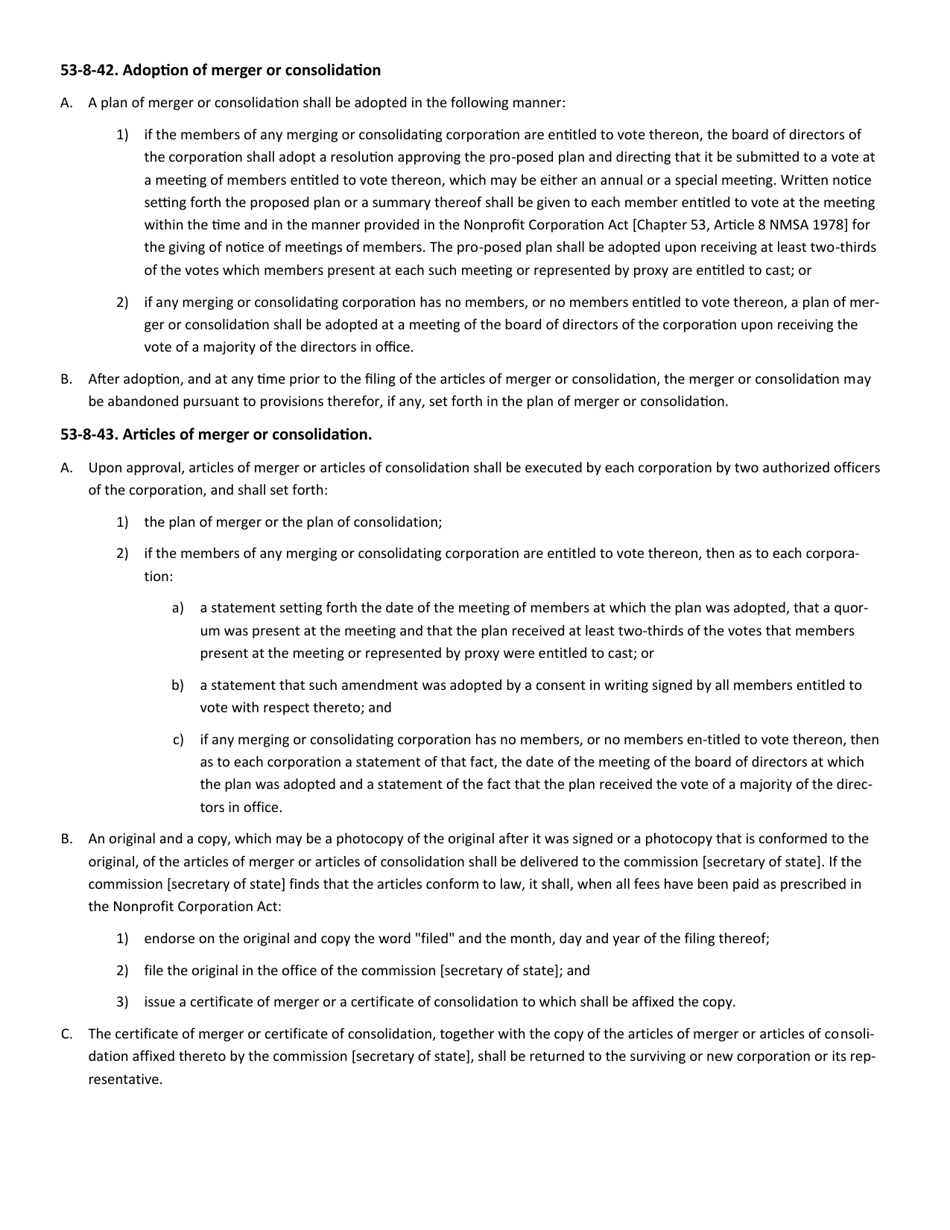

Q: What are the requirements for a merger into a foreign nonprofit corporation in New Mexico?

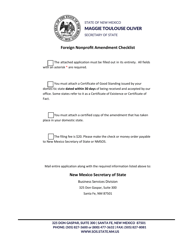

A: The requirements for a merger into a foreign nonprofit corporation in New Mexico may include obtaining approval from the New Mexico Attorney General, filing the appropriate documents with the New Mexico Secretary of State, and complying with any other applicable state laws.

Q: What are the benefits of merging into a foreign nonprofit corporation?

A: The benefits of merging into a foreign nonprofit corporation may include increased resources, expanded programs and services, access to new markets, and the potential for greater impact and sustainability.

Q: What is the process for merging into a foreign nonprofit corporation in New Mexico?

A: The process for merging into a foreign nonprofit corporation in New Mexico typically involves conducting due diligence, developing a merger plan, obtaining required approvals, filing the necessary documents, and complying with any other legal obligations.

Q: Are there any tax implications for merging into a foreign nonprofit corporation?

A: There may be tax implications for merging into a foreign nonprofit corporation, and it is important to consult with legal and tax professionals to understand and address any potential tax consequences.

Q: What should a nonprofit corporation consider before deciding to merge into a foreign nonprofit corporation?

A: Before deciding to merge into a foreign nonprofit corporation, a nonprofit corporation should consider the potential benefits and challenges of the merger, conduct thorough due diligence, seek legal and financial advice, and ensure that the merger aligns with its mission and goals.

Q: Are there any risks or drawbacks to merging into a foreign nonprofit corporation?

A: There can be risks and drawbacks to merging into a foreign nonprofit corporation, such as potential differences in laws and regulations, cultural differences, and challenges in integrating the organizations and their missions.

Q: Can a nonprofit corporation merge into a foreign for-profit corporation?

A: In general, a nonprofit corporation cannot merge into a for-profit corporation. Nonprofit corporations must merge with another nonprofit corporation or a foreign nonprofit corporation.

Q: Is it possible for a nonprofit corporation to merge into a foreign nonprofit corporation in a different country?

A: Yes, it is possible for a nonprofit corporation to merge into a foreign nonprofit corporation in a different country. However, the specific requirements and processes may vary depending on the laws and regulations of that country.

Form Details:

- Released on May 1, 2021;

- The latest edition currently provided by the New Mexico Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New Mexico Secretary of State.