This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

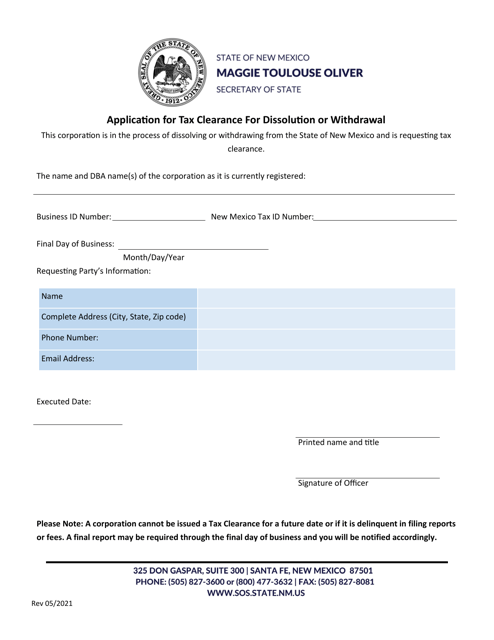

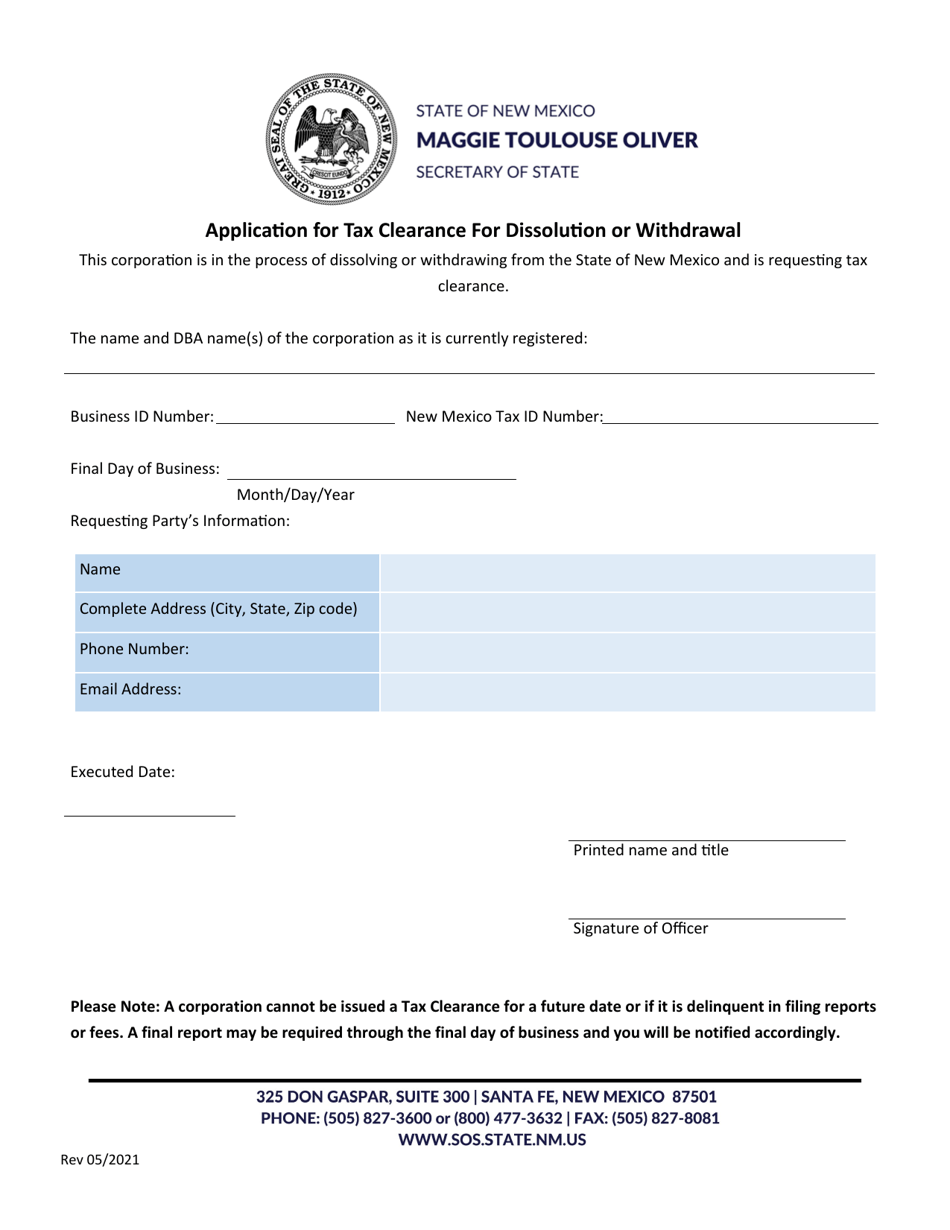

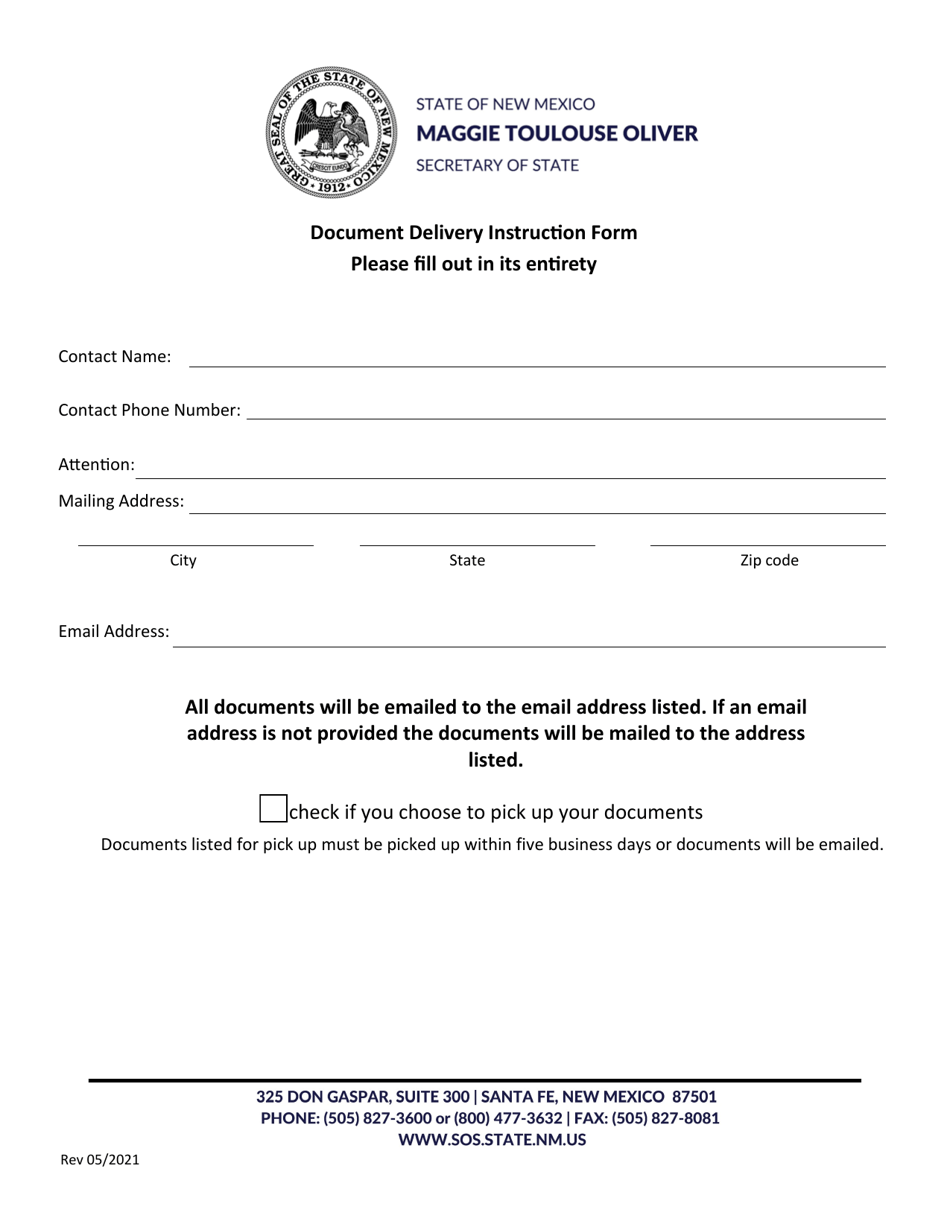

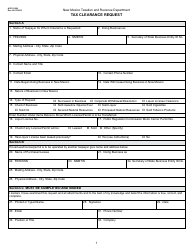

Application for Tax Clearance for Dissolution or Withdrawal - New Mexico

Application for Tax Clearance for Dissolution or Withdrawal is a legal document that was released by the New Mexico Secretary of State - a government authority operating within New Mexico.

FAQ

Q: What is Tax Clearance?

A: Tax Clearance is a process where a business ensures that all of its tax obligations have been met before dissolving or withdrawing from the state of New Mexico.

Q: Who needs to apply for Tax Clearance?

A: Any business entity that wishes to dissolve or withdraw from New Mexico needs to apply for Tax Clearance.

Q: What is the purpose of applying for Tax Clearance?

A: The purpose of applying for Tax Clearance is to confirm that the business has paid all taxes owed to the state before it ceases operations.

Q: How can I apply for Tax Clearance?

A: You can apply for Tax Clearance by submitting Form ACD-31015 through the Taxpayer Access Point (TAP) system or by mail.

Q: What information is required to apply for Tax Clearance?

A: You will need to provide your business information, including the FEIN or SSN, as well as information about your tax liabilities and any outstanding tax returns.

Q: Are there any fees for applying for Tax Clearance?

A: There are no fees for applying for Tax Clearance in New Mexico.

Q: How long does it take to receive Tax Clearance?

A: The processing time for Tax Clearance applications is usually around 7-10 business days.

Q: What happens if I don't apply for Tax Clearance?

A: If you don't apply for Tax Clearance and still dissolve or withdraw from New Mexico, you may face penalties and legal consequences.

Q: Can I withdraw my Tax Clearance application?

A: Yes, you can withdraw your Tax Clearance application by contacting the New Mexico Taxation and Revenue Department.

Form Details:

- Released on May 1, 2021;

- The latest edition currently provided by the New Mexico Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New Mexico Secretary of State.