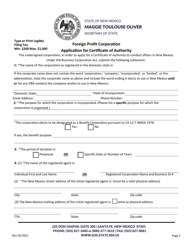

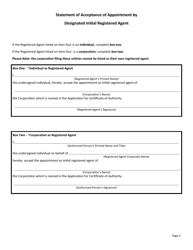

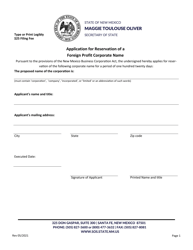

Foreign Profit Corporation Application for Certificate of Authority - New Mexico

Foreign Profit Corporation Application for Certificate of Authority is a legal document that was released by the New Mexico Secretary of State - a government authority operating within New Mexico.

FAQ

Q: What is a Foreign Profit Corporation?

A: A Foreign Profit Corporation is a business entity that is incorporated in another state or country, but wants to do business in the state of New Mexico.

Q: What is a Certificate of Authority?

A: A Certificate of Authority is a document issued by the state of New Mexico that allows a Foreign Profit Corporation to conduct business within the state.

Q: Why does a Foreign Profit Corporation need a Certificate of Authority?

A: A Foreign Profit Corporation needs a Certificate of Authority in order to legally operate and do business in the state of New Mexico.

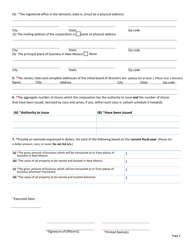

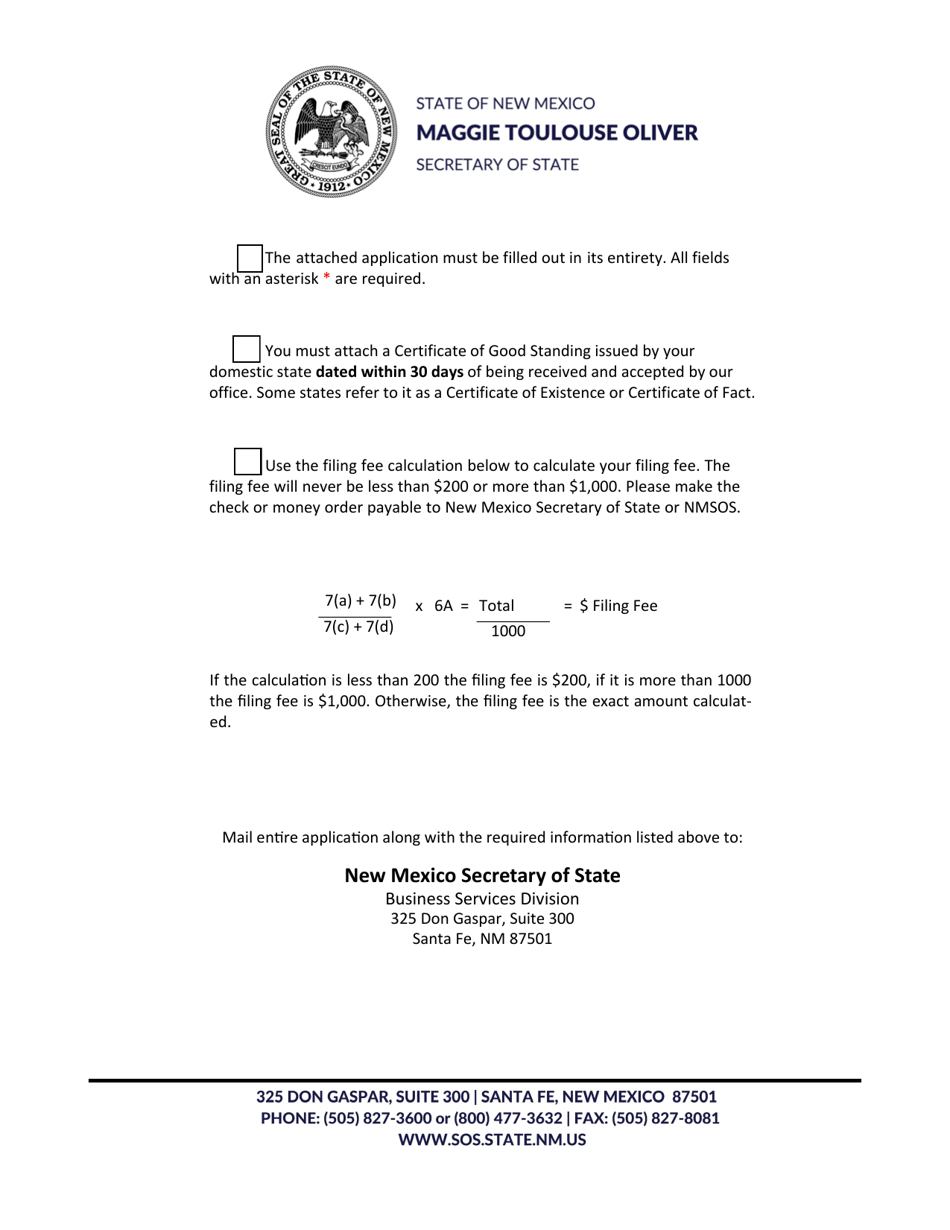

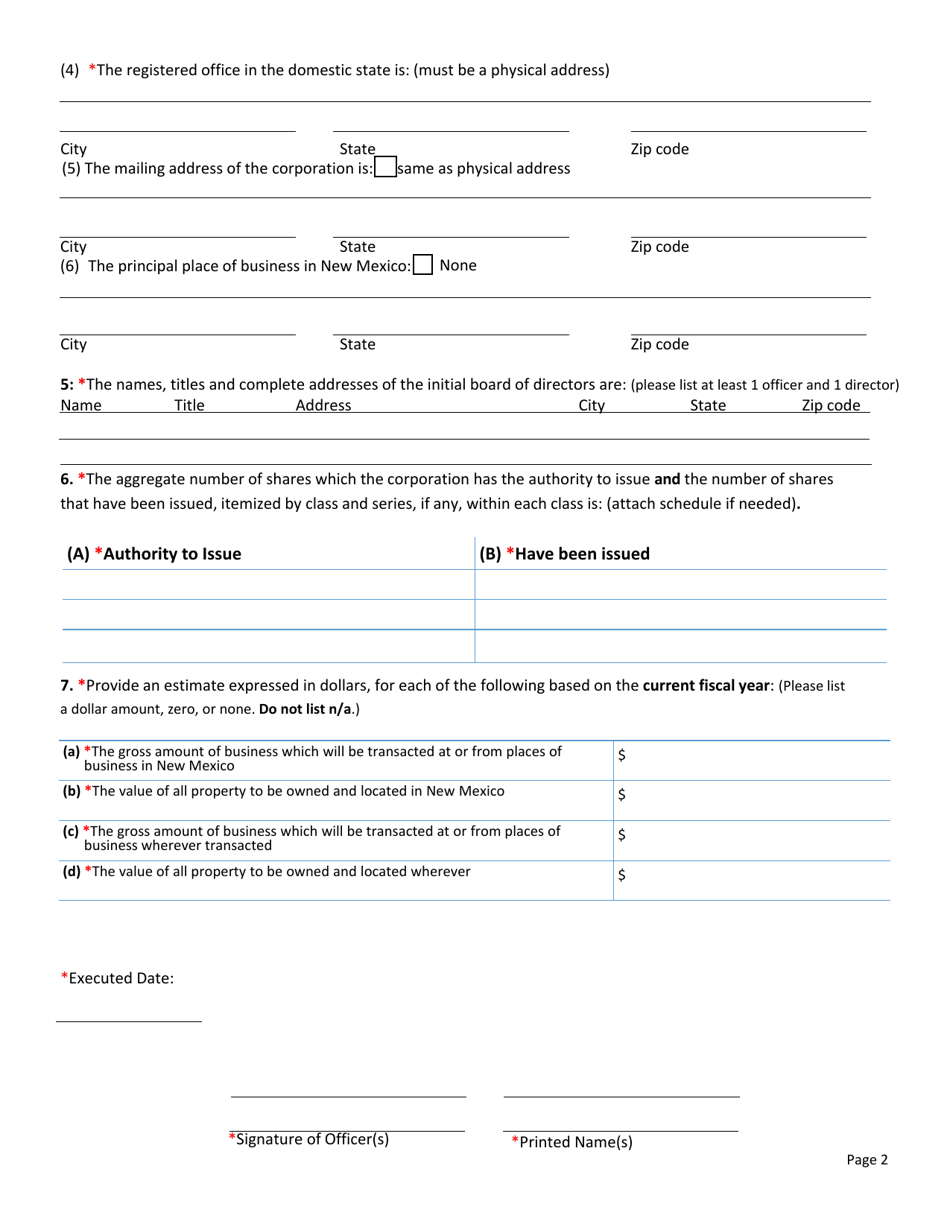

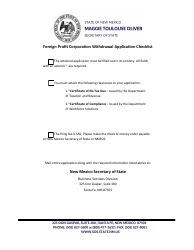

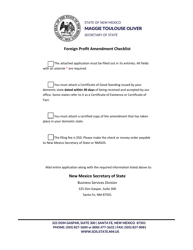

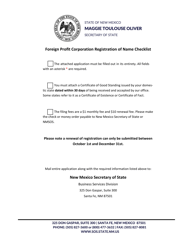

Q: What are the requirements for obtaining a Certificate of Authority in New Mexico?

A: The requirements for obtaining a Certificate of Authority in New Mexico include submitting a completed application, paying the required fees, and providing certain documents, such as a certified copy of the corporation's articles of incorporation.

Q: How long does it take to get a Certificate of Authority in New Mexico?

A: The processing time for a Certificate of Authority application in New Mexico can vary, but typically takes several weeks.

Q: What is the cost of obtaining a Certificate of Authority in New Mexico?

A: The cost of obtaining a Certificate of Authority in New Mexico varies depending on the corporation's authorized shares, with a minimum fee of $50.

Q: Can a Foreign Profit Corporation do business in New Mexico without a Certificate of Authority?

A: No, a Foreign Profit Corporation cannot legally do business in New Mexico without a Certificate of Authority.

Q: Are there any ongoing compliance requirements for Foreign Profit Corporations in New Mexico?

A: Yes, Foreign Profit Corporations are required to file an annual report and pay the associated fee to maintain their Certificate of Authority in New Mexico.

Form Details:

- Released on May 1, 2021;

- The latest edition currently provided by the New Mexico Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New Mexico Secretary of State.