This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

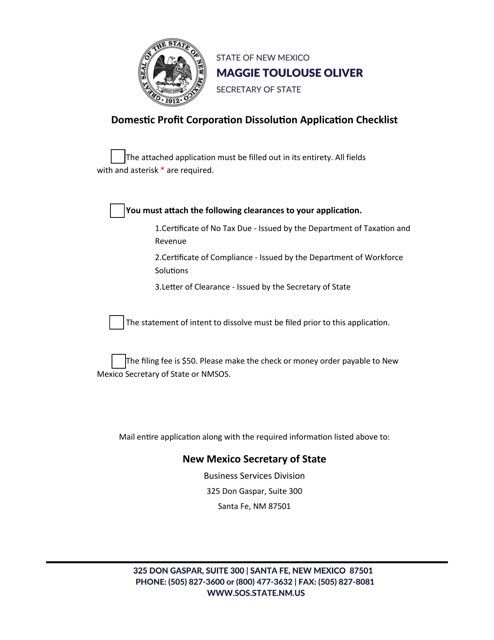

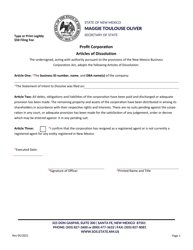

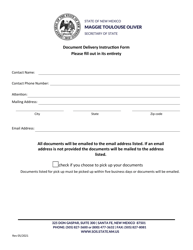

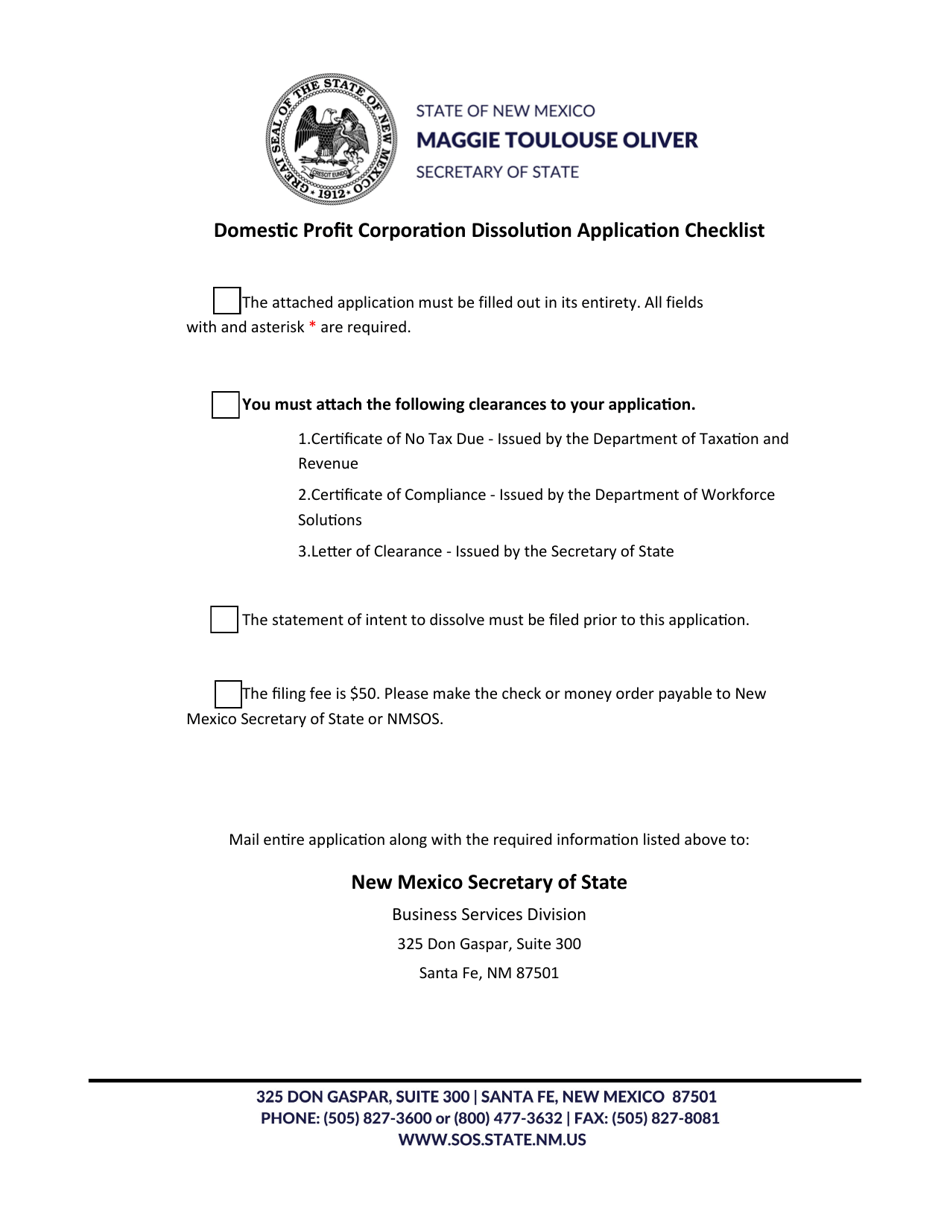

Domestic Profit Corporation Articles of Dissolution - New Mexico

Domestic Profit Corporation Articles of Dissolution is a legal document that was released by the New Mexico Secretary of State - a government authority operating within New Mexico.

FAQ

Q: What are Domestic Profit Corporation Articles of Dissolution?

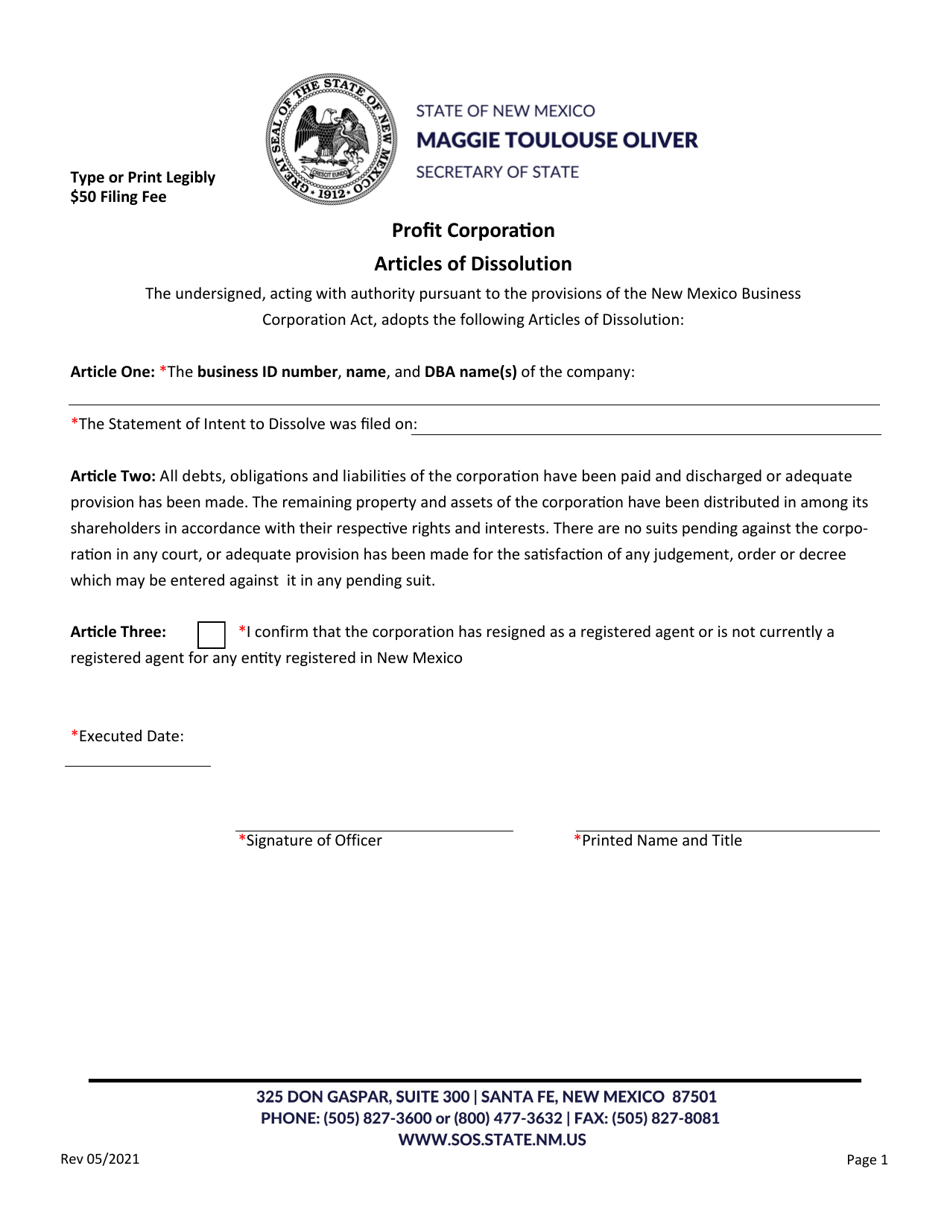

A: Domestic Profit Corporation Articles of Dissolution are legal documents filed to permanently close and dissolve a profit corporation in New Mexico.

Q: Who can file Domestic Profit Corporation Articles of Dissolution?

A: The articles can be filed by the corporation's officers or directors.

Q: What is the purpose of filing Domestic Profit Corporation Articles of Dissolution?

A: The purpose is to officially dissolve the profit corporation and terminate its legal existence.

Q: What information is required in the Domestic Profit Corporation Articles of Dissolution?

A: The articles must include the corporate name, date of dissolution, and a statement of the events leading to the decision to dissolve.

Q: Are there any filing fees associated with the Domestic Profit Corporation Articles of Dissolution?

A: Yes, there is a filing fee that must be paid at the time of submission.

Q: Is there a deadline for filing the Domestic Profit Corporation Articles of Dissolution?

A: There is no specific deadline, but it is recommended to file the articles as soon as the decision to dissolve is made.

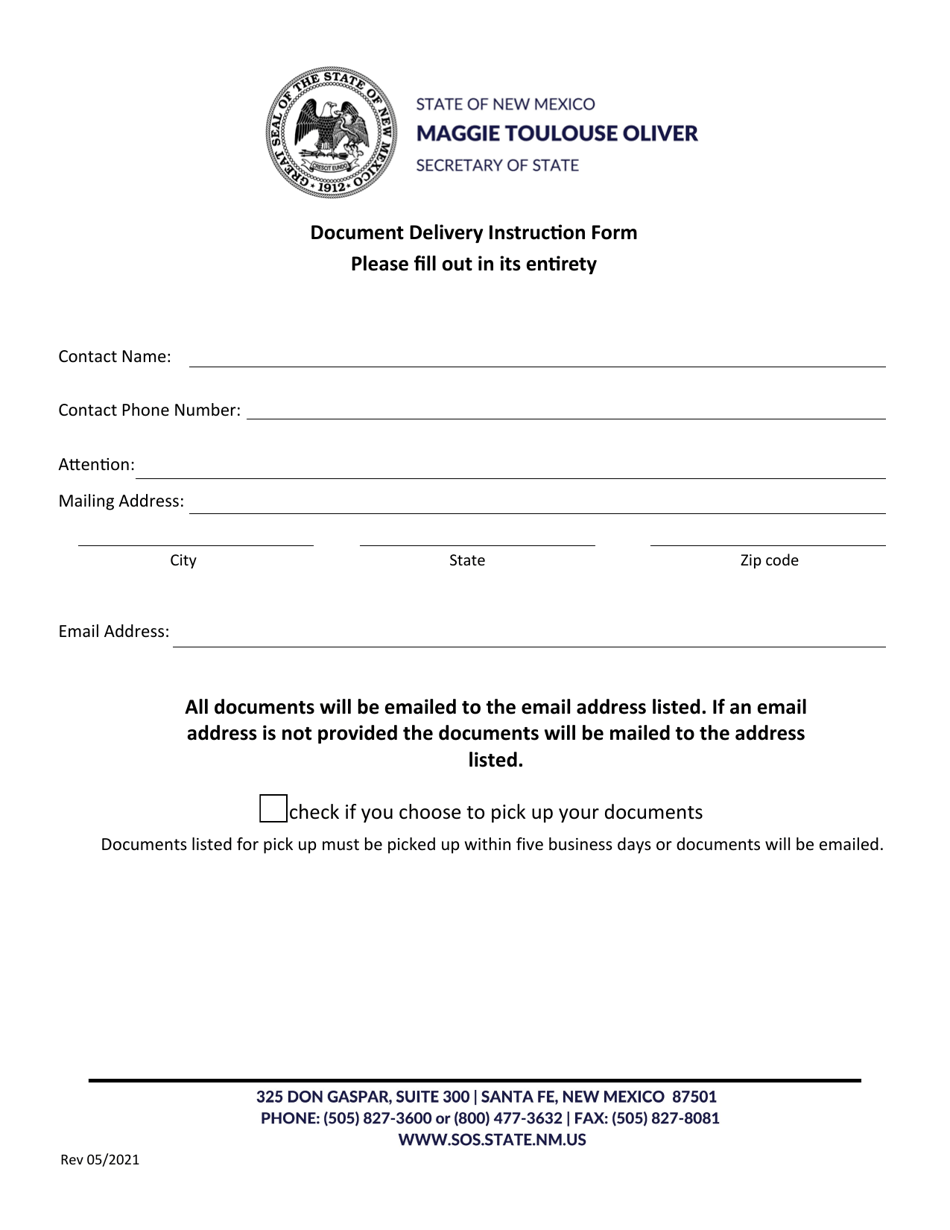

Q: What happens after filing the Domestic Profit Corporation Articles of Dissolution?

A: Upon approval by the New Mexico Secretary of State, the corporation will be officially dissolved and its legal obligations will come to an end.

Q: Can a dissolved corporation continue to do business in New Mexico?

A: No, a dissolved corporation cannot continue to operate or conduct business in New Mexico.

Q: What should be done with the corporation's assets and liabilities after dissolution?

A: The corporation must settle its outstanding debts and distribute its assets among its shareholders according to the corporate bylaws and applicable laws.

Q: Is it necessary to notify creditors, employees, and other stakeholders about the dissolution?

A: Yes, it is important to notify all relevant parties about the corporation's dissolution to ensure proper handling of debts and obligations.

Form Details:

- Released on May 1, 2021;

- The latest edition currently provided by the New Mexico Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New Mexico Secretary of State.