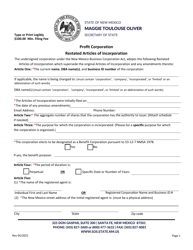

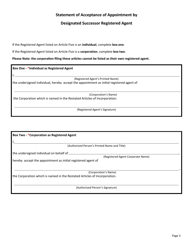

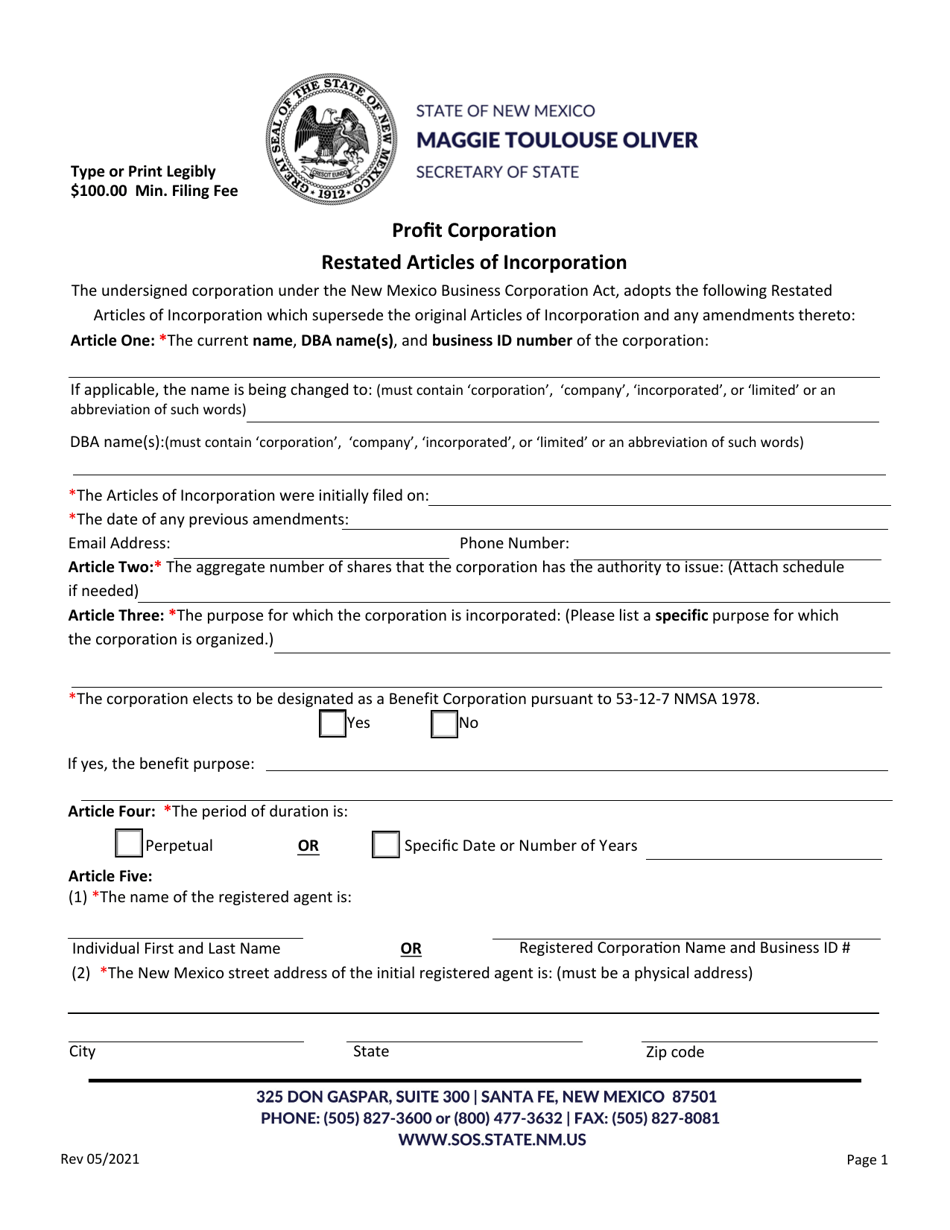

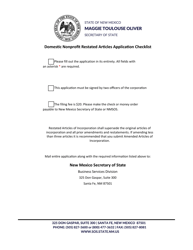

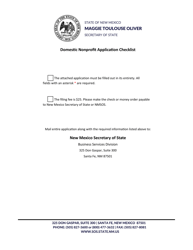

Domestic Profit Corporation Restated Articles of Incorporation - New Mexico

Domestic Profit Corporation Restated Articles of Incorporation is a legal document that was released by the New Mexico Secretary of State - a government authority operating within New Mexico.

FAQ

Q: What are Restated Articles of Incorporation?

A: Restated Articles of Incorporation are revised and consolidated versions of the original Articles of Incorporation of a corporation.

Q: What is a Domestic Profit Corporation?

A: A Domestic Profit Corporation is a business entity organized for the purpose of making profit for its shareholders.

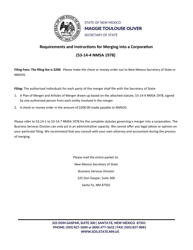

Q: What is the requirement for filing Restated Articles of Incorporation?

A: A corporation must file Restated Articles of Incorporation if it wants to update or amend its original Articles of Incorporation.

Q: Why would a corporation file Restated Articles of Incorporation?

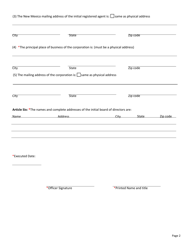

A: A corporation may file Restated Articles of Incorporation to reflect changes in its name, address, purpose, or other significant modifications.

Q: Do Restated Articles of Incorporation signify a new corporation?

A: No, Restated Articles of Incorporation do not create a new corporation. They simply consolidate and clarify the existing provisions of the corporation's original Articles of Incorporation.

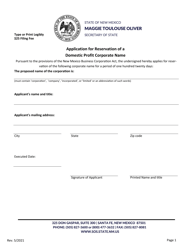

Q: Who needs to file the Restated Articles of Incorporation?

A: A Domestic Profit Corporation organized under the laws of New Mexico needs to file the Restated Articles of Incorporation.

Q: What is the purpose of filing the Restated Articles of Incorporation?

A: The purpose of filing the Restated Articles of Incorporation is to provide clarity and update the information contained in the original Articles of Incorporation of a corporation.

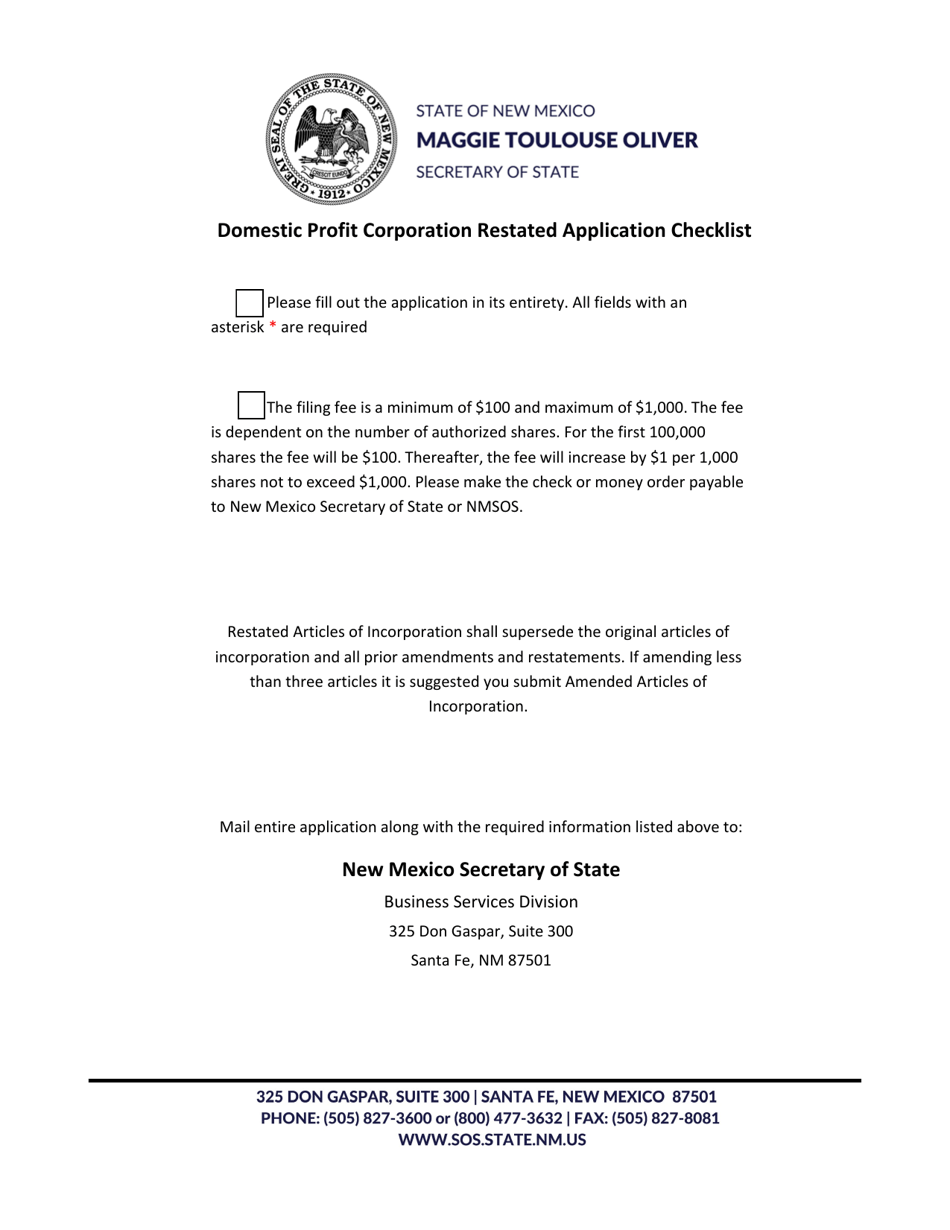

Q: Is there a fee for filing the Restated Articles of Incorporation?

A: Yes, there is a fee associated with filing the Restated Articles of Incorporation, and the fee amount may vary.

Form Details:

- Released on May 1, 2021;

- The latest edition currently provided by the New Mexico Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New Mexico Secretary of State.