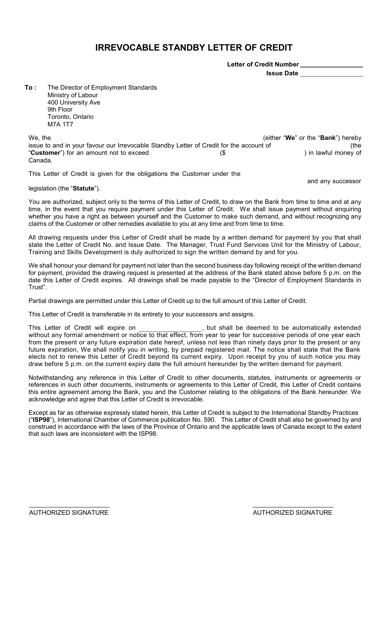

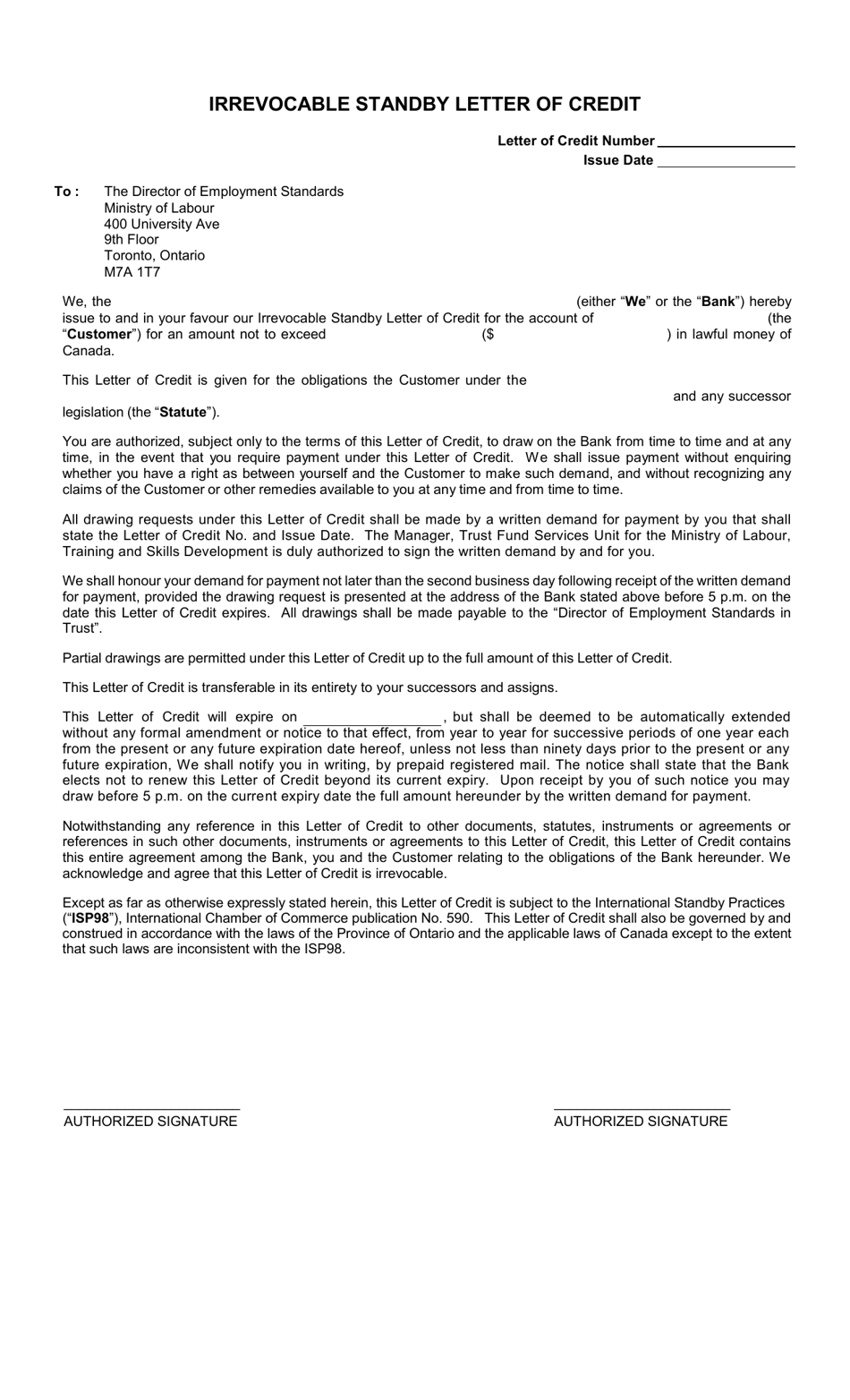

Irrevocable Standby Letter of Credit - Ontario, Canada

An Irrevocable Standby Letter of Credit in Ontario, Canada is commonly used as a financial guarantee. It serves as a commitment to pay a specified amount to a beneficiary if the applicant fails to fulfill their obligations.

In Ontario, Canada, the party filing the Irrevocable Standby Letter of Credit can vary depending on the specific circumstances of the transaction. It is typically the issuing bank or financial institution that files the letter of credit on behalf of their client, the applicant. However, it is recommended to consult with a legal professional or financial institution for the exact requirements and procedures.

FAQ

Q: What is an irrevocable standby letter of credit?

A: An irrevocable standby letter of credit is a payment guarantee issued by a bank on behalf of a buyer to a seller. It assures the seller that they will receive payment in the event that certain agreed-upon conditions are met.

Q: How does an irrevocable standby letter of credit work?

A: When a seller requires a guarantee of payment, the buyer's bank issues an irrevocable standby letter of credit on behalf of the buyer. If the seller meets the specified conditions, they can present the letter of credit to the bank and receive payment.

Q: What are the benefits of using an irrevocable standby letter of credit?

A: Using an irrevocable standby letter of credit provides peace of mind to the seller, as it guarantees payment if the buyer fails to fulfill their obligations. It also eliminates the need for the seller to assess the buyer's creditworthiness.

Q: Are there any risks involved with an irrevocable standby letter of credit?

A: There is a risk of fraudulent letters of credit or disputes over the fulfillment of conditions. However, if the letter of credit is issued by a reputable bank and the terms are clear, the risk can be minimized.

Q: Is an irrevocable standby letter of credit legally binding?

A: Yes, an irrevocable standby letter of credit is legally binding. Once it is issued, the bank is obligated to make payment as long as the conditions of the letter of credit are met.

Q: Are standby letters of credit commonly used in Ontario, Canada?

A: Yes, standby letters of credit are commonly used in Ontario, Canada. They are a popular tool for securing payments in various transactions, such as international trade or construction contracts.