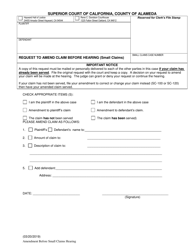

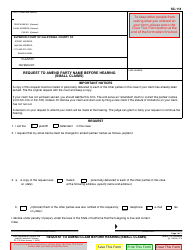

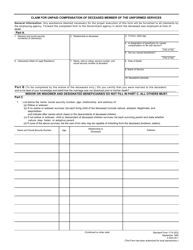

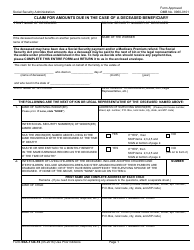

Deceased Owner Heir Claim Filing Instructions and Requested Documentation - California

Deceased Owner Heir Claim Filing Instructions and Requested Documentation is a legal document that was released by the California State Controller’s Office - a government authority operating within California.

FAQ

Q: Who can file a claim as an heir of a deceased owner in California?

A: Any person who is related to the deceased owner as a spouse, domestic partner, child, grandchild, parent, sibling, niece or nephew can file a claim as an heir.

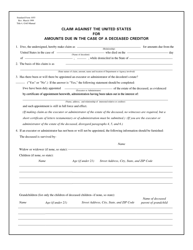

Q: What is the purpose of filing a claim as an heir of a deceased owner in California?

A: The purpose of filing a claim is to establish legal ownership of the deceased owner's property and assets.

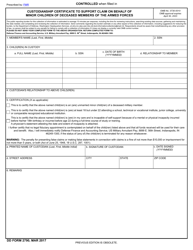

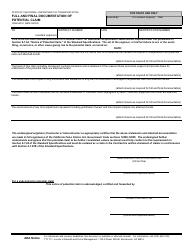

Q: What documents are required to file a claim as an heir of a deceased owner in California?

A: The required documents may include a death certificate, proof of relationship to the deceased owner, and any relevant legal documents such as a will or trust.

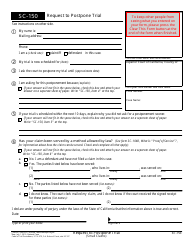

Q: Is there a deadline to file a claim as an heir of a deceased owner in California?

A: Yes, there is a deadline to file a claim, which is usually within a certain number of months after the date of the deceased owner's death. It is important to check with the probate court or county clerk for the specific deadline.

Q: What happens after I file a claim as an heir of a deceased owner in California?

A: After you file a claim, the probate court will review the documentation and make a determination regarding the ownership of the deceased owner's property and assets.

Q: Do I need legal representation to file a claim as an heir of a deceased owner in California?

A: While it is not required, it is recommended to seek legal advice or representation to ensure the proper filing of the claim and to address any potential legal issues.

Q: What should I do if there are other heirs contesting my claim?

A: If there are other heirs contesting your claim, it is advisable to consult with an attorney who specializes in probate or estate law to protect your interests and navigate the legal process.

Q: Are there any fees associated with filing a claim as an heir of a deceased owner in California?

A: There may be filing fees associated with filing a claim, which vary depending on the county. It is advisable to check with the probate court or county clerk's office for the specific fees.

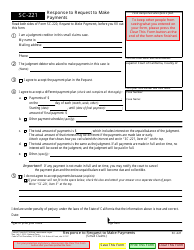

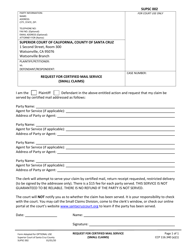

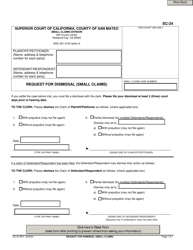

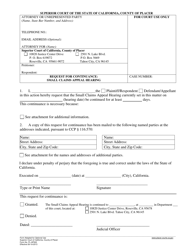

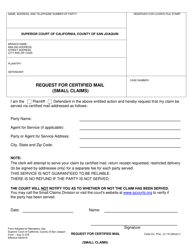

Form Details:

- Released on May 5, 2022;

- The latest edition currently provided by the California State Controller’s Office;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the California State Controller’s Office.