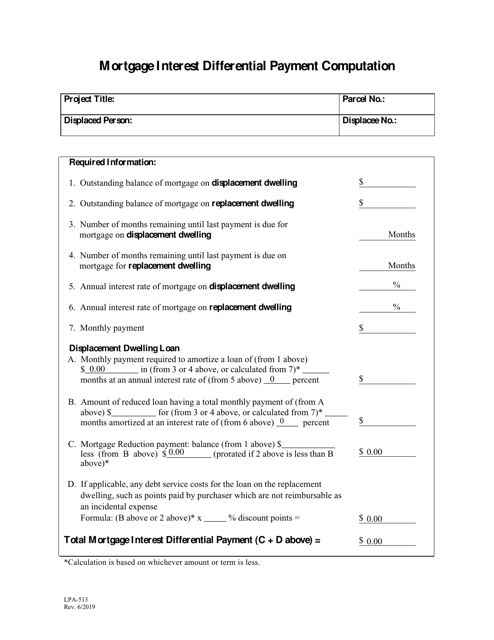

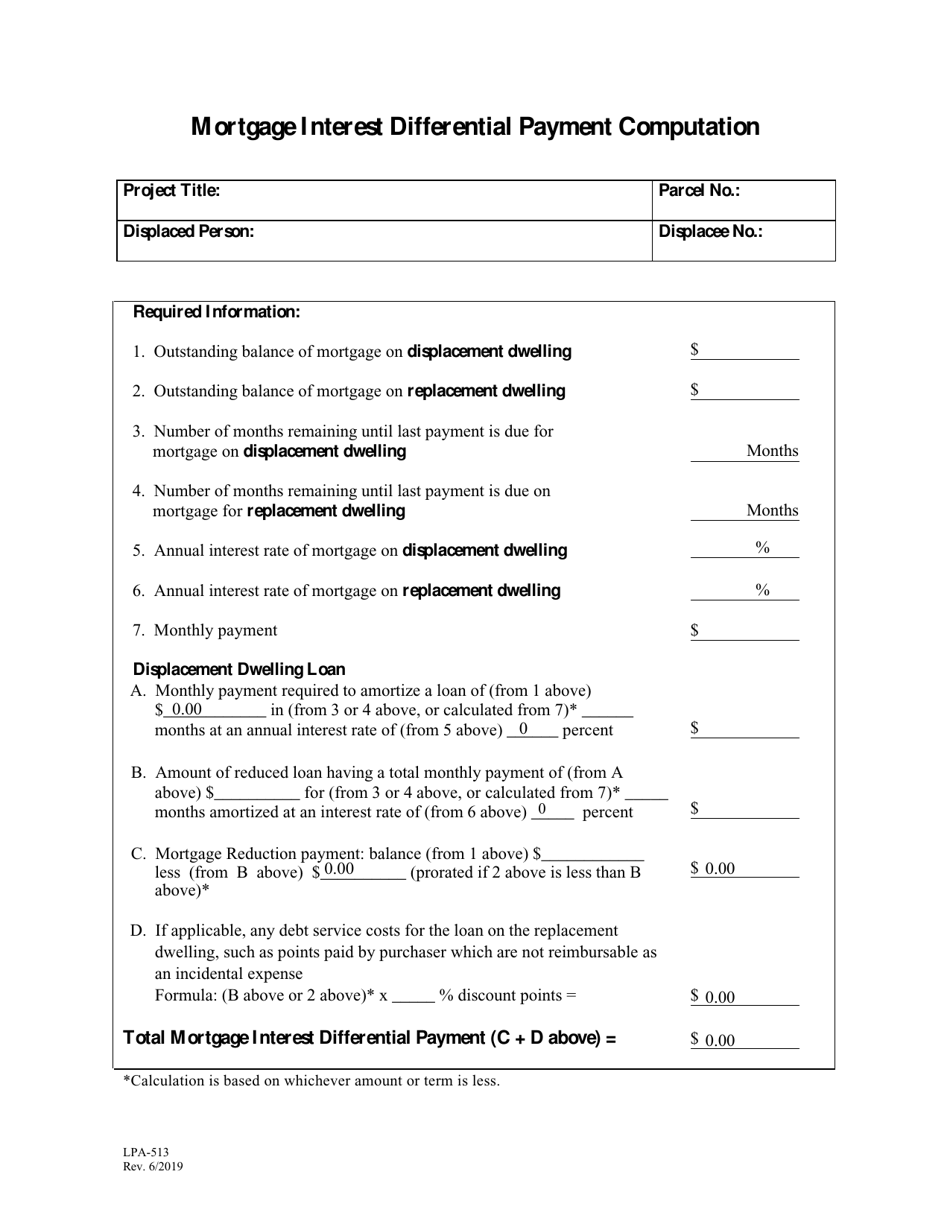

Form LPA-513 Mortgage Interest Differential Payment Computation - Washington

What Is Form LPA-513?

This is a legal form that was released by the Washington State Department of Transportation - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LPA-513?

A: Form LPA-513 is a document used for Mortgage Interest Differential Payment Computation in Washington.

Q: What is Mortgage Interest Differential Payment?

A: Mortgage Interest Differential Payment is the difference between the total interest paid on an existing mortgage and the total interest that would have been paid had the mortgage not been paid off early.

Q: Who uses Form LPA-513?

A: Form LPA-513 is used by borrowers and lenders in Washington to calculate the Mortgage Interest Differential Payment.

Q: What is the purpose of the Mortgage Interest Differential Payment Computation?

A: The purpose of the computation is to determine the amount of payment a borrower is required to make to the lender for paying off a mortgage early.

Q: Are there specific requirements for using Form LPA-513 in Washington?

A: Yes, borrowers and lenders must follow the guidelines provided by the Washington State Legislature and the Washington State Department of Financial Institutions.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Washington State Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LPA-513 by clicking the link below or browse more documents and templates provided by the Washington State Department of Transportation.