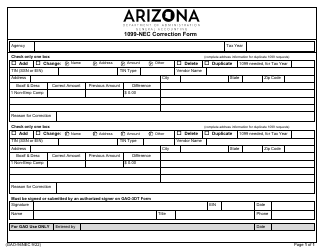

This version of the form is not currently in use and is provided for reference only. Download this version of

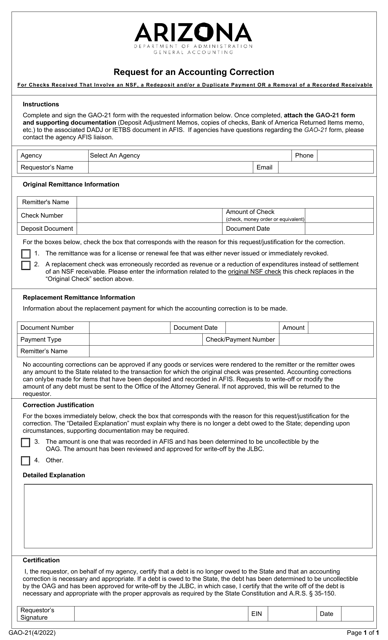

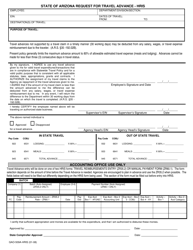

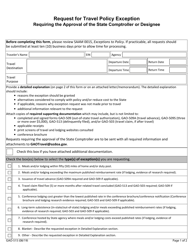

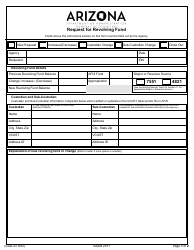

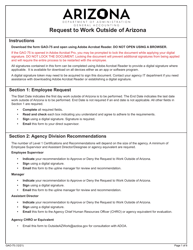

Form GAO-21

for the current year.

Form GAO-21 Request for an Accounting Correction - Arizona

What Is Form GAO-21?

This is a legal form that was released by the Arizona Department of Administration - General Accounting Office - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

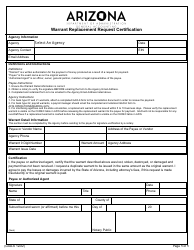

Q: What is Form GAO-21?

A: Form GAO-21 is a request for an accounting correction.

Q: Who can use Form GAO-21?

A: Anyone who wants to request an accounting correction in Arizona.

Q: What is an accounting correction?

A: An accounting correction is a change made to correct an error or omission in financial records.

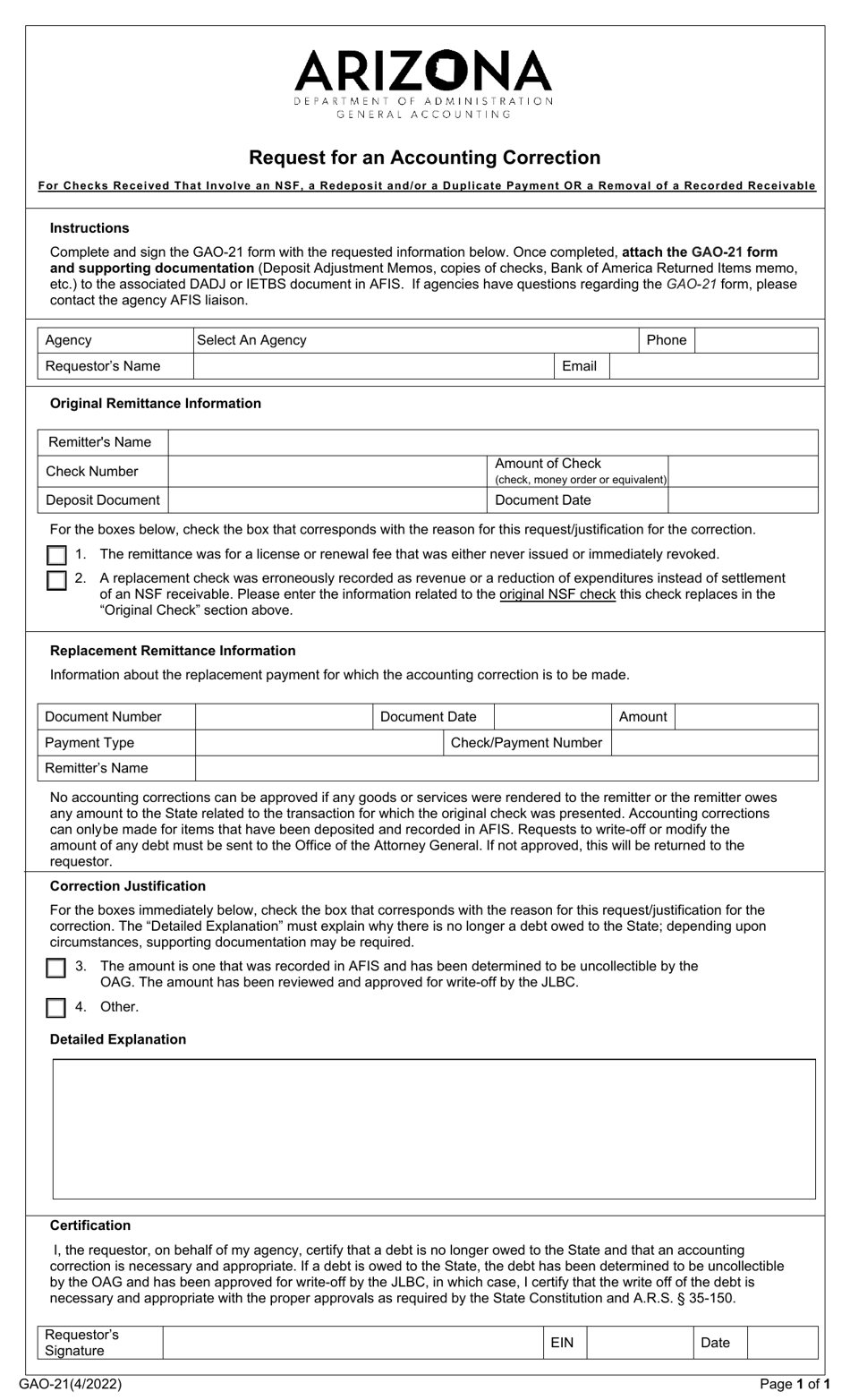

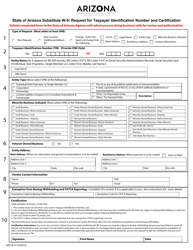

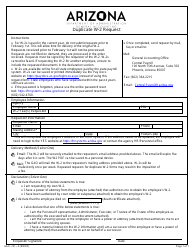

Q: How do I fill out Form GAO-21?

A: You need to provide your personal information, a detailed explanation of the accounting correction, and any supporting documentation.

Q: Is there a fee for submitting Form GAO-21?

A: There may be a fee associated with submitting Form GAO-21, depending on the specific circumstances.

Q: How long does it take to process a request for an accounting correction?

A: The processing time can vary, but it typically takes a few weeks to a few months.

Q: What should I do if my request for an accounting correction is denied?

A: If your request is denied, you may have the option to appeal the decision or seek further assistance from a legal professional.

Q: Are there any special requirements for filling out Form GAO-21?

A: There may be specific requirements outlined in the instructions for Form GAO-21, so it's important to carefully review them before filling out the form.

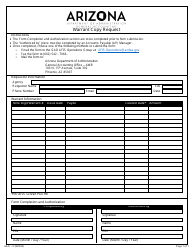

Form Details:

- Released on April 1, 2022;

- The latest edition provided by the Arizona Department of Administration - General Accounting Office;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GAO-21 by clicking the link below or browse more documents and templates provided by the Arizona Department of Administration - General Accounting Office.