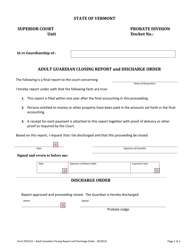

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 700-00152

for the current year.

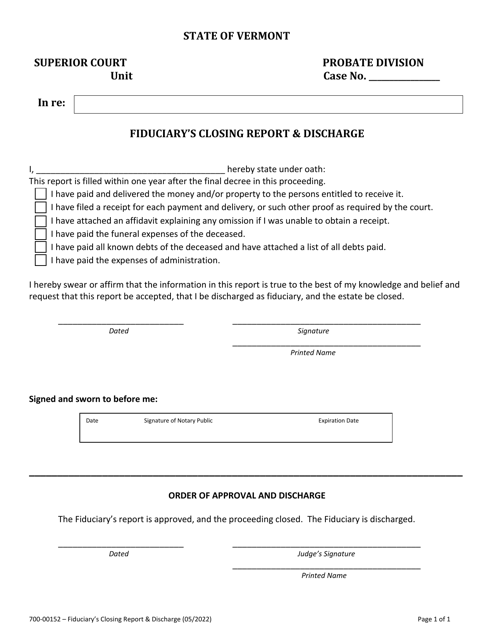

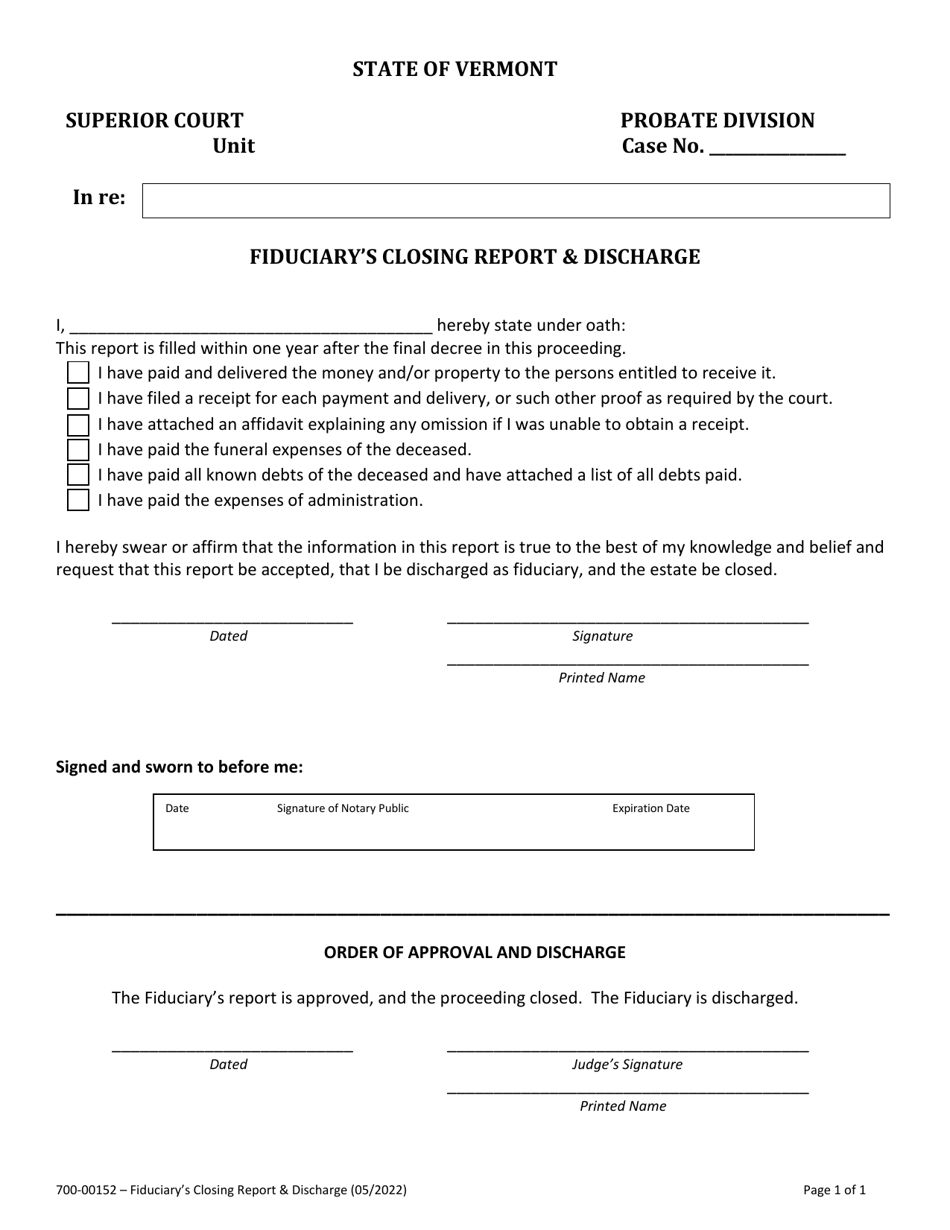

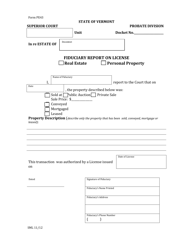

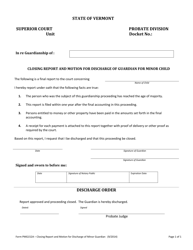

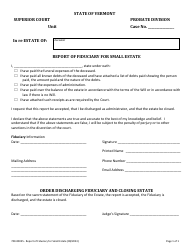

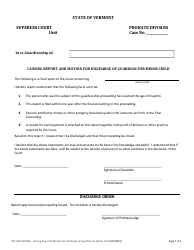

Form 700-00152 Fiduciary's Closing Report & Discharge - Vermont

What Is Form 700-00152?

This is a legal form that was released by the Vermont Superior Court - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

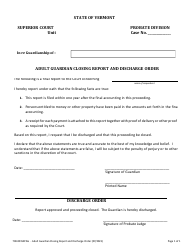

Q: What is Form 700-00152?

A: Form 700-00152 is the Fiduciary's Closing Report & Discharge form in Vermont.

Q: Who needs to file Form 700-00152?

A: If you are a fiduciary handling an estate or trust in Vermont and the administration is complete, you may need to file Form 700-00152.

Q: What is the purpose of Form 700-00152?

A: The purpose of Form 700-00152 is to report the final accounting of an estate or trust and request for the fiduciary to be discharged.

Q: What information is required on Form 700-00152?

A: Form 700-00152 requires information about the estate or trust, including details of income, expenses, distributions, and any remaining assets.

Q: Is there a deadline for filing Form 700-00152?

A: Yes, Form 700-00152 must be filed within 30 days after the closing of the estate or trust administration.

Q: What happens after I file Form 700-00152?

A: After filing Form 700-00152, the court will review the report and, if everything is in order, the fiduciary will be discharged.

Q: Do I need to provide supporting documentation with Form 700-00152?

A: Yes, you should include supporting documentation such as bank statements, invoices, and receipts to substantiate the information reported on Form 700-00152.

Q: Can I request an extension to file Form 700-00152?

A: Yes, you can request an extension to file Form 700-00152 by submitting a written request to the court explaining the reason for the extension.

Form Details:

- Released on May 1, 2022;

- The latest edition provided by the Vermont Superior Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 700-00152 by clicking the link below or browse more documents and templates provided by the Vermont Superior Court.