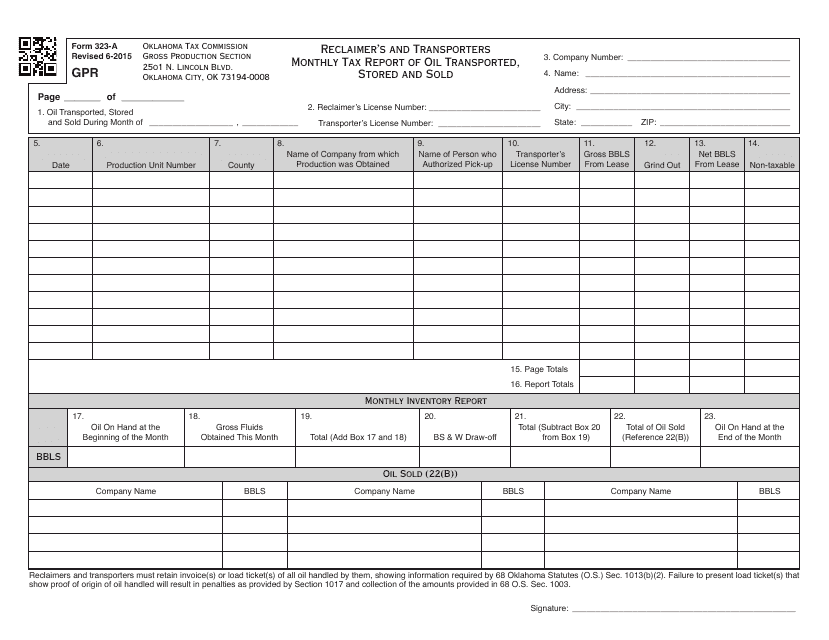

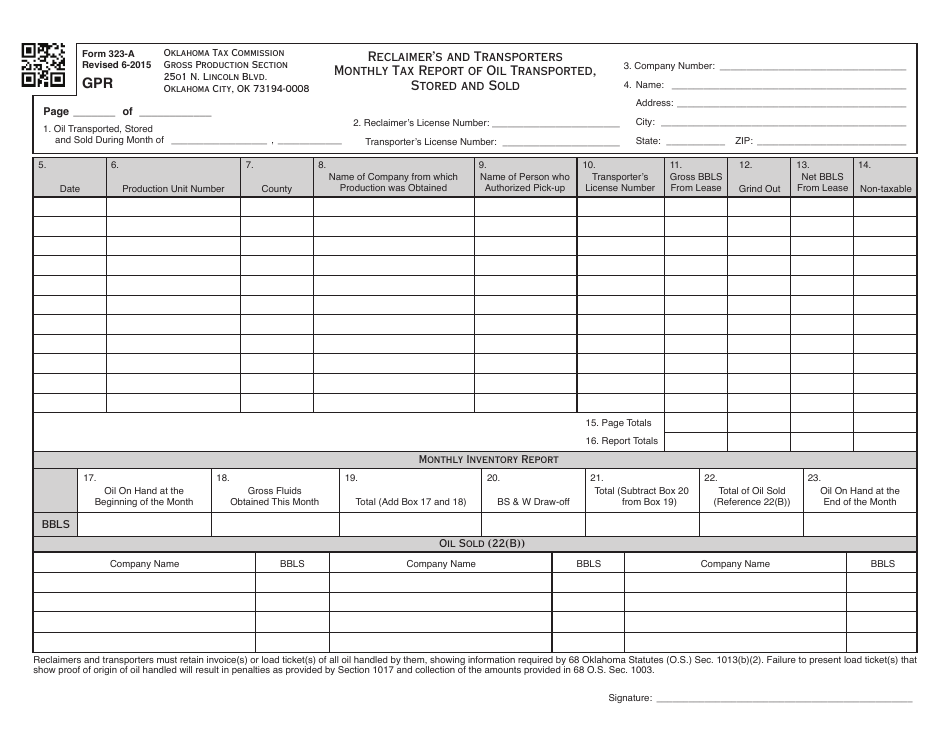

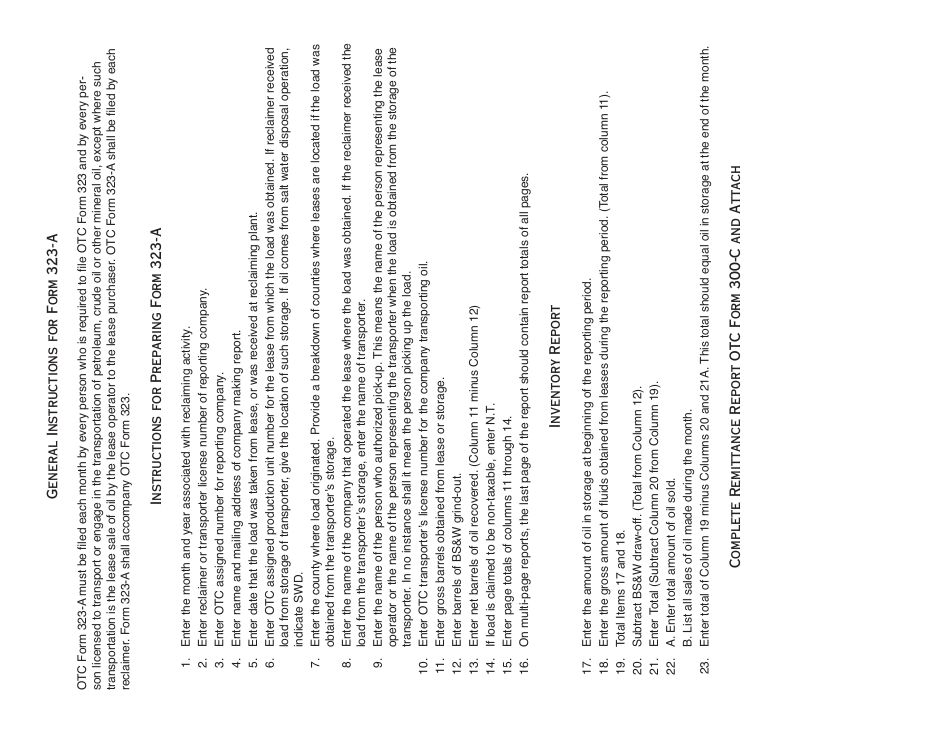

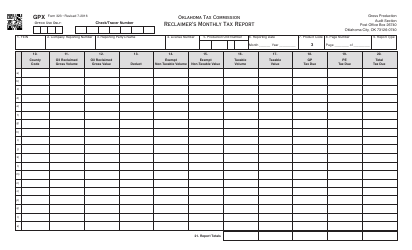

Form 323-A Reclaimer's and Transporters Monthly Tax Report of Oil Transported, Stored and Sold - Oklahoma

What Is Form 323-A?

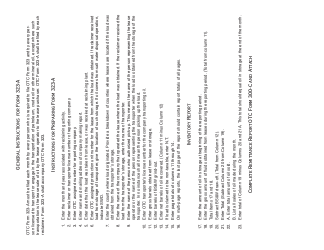

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 323-A?

A: Form 323-A is the Reclaimer's and Transporters Monthly Tax Report of Oil Transported, Stored and Sold in Oklahoma.

Q: Who needs to file Form 323-A?

A: Reclaimers and transporters of oil in Oklahoma need to file Form 323-A.

Q: What does Form 323-A require?

A: Form 323-A requires information about the oil transported, stored, and sold, as well as tax calculations and payments.

Q: When is Form 323-A due?

A: Form 323-A is due by the 20th day of the month following the reporting month.

Form Details:

- Released on June 1, 2015;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 323-A by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.