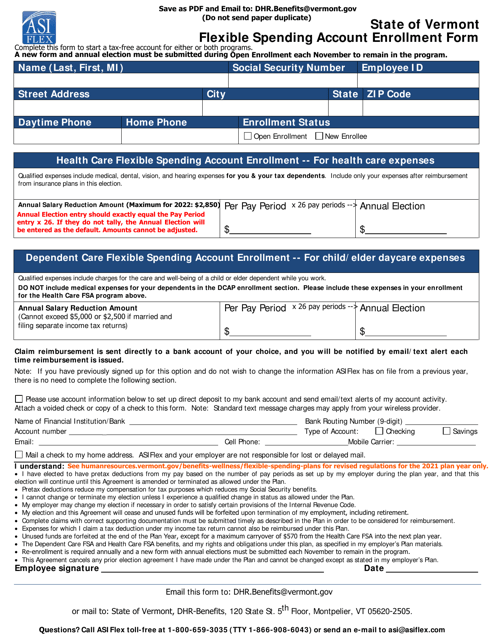

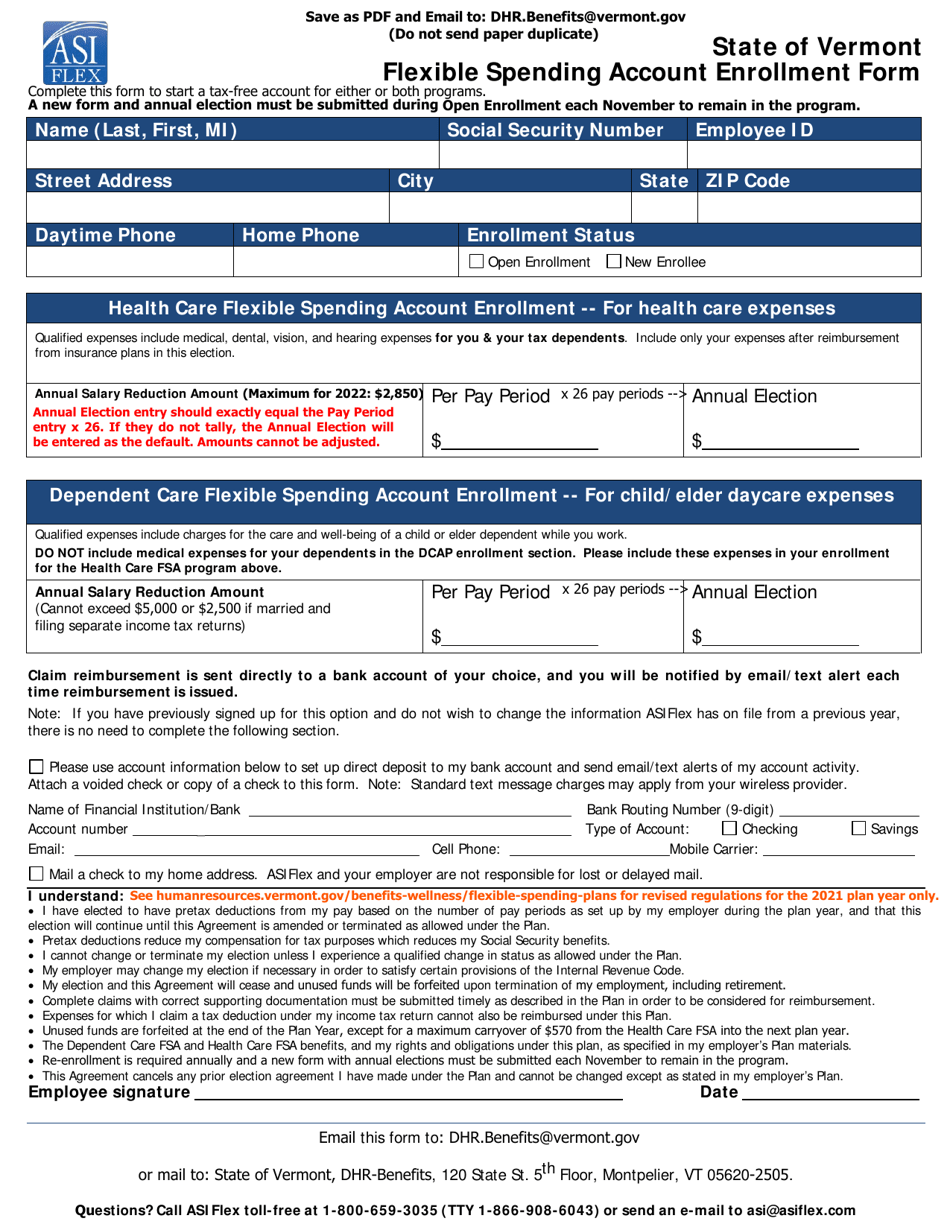

Flexible Spending Account Enrollment Form - Vermont

Flexible Spending Account Enrollment Form is a legal document that was released by the Vermont Department of Human Resources - a government authority operating within Vermont.

FAQ

Q: What is a Flexible Spending Account?

A: A Flexible Spending Account (FSA) is a tax-advantaged financial account that allows you to set aside pre-tax dollars to pay for eligible healthcare and dependent care expenses.

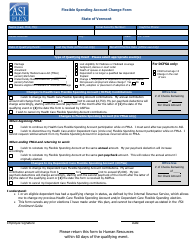

Q: What expenses can be paid for with a Flexible Spending Account?

A: A Flexible Spending Account can be used to pay for eligible healthcare expenses such as doctor's visits, prescription medications, and medical supplies. It can also be used to pay for eligible dependent care expenses, such as daycare or after-school programs.

Q: Can I use a Flexible Spending Account for over-the-counter medications?

A: Yes, as of 2020, you can use a Flexible Spending Account to pay for over-the-counter medications without a prescription.

Q: Can I roll over funds from year to year in a Flexible Spending Account?

A: It depends. In general, funds in a Healthcare FSA cannot be rolled over from year to year, but some plans may offer a limited rollover option or a grace period to use the funds. Dependent Care FSAs do not have a rollover option.

Q: How much can I contribute to a Flexible Spending Account?

A: The maximum annual contribution limit for a Healthcare FSA is $2,750 in 2021. The maximum contribution limit for a Dependent Care FSA is $5,000 per household, or $2,500 if married filing separately.

Q: When can I enroll in a Flexible Spending Account?

A: Open enrollment periods for Flexible Spending Accounts usually occur once a year, typically before the start of the plan year. Some employers may also offer a special enrollment period for new hires or employees experiencing qualifying life events.

Q: What happens to unused funds in a Flexible Spending Account at the end of the plan year?

A: Unused funds in a Healthcare FSA are typically forfeited at the end of the plan year, unless your plan offers a limited rollover or a grace period. Unused funds in a Dependent Care FSA are not eligible for rollover and are generally forfeited.

Q: Can I change my contribution amount during the plan year?

A: Generally, you cannot change your contribution amount during the plan year unless you experience a qualifying life event such as marriage, birth/adoption of a child, or a change in employment status.

Form Details:

- The latest edition currently provided by the Vermont Department of Human Resources;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Vermont Department of Human Resources.