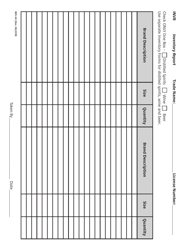

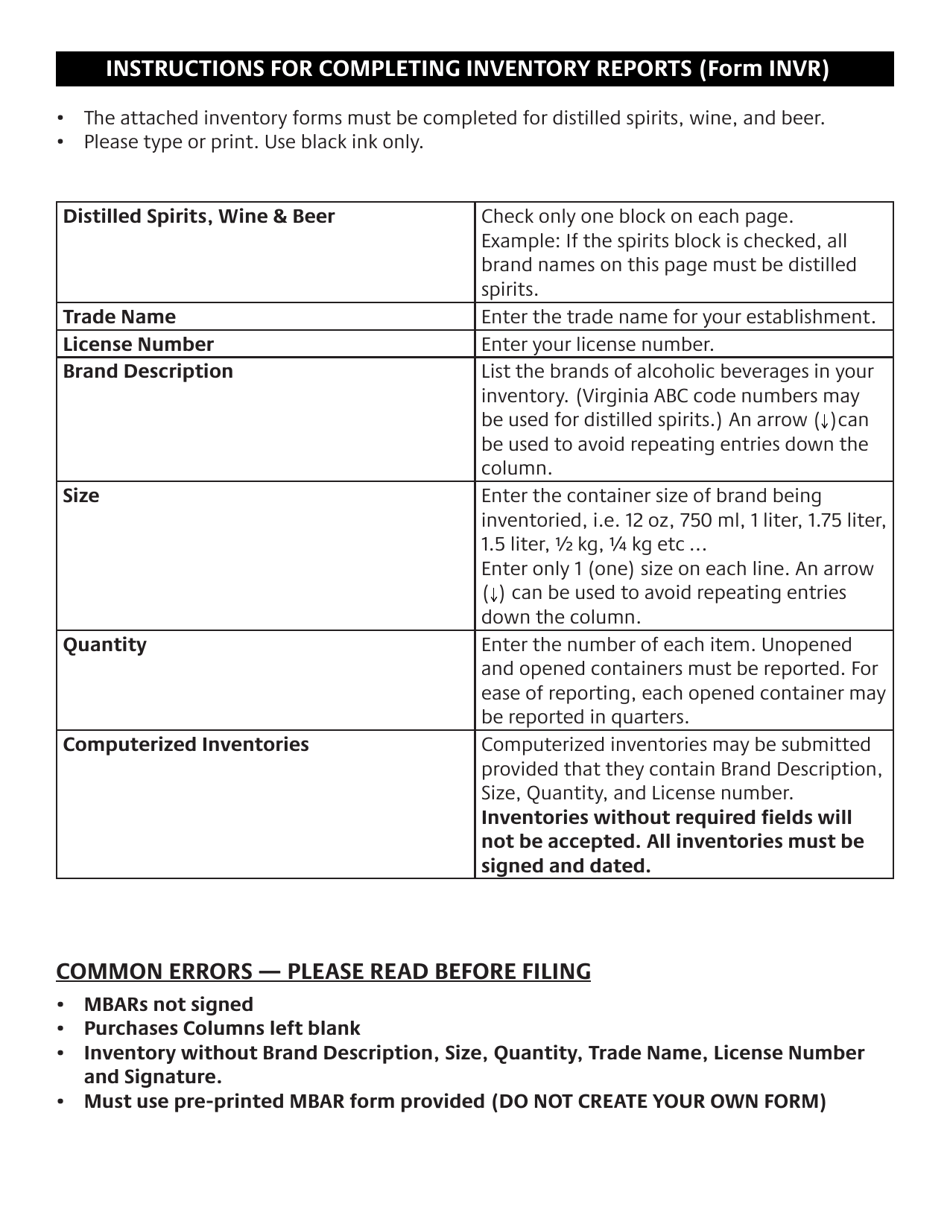

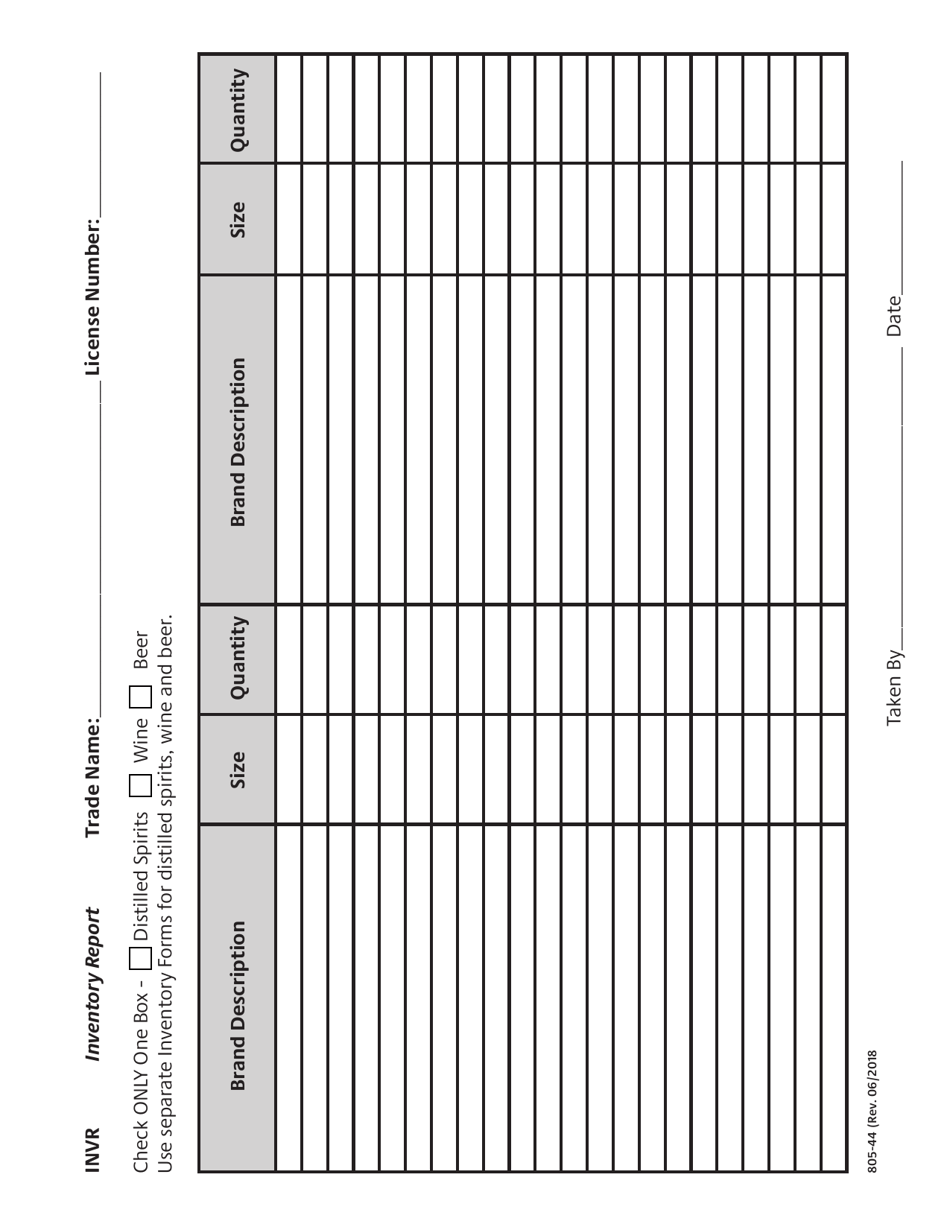

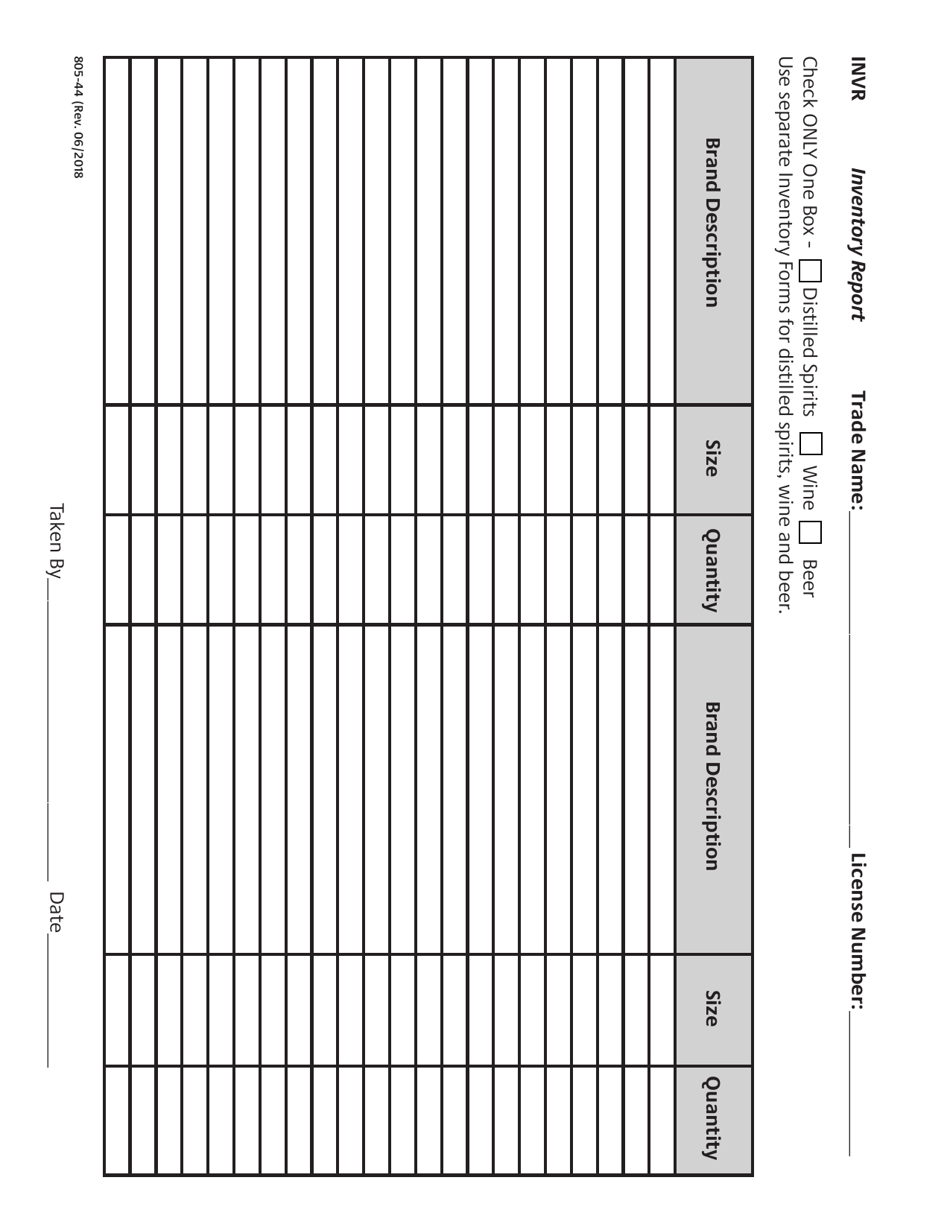

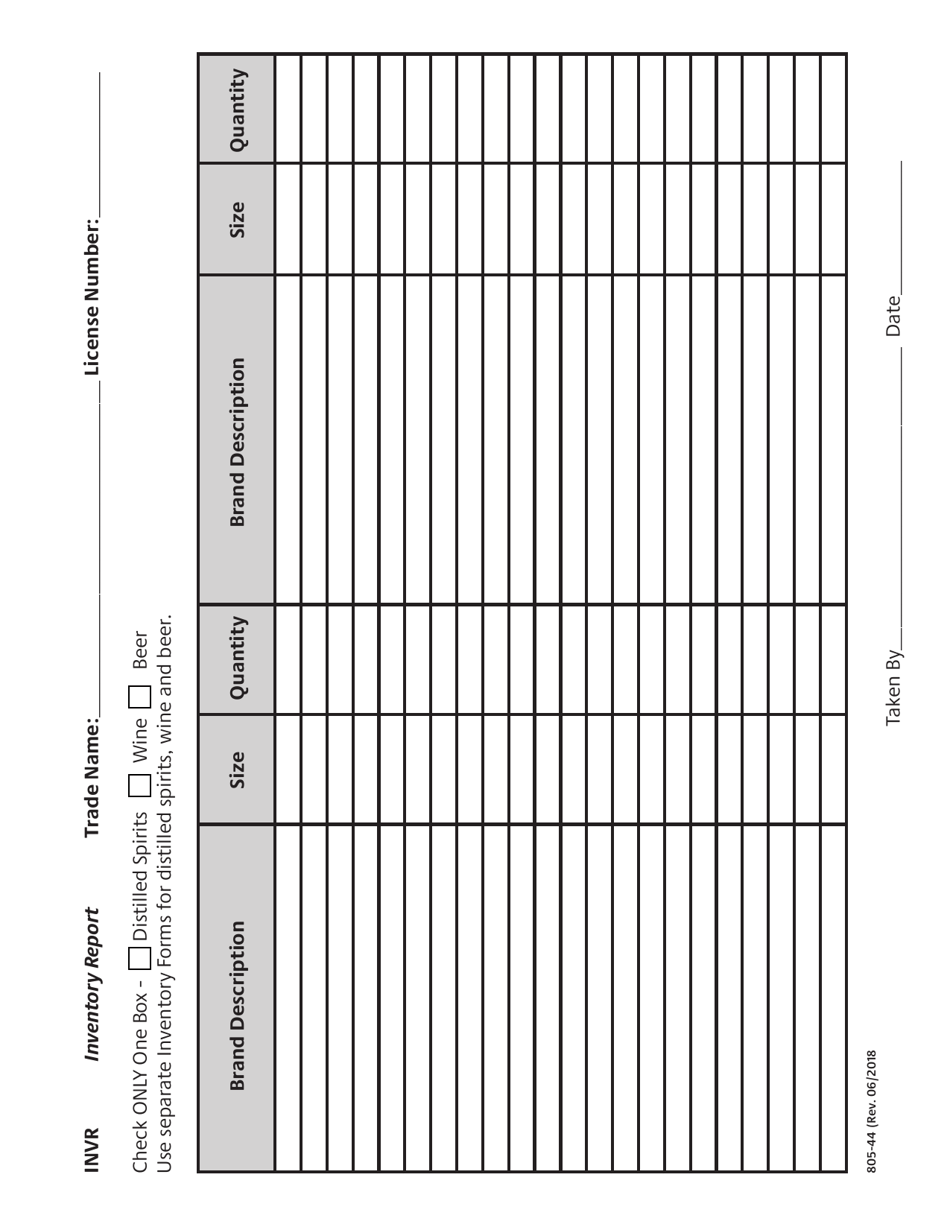

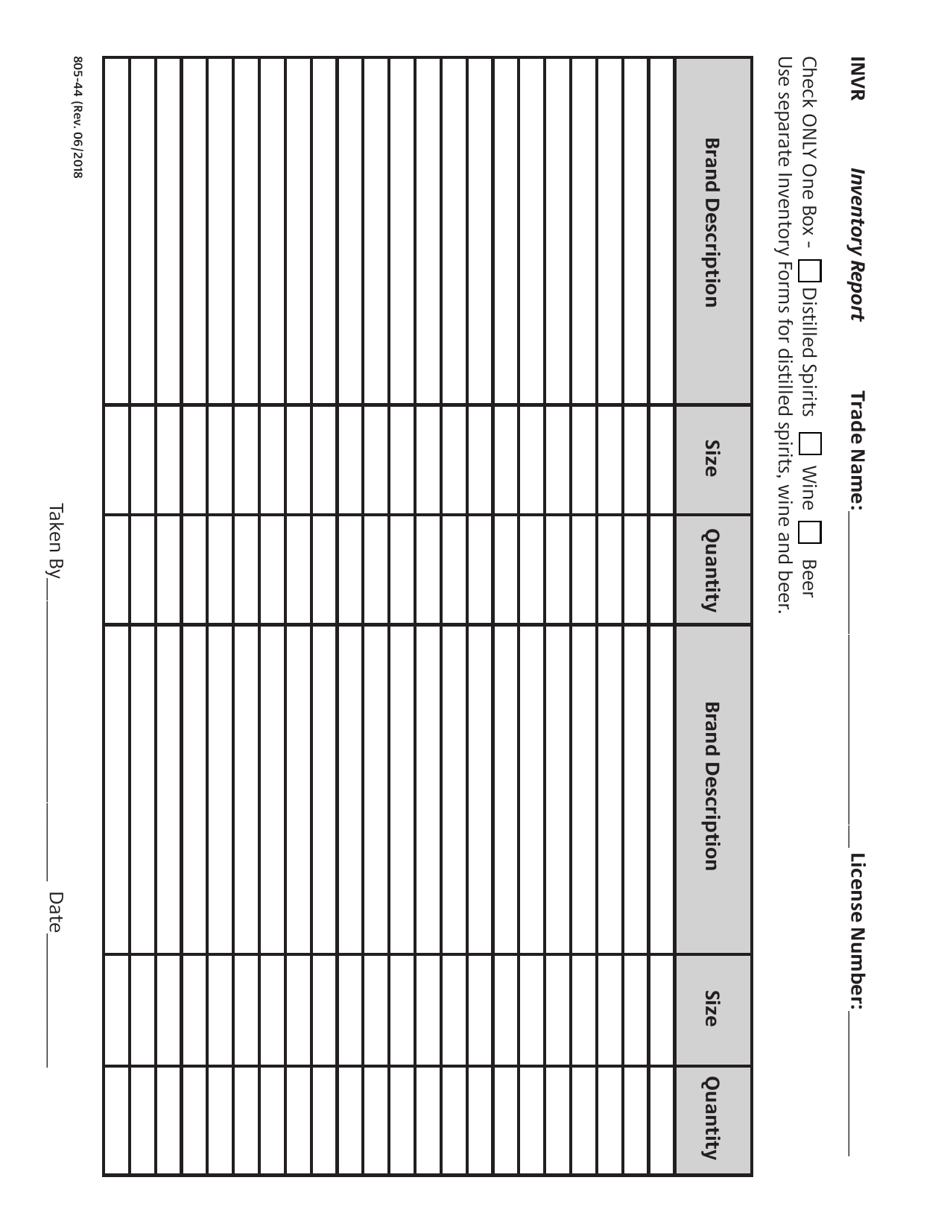

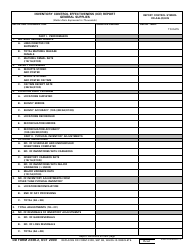

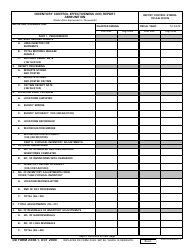

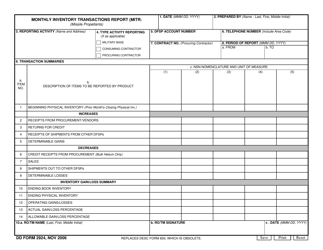

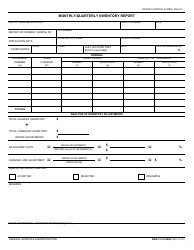

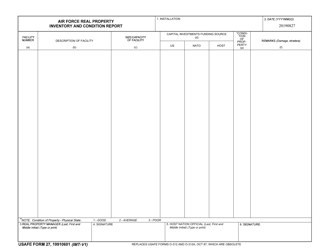

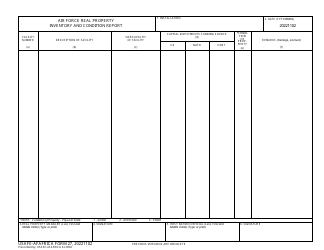

Form 805-44 Inventory Report Form - Virginia

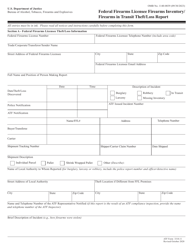

What Is Form 805-44?

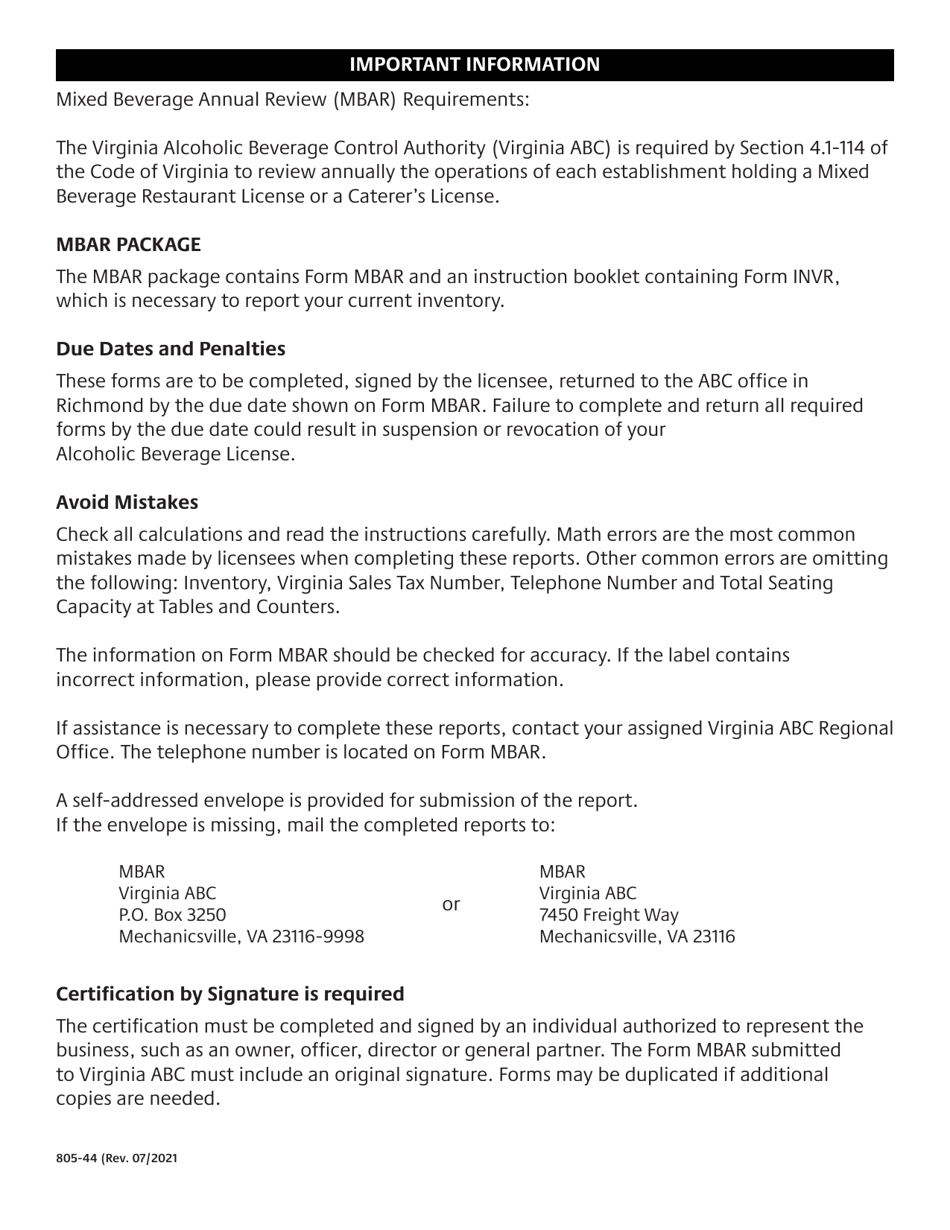

This is a legal form that was released by the Virginia Alcoholic Beverage Control Authority - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 805-44?

A: Form 805-44 is the Inventory Report Form used in Virginia.

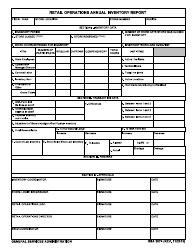

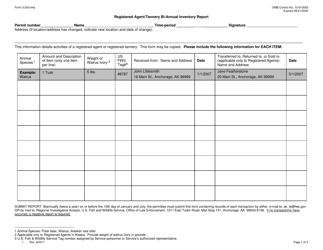

Q: Who needs to file Form 805-44?

A: Businesses licensed in Virginia that maintain an inventory of goods for sale or use need to file Form 805-44.

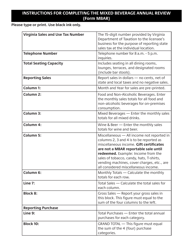

Q: When is Form 805-44 due?

A: Form 805-44 is due on or before the last day of the month following the close of the reporting period.

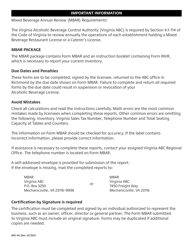

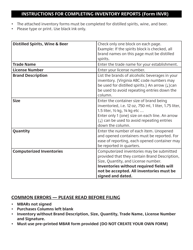

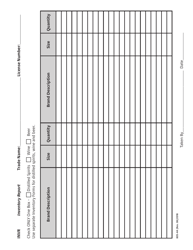

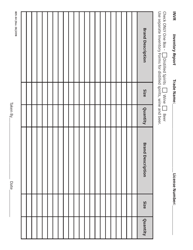

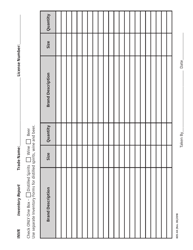

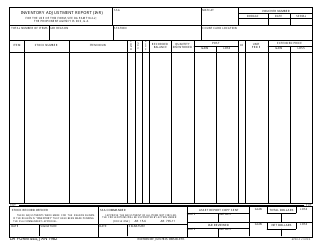

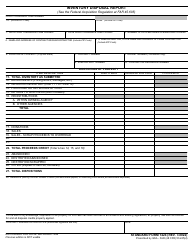

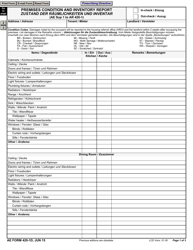

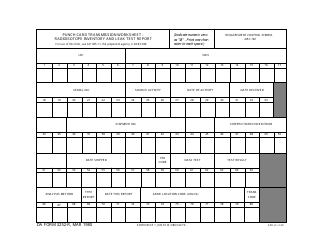

Q: What information is required on Form 805-44?

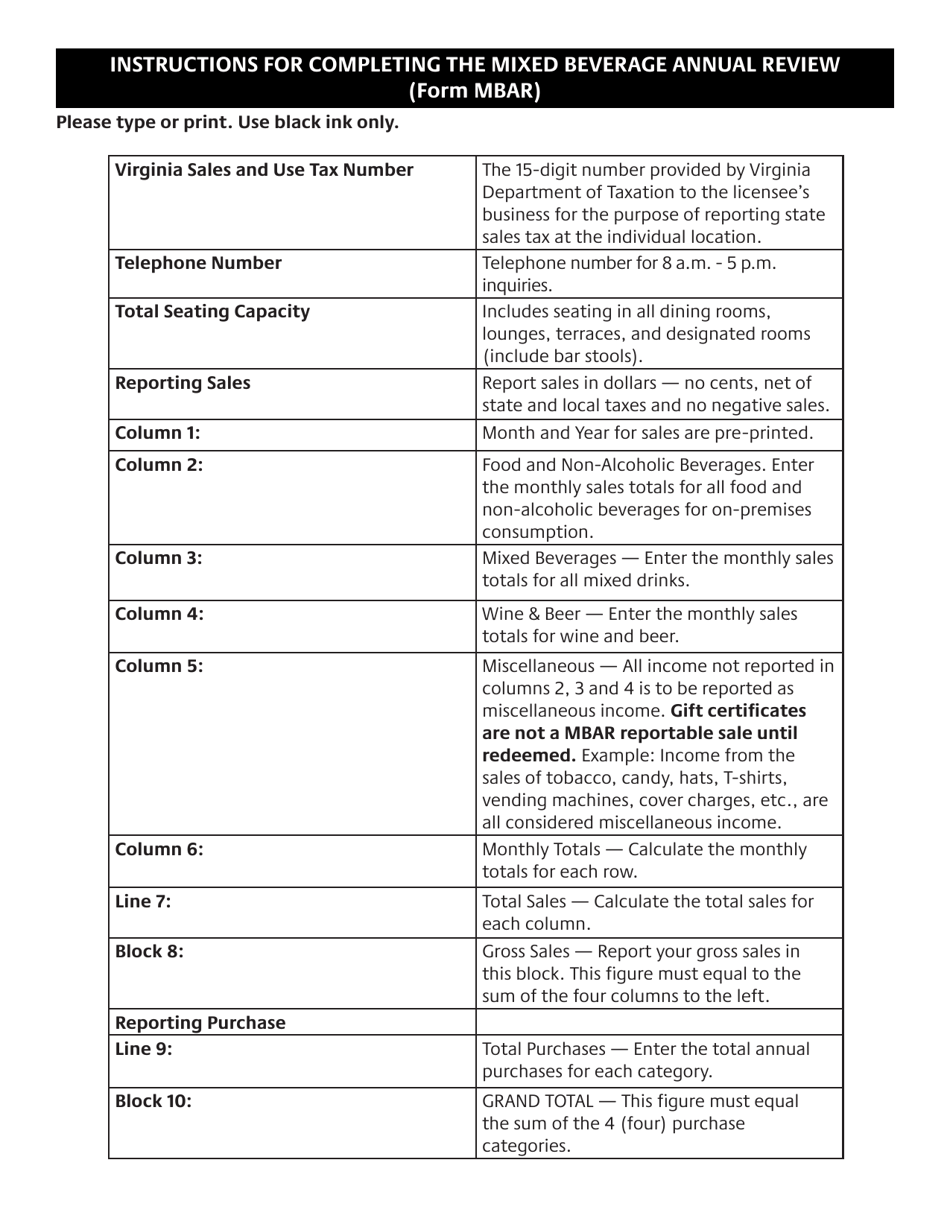

A: Form 805-44 requires detailed information about the inventory such as the quantities and values of each item.

Q: Is there a penalty for not filing Form 805-44?

A: Yes, failure to file Form 805-44 or filing it late can result in penalties and interest.

Q: Can I amend Form 805-44 if I made a mistake?

A: Yes, if you made a mistake on Form 805-44, you can file an amended form to correct the error.

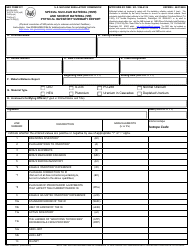

Q: Are there any exemptions to filing Form 805-44?

A: Some businesses may be exempt from filing Form 805-44. It is best to consult the Virginia Department of Taxation for specific exemption rules.

Q: What should I do if I have additional questions about Form 805-44?

A: If you have additional questions about Form 805-44, you can contact the Virginia Department of Taxation for assistance.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the Virginia Alcoholic Beverage Control Authority;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 805-44 by clicking the link below or browse more documents and templates provided by the Virginia Alcoholic Beverage Control Authority.