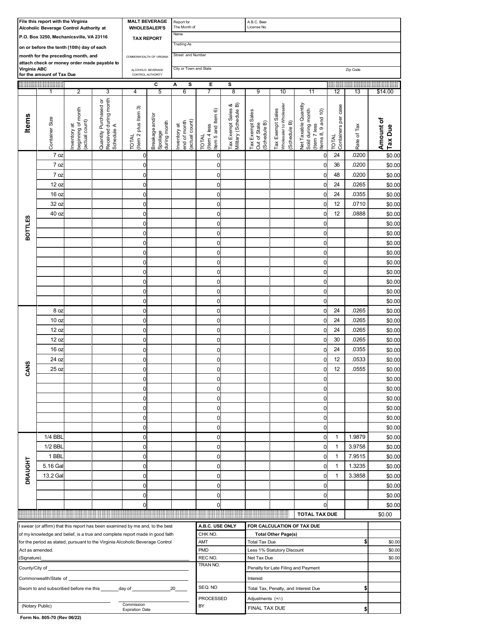

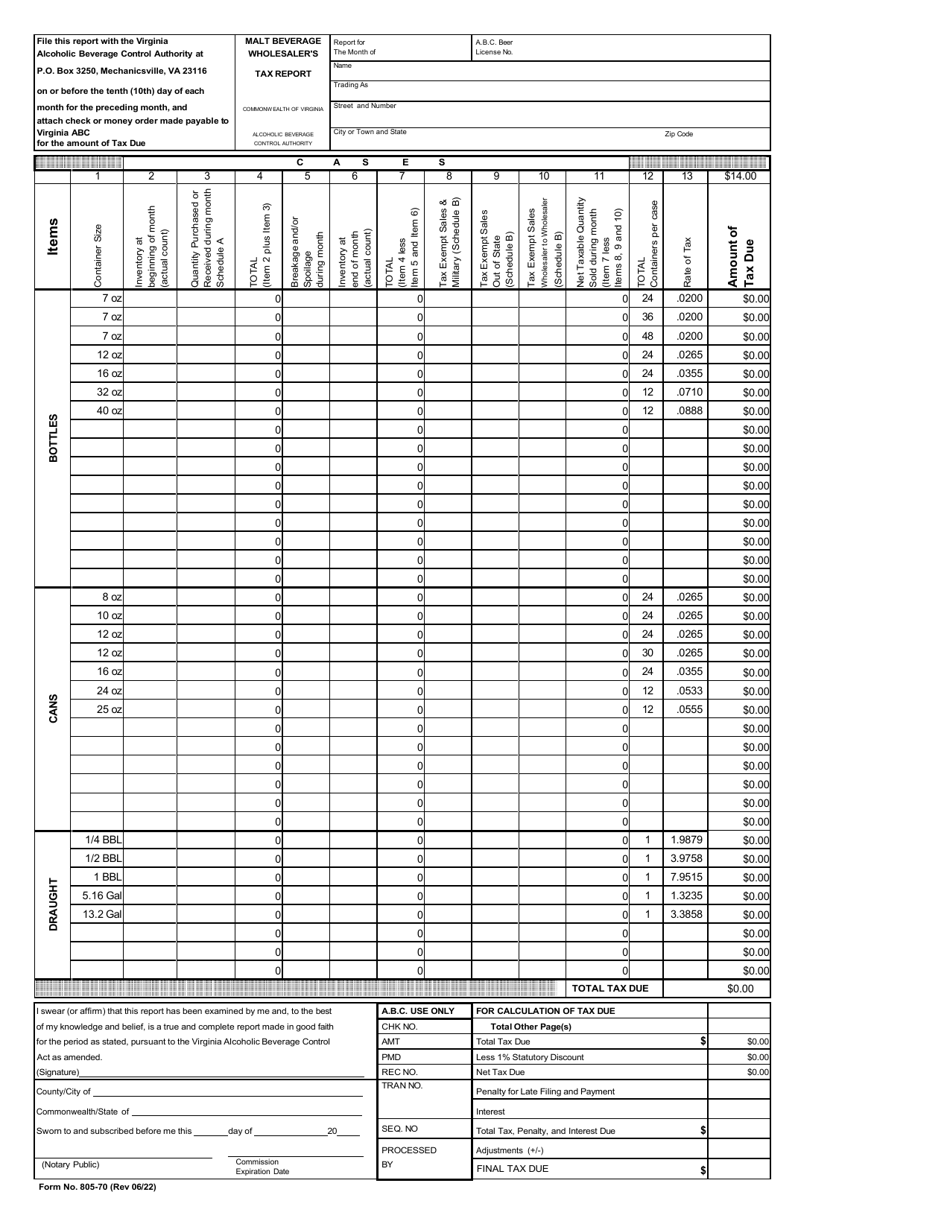

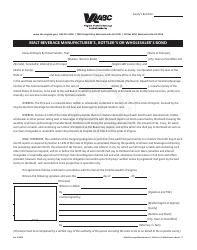

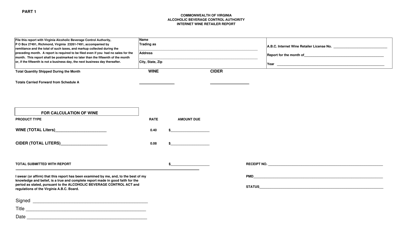

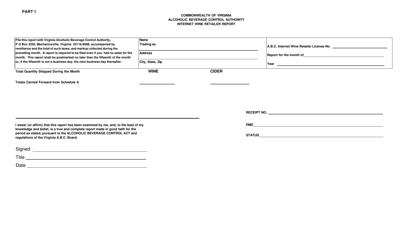

Form 805-70 Malt Beverage Wholesaler's Tax Report - Virginia

What Is Form 805-70?

This is a legal form that was released by the Virginia Alcoholic Beverage Control Authority - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 805-70?

A: Form 805-70 is the Malt Beverage Wholesaler's Tax Report in Virginia.

Q: Who needs to file Form 805-70?

A: Malt beverage wholesalers in Virginia need to file Form 805-70.

Q: What is the purpose of Form 805-70?

A: Form 805-70 is used to report and pay taxes on malt beverages sold in Virginia.

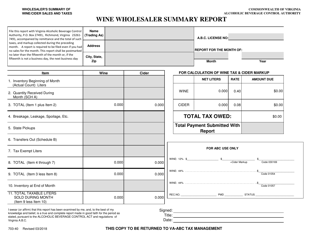

Q: What information is required on Form 805-70?

A: Form 805-70 requires information about the quantities and sales of malt beverages.

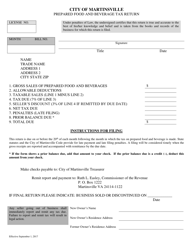

Q: When is Form 805-70 due?

A: Form 805-70 is due by the 20th day of each month following the reporting period.

Q: Can Form 805-70 be filed electronically?

A: Yes, Form 805-70 can be filed electronically.

Q: Are there any penalties for late filing or non-filing of Form 805-70?

A: Yes, penalties may be imposed for late filing or non-filing of Form 805-70.

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the Virginia Alcoholic Beverage Control Authority;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 805-70 by clicking the link below or browse more documents and templates provided by the Virginia Alcoholic Beverage Control Authority.