This version of the form is not currently in use and is provided for reference only. Download this version of

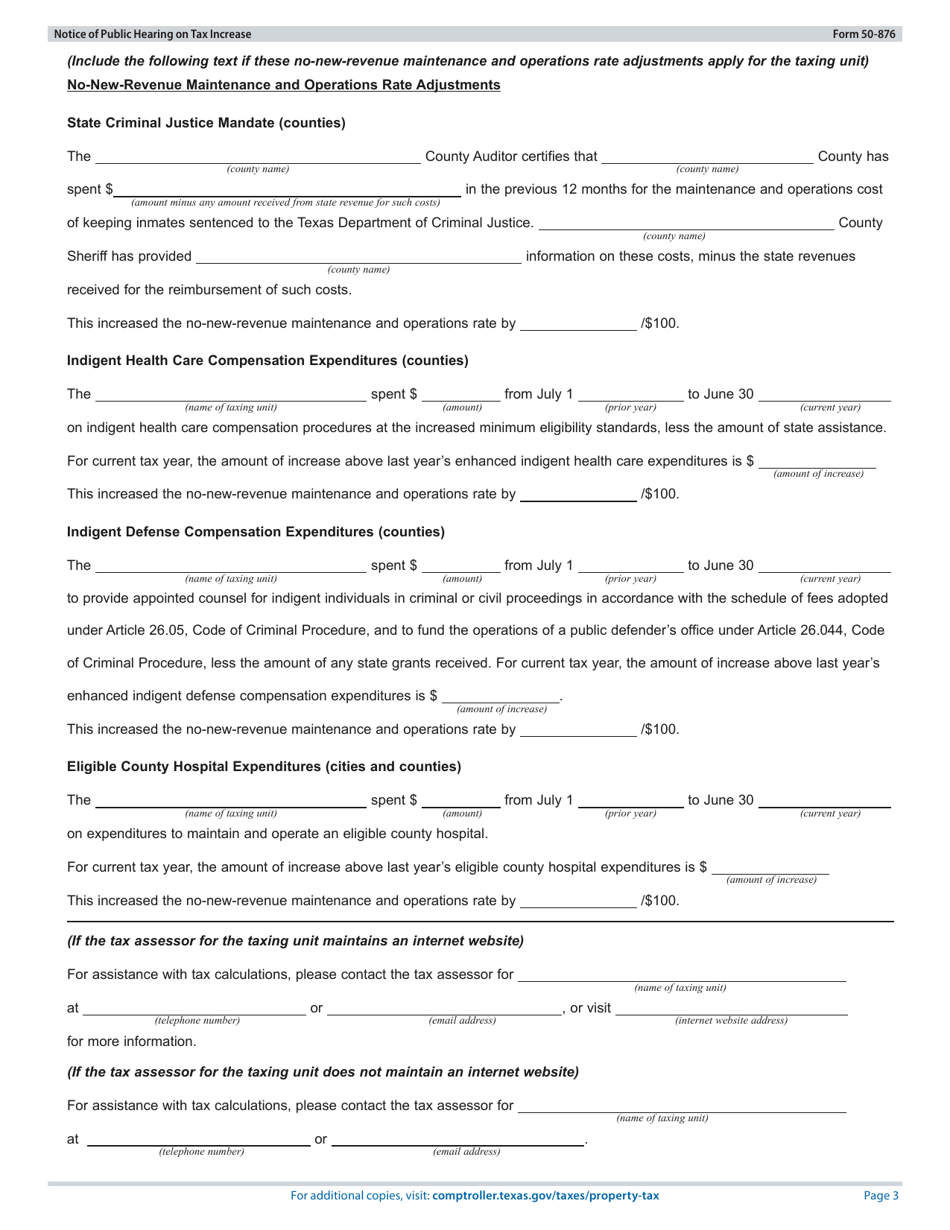

Form 50-876

for the current year.

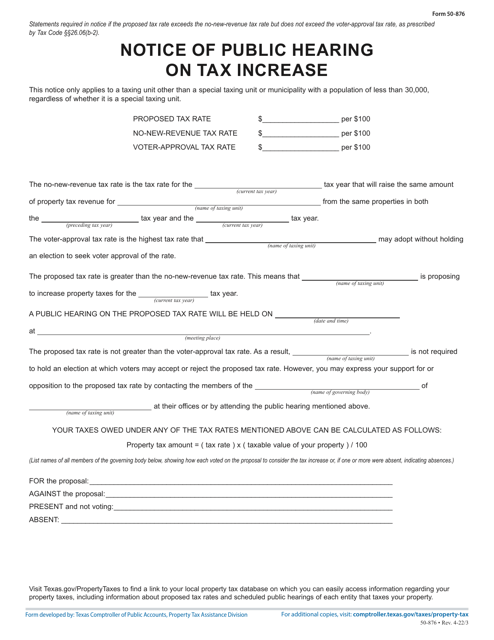

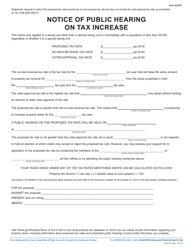

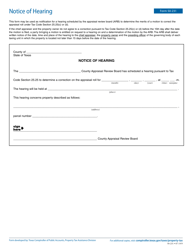

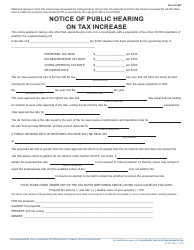

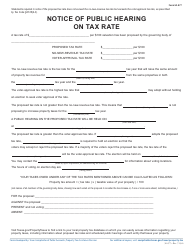

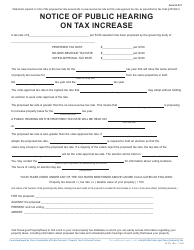

Form 50-876 Notice of Public Hearing on Tax Increase - Proposed Rate Exceeds No-New-Revenue, but Not Voter-Approval Tax Rate - Texas

What Is Form 50-876?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-876?

A: Form 50-876 is a notice of public hearing on a tax increase.

Q: What does the notice pertain to?

A: The notice pertains to a proposed tax rate that exceeds the no-new-revenue rate, but not the voter-approval rate.

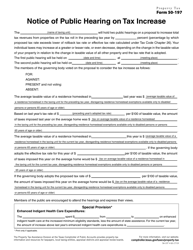

Q: What is the purpose of the public hearing?

A: The purpose of the public hearing is to discuss the proposed tax increase.

Q: What are the different tax rates mentioned in the notice?

A: The notice mentions the no-new-revenue rate and the voter-approval rate.

Q: Who will be involved in the public hearing?

A: Members of the public and relevant authorities will be involved in the public hearing.

Q: What does it mean if the proposed tax rate exceeds the voter-approval rate?

A: If the proposed tax rate exceeds the voter-approval rate, it requires voter approval before it can be adopted.

Q: Is the public hearing mandatory?

A: Yes, the public hearing is mandatory for discussing the proposed tax increase.

Q: What should individuals do if they have questions or concerns about the notice?

A: Individuals should attend the public hearing or contact the relevant authorities for questions or concerns about the notice.

Q: Can individuals provide feedback during the public hearing?

A: Yes, individuals can provide feedback and voice their concerns during the public hearing.

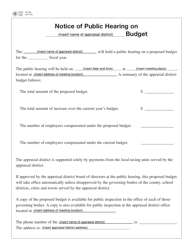

Form Details:

- Released on April 1, 2022;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 50-876 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.