This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

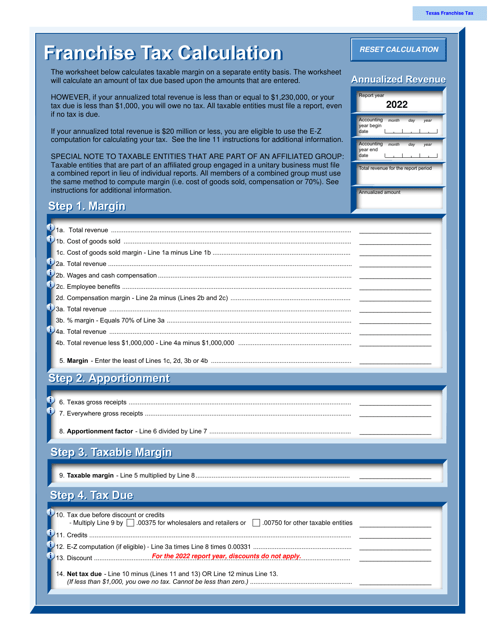

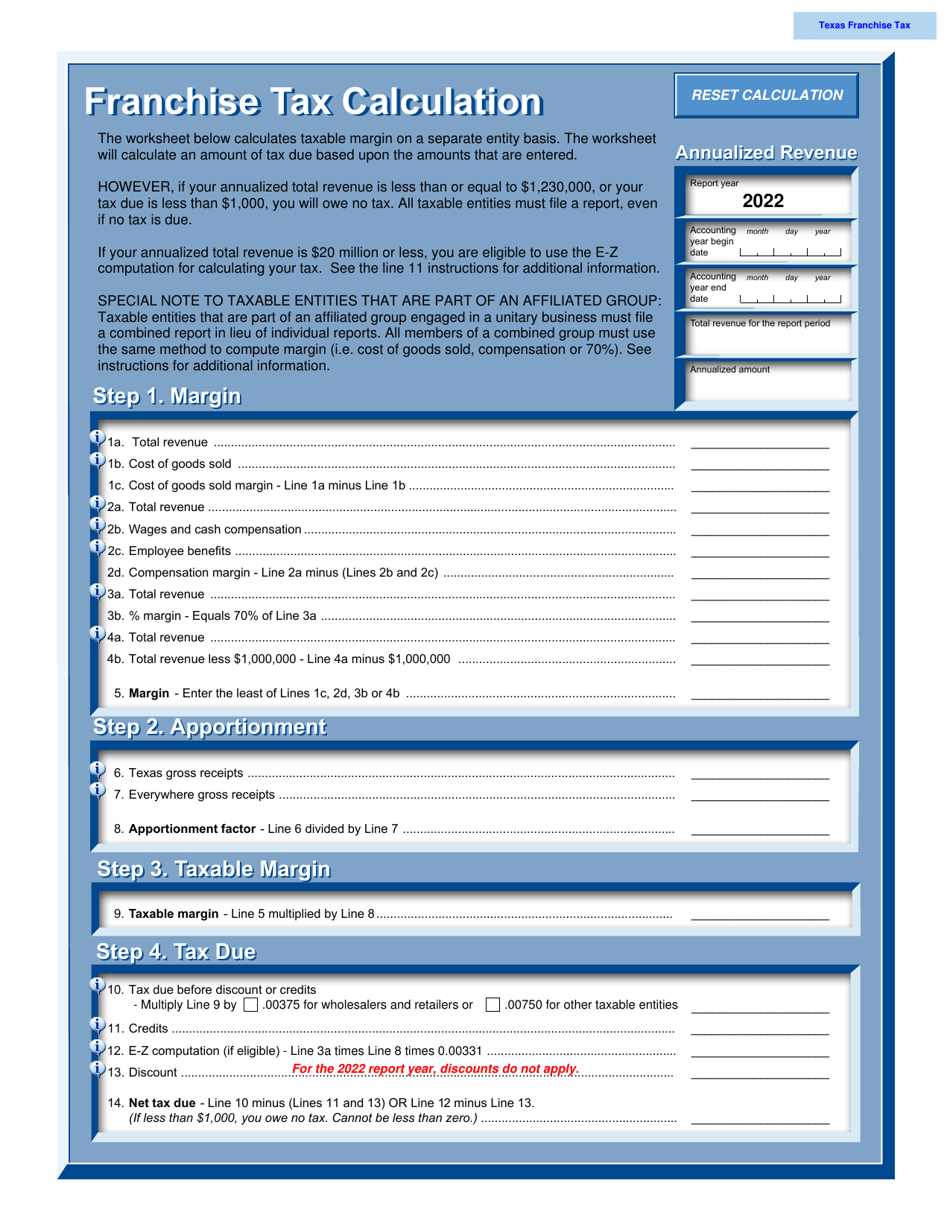

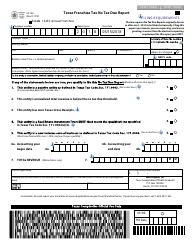

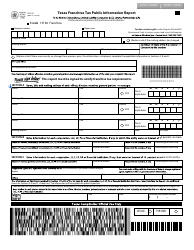

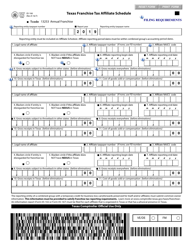

Franchise Tax Calculation - Texas

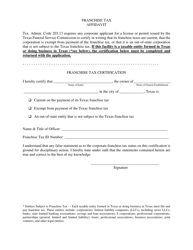

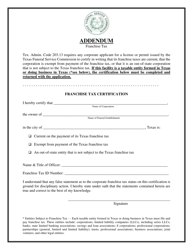

Franchise Tax Calculation is a legal document that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas.

FAQ

Q: What is franchise tax?

A: Franchise tax is a tax imposed on businesses or entities that are chartered or organized in Texas.

Q: How is franchise tax calculated?

A: Franchise tax is calculated based on the taxable margin or taxable entity's revenue.

Q: What is taxable margin?

A: Taxable margin is the amount of net taxable income a business has after subtracting certain deductions.

Q: What is the tax rate for franchise tax in Texas?

A: The tax rate for franchise tax in Texas is 1% for most entities.

Q: Are there any exemptions or deductions for franchise tax?

A: Yes, there are exemptions and deductions available, such as the no-tax-due threshold and the cost of goods sold deduction.

Q: When is the franchise tax due?

A: The franchise tax is generally due on May 15th every year.

Form Details:

- The latest edition currently provided by the Texas Comptroller of Public Accounts;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.