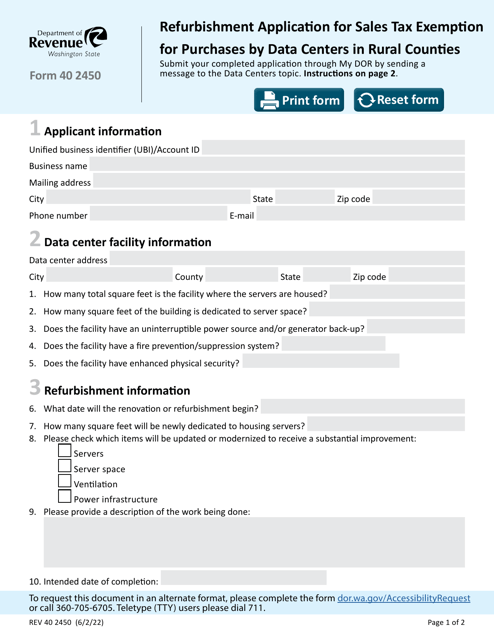

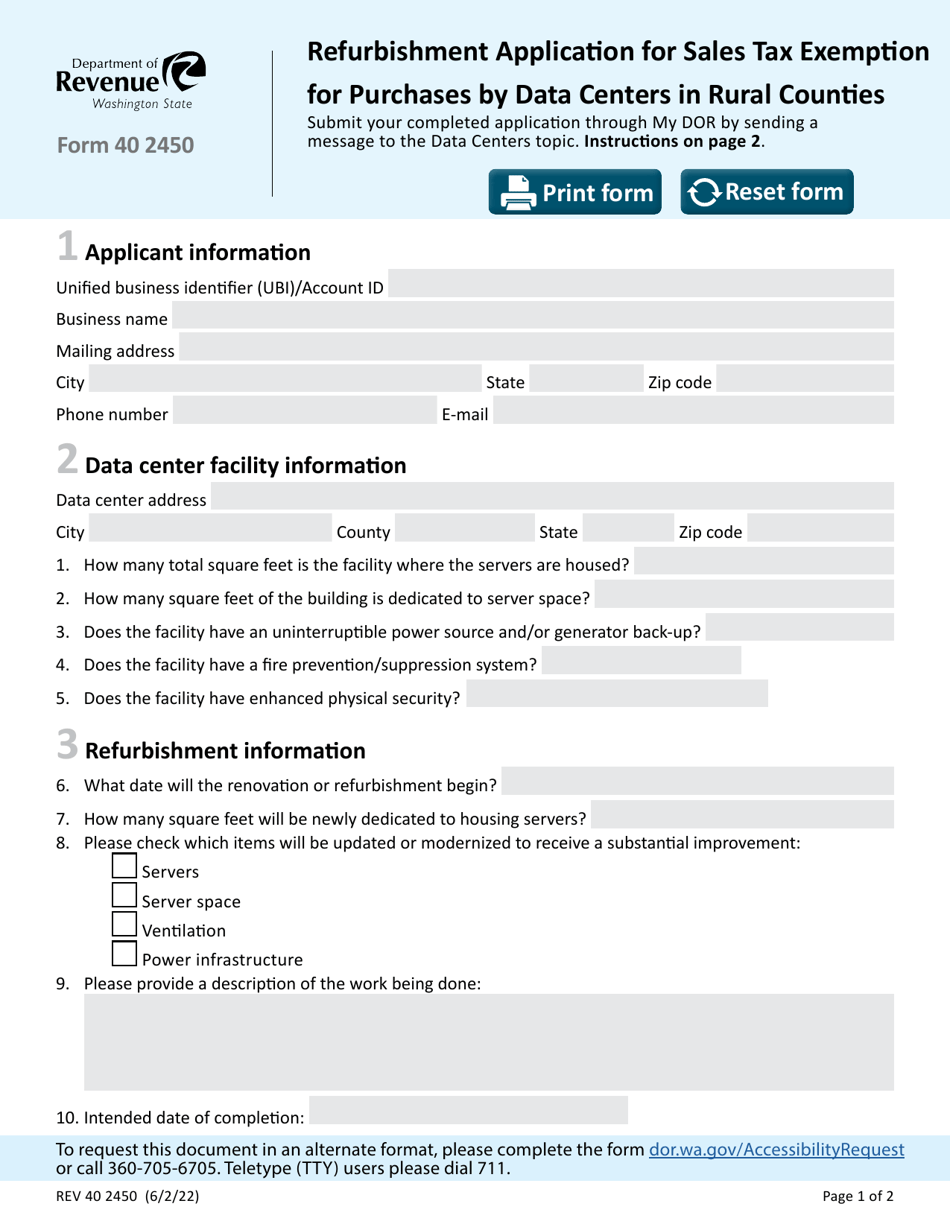

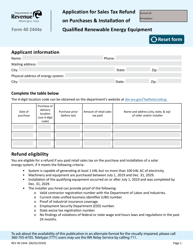

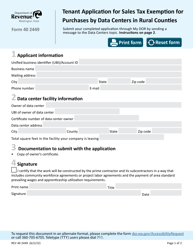

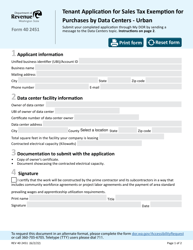

Form REV40 2450 Refurbishment Application for Sales Tax Exemption for Purchases by Data Centers in Rural Counties - Washington

What Is Form REV40 2450?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form REV40 2450?

A: Form REV40 2450 is an application for sales tax exemption for purchases by data centers in rural counties in Washington.

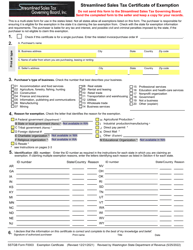

Q: Who can apply for sales tax exemption using form REV40 2450?

A: Data centers in rural counties in Washington can apply for sales tax exemption using form REV40 2450.

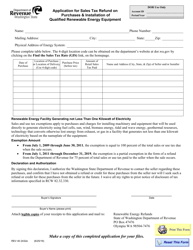

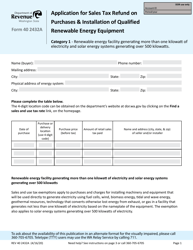

Q: What is the purpose of the sales tax exemption for data centers in rural counties?

A: The purpose of the sales tax exemption is to encourage the development and expansion of data centers in rural counties.

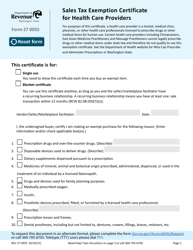

Q: What purchases are eligible for sales tax exemption for data centers in rural counties?

A: Purchases of equipment and infrastructure necessary for the operation of data centers are eligible for sales tax exemption.

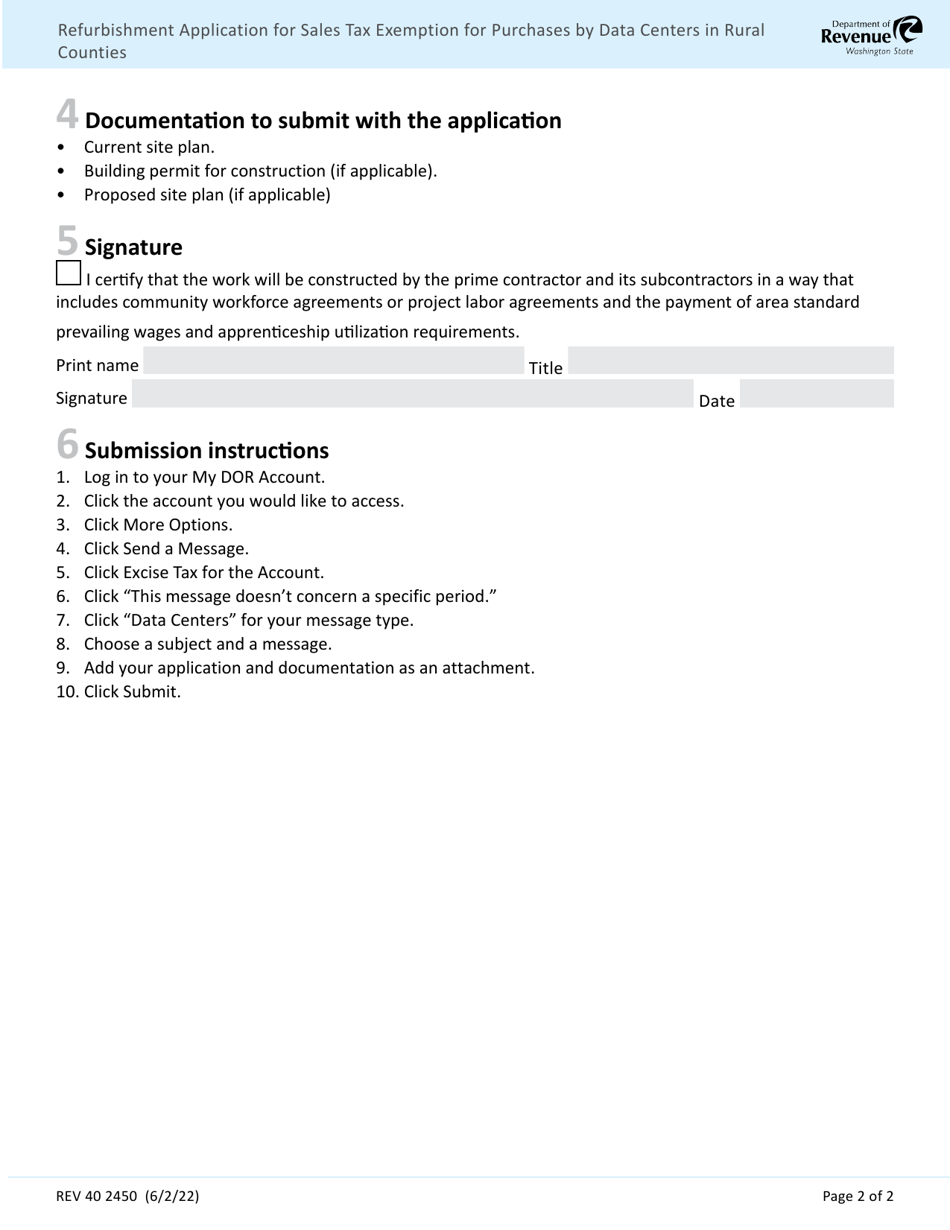

Q: What documentation do I need to submit with the application?

A: You may need to submit documentation such as a purchase invoice or lease agreement with the application.

Q: Is there a fee for filing the application?

A: No, there is no fee for filing the sales tax exemption application.

Q: How long does it take to process the application?

A: The processing time for the application can vary, but it typically takes several weeks.

Q: Can I apply for retroactive sales tax exemption?

A: Yes, you may be able to apply for retroactive sales tax exemption for eligible purchases made within the past 12 months.

Q: Who should I contact for more information about the sales tax exemption for data centers in rural counties?

A: You can contact the Washington State Department of Revenue for more information about the sales tax exemption.

Form Details:

- Released on June 2, 2022;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV40 2450 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.