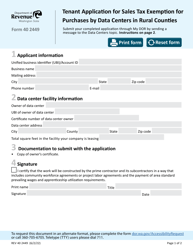

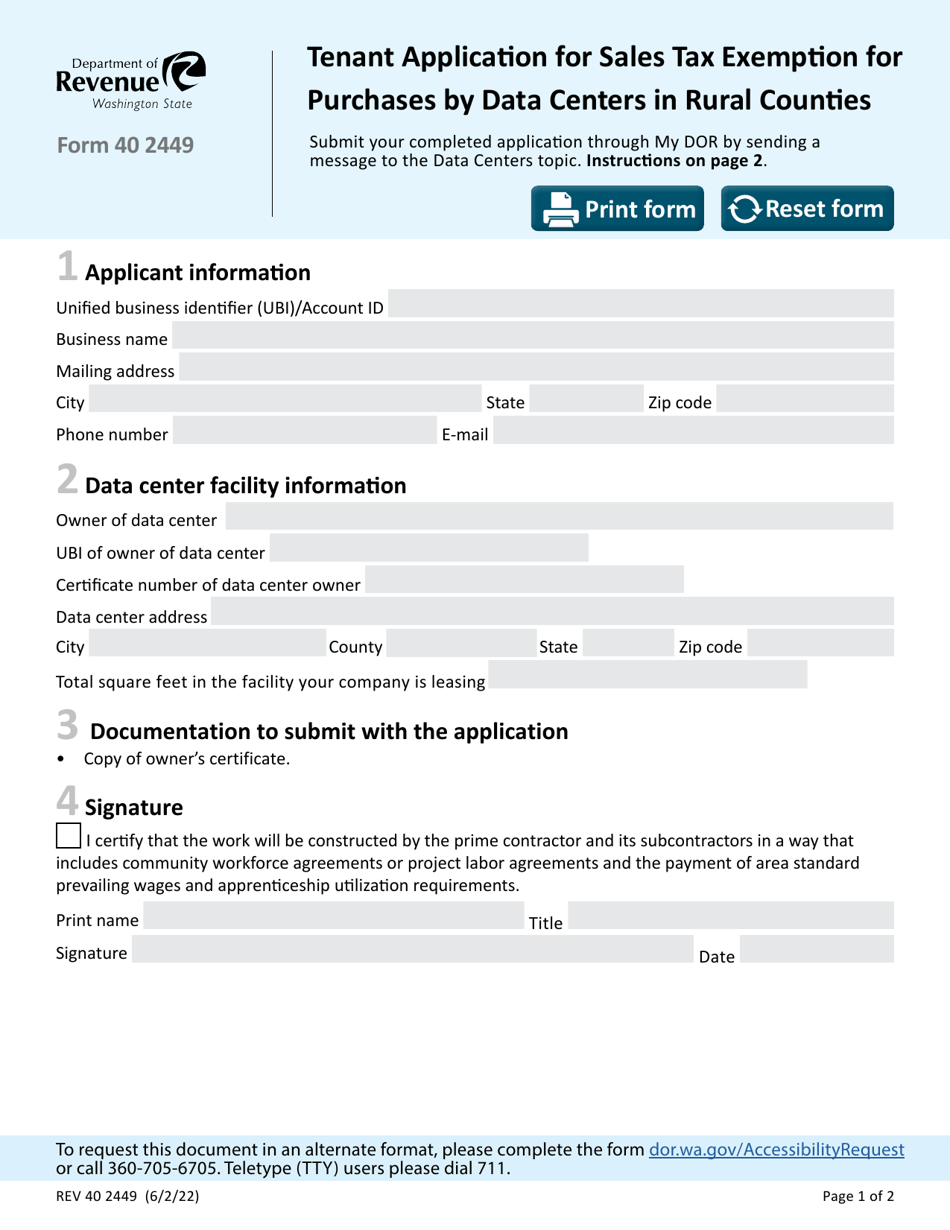

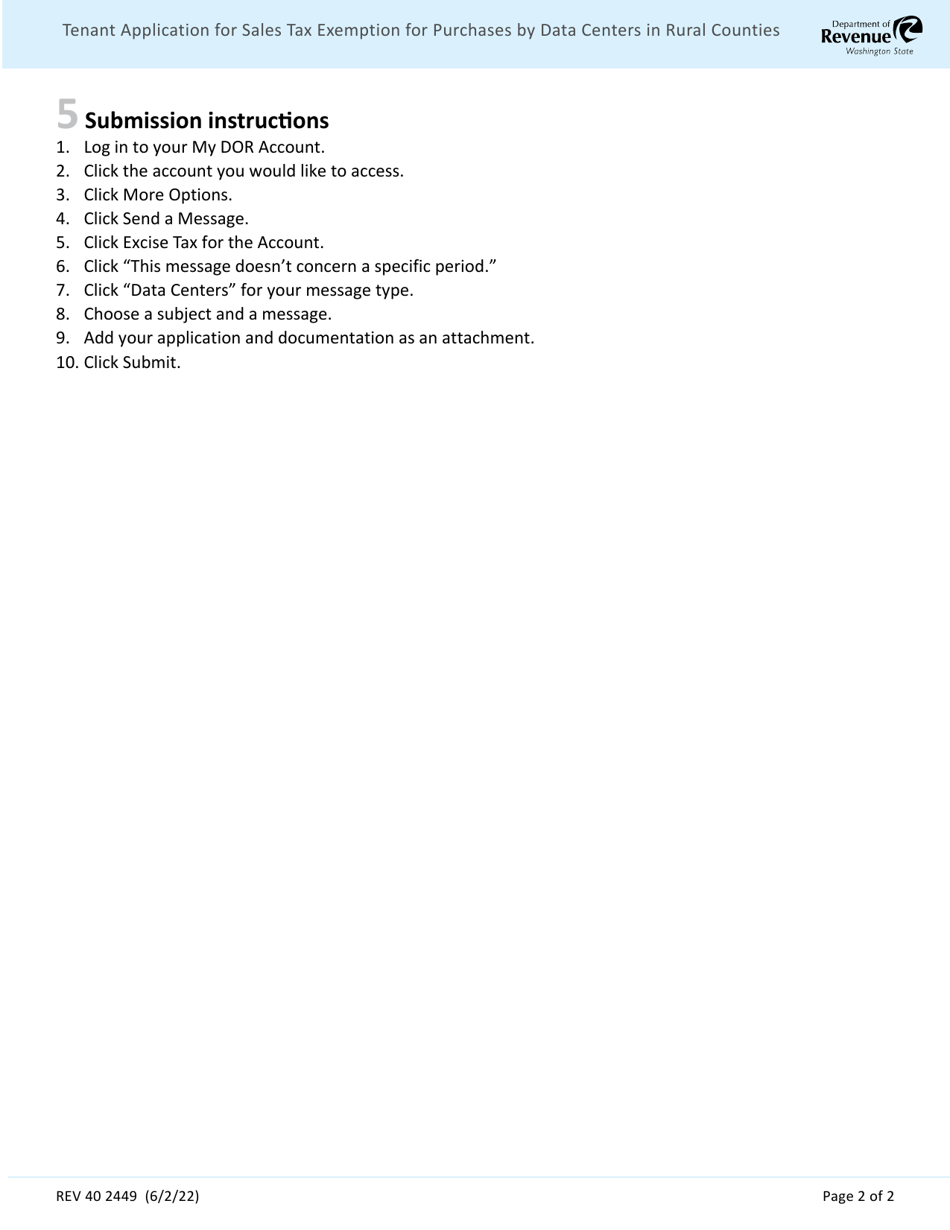

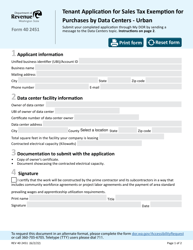

Form REV40 2449 Tenant Application for Sales Tax Exemption for Purchases by Data Centers in Rural Counties - Washington

What Is Form REV40 2449?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form REV40 2449?

A: Form REV40 2449 is the Tenant Application for Sales Tax Exemption for Purchases by Data Centers in Rural Counties in Washington.

Q: Who is eligible to use Form REV40 2449?

A: Data centers in rural counties in Washington are eligible to use Form REV40 2449 to apply for sales tax exemption.

Q: What is the purpose of Form REV40 2449?

A: The purpose of Form REV40 2449 is to apply for sales tax exemption for purchases made by data centers in rural counties.

Q: Which state is Form REV40 2449 applicable to?

A: Form REV40 2449 is applicable to the state of Washington.

Q: What kind of purchases does Form REV40 2449 cover?

A: Form REV40 2449 covers purchases made by data centers in rural counties.

Form Details:

- Released on June 2, 2022;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV40 2449 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.