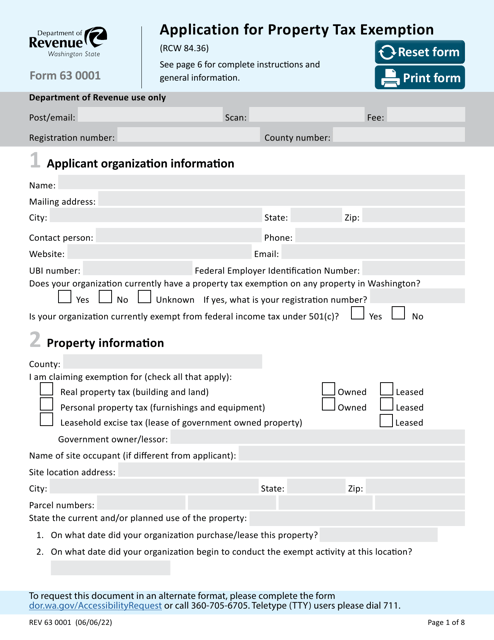

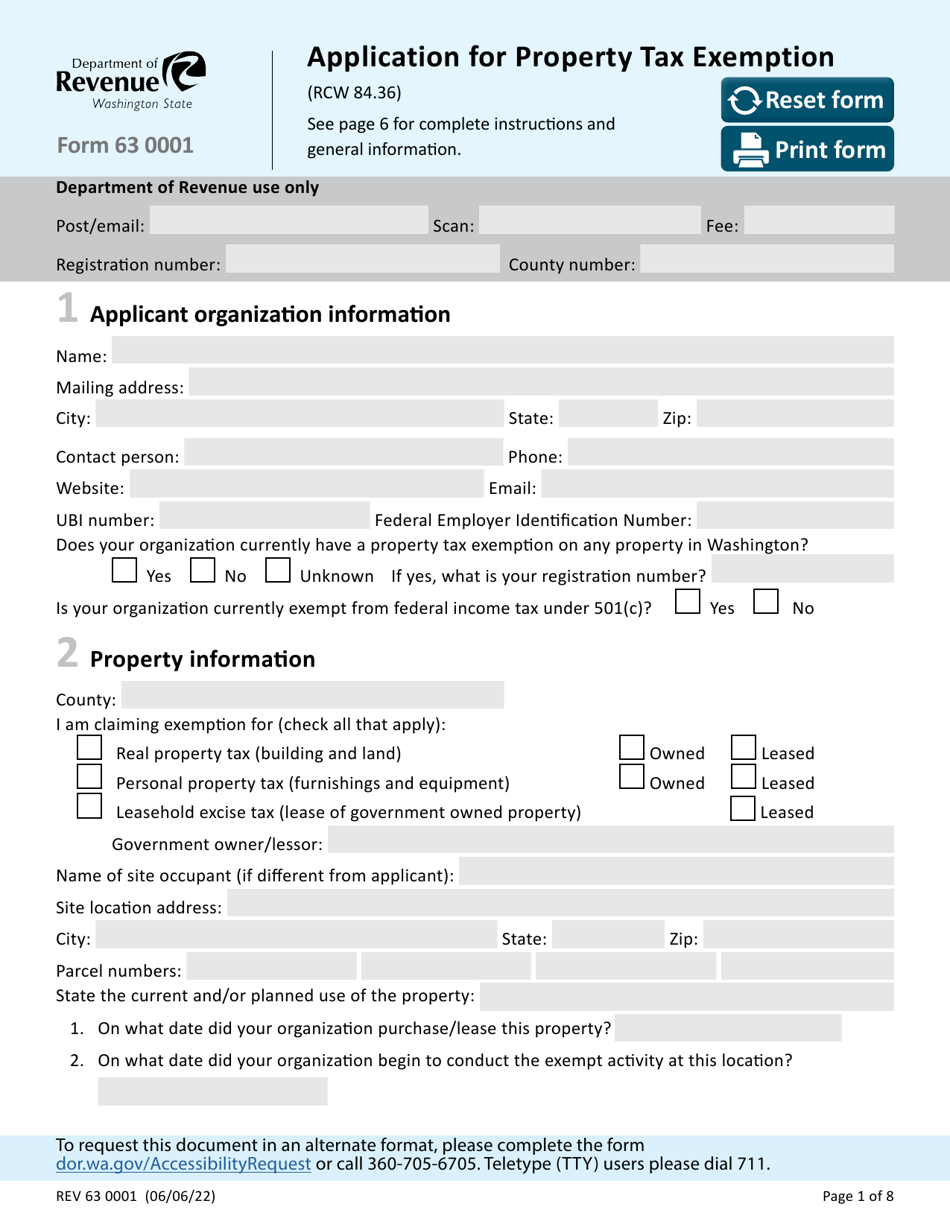

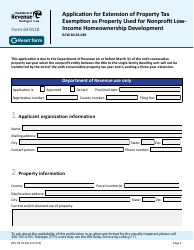

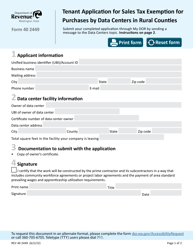

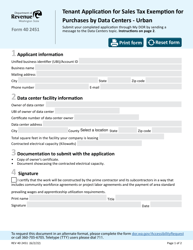

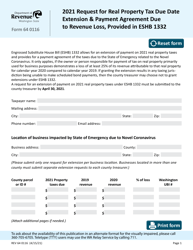

Form 63 0001 Application for Property Tax Exemption - Washington

What Is Form 63 0001?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 63 0001?

A: Form 63 0001 is the application for property tax exemption in Washington.

Q: Who is eligible to use Form 63 0001?

A: Property owners in Washington who meet certain criteria may be eligible to use Form 63 0001.

Q: What is the purpose of Form 63 0001?

A: The purpose of Form 63 0001 is to apply for property tax exemption in Washington.

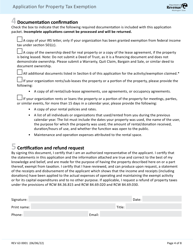

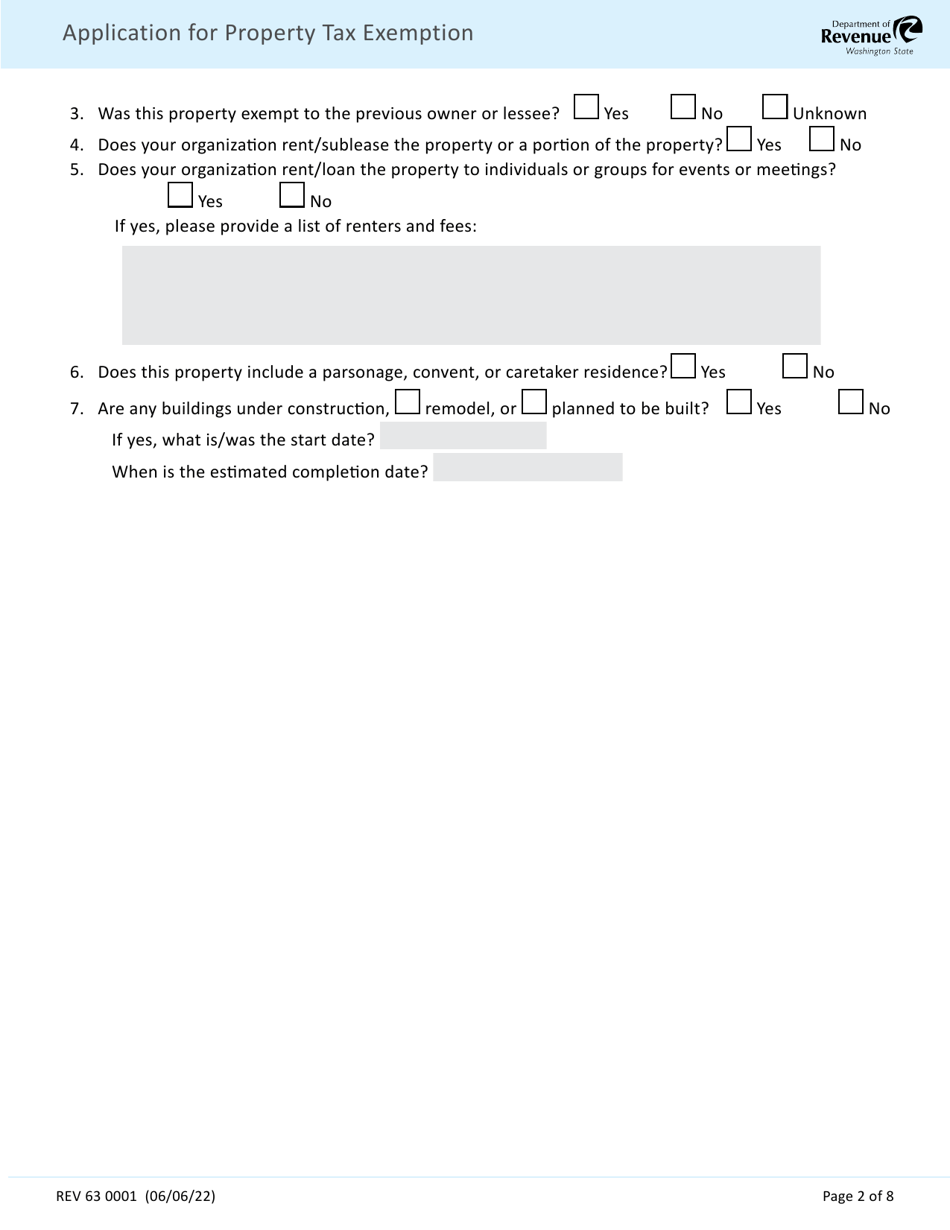

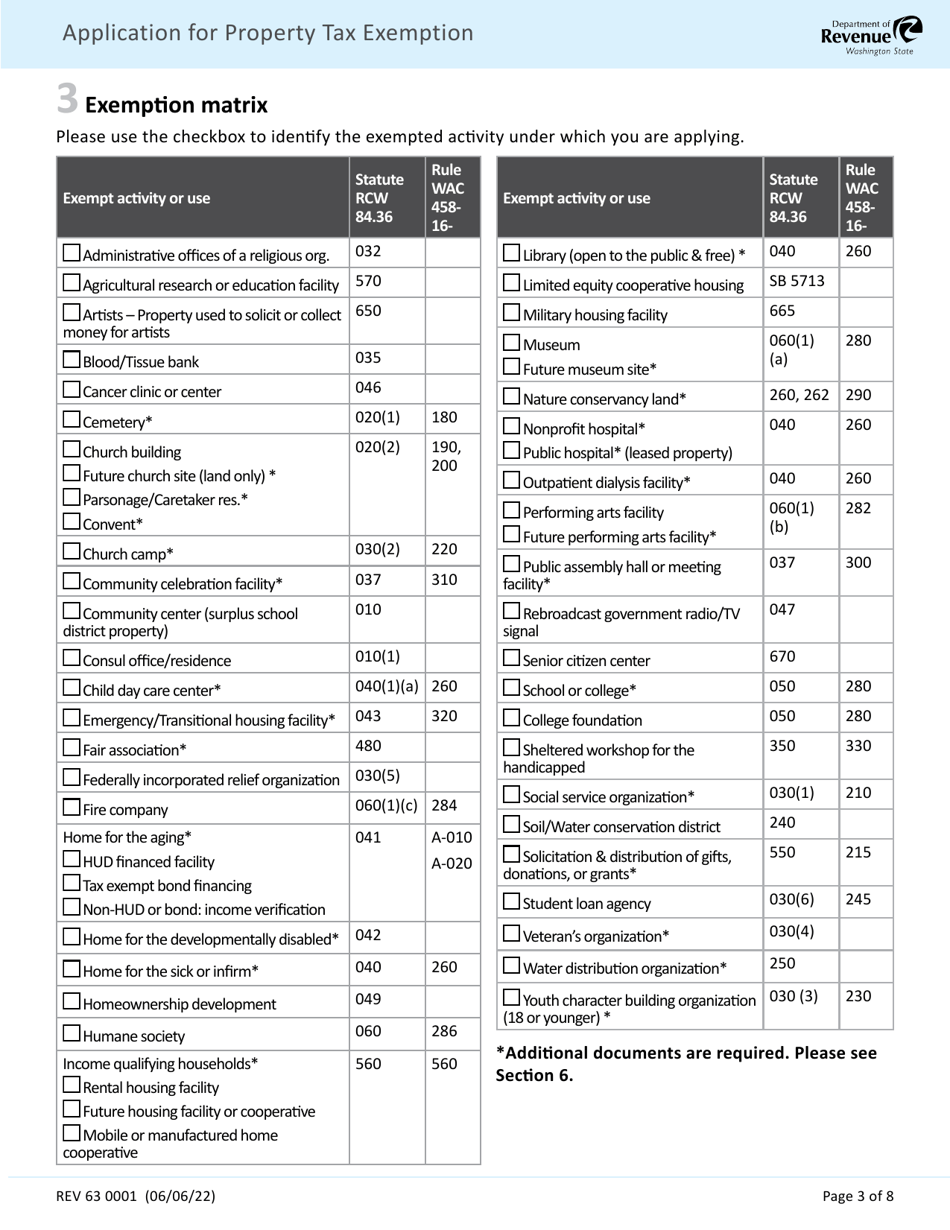

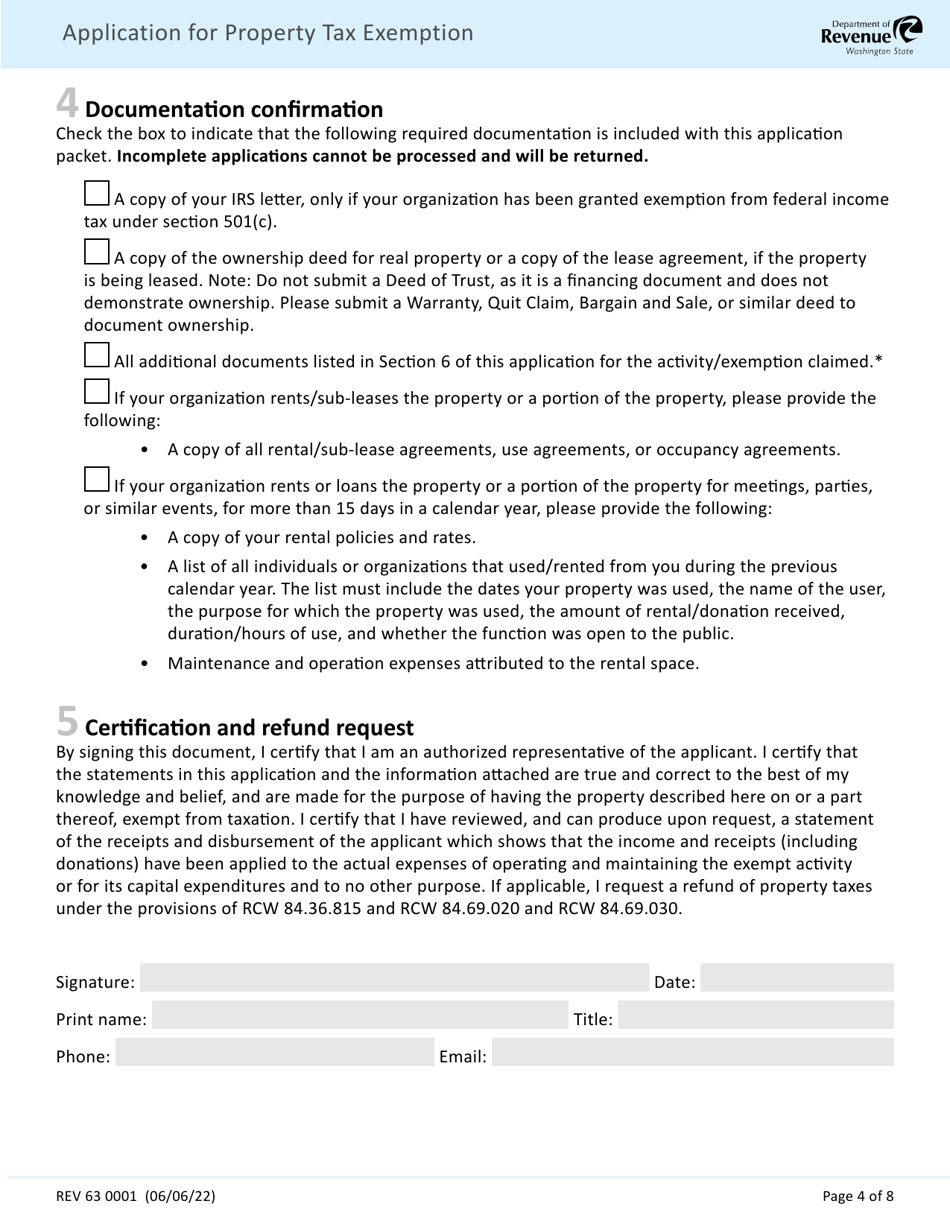

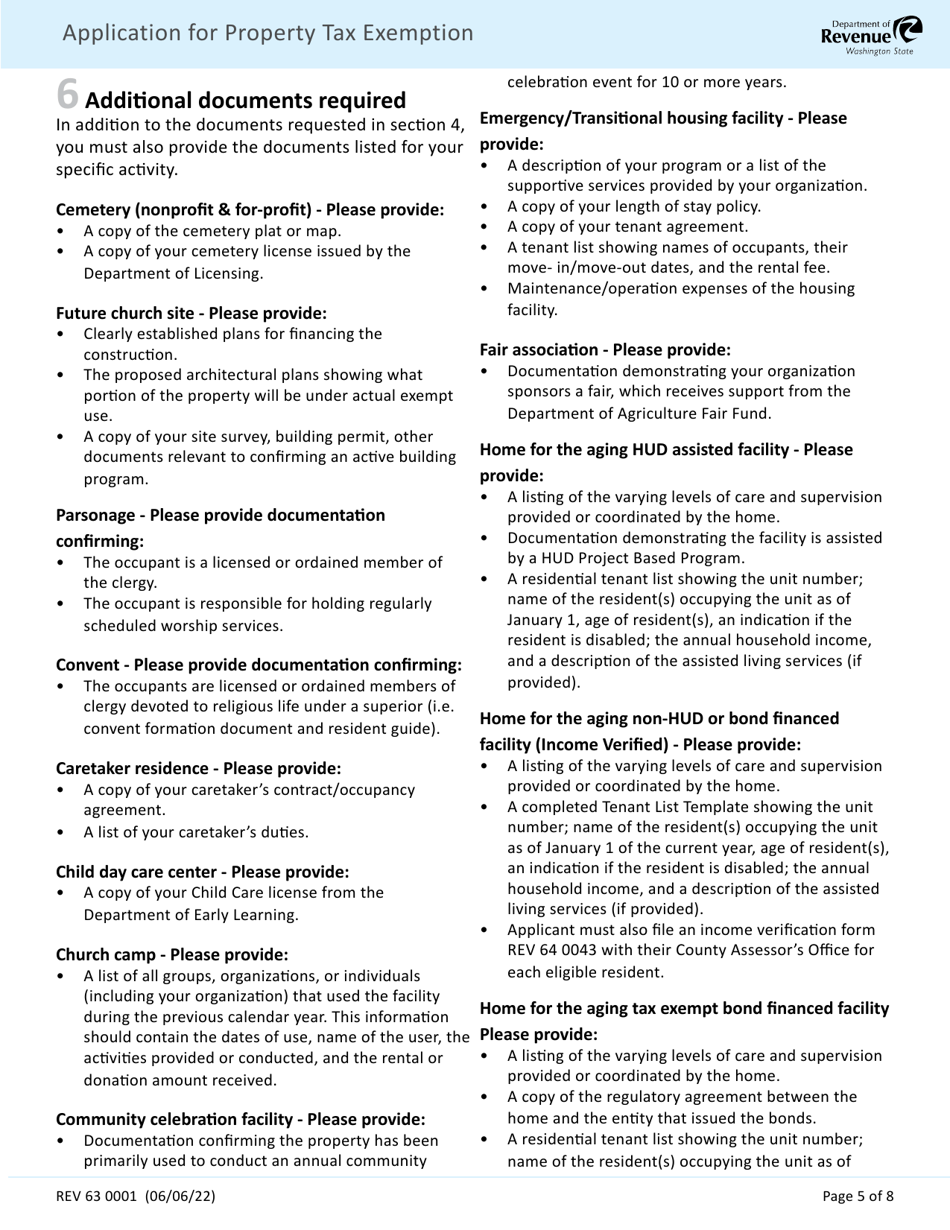

Q: What information is required on Form 63 0001?

A: Form 63 0001 requires information about the property owner, the property itself, and the reason for seeking tax exemption.

Q: Is there a deadline for filing Form 63 0001?

A: Yes, the deadline for filing Form 63 0001 is typically April 30th of each year.

Q: What happens after I submit Form 63 0001?

A: After submitting Form 63 0001, your application will be reviewed by the county assessor's office.

Q: How long does it take to receive a decision on Form 63 0001?

A: The processing time for Form 63 0001 varies, but you can generally expect to receive a decision within a few months.

Q: What if my Form 63 0001 is approved?

A: If your Form 63 0001 is approved, your property will be granted a tax exemption for the specified period.

Q: What if my Form 63 0001 is denied?

A: If your Form 63 0001 is denied, you may have the option to appeal the decision or reapply in the future.

Form Details:

- Released on June 6, 2022;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 63 0001 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.