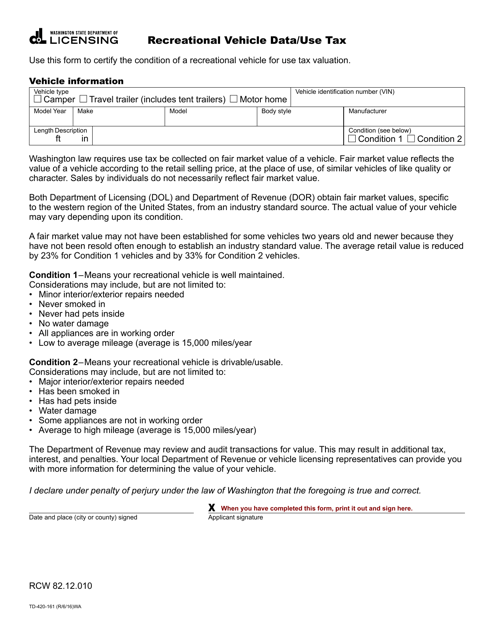

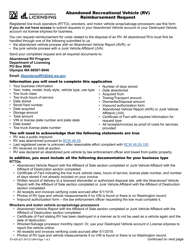

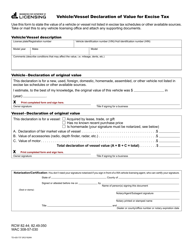

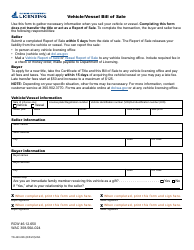

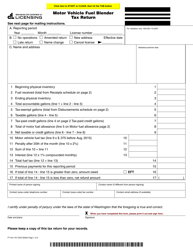

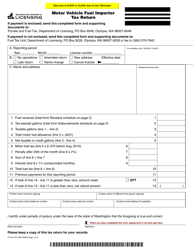

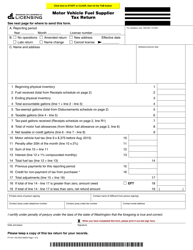

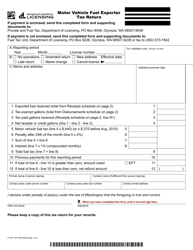

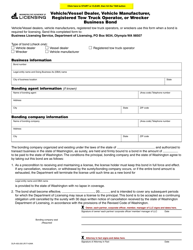

Form TD-420-161 Recreational Vehicle Data / Use Tax - Washington

What Is Form TD-420-161?

This is a legal form that was released by the Washington State Department of Licensing - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TD-420-161?

A: Form TD-420-161 is a tax form related to recreational vehicles in Washington.

Q: What is the purpose of Form TD-420-161?

A: Form TD-420-161 is used to report and pay use tax on recreational vehicles.

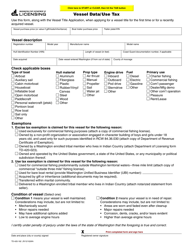

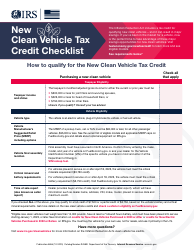

Q: What is use tax?

A: Use tax is a tax on goods purchased outside of Washington for use within the state.

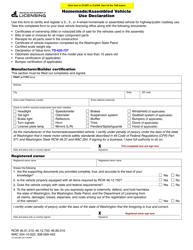

Q: Who needs to file Form TD-420-161?

A: Anyone who purchased a recreational vehicle outside of Washington and is using it within the state needs to file this form.

Q: When is Form TD-420-161 due?

A: Form TD-420-161 is due within 30 days of bringing the recreational vehicle into Washington.

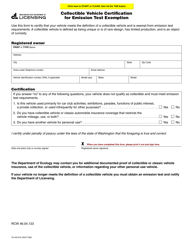

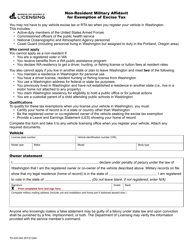

Q: Are there any exemptions to the use tax for recreational vehicles?

A: Yes, certain exemptions apply, such as if the vehicle was previously titled in Washington or if it is a gift.

Q: What happens if I don't file Form TD-420-161?

A: Failure to file Form TD-420-161 and pay the use tax may result in penalties and interest.

Q: Can I e-file Form TD-420-161?

A: No, Form TD-420-161 cannot be e-filed and must be submitted by mail.

Form Details:

- Released on June 1, 2016;

- The latest edition provided by the Washington State Department of Licensing;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TD-420-161 by clicking the link below or browse more documents and templates provided by the Washington State Department of Licensing.