This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

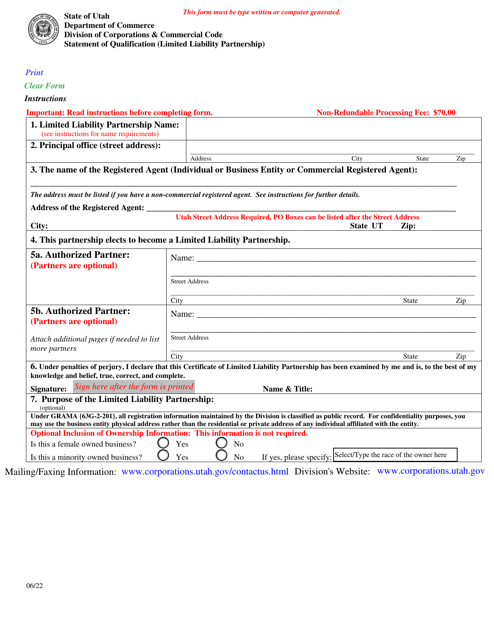

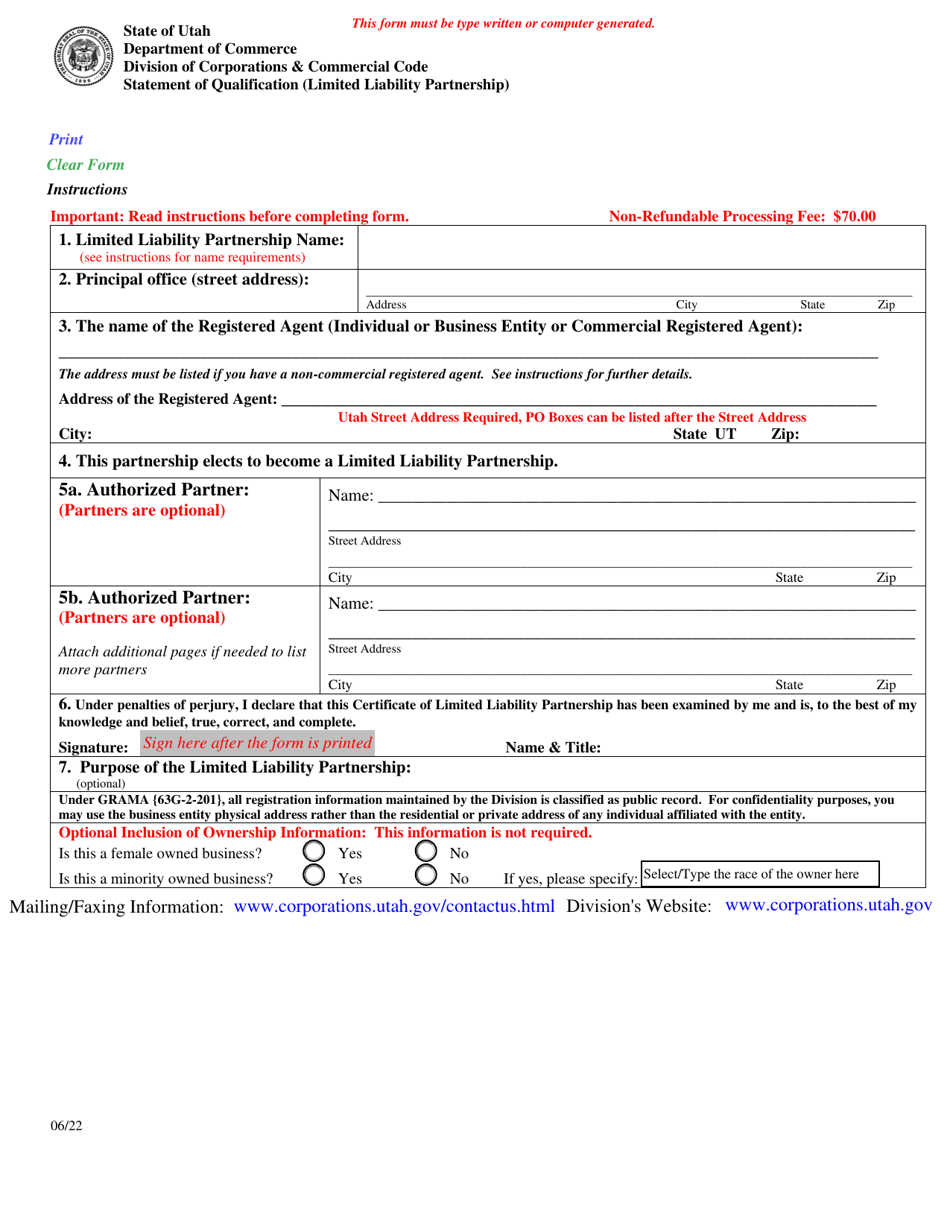

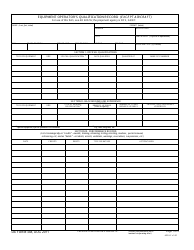

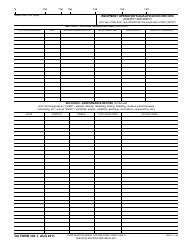

Statement of Qualification (Limited Liability Partnership) - Utah

Statement of Qualification (Limited Liability Partnership) is a legal document that was released by the Utah Department of Commerce - a government authority operating within Utah.

FAQ

Q: What is a Statement of Qualification?

A: A Statement of Qualification is a document that establishes a limited liability partnership (LLP) in Utah.

Q: What is a limited liability partnership?

A: A limited liability partnership (LLP) is a business structure where partners have limited personal liability for the LLP's debts and obligations.

Q: Why would a business choose to form a limited liability partnership?

A: A business may choose to form an LLP to have the flexibility of a partnership while also limiting personal liability.

Q: How do I file a Statement of Qualification for an LLP in Utah?

A: You can file a Statement of Qualification for an LLP in Utah with the Utah Division of Corporations and Commercial Code.

Q: What information is required in the Statement of Qualification?

A: The Statement of Qualification typically requires information such as the LLP's name, registered agent, principal office address, and the name and address of each partner.

Q: Is there a fee for filing a Statement of Qualification?

A: Yes, there is a filing fee for the Statement of Qualification, which can be paid to the Utah Division of Corporations and Commercial Code.

Q: Can I form a limited liability partnership in any state?

A: Yes, LLPs can be formed in most states, although the requirements and regulations may vary.

Q: What are some advantages of a limited liability partnership?

A: Advantages of an LLP include limited personal liability for partners, flexibility in management, and pass-through taxation.

Q: Can I convert an existing business into an LLP?

A: Yes, in some cases, an existing business can convert into an LLP by filing the necessary documents and meeting the requirements of the state.

Q: Do LLPs have annual reporting requirements?

A: Yes, LLPs typically have annual reporting requirements, which may include filing an annual report and paying a fee.

Form Details:

- Released on June 1, 2022;

- The latest edition currently provided by the Utah Department of Commerce;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Utah Department of Commerce.